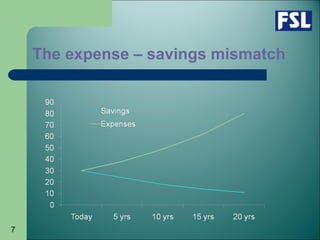

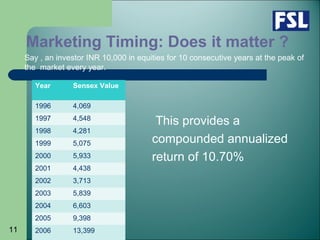

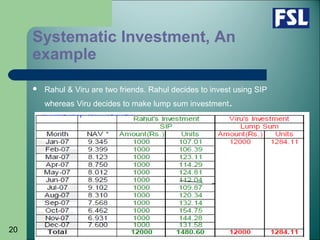

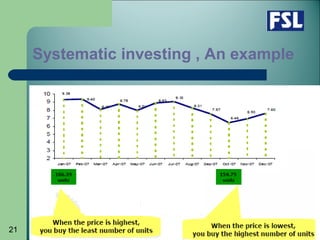

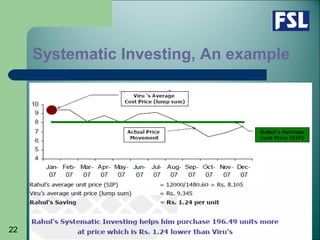

This document discusses Systematic Investment Plans (SIPs) and their benefits over lump sum investing. It notes that SIPs allow investors to invest fixed amounts regularly in mutual funds. Through an example comparing SIP investing to lump sum investing, it shows how SIPs benefit from rupee cost averaging by purchasing more units when prices are low and fewer when they are high. This can lead to higher overall returns. The document advocates for long term SIP investing, noting it helps achieve financial goals while avoiding issues with market timing. It addresses common objections to investing and argues that SIPs provide an easy way to start investing and benefit from compounding returns.