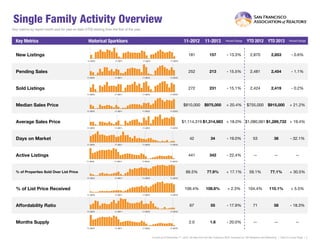

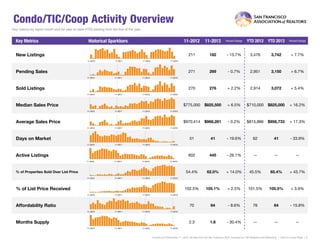

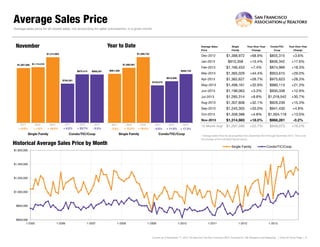

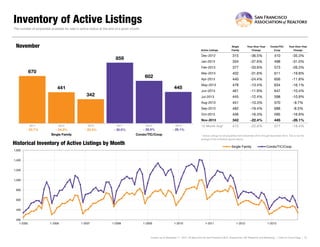

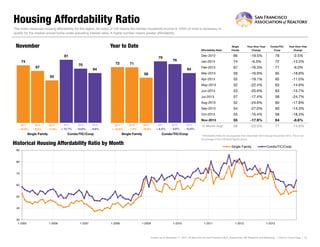

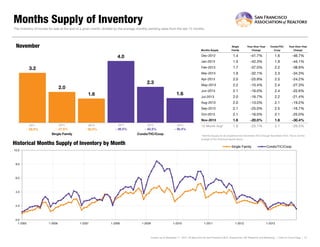

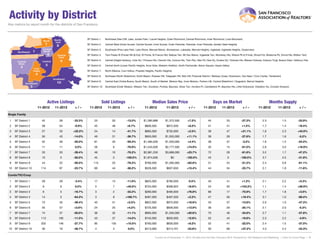

Residential real estate activity in San Francisco County saw encouraging signs in November 2013, though some metrics moderated from multiyear highs. New listings and pending sales decreased month-over-month for both single family homes and condos/co-ops. However, median sales prices continued rising sharply with a 20.4% increase for single family homes and 6.5% for condos/co-ops compared to November 2012. Strong economic data and job growth are supporting the housing recovery. Watch for further tapering of the Federal Reserve's stimulus program in March 2014.