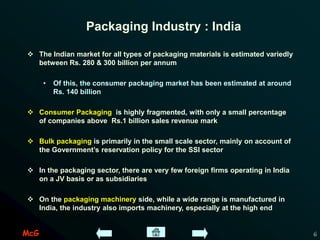

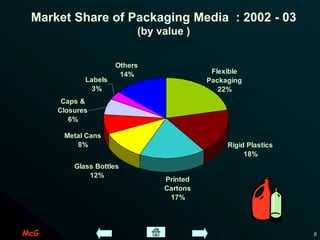

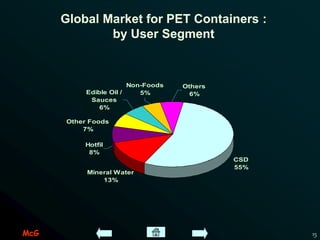

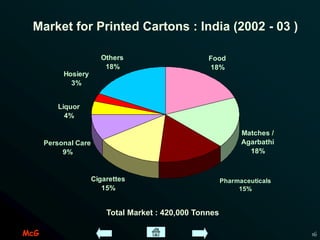

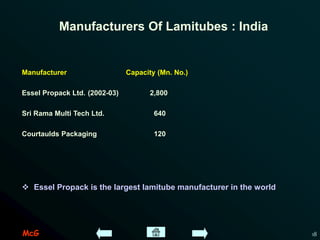

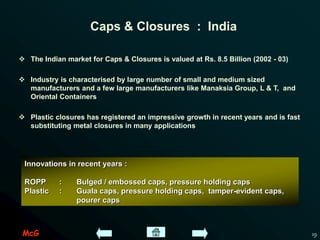

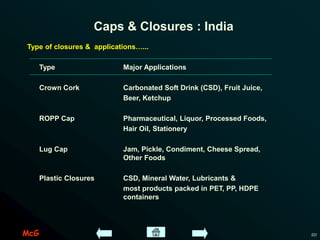

The document presents an overview of the packaging industry in India, highlighting its estimated market size of Rs. 280-300 billion, with consumer packaging at around Rs. 140 billion. It emphasizes growth trends, the dominance of plastics over traditional materials, notable packaging developments, and the competitive landscape of manufacturers across various segments, including flexible packaging, metal cans, and labels. The report also outlines the significant annual growth rates in specific sectors, such as PET containers and caps, alongside emerging innovations in packaging technologies.