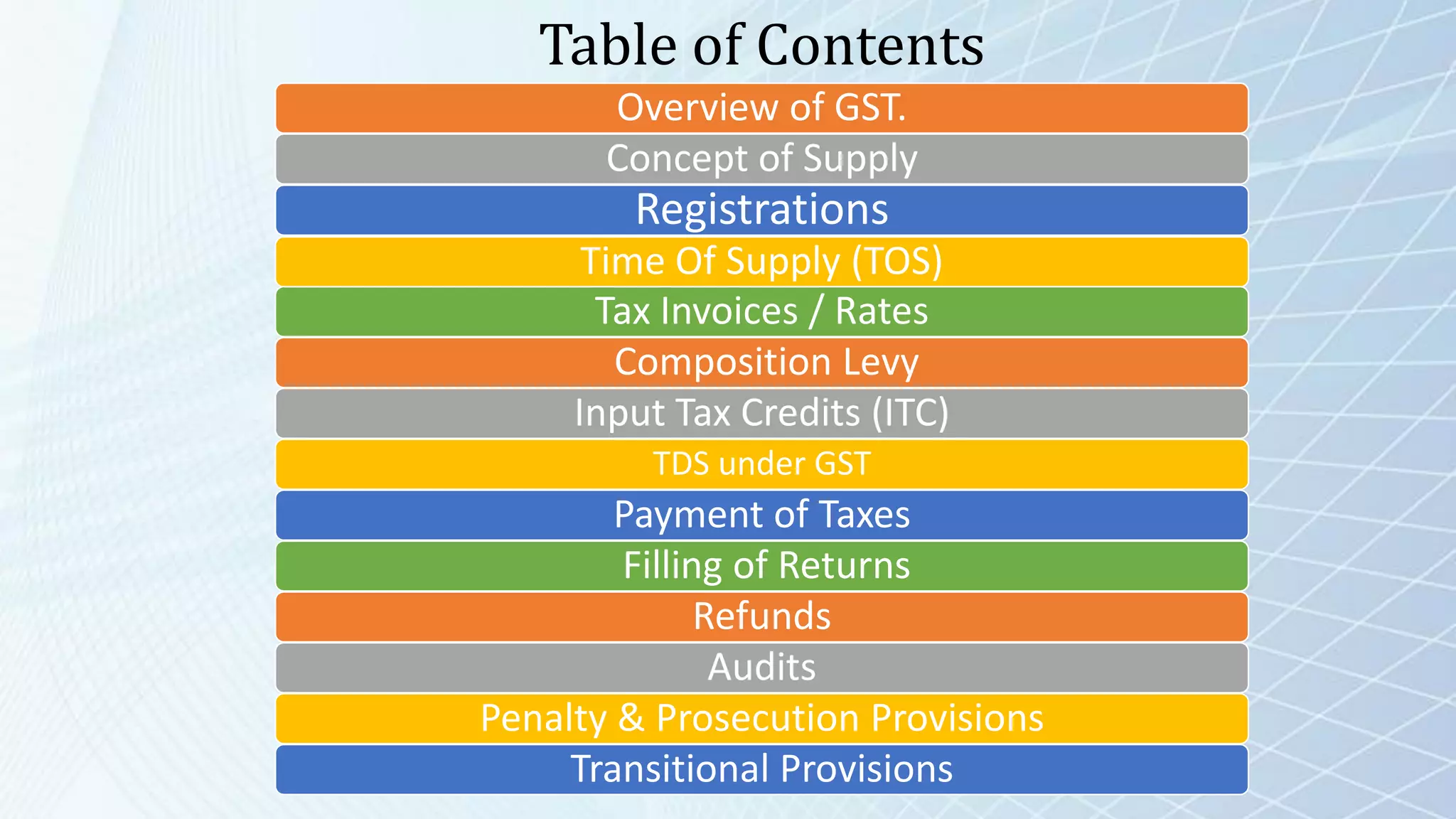

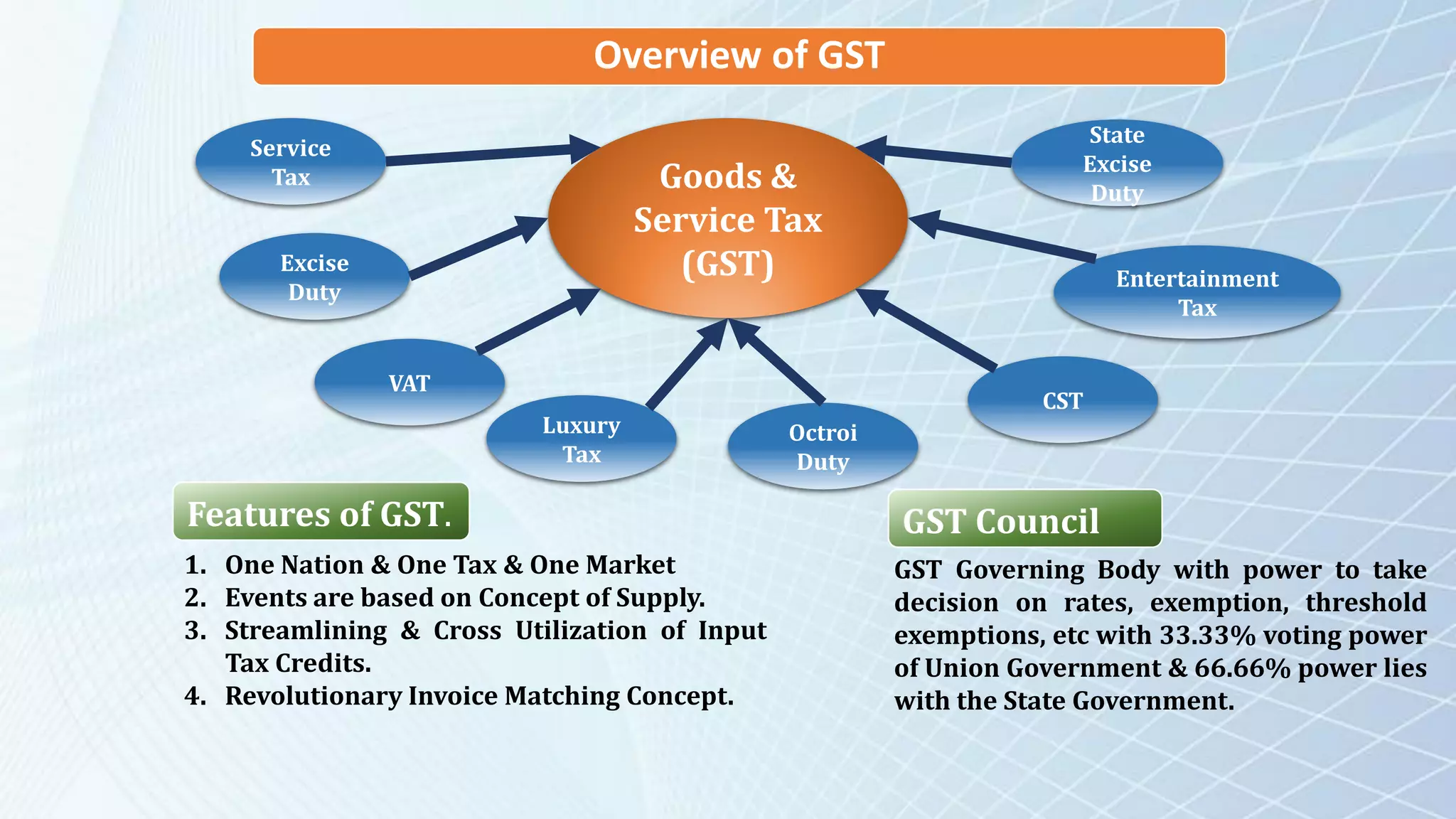

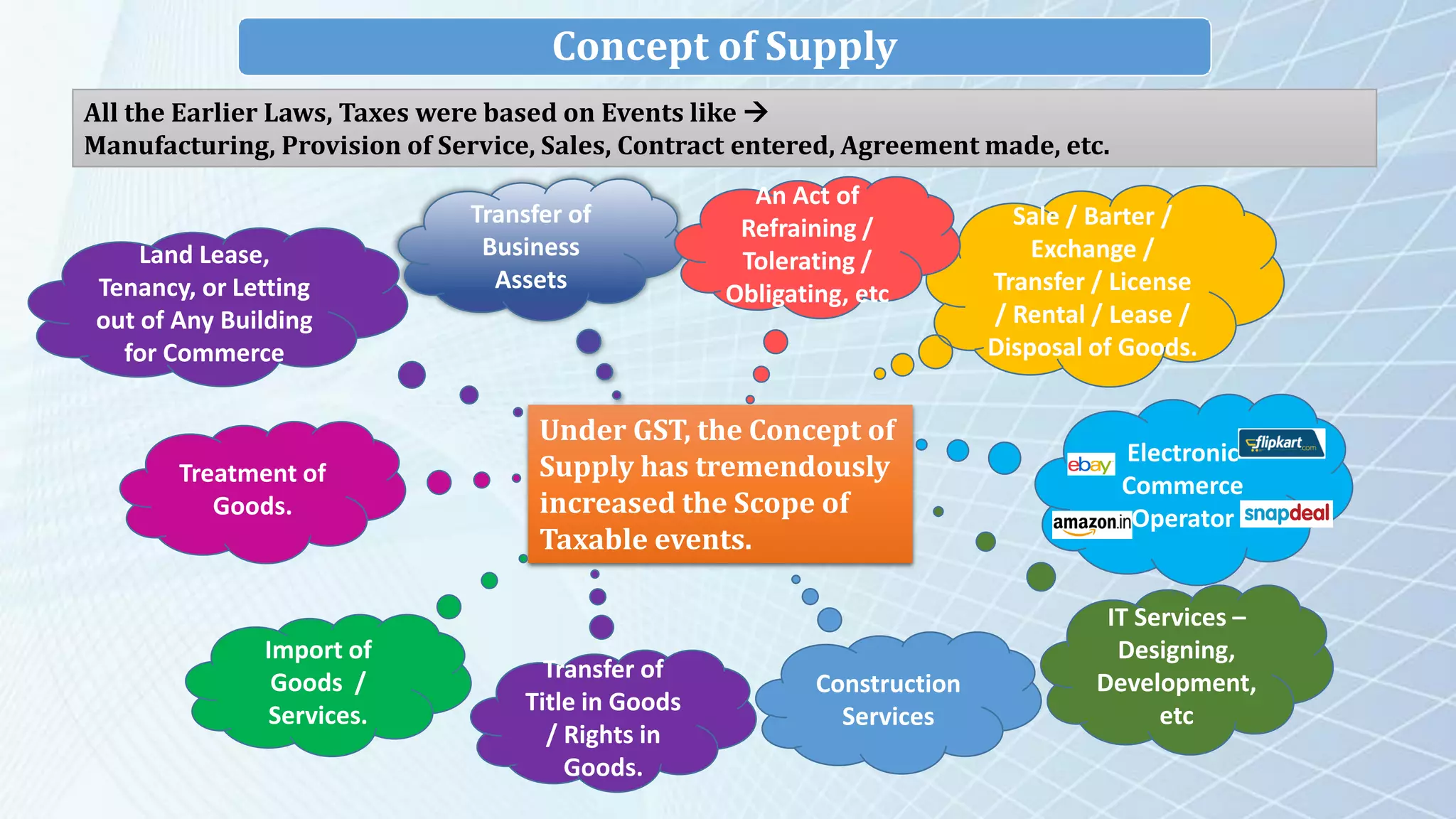

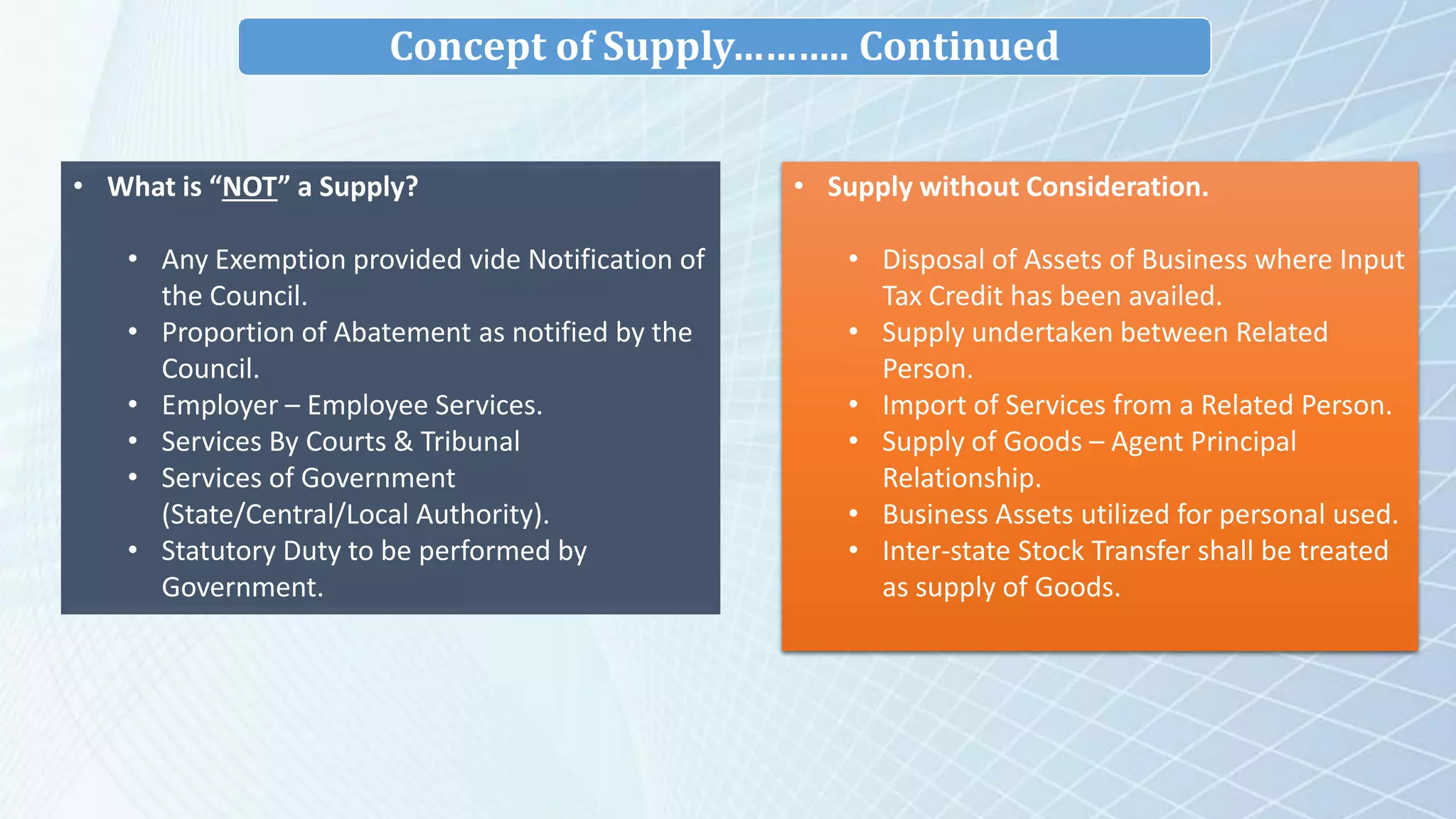

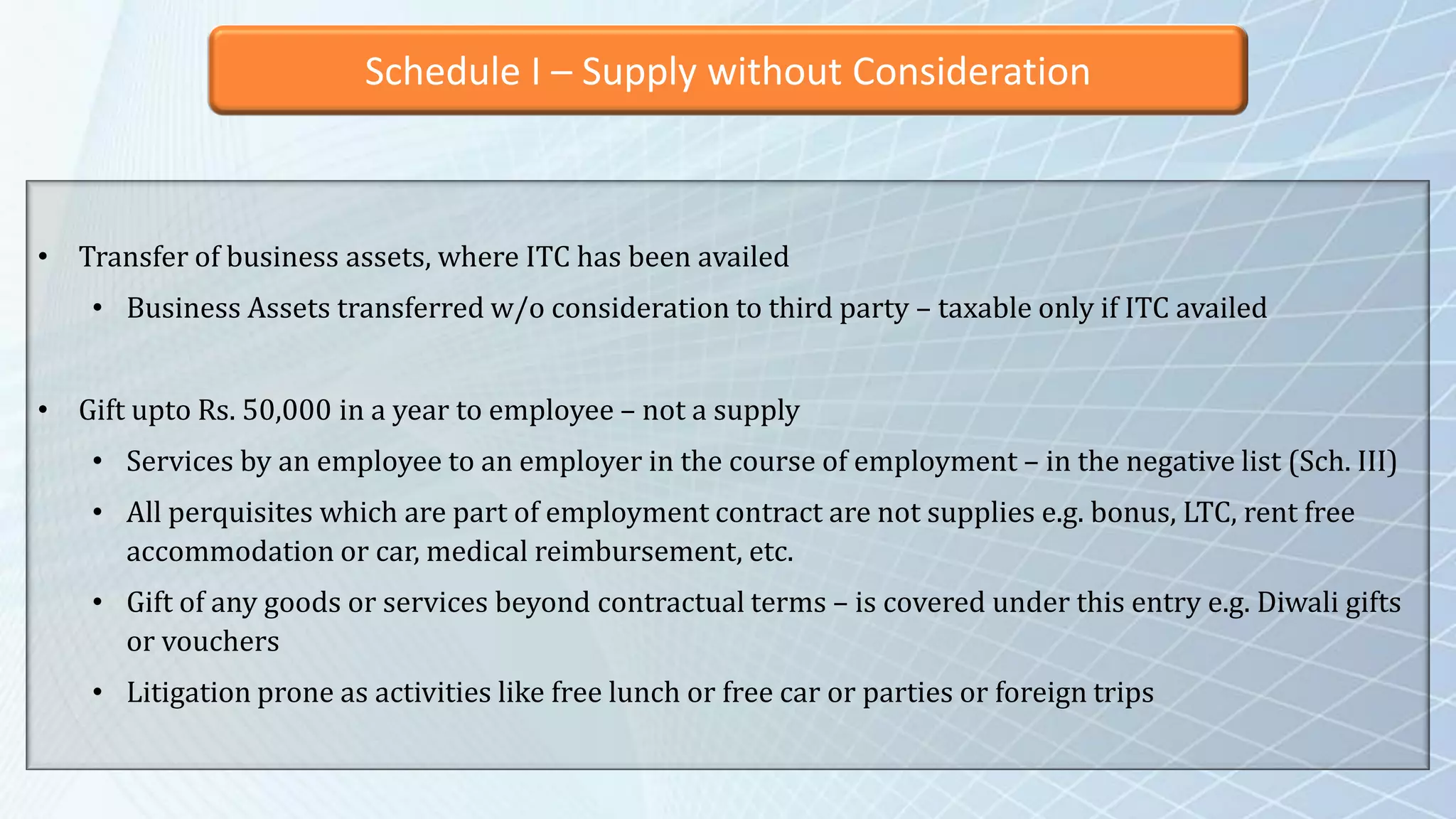

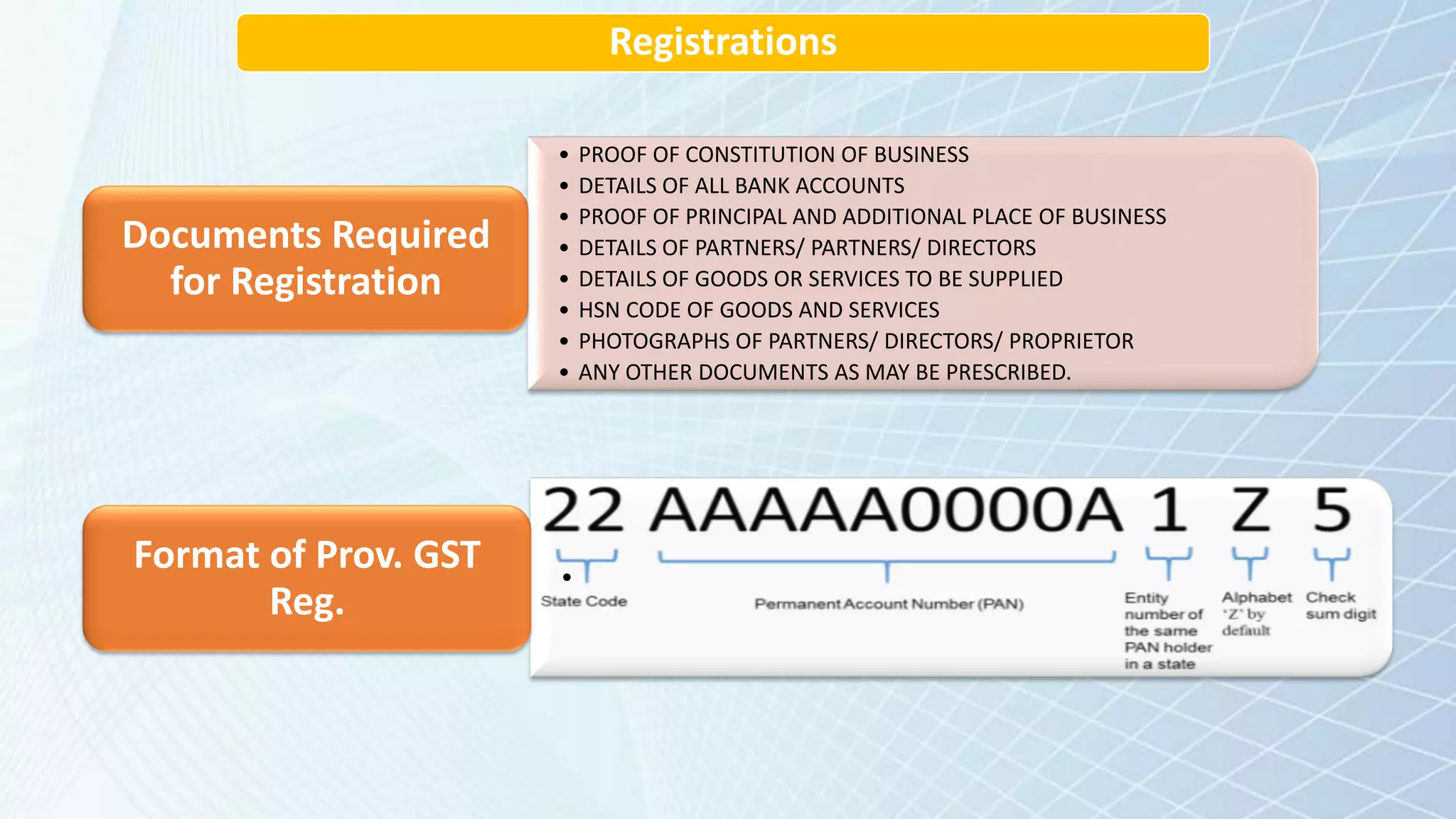

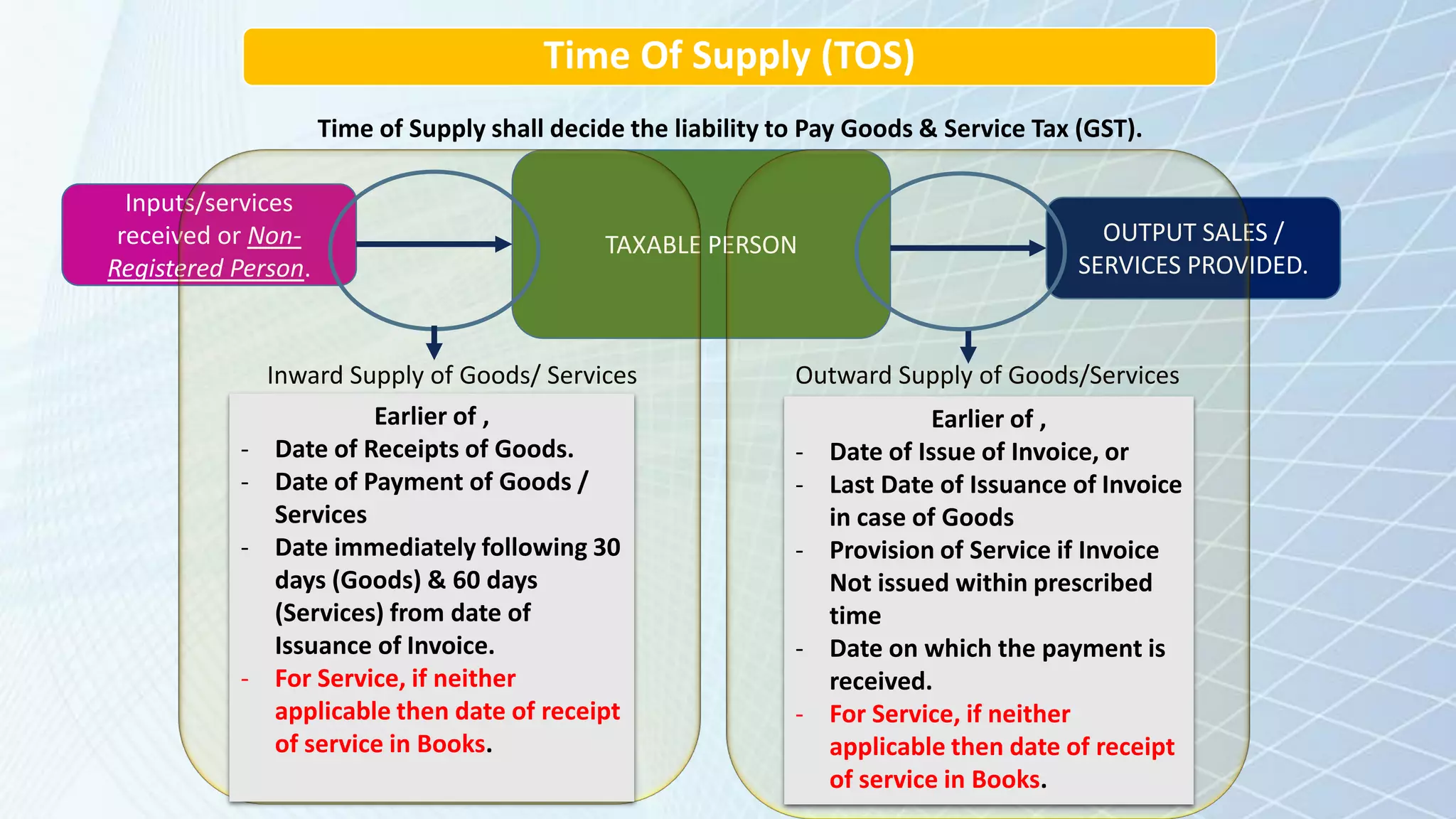

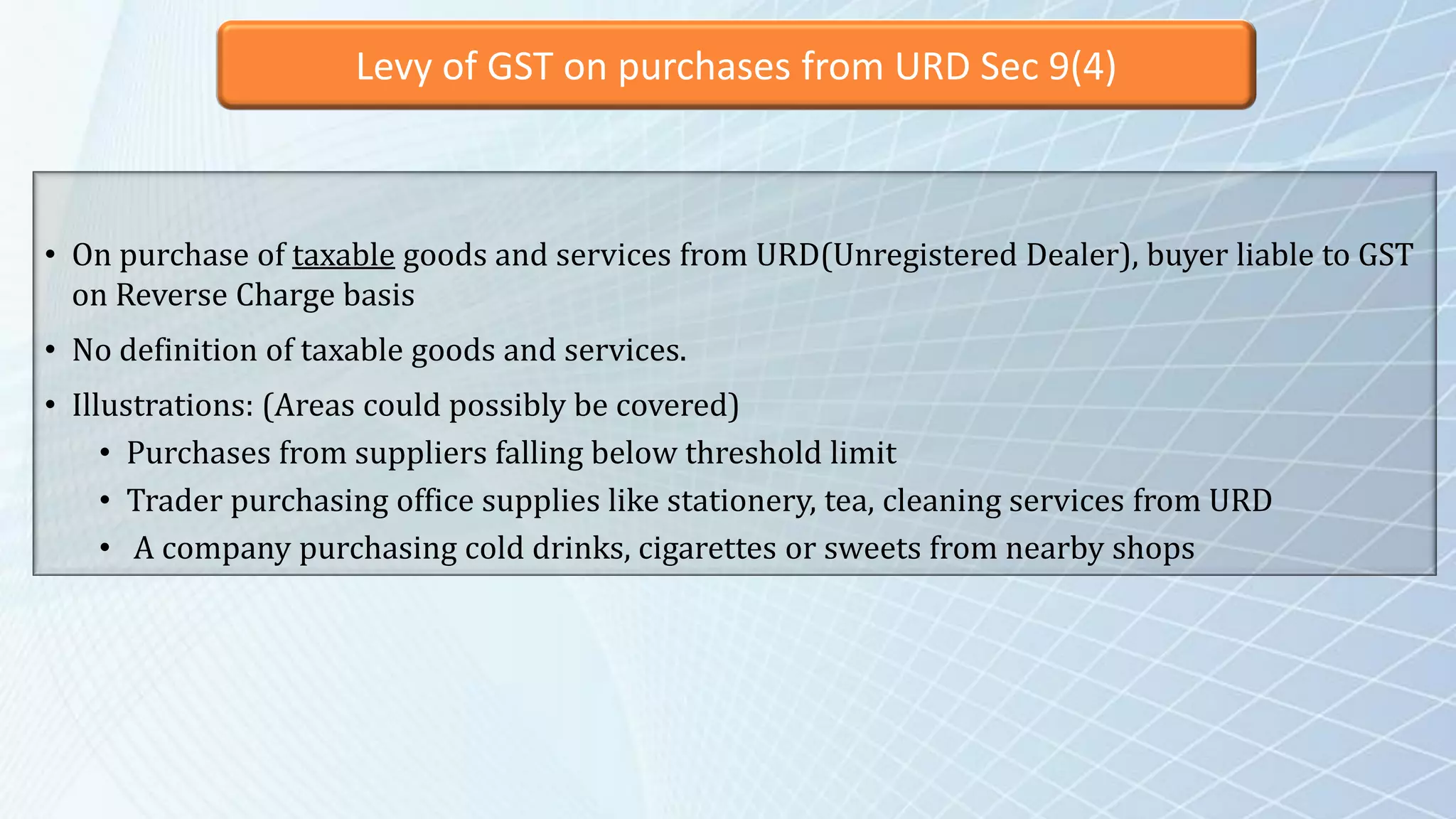

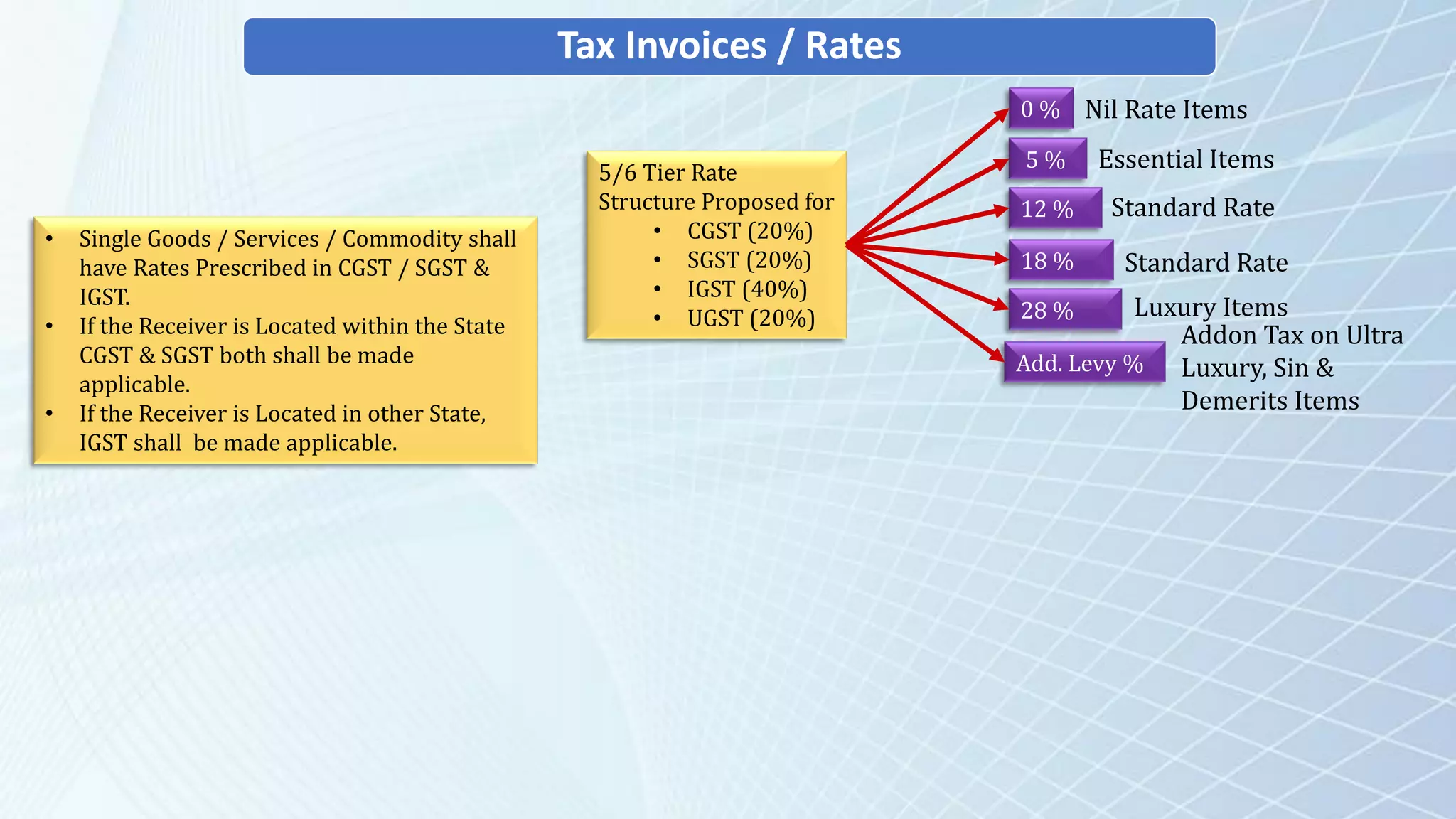

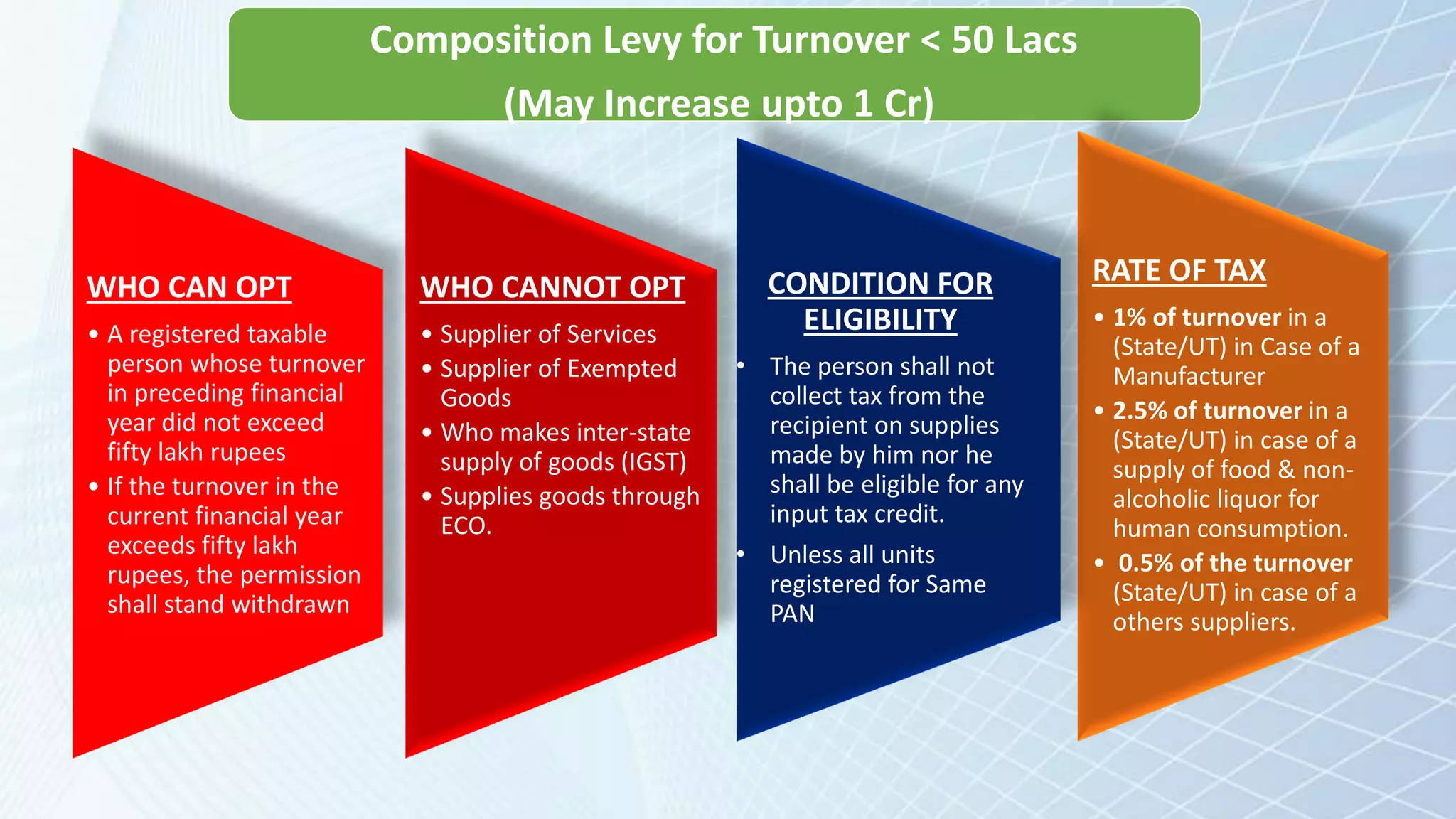

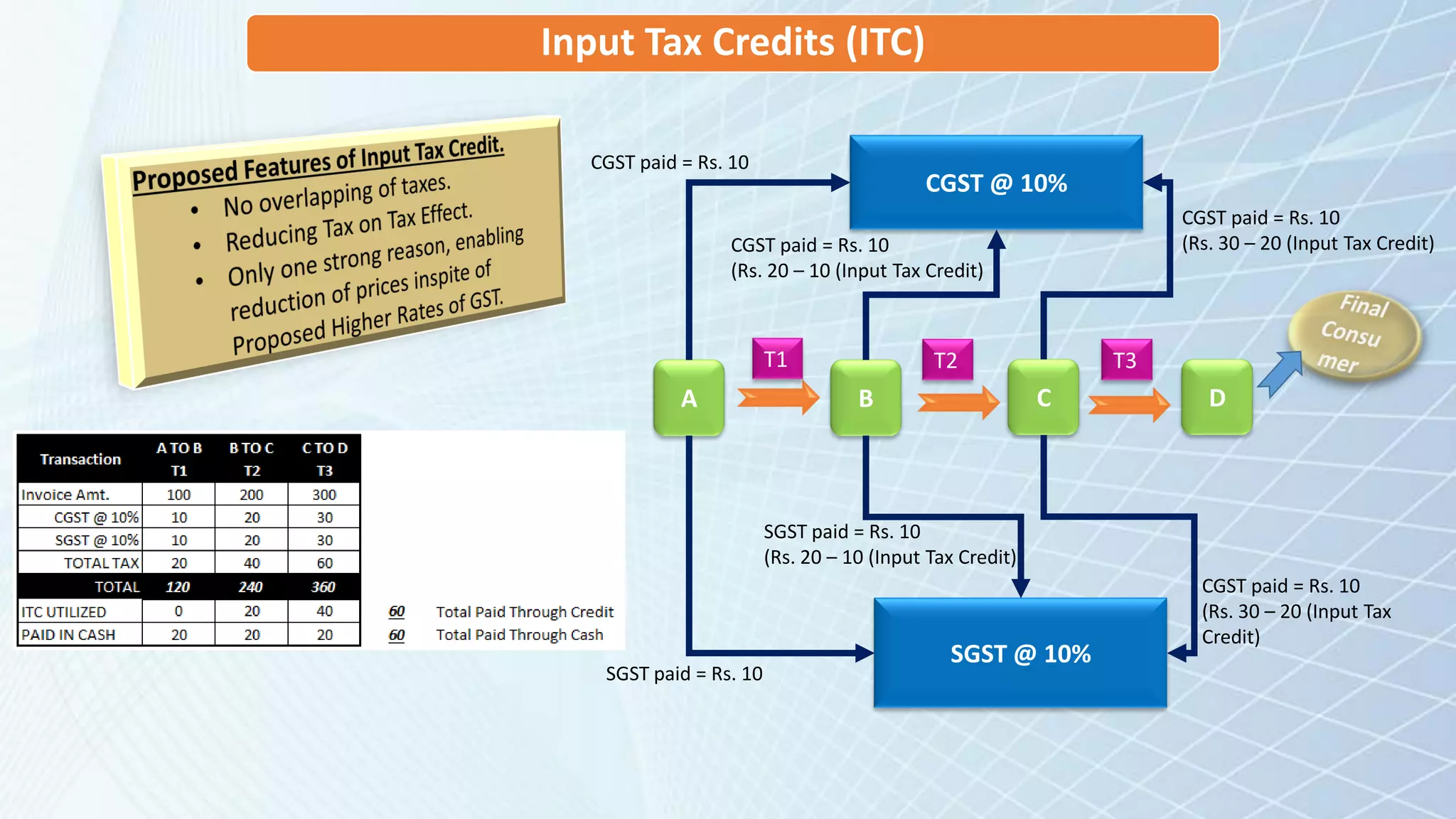

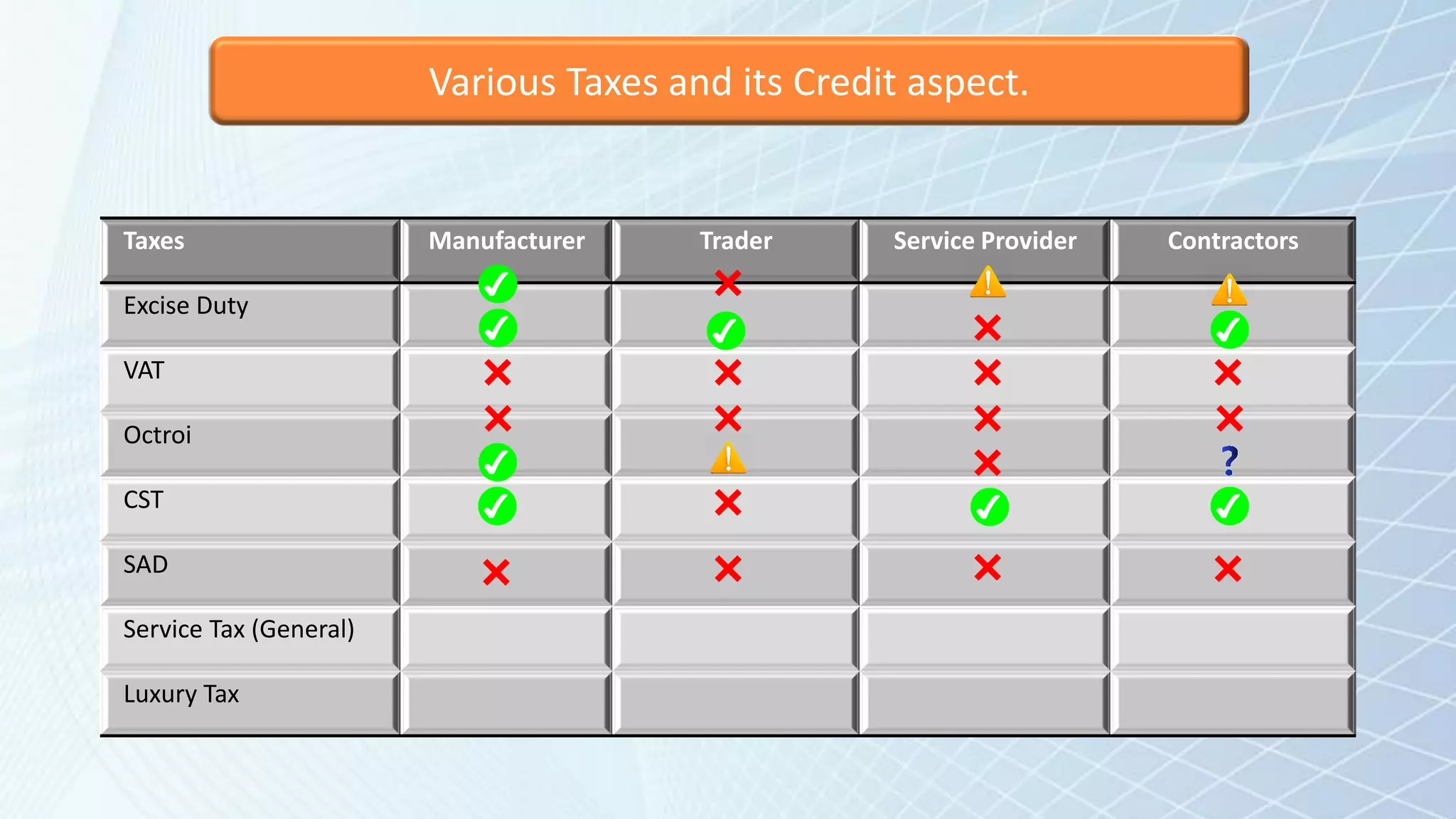

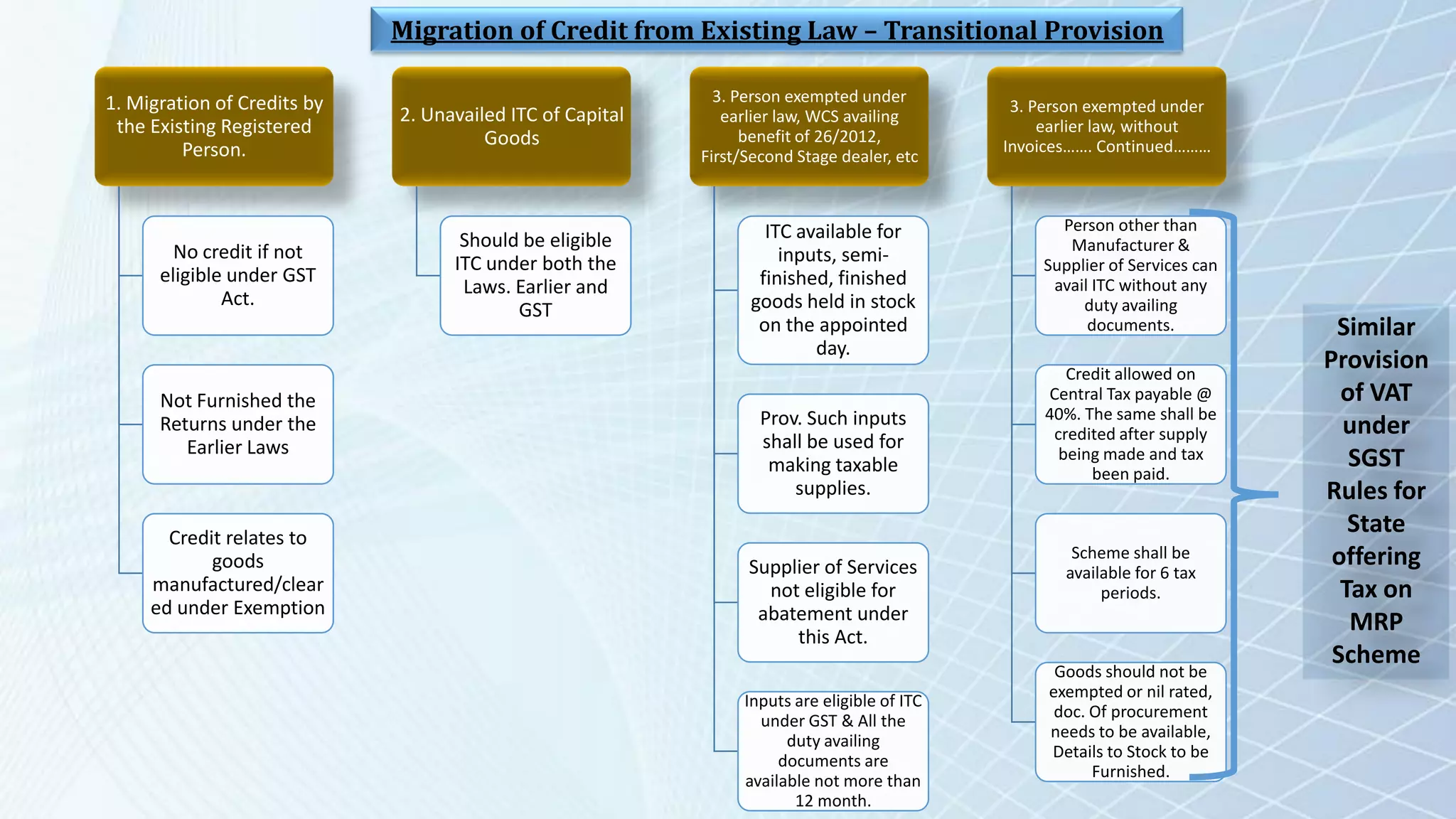

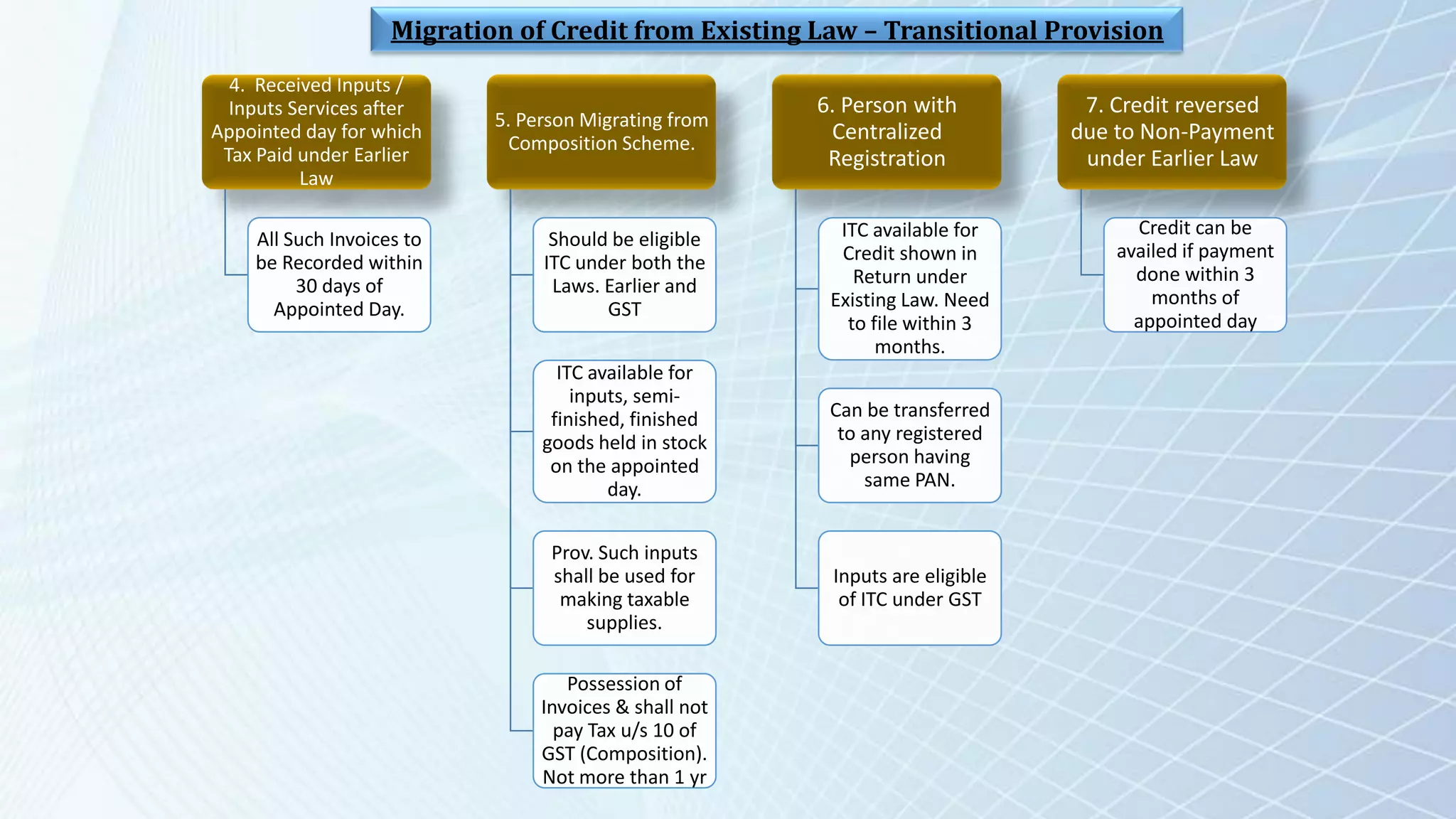

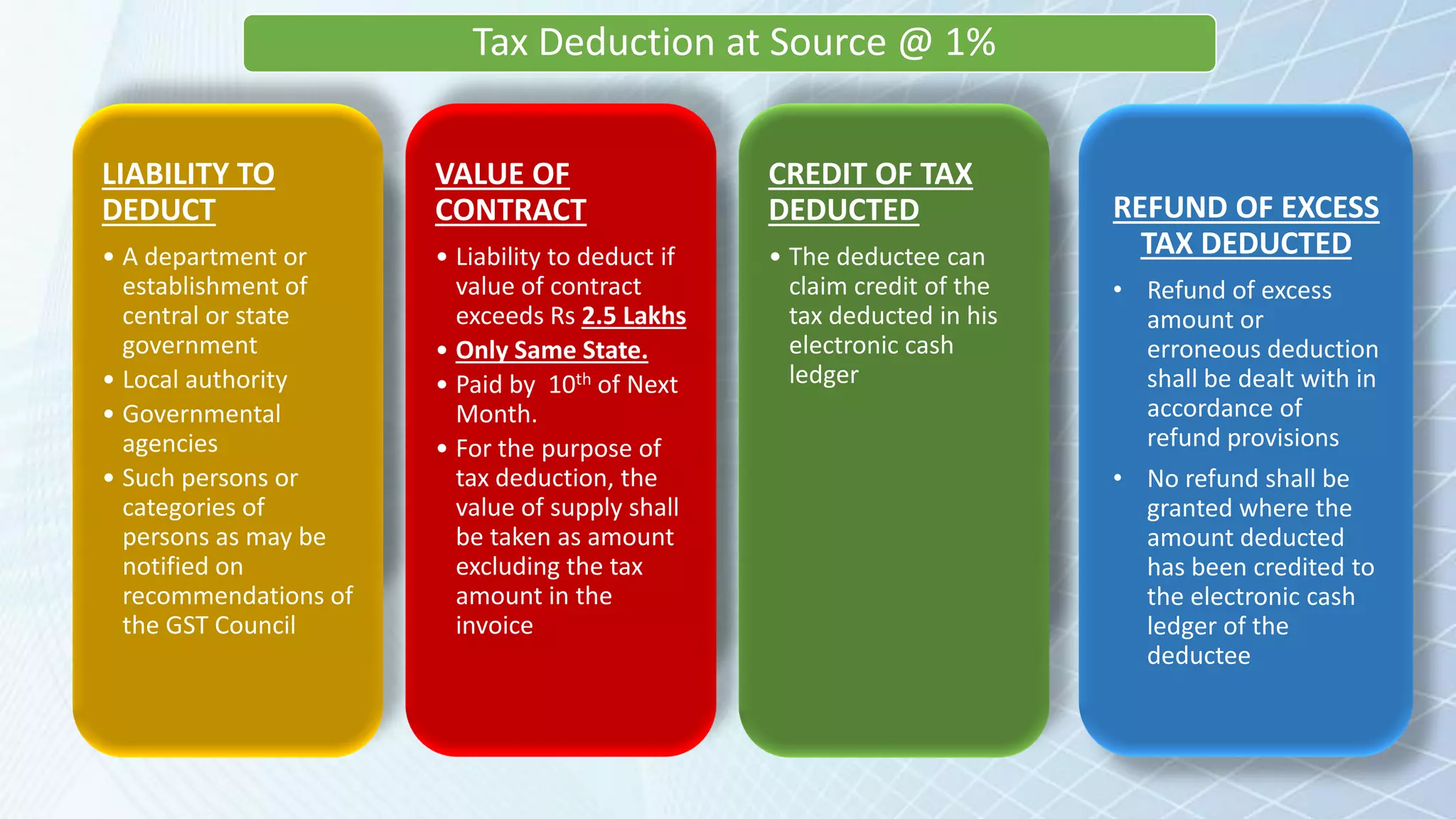

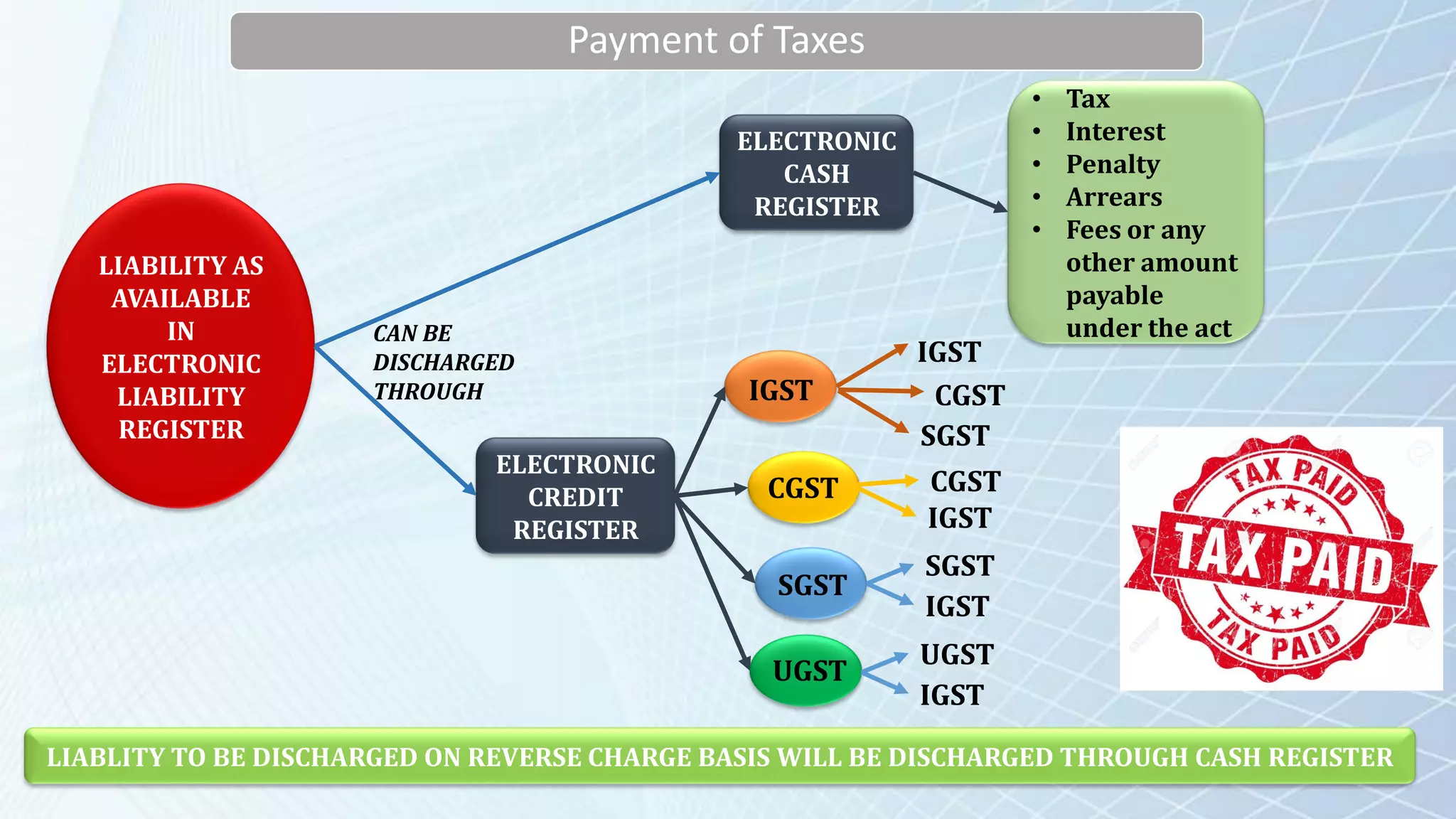

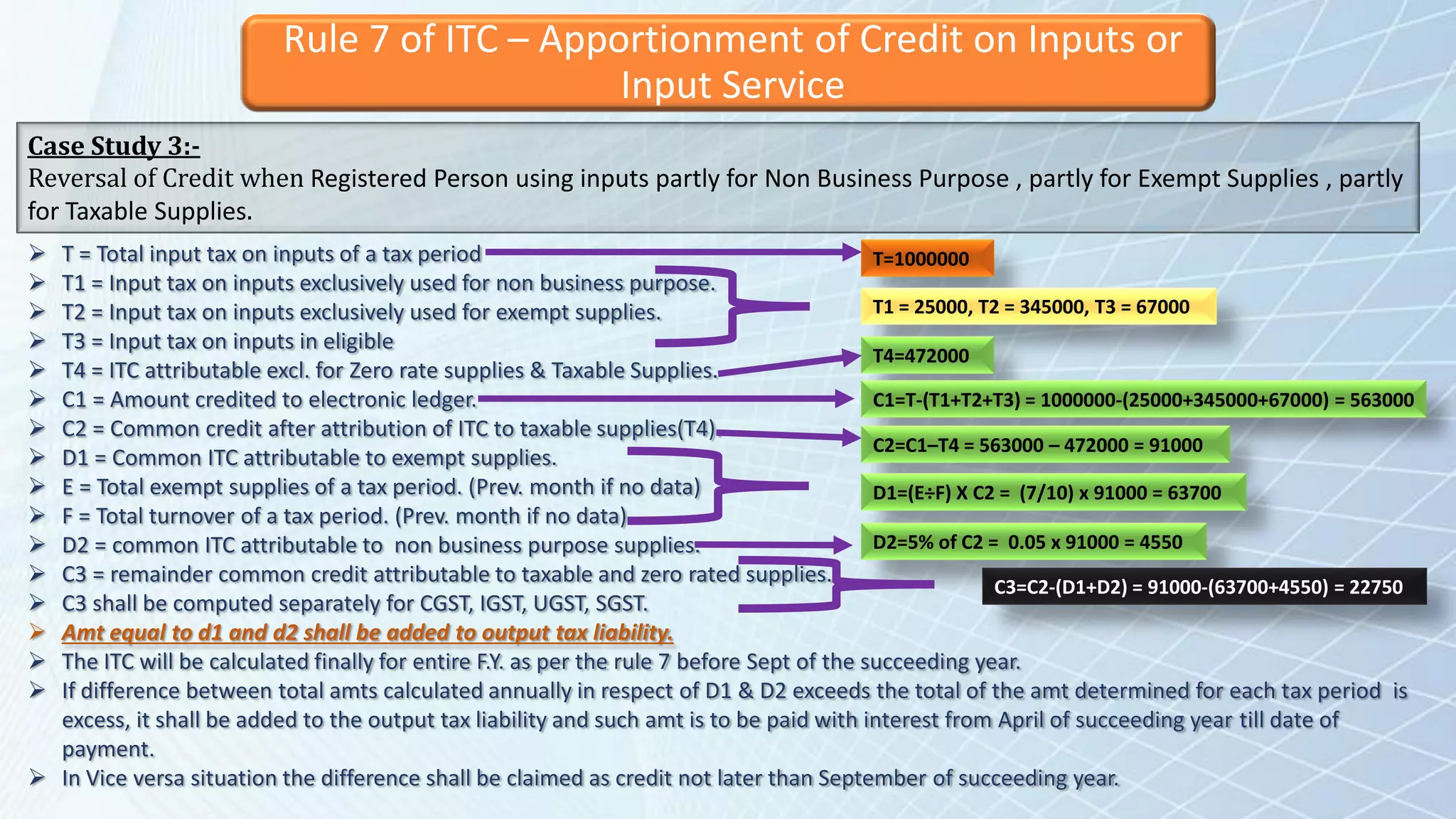

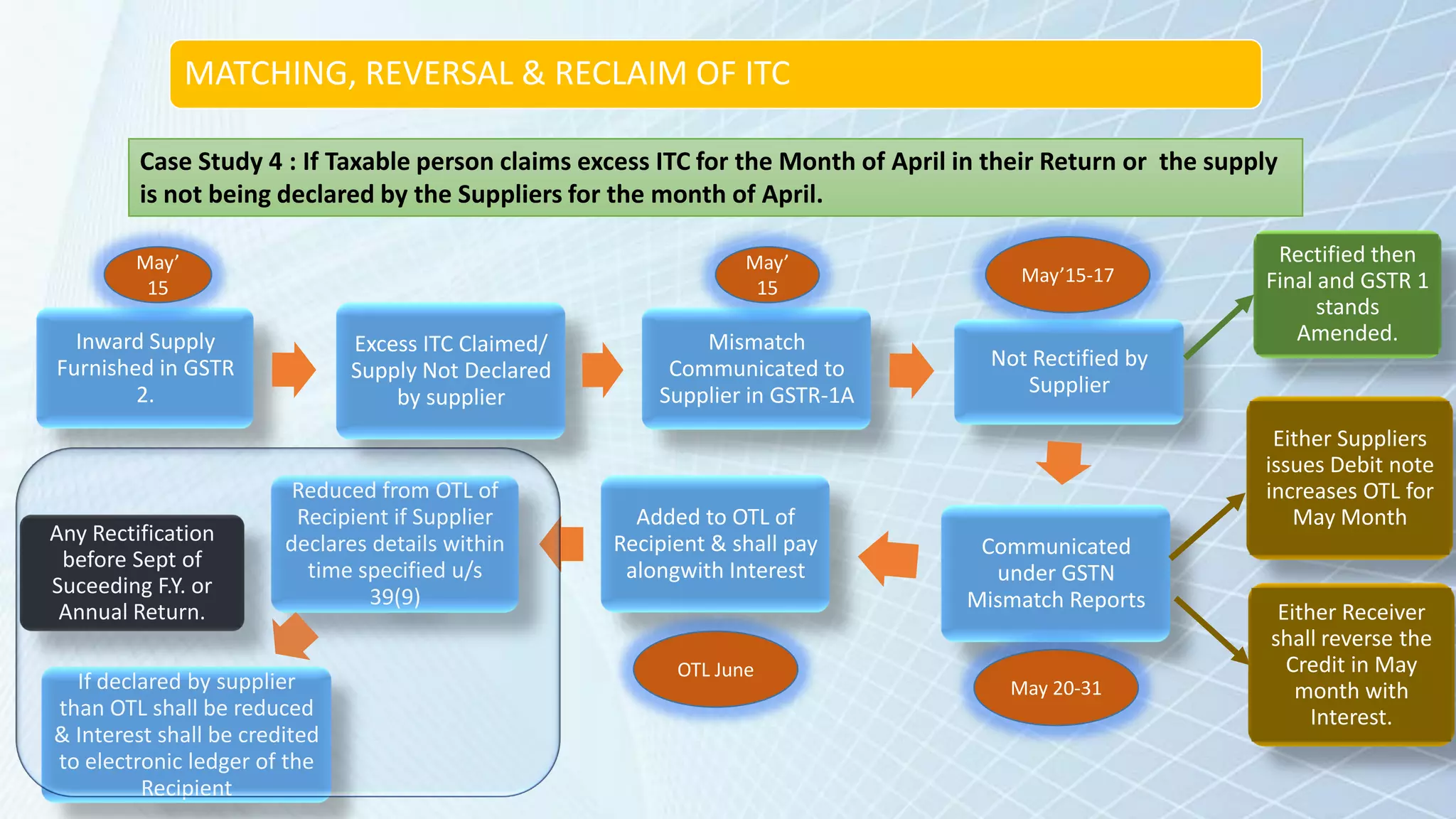

This document provides an overview of key concepts and provisions under the Goods and Services Tax (GST) in India, as presented by Dr. RamSingh from Quantum University, Roorkee India. It covers topics such as the concept of supply, registrations, tax invoices and rates, input tax credits, tax deduction at source, payment of taxes, and transitional provisions for migrating to GST. Some key points include that GST is based on the concept of supply rather than individual taxes, there will be a single registration system across states, tax credits can be claimed across goods and service taxes, and the document provides guidance on carrying forward credits and assets from prior tax regimes to GST.