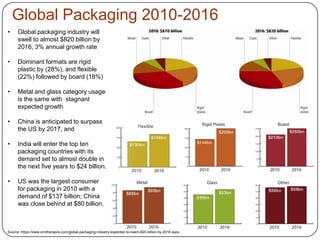

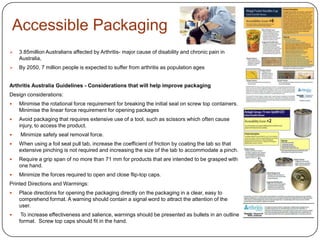

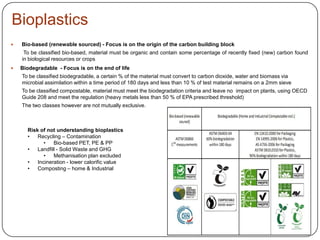

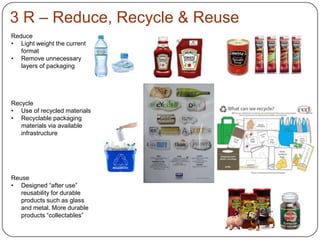

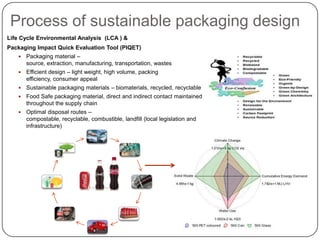

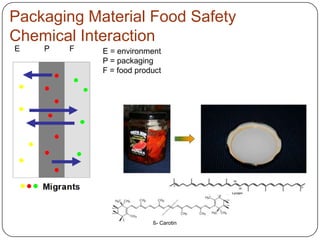

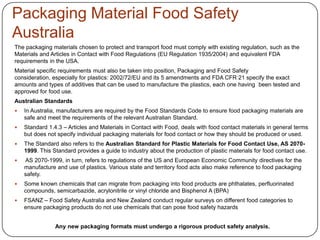

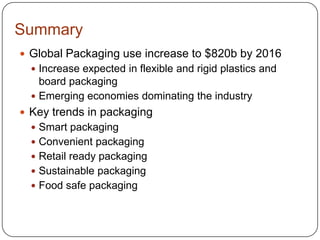

Global packaging use is expected to increase to $820 billion by 2016, with flexible and rigid plastics and board packaging formats seeing the most growth. Key packaging trends include smart packaging that provides consumer information via technologies like QR codes, convenient packaging that offers benefits like easy opening and microwavability, and retail ready packaging that is shelf ready. Sustainable packaging focuses on areas like bioplastics and the 3Rs of reduce, reuse, and recycle. Food packaging must ensure safety by preventing chemical interactions between packaging, food, and the environment according to regulations and standards.