Debt mutual funds - Scenario post the finance bill (no.2) - 2014

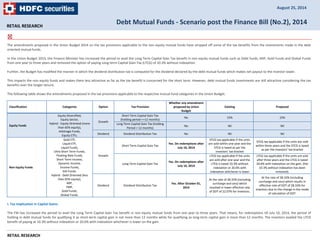

- 1. RETAIL RESEARCH August 25, 2014 Debt Mutual Funds ‐ Scenario post the Finance Bill (No.2), 2014 The amendments proposed in the Union Budget 2014 on the tax provisions applicable to the non equity mutual funds have stripped off some of the tax benefits from the investments made in the debt oriented mutual funds. In the Union Budget 2014, the Finance Minister has increased the period to avail the Long Term Capital Gain Tax benefit in non equity mutual funds such as Debt funds, MIP, Gold Funds and Global Funds from one year to three years and removed the option of paying Long‐term Capital Gain Tax (LTCG) of 10.3% without indexation. Further, the Budget has modified the manner in which the dividend distribution tax is computed for the dividend declared by the debt mutual funds which makes net payout to the investor lower. This impacts the non equity funds and makes them less attractive as far as the tax benefit is concerned for the short term. However, debt mutual funds investments are still attractive considering the tax benefits over the longer tenure. The following table shows the amendments proposed in the tax provisions applicable to the respective mutual fund categories in the Union Budget. Classification Categories Option Tax Provision RETAIL RESEARCH Whether any amendment proposed by Union Budget Existing Proposed Equity Funds Equity Diversified, Equity Sector, Hybrid ‐ Equity Oriented (more than 65% equity), Arbitrage Funds, Equity ETFs. Growth Short Term Capital Gain Tax (holding period <=12 months) No 15% 15% Long Term Capital Gain Tax (holding Period > 12 months) No Nil Nil Dividend Dividend Distribution Tax No Nil Nil Non Equity Funds Gold ETF, Liquid ETF, Liquid Funds, Ultra Short Term Funds, Floating Rate Funds, Short Term Income, Dynamic Income, Income Funds, Gilt Funds. Hybrid ‐ Debt Oriented (less than 65% equity), MIP, FMP, Gold Funds, Global Funds. Growth Short Term Capital Gain Tax Yes. On redemptions after July 10, 2014 STCG tax applicable if the units are sold within one year and the STCG is taxed as per the investors' tax bracket STCG tax applicable if the units are sold within three years and the STCG is taxed as per the investors' tax bracket Long Term Capital Gain Tax Yes. On redemptions after July 10, 2014 LTCG tax applicable if the units are sold after one year and the LTCG is taxed 10.3% without indexation or 20.6% with indexation whichever is lower LTCG tax applicable if the units are sold after three years and the LTCG is taxed 20.6% with indexation on the gain. (the 10.3% without indexation has been removed). Dividend Dividend Distribution Tax Yes. After October 01, 2014 At the rate of 28.33% (including surcharge and cess) which resulted in lower effective rate of DDT of 22.07% for investors. At the rate of 28.33% (including surcharge and cess) which results in effective rate of DDT of 28.33% for investors due to the change in the mode of calculation of DDT. i. Tax Implication in Capital Gains: The FM has increased the period to avail the Long Term Capital Gain Tax benefit in non equity mutual funds from one year to three years. That means, for redemptions till July 10, 2014, the period of holding in debt mutual funds for qualifying it as short‐term capital gain is not more than 12 months while for qualifying as long‐term capital gain is more than 12 months. The investors availed the LTCG benefit of paying at 10.3% without indexation or 20.6% with indexation whichever is lower on the gain.

- 2. The amendment is now made in a manner that the short‐term capital gain is applicable for debt oriented funds if the units are held for not more than 36 months. So any investors who want to get long term capital gain benefit from the debt mutual funds, must hold the units of the debt mutual funds for at least three years. Secondly, the Finance Minister has retained only the option of paying LTCG tax @ 20.6% with indexation and removed the option of 10.3% without indexation. ii. Change in the methodology of calculating Dividend Distribution Tax (DDT): In mutual funds, any dividends which are declared by the fund houses are exempt from tax in the hands of investors. However, in debt mutual funds, AMCs pay Dividend Distribution Tax (DDT) from the distributable income at the rate of 28.33% (including surcharge and cess) (for Individuals and HUF investors). (Please note that there is no Dividend Distribution Tax (DDT) charged for equity mutual funds). In that case, the effective rates so far are lower for investors as the DDT is calculated on actual dividend distributed and not on gross amount distributed. But for an investor, the tax saved is calculated based on gross returns of his investment. For example, out of Rs.1 of distributable income, the AMC has to pay DDT on the dividend of retail investors based on the following formula. That is (x + 28.33% of x = Re 1). Here, “x” denotes the dividend portion for retail investors. The result becomes (0.7793 paisa dividend + 0.2207 paisa DDT = Re. 1). Hence, the effective tax rate for retail investors (on the income distributed) comes closer to 22.07% and not 28.33%. In a nutshell, we can say that the AMC pays 28.33% on the dividend of retail investors which is the same as 22.07% tax on the gross returns of the investment of the investors. Now the Union Budget has proposed that the investors have to pay tax as 28.33%. Hence there is no effective tax benefit for investors. So the investor will lose out the benefit of the difference of the 6.26% (28.325% ‐ 22.07%). The impacts in the mutual funds investments: These amendments have removed the tax arbitrage between the debt mutual funds and Bank Fixed Deposits (FD). In case of FDs, interest earned is taxed as income in the year and at rates as applicable to the individual. This means that an individual in the higher tax bracket would pay 30.90% tax on interest earned from bank FDs ( for the taxable Income upto Rs 1 crore). The proposal in the budget has made the debt mutual funds matching almost with the Bank FDs as far as tax implications are concerned. Debt mutual funds are still attractive over FDs. How? Debt Mutual funds continue to have their advantages over FDs. • Firstly, given the higher inflation, while redeeming the debt MF units after three years by using indexation method, the post tax returns could still be higher than that offered by bank fixed deposits. • Secondly, the tax in debt mutual funds does not accrue till the investor does not exit. But in FD, the investor has to pay taxes every year on accrual (unless he follows cash system of accounting). By holding longer term (for the period of more than three years), the tax applicable in debt mutual funds is likely to be reduced due to indexation benefits. The indexation benefits results in the investors paying almost nil tax for the returns from the debt mutual fund investment as currently the inflation rate is almost the same as the income earned on debt MF investments. • Thirdly, there is no TDS on debt funds redemptions but while in the case of Bank FDs, TDS is applicable if the interest earned in a year by an investor from a Bank is more than Rs. 10,000 (this can be avoided by submitting form 15G in case the investor has no taxable income in a financial year. For senior citizens, the requisite form to avoid TDS is 15H. • Fourthly, there is a tax arbitrage still existing between the bank FDs and the dividend option of the debt mutual funds. The dividend declared by the debt mutual funds attracts the Dividend Distribution Tax (DDT) at the rate of 28.33% while the tax on interest earned from bank FDs for the taxable Income upto Rs 1 crore levied at the rate of 30.90% (33.99% for taxable Income exceeds Rs 1 crore) for the investors falling under highest tax bracket. Hence the 2.57% lower tax makes the debt mutual funds more attractive than the bank FDs. The difference becomes higher of 5.66% lower for debt mutual funds for the taxable income exceeds Rs 1 crore. RETAIL RESEARCH

- 3. Dividend plans in the Debt schemes are still attractive for investors those who fall under the higher tax slab of 30%: Particular Taxable Income upto Rs 1 crore Taxable Income exceeds Rs 1 crore RETAIL RESEARCH Fixed Deposit Debt MF Dividend Option Fixed Deposit Debt MF Dividend Option Assumed rate of return from the investment (%) p.a 9% 9% 9% 9% Income tax rate 30.90% NA 33.99% NA Dividend Distribution Tax NA 28.33% NA 28.33% Effective post tax yields 6.22% 6.45% 5.94% 6.45% Bonus stripping: Bonus stripping is one of the other ways to save tax. In this, an investor can set off his capital gains against the losses arising out of bonus stripping. This involves transactions such as investing in bonus plan of a debt mutual fund schemes before the record date, selling the original units and bonus units at different timeframes resulting in short term capital loss and long term capital gain. Mutual Fund Units Stripping means after the units of a mutual fund are purchased, the mutual fund allots bonus units to the holder of the units, and after receiving the additional units, the original units are sold. Usually after the declaration of bonus units, the NAV of the mutual fund will decline proportionately. Hence, on sale of the original units, short‐term capital loss will arise. Subject to provisions of section 94(8) referred to above, that loss can be set off against the other short‐term capital gains or against a taxable long‐term capital gain. This will thus result into no commercial loss but only tax loss and therefore there would be a tax benefit. On sale of bonus units of debt‐oriented mutual fund after a period of 36 months, the gain, if any, will be treated as long‐term capital gains and the same is taxable @ 20% (with indexation) + surcharge/cess as may be applicable. Arbitrage Funds: Arbitrage schemes are equity oriented schemes and reap the benefit from the arbitrage opportunities between the cash and the futures markets. They are considered as best alternates for liquid and other short‐term income categories, since they provide better tax benefit and steady returns for shorter period. Investors with low risk appetite can consider investing in it. Arbitrage schemes generate income through arbitrage opportunities arising out of pricing mismatch in a security between different markets or as a result of special situations. They are completely hedged positions, neutralizes market risk (volatility) and targets absolute returns irrespective of market conditions with no specific equity risk. The schemes will aim to have prudent balance of safety, returns and liquidity. Typically, volatile markets offer more arbitrage opportunities between the cash and derivative market. In the event of no adequate arbitrage opportunities, funds may choose to increase exposure to short‐term debt and liquid instruments. Tax benefits in Arbitrage funds: Arbitrage schemes enjoy tax benefits (nil dividend distribution tax vs 28.33% for debt mutual funds) as they are treated as equity oriented schemes. Hence the post tax return of such schemes works out to be better than debt funds. Investment in arbitrage schemes attracts a short‐term capital gain tax of 15%, if they are sold within one year. In case of debt funds, short term capital gain tax is charged for the investments redeemed within three years and taxed as per the tax slab of the investors. Long term capital gain (LTCG) is nil for arbitrage schemes, if the investments are sold after one year. Top performing schemes from Arbitrage Category: Scheme Name Latest Corpus (Rs Crs) Expense Ratio (%) Trailing Returns (%) Rolling Returns (%) Standard Deviation 1 Month 3 Month 6 Month 1 Year 2 Year 3 Year 1 Month 3 Month 6 Month 1 Year 2 Year (Daily) Absolute Absolute Absolute CAGR CAGR CAGR Absolute Absolute Absolute CAGR CAGR ICICI Pru Blended ‐ Plan A (G) 772 0.83 0.66 2.65 4.50 9.47 9.49 9.39 0.76 2.26 4.54 9.29 8.86 0.08

- 4. Kotak Equity Arbitrage Fund (G) 1610 0.87 0.68 2.65 4.60 9.84 9.22 9.06 0.74 2.20 4.40 8.86 8.44 0.07 Reliance Arbitrage Advantage Fund (G) 346 0.82 0.54 2.39 3.96 8.54 8.93 9.15 0.75 2.25 4.56 9.42 9.53 0.09 JM Arbitrage Advantage Fund (G) 5669 0.78 0.72 2.56 4.43 9.46 8.97 9.05 0.74 2.19 4.39 8.85 8.33 0.07 IDFC Arbitrage ‐ Plan A (G) 1864 1.00 0.66 2.53 4.42 9.46 8.97 9.05 0.74 2.19 4.40 8.89 8.36 0.07 SBI Arbitrage Opportunities Fund (G) 169 1.32 0.71 2.54 4.38 9.06 8.76 8.84 0.72 2.17 4.37 8.86 8.42 0.07 Category Average of Arbitrage Funds ‐ 0.96 0.66 2.41 4.38 9.15 8.76 8.76 0.72 2.14 4.29 8.69 8.31 0.08 Category Average of Liquid Funds ‐ 0.43 0.68 2.04 4.21 8.98 8.55 8.75 0.71 2.13 4.29 8.67 8.17 0.02 Risks of investing in Arbitrage Funds: The main concerns are higher transaction costs like broking costs on four legs in the transaction. The arbitrage fund’s expenses are higher and almost double that of the Liquid Funds category (0.96% for this category and 0.43% in case of liquid funds), though the schemes give returns like a fixed income fund. In sideways/falling markets, fund managers have to perforce invest a portion (small or large) into money market instruments as they do not perform well in all markets. They stand out in volatile or buoyant markets but not range‐bound or bear markets. Changes in regulations by exchanges in terms of exposure, margins etc could impact the flexibility of these funds. Further difference in opportunities from time to time could cause the returns from these schemes to be volatile in a band. Relative performance of Debt Funds categories including Arbitrage Funds: Category RETAIL RESEARCH Expense Ratio (%) Trailing Returns (%) Rolling Returns (%) Standard Deviation (Daily) 1 Month Absolute 3 Month Absolute 6 Month Absolute 1 Year CAGR 2 Year CAGR 3 Year CAGR 1 Month Absolute 3 Month Absolute 6 Month Absolute 1 Year CAGR 2 Year CAGR Arbitrage Funds 0.96 0.66 2.41 4.38 9.15 8.76 8.76 0.72 2.14 4.29 8.69 8.31 0.08 Floating Rate ‐ LT 0.66 0.70 2.18 4.72 10.01 8.36 8.69 0.71 2.13 4.25 8.54 8.19 0.08 Floating Rate ‐ ST 0.69 0.70 2.15 4.67 9.74 8.96 9.15 0.74 2.23 4.49 9.07 8.65 0.04 Gilt ‐ LT 1.45 0.71 2.96 5.71 8.46 7.36 7.90 0.66 1.88 3.53 6.89 7.27 0.37 Gilt ‐ ST 0.87 0.67 2.47 4.84 9.70 8.53 8.45 0.70 2.05 3.99 7.86 7.39 0.18 Income Funds 1.45 0.73 2.28 5.02 9.20 7.78 8.38 0.70 2.12 3.95 7.79 7.99 0.20 Liquid Funds 0.43 0.68 2.04 4.21 8.98 8.55 8.75 0.71 2.13 4.29 8.67 8.17 0.02 Short Term Income Funds 0.99 0.77 2.16 4.81 10.10 8.63 8.87 0.72 2.17 4.35 8.75 8.56 0.07 Ultra Short Term Funds 0.79 0.68 2.09 4.42 9.55 8.64 8.83 0.72 2.17 4.36 8.82 8.43 0.03 To conclude; To earn best tax efficient returns on debt mutual fund schemes; • High tax paying Investors who want to park the amount for short term (from say a week to upto 3 years) can consider investing in the dividend plan of the liquid funds, Ultra Short Term, Short Term, Floating Rate etc.

- 5. • Investors who are willing to hold on for a period upto 1 year can opt for dividend plan of Arbitrage funds. Investors who wish to hold on for more than 1 year but less than 3 years could opt for growth plan of Arbitrage funds. • Investors who have short term Capital gains in the same year from sources other than listed equity shares or equity oriented mutual funds) and who can wait for 3 and further 6 months from their investment date (which is closer to the record date) can opt for Bonus option. Bonus stripping in Arbitrage funds also provides good post tax returns in a much shorter holding period. • Investors who are willing to hold on for a period more than 3 years can consider investing in Growth plan of the FMPs, Liquid, Ultra Short Term, Short Term, Floating Rate, Income or Gilt funds. Analyst: Dhuraivel Gunasekaran (Dhuraivel.gunasekaran@hdfcsec.com) RETAIL RESEARCH Fax: (022) 3075 3435 Corporate Office: HDFC Securities Limited, I Think Techno Campus, Building –B, ”Alpha”, Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042 Fax: (022) 30753435 Website: www.hdfcsec.com Disclaimer: Mutual Funds investments are subject to risk. Past performance is no guarantee for future performance. This document has been prepared by HDFC Securities Limited and is meant for sole use by the recipient and not for circulation. This document is not to be reported or copied or made available to others. It should not be considered to be taken as an offer to sell or a solicitation to buy any security. The information contained herein is from sources believed reliable. We do not represent that it is accurate or complete and it should not be relied upon as such. We may have from time to time positions or options on, and buy and sell securities referred to herein. We may from time to time solicit from, or perform investment banking, or other services for, any company mentioned in this document. This report is intended for non‐Institutional Clients. RETAIL RESEARCH