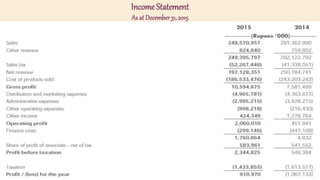

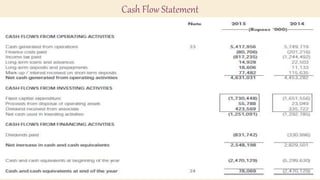

Royal Dutch Shell is a major global energy and petrochemical company, with roots tracing back nearly 200 years. The company operates in over 70 countries and employs approximately 93,000 people, producing 3.0 million barrels of oil equivalent each day. Financial metrics for 2015 indicate a current ratio of 0.83, a net profit margin of 0.0037, and a gross profit margin of 0.0426.