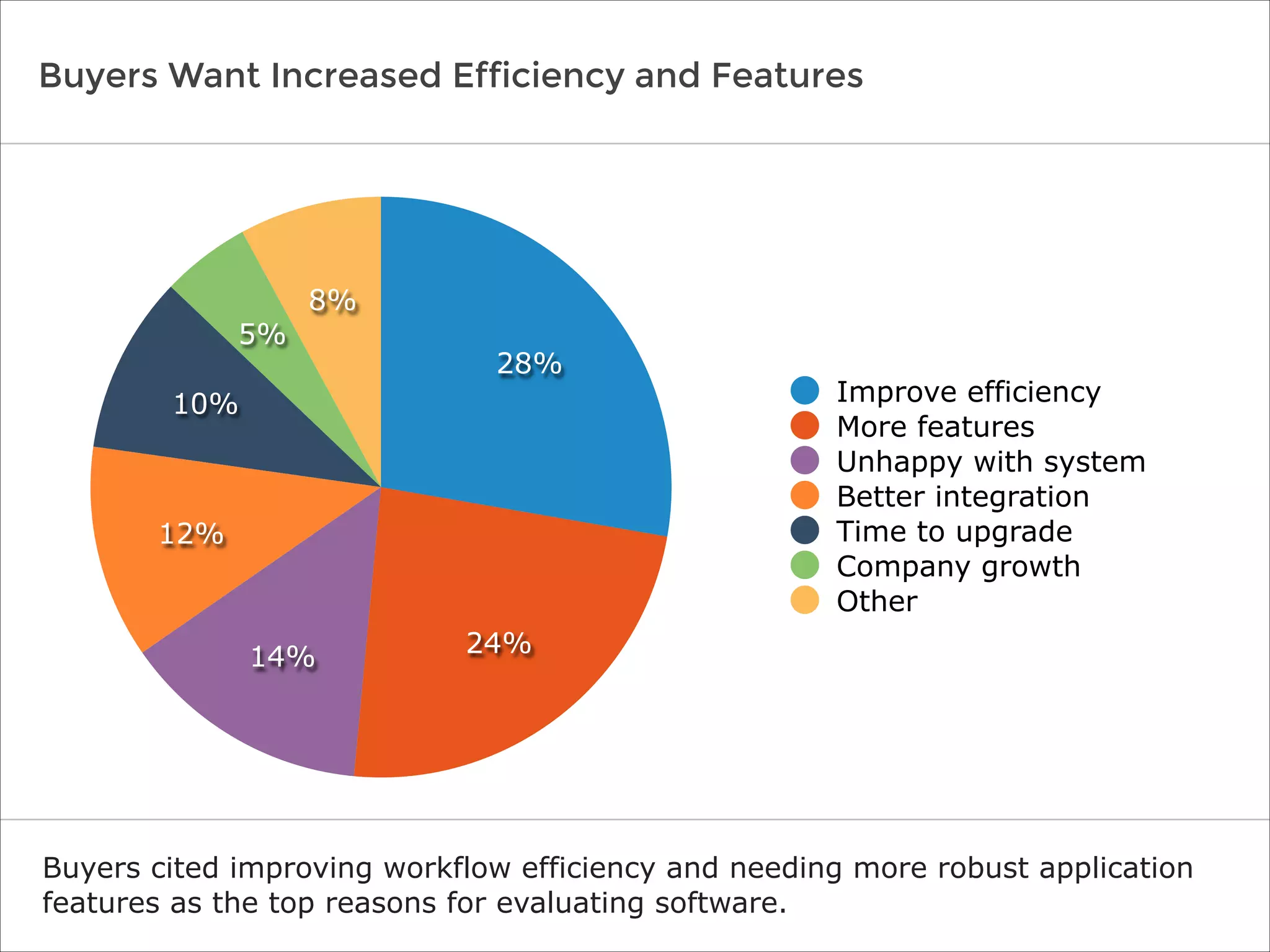

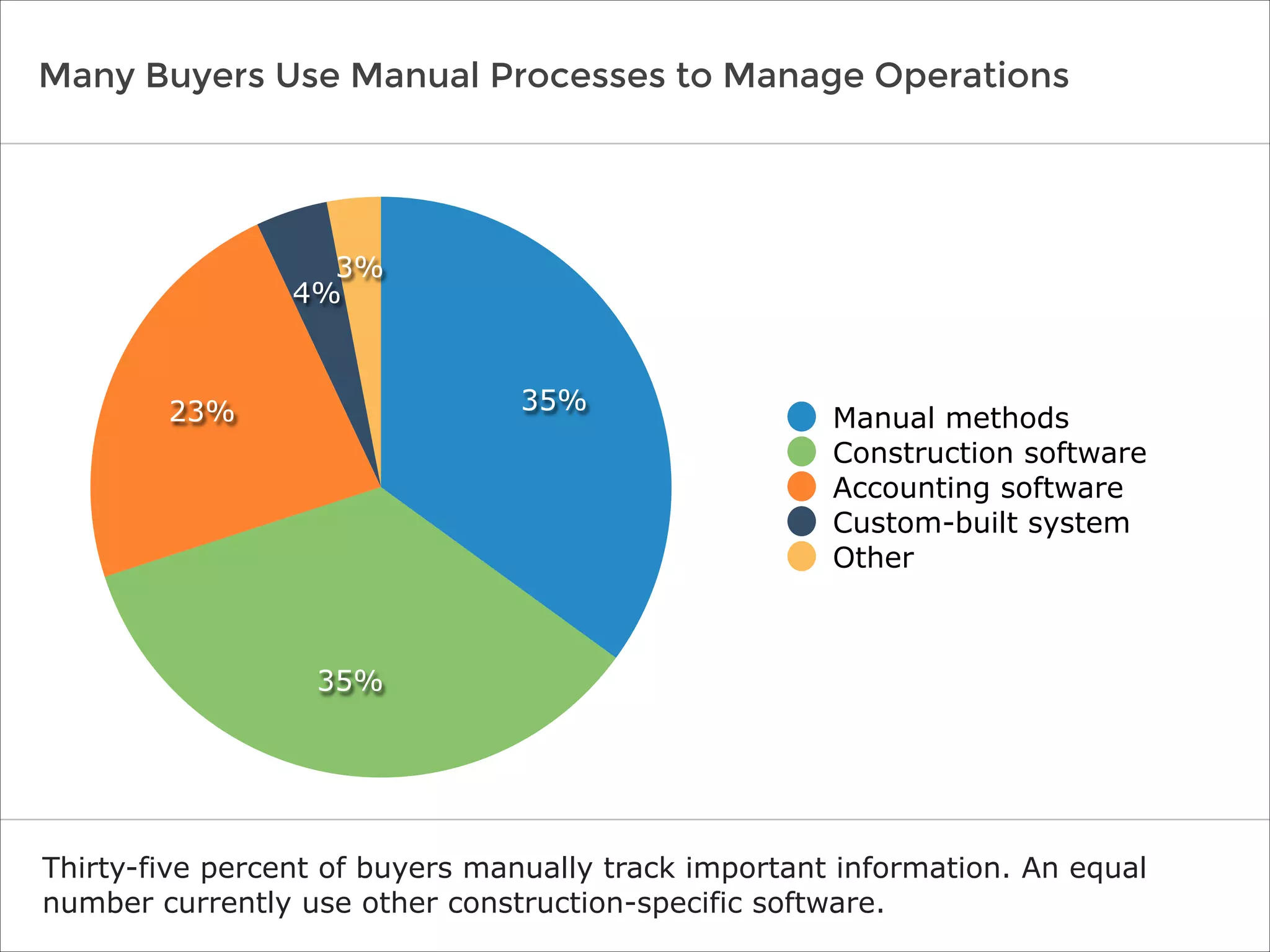

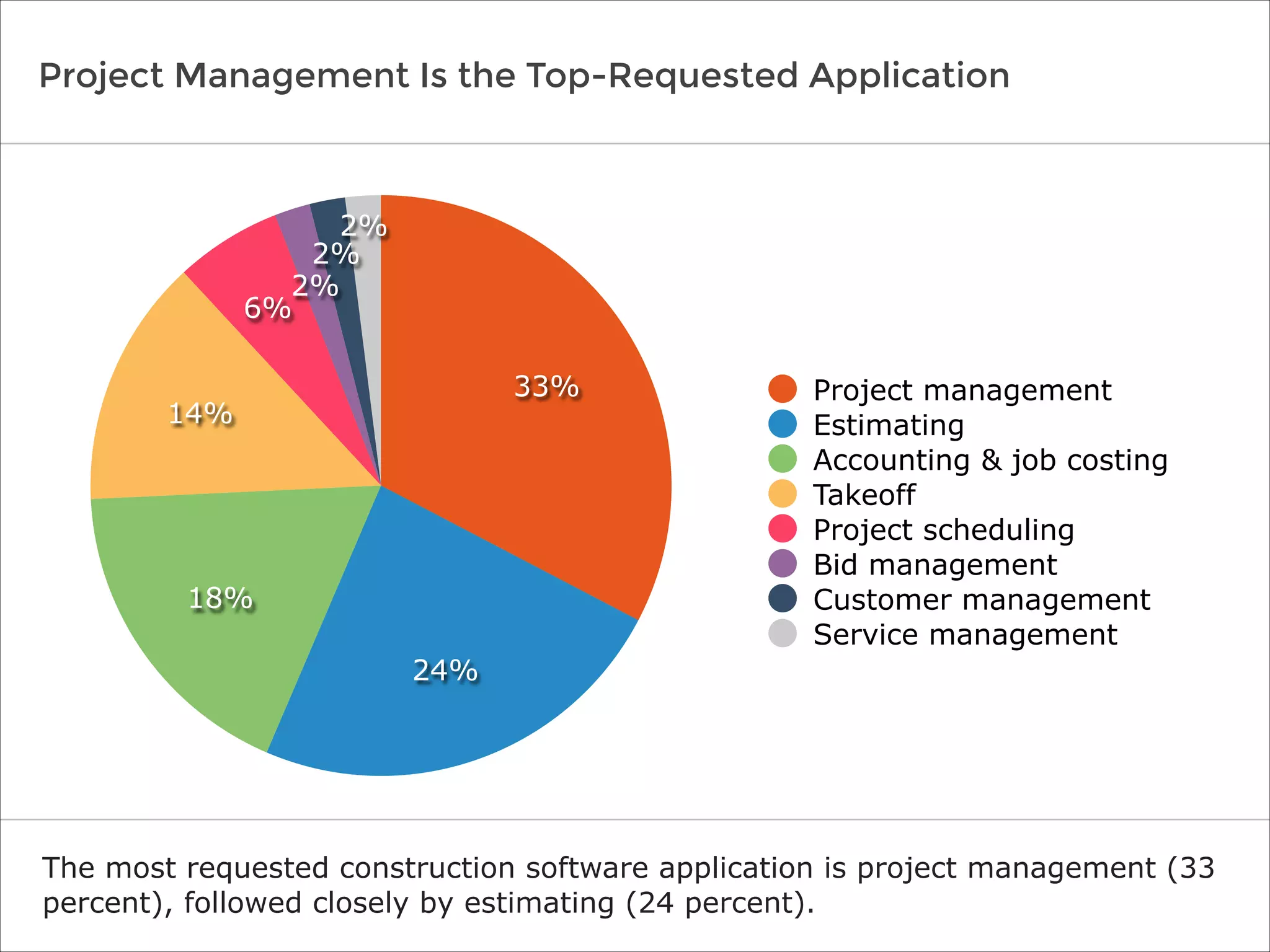

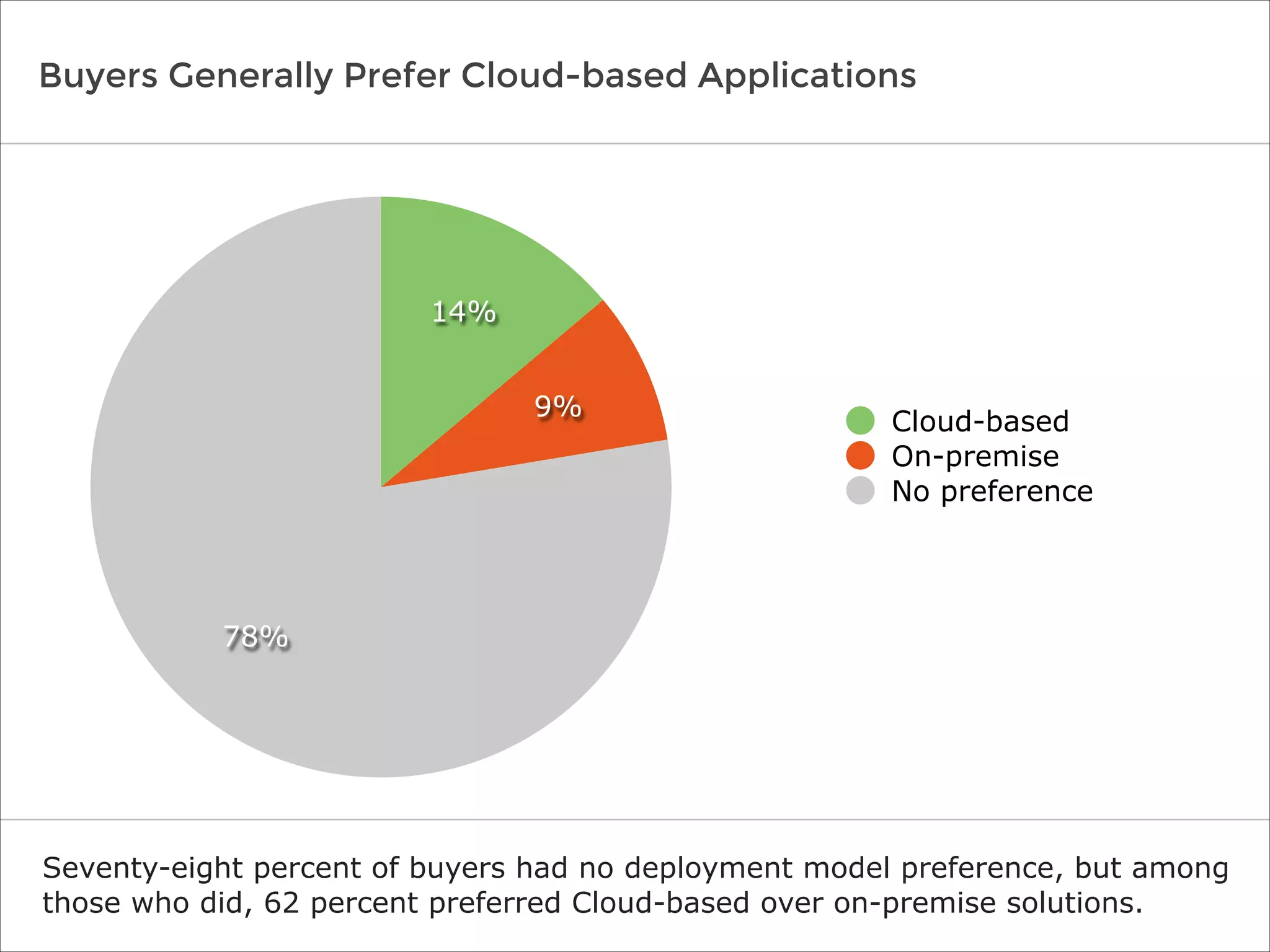

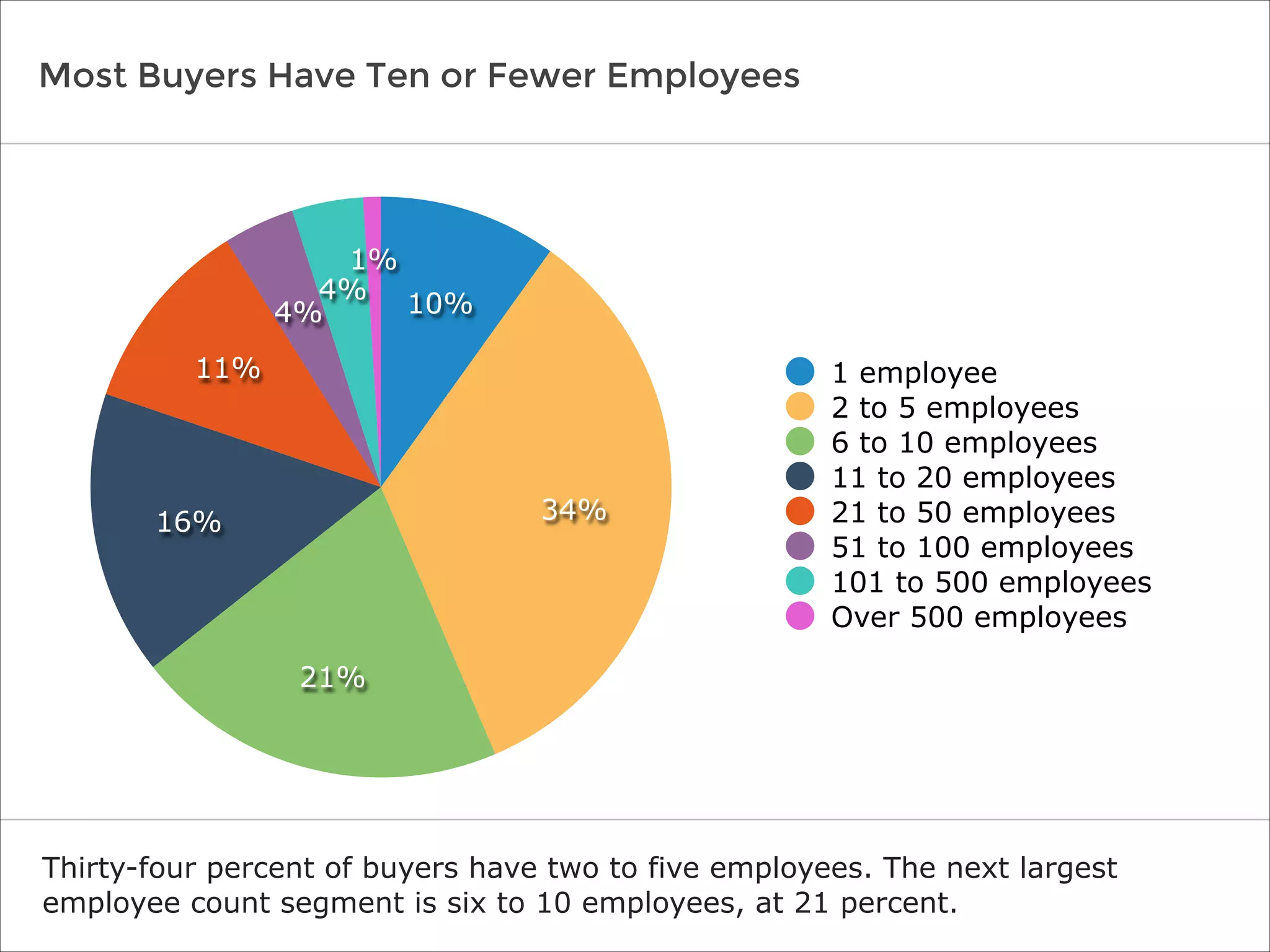

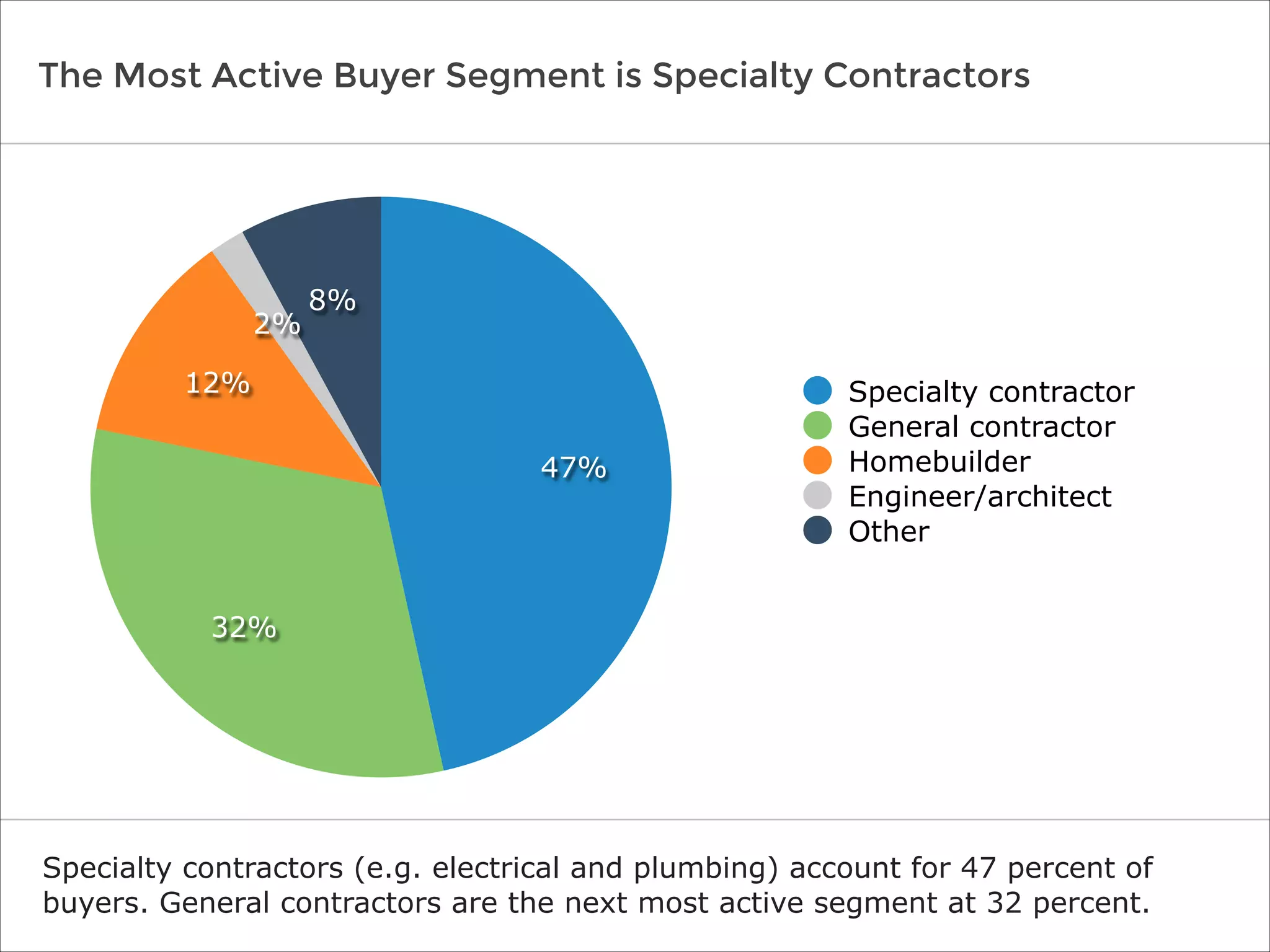

Construction companies are evaluating new software primarily to increase efficiency of processes. Project management and estimating applications are most frequently requested. While most buyers do not have a preference for cloud-based or on-premise software, those that do prefer cloud-based options. Specialty contractors represent the largest segment of buyers.