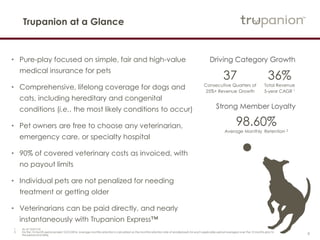

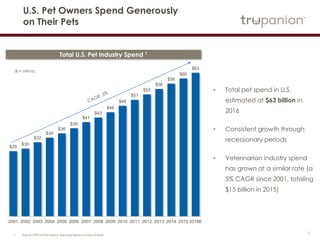

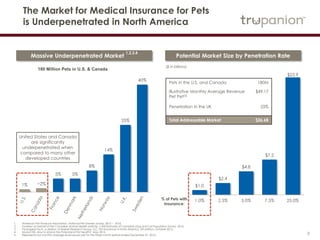

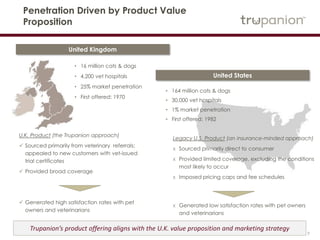

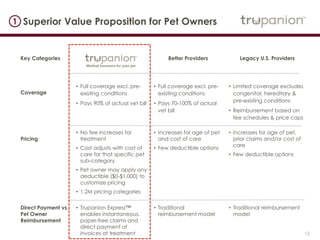

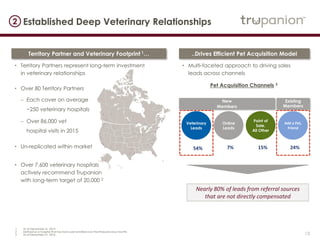

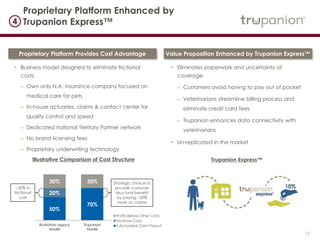

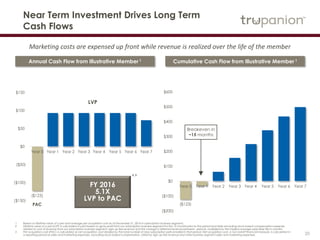

Trupanion presented an investor presentation in March 2017. The presentation summarized Trupanion's mission to provide the best veterinary care for pets, highlighted the company's focus on medical insurance for pets, and presented data showing the large underpenetrated market opportunity in North America. The presentation also discussed Trupanion's advantages, including its superior value proposition for pet owners compared to legacy US providers, established veterinarian relationships, data-driven proprietary platform, and barriers to competition.