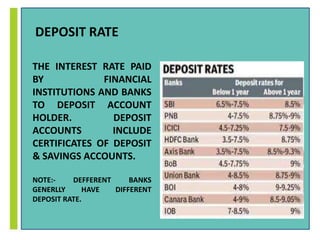

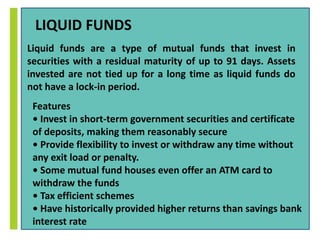

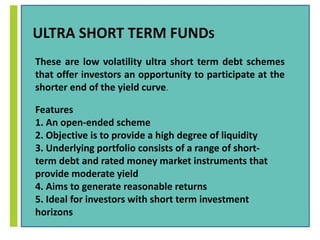

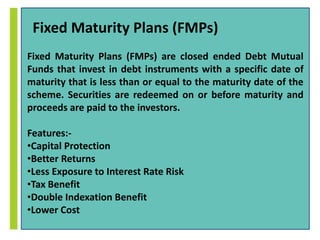

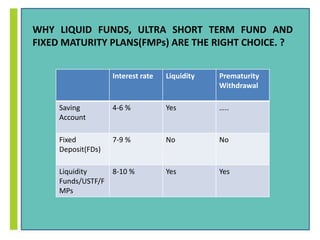

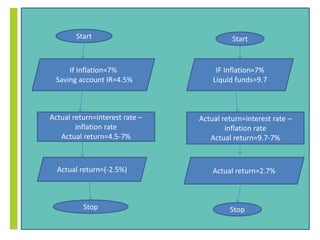

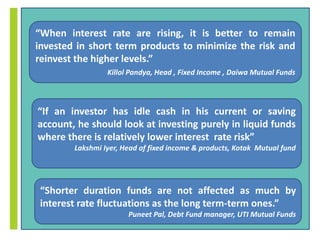

In a rising interest rate environment, short duration plans like liquid funds, ultra short term funds, and fixed maturity plans (FMPs) are the best choice. These products have maturity periods of less than one year, so they are less impacted by rising interest rates than long duration debt instruments. They provide better returns than savings accounts while still allowing flexibility to withdraw funds without penalty. When interest rates are increasing, it is preferable to invest in short term plans that minimize interest rate risk and allow reinvesting funds at higher rates.