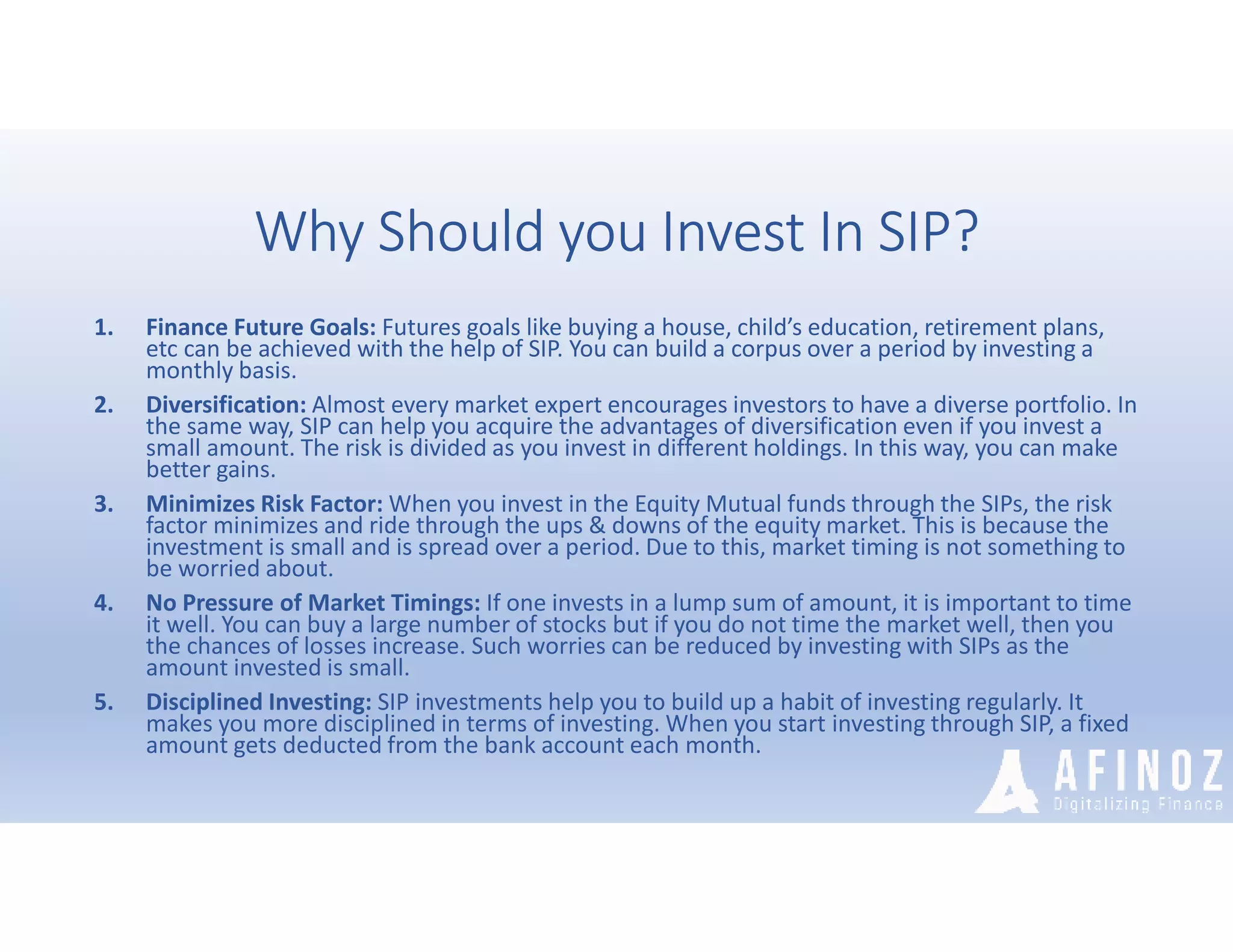

The document discusses Systematic Investment Plans (SIPs) and SIP calculators. It defines an SIP as an investment strategy where a fixed amount is automatically invested in a mutual fund on a regular basis. An SIP calculator helps estimate potential returns and maturity amounts based on projected returns. The document outlines different types of SIPs and their features and benefits, including rupee cost averaging and disciplined savings. It also explains how to use an SIP calculator and why SIPs are preferable to lump sum investments due to their ability to reduce risk in volatile markets through rupee cost averaging.