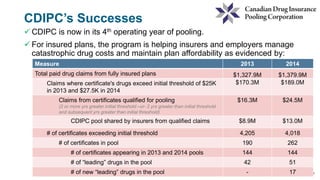

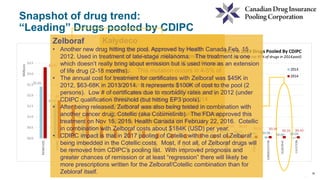

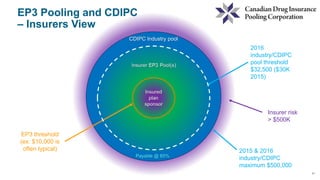

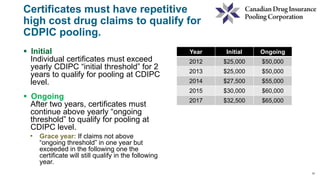

CDIPC manages high drug costs for the insurance industry through two pooling levels. The EP3 pool covers individual plans for claims above a threshold, usually $10,000. The CDIPC industry pool then covers recurring claims over $32,500 across the insurance industry. This system allows for affordability, availability, and transferability of drug coverage. In its fourth year, CDIPC has pooled over $24 million in claims and helped insurers manage unpredictable drug costs. However, new specialty drugs like Kalydeco continue driving costs higher, presenting ongoing challenges for CDIPC.

![13

13

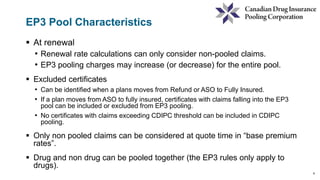

Insurance Company “A” has an EP3 plan which pools claims at the individual

level / certificate level at $10,000 (somewhat typical)

Example of an eligible certificate hitting EP3 then CDIPC industry pool (in 2nd

year of exceeding CDIPC initial threshold of $65,000):

Family Member Paid Claims

Amount

A) “Direct” plan

sponsor claims

experience

B) Amount flowing to

insurer’s EP3 pool

[ with CDIPC ongoing threshold

@ $32.5K ]

C) Amount flowing to

CDIPC industry pool

Certificate Holder $300 $300 $0 $0

Spouse $102,000 $9,700 $22,500 $69,800

Child $50 $0 $0 $50

Allocations $102,350 $10,000 $22,500 $72,350 @ 85% =

$61,498

Example](https://image.slidesharecdn.com/session7-cdipcoverviewdanberty-160427132449/85/Session-7-13-320.jpg)