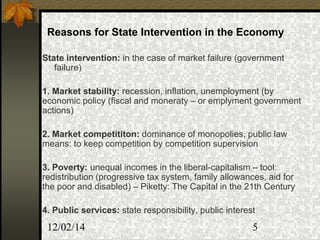

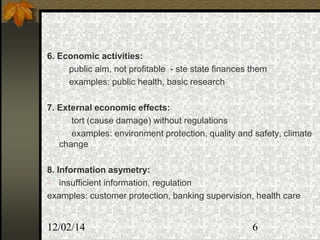

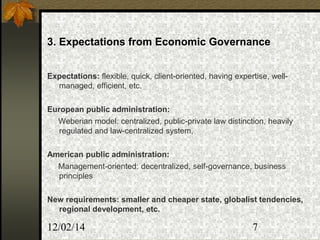

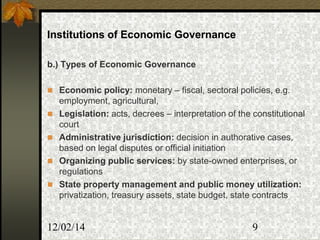

This document discusses state institutions of economic governance. It outlines several goals governments must follow in developing their economies, including GDP growth, efficiency, welfare of citizens, and upholding certain values. The document also examines two extremes of state intervention in economies - liberal capitalism with no intervention and communist economies with total intervention. It provides reasons for some level of state intervention, such as to ensure market stability, competition, poverty reduction, and provision of public services. Finally, it outlines the key institutions involved in economic governance, including political parties, parliaments, governments, administrative organizations, courts, and international organizations.