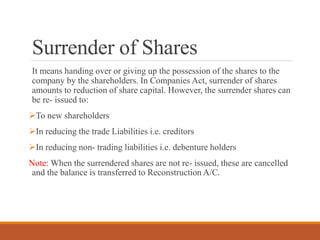

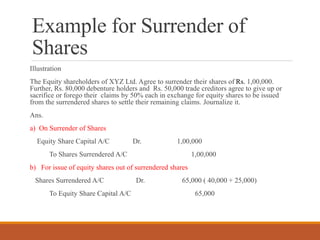

The document discusses the concepts and accounting treatments related to the surrender of shares, which involves shareholders relinquishing share possession to a company, leading to a reduction in share capital. It outlines how surrendered shares can be re-issued, canceled, or used to settle liabilities, along with relevant journal entries for each scenario. Additionally, it explains the utilization of the reconstruction account for writing off assets and liabilities as part of the reconstruction process.