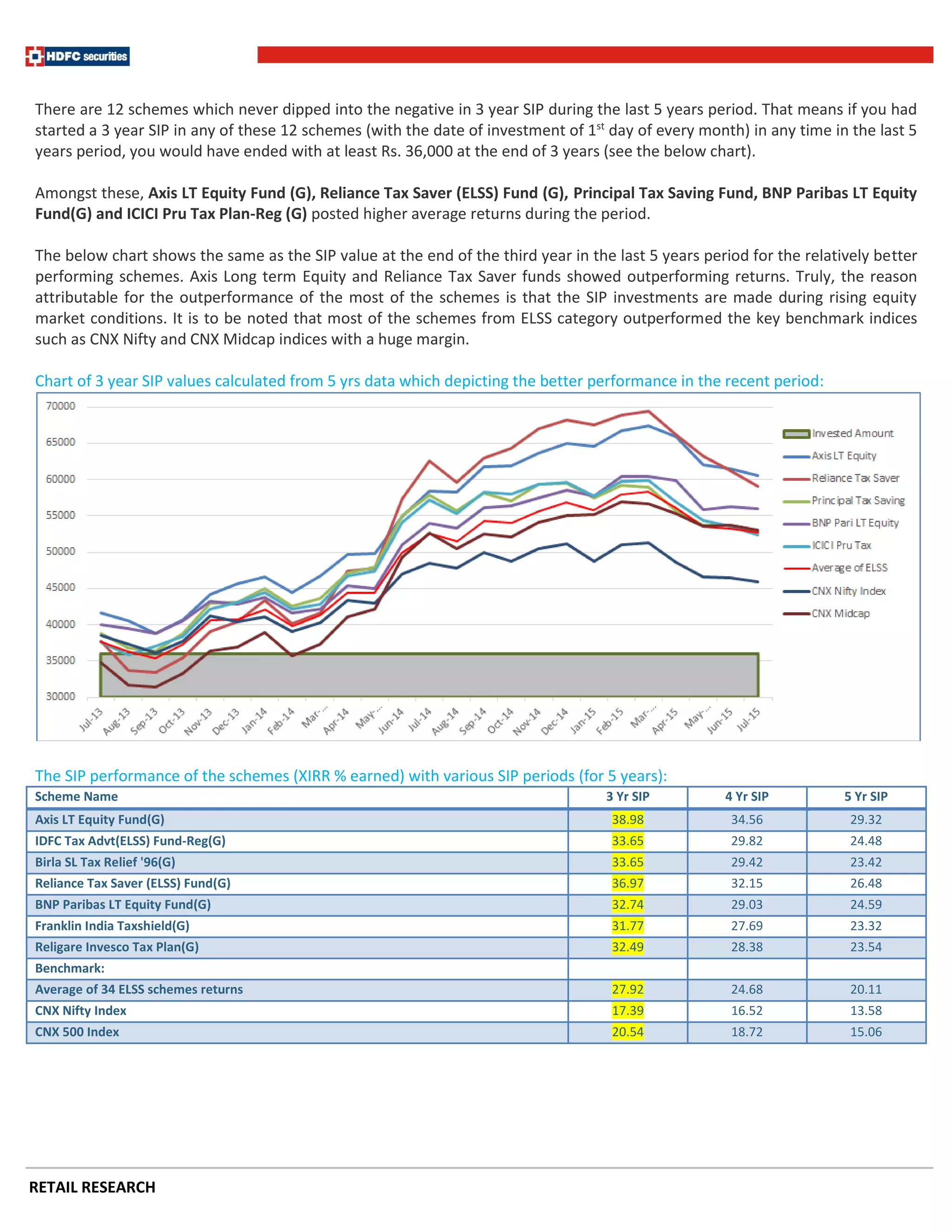

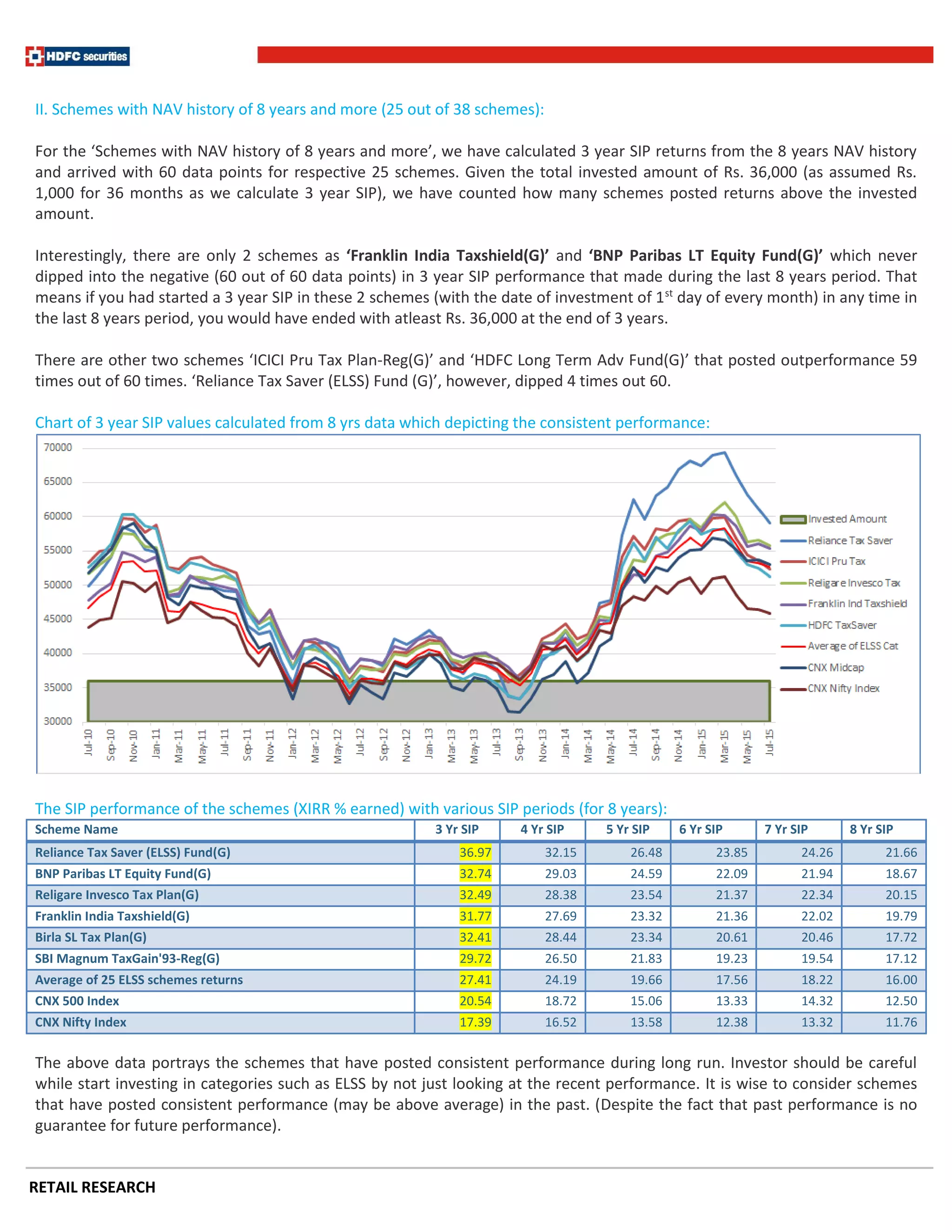

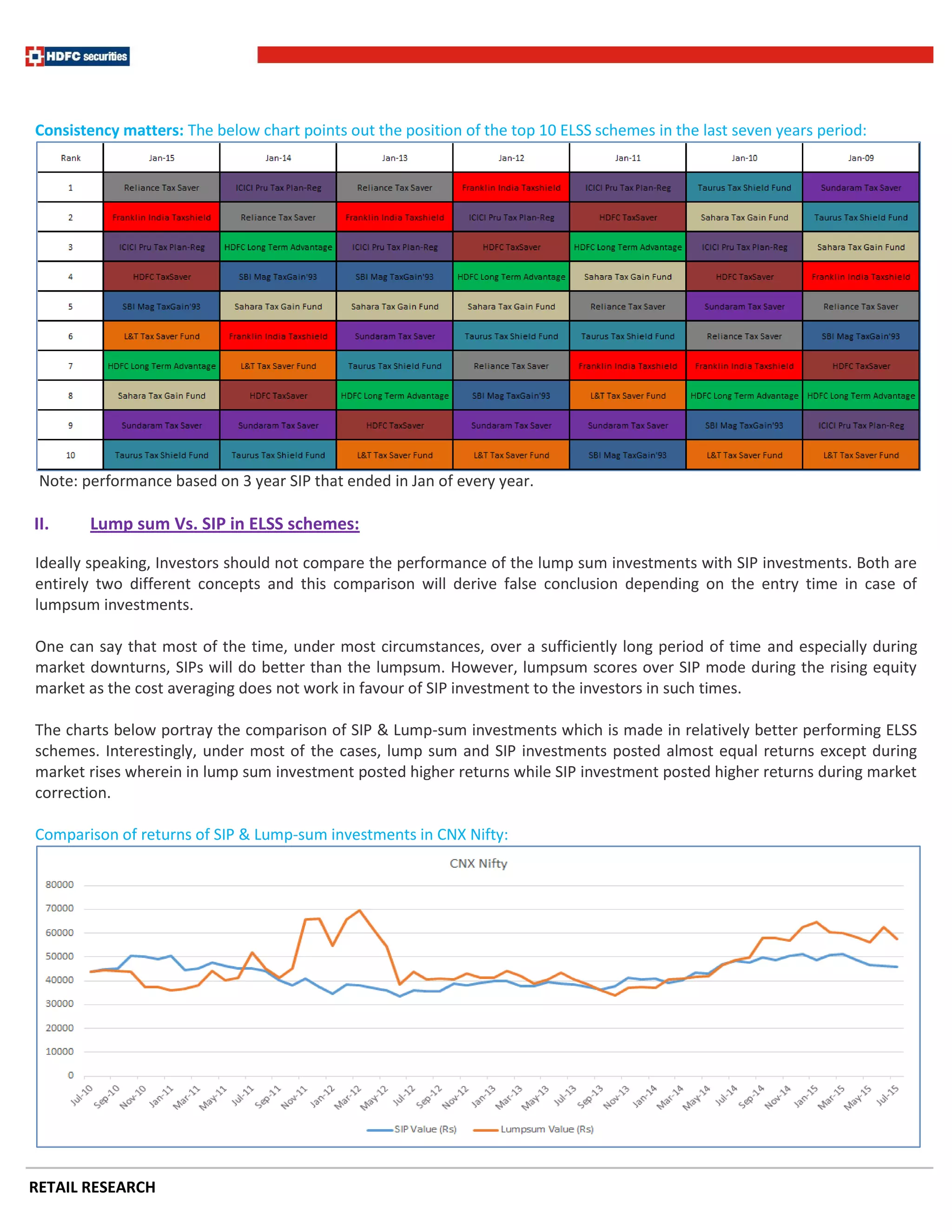

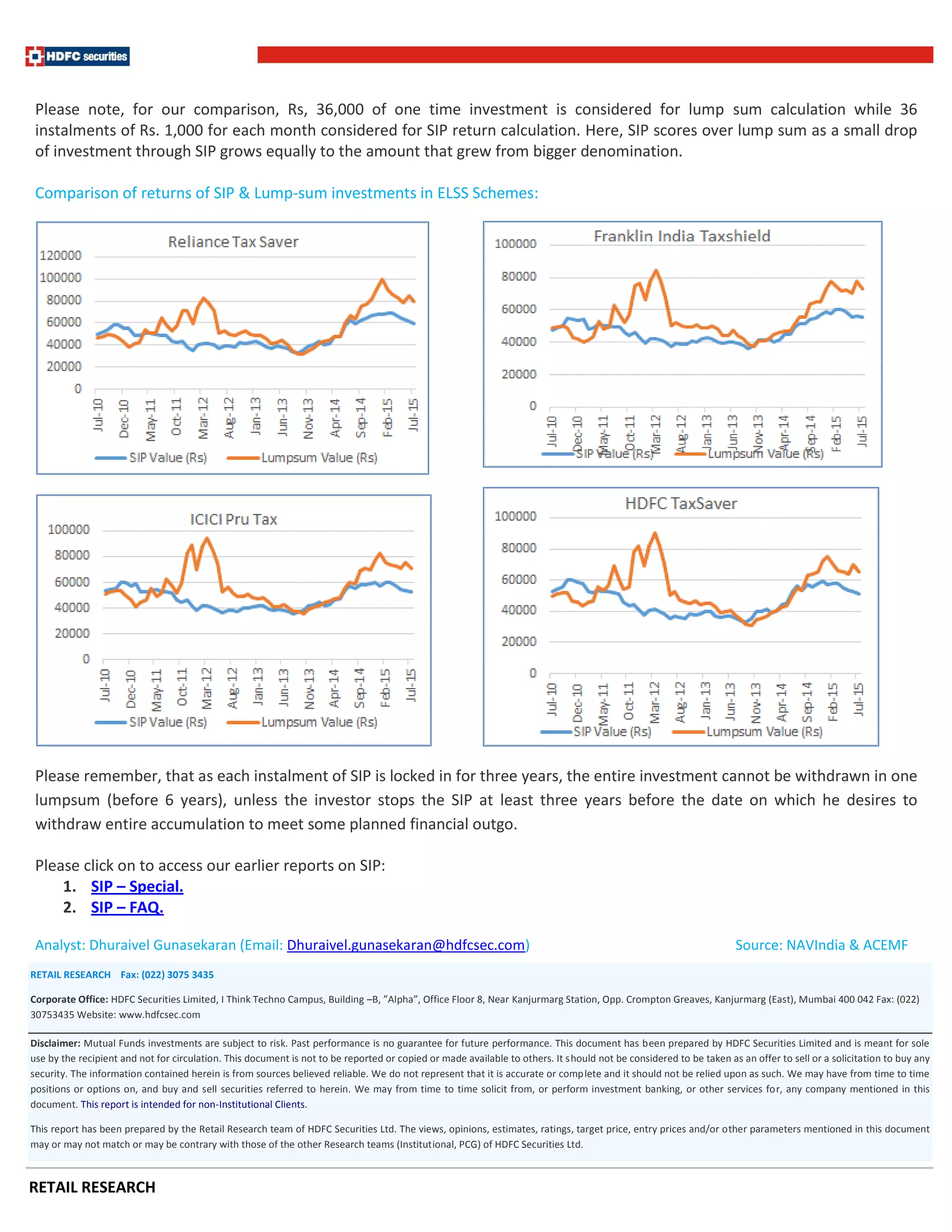

This document summarizes investing through systematic investment plans (SIP) in tax saving mutual funds, specifically equity linked saving schemes (ELSS). It discusses the benefits of SIP for long term wealth accumulation and tax savings. It analyzes the performance of 38 ELSS schemes over 3, 4, and 5 year periods based on monthly SIP investments of Rs. 1,000. Several schemes consistently outperformed benchmarks like Nifty and provided returns higher than the total investment amount. While lump sum returns are higher during market rises, SIP performs better during downturns and over the long run.