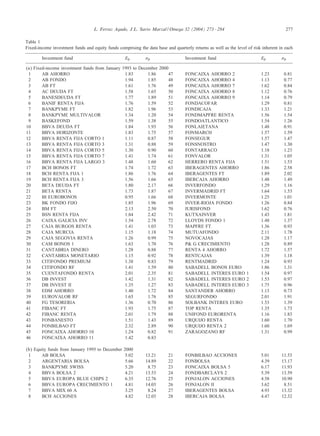

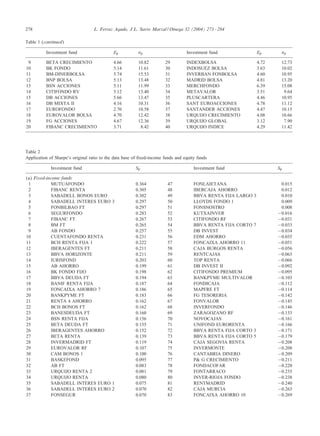

This document analyzes Sharpe's ratio as a measure of investment fund performance. It discusses Sharpe's ratio in the context of portfolio theory and as an approximation of a utility index. The document proposes some modifications to Sharpe's ratio to avoid inconsistent assessments and better approximate a utility index. It establishes six postulates regarding utility theory in the presence of risk to provide a conceptual framework. The document notes two cases where Sharpe's ratio may not function properly and proposes an alternative variation to address situations where expected return is less than the risk-free rate of return. It applies the various performance measures to a sample of Spanish investment funds.

![Available online at www.sciencedirect.com

Omega 32 (2004) 273 – 284

www.elsevier.com/locate/dsw

An analysis of Spanish investment fund performance:

some considerations concerning Sharpe’s ratio

Luis Ferruz Agudo∗ , Josà Luis Sarto Marzal

e

Faculty of Economics and Business Studies, University of Zaragoza, Gran VÃa 2, 50005-Zaragoza, Spain

Received 20 November 2002; accepted 25 November 2003

Abstract

This paper concentrates on the ÿnancial analysis of investment performance taking Sharpe’s ratio as a basic point of

reference, as well as giving further consideration to the use of this performance measure as an approximation to a utility index.

We also propose certain changes to Sharpe’s ratio which would, on the one hand, avoid the appearance of inconsistent

assessments and, on the other, provide an approach to the use of Sharpe’s performance measure as a utility index. All of the

measures involved in this study have been applied to a sample of Spanish investment funds.

? 2004 Elsevier Ltd. All rights reserved.

Keywords: Return; Risk; Fund management performance; Investment funds; Utility indices

The object of this paper is to analyse Sharpe’s ratio [1–4]

not only from the point of view of its usual application as a

performance measure for ÿnancial investments but also by

way of an approximation to a utility index, representing the

satisfaction obtained by an investor from such investments.

Sharpe’s ratio may be considered as the ÿrst measure

to combine the two key attributes of ÿnancial investments:

risks and returns. This risk/return context itself represents

a continuation of the conceptual framework developed by

Markowitz [5].

The portfolio selection model designed by Markowitz

[5–7] in the context of Portfolio Theory, the inclusion of

risk-free assets by Tobin [8] and the contributions made

by Sharpe himself [9,2–4] laid the foundations for the creation of the Capital Asset Pricing Model (CAPM) developed

by Sharpe [1] and described by Fama [10] as the Sharpe–

Lintner–Black model.

Building on the foundations of Portfolio Theory and the

market equilibrium model, Sharpe [1], Treynor [11] and

Jensen [12] succeeded in weaving together the strands of risk

and returns to establish the ÿrst indices for the measurement

of portfolio management performance.

Subsequent research related with investment performance

has produced certain criticisms of the CAPM, including the

work of scholars such as Roll–Ross [13] and Leland [14].

These failures or inconsistencies in the CAPM would a ect

those performance indices using beta as the systematic risk

indicator.

Modern ÿnancial literature rarely if ever fails to refer to

the CAPM or apply a single factor model, although Carhart’s

[15] four factor model is also commonly used. This model

includes the three factor model created by Fama and French

[16] and Jegadeesh and Titman’s [17] “momentum factor”,

as Khorama [18] explains in a recent paper.

Other signiÿcant lines of research into portfolio management performance include:

∗ Corresponding author. Tel.: +34-976-762-494; fax: +34-976761-791.

E-mail addresses: lferruz@posta.unizar.es (L. Ferruz Agudo),

jlsarto@posta.unizar.es (J.L. Sarto Marzal).

• The work of scholars such as Modigliani and Modigliani

[19], who analyse risk-adjusted returns as a measure of

performance. The performance measures derived from

this work are in line with those drawn from Sharpe’s ratio.

1. Introduction

0305-0483/$ - see front matter ? 2004 Elsevier Ltd. All rights reserved.

doi:10.1016/j.omega.2003.11.006](https://image.slidesharecdn.com/sesin4-131023112348-phpapp02/85/Sesion-4-articulo-omega-1-320.jpg)

![274

L. Ferruz Agudo, J.L. Sarto Marzal / Omega 32 (2004) 273 – 284

• Other authors have tried to break investment performance down into constituent factors such as portfolio

management style, synchronisation with the market and

investment securities selection. The work of Grinblatt and

Titman [20–22], Sharpe [2], Rubio [23], Ferson and

Schadt [24], Daniel et al. [25], Christopherson et al. [26],

Becker et al. [27] and Basarrate and Rubio [28] stands out

in this ÿeld. Recent empirical work includes a study by

Kothari and Warner [29], which concentrates especially

on what has come to be termed “style characteristics”

and “abnormal performance”.

• A third line of research looks at persistence with the objective of predicting future fund performance on the basis of historical data. These issues have been addressed

by Grinblatt and Titman [21], Malkiel [30], Elton et al.

[31], Carhart [15], Ribeiro et al. [32], Jain and Wu [33],

Argawal and Yaik [34], Casarin et al. [35], Hallahan and

Fa [36], Droms and Walker [37] and Davis [38] among

others.

As we have already mentioned, this paper takes Sharpe’s

ratio as the starting point for performance measurement,

since it continues to be a valid reference for the task, as

has been made clear in a number of recent papers, including work by Stutzer [39] and Muralidhar [40]. Moreover,

Sharpe’s ratio does not require the validation or veriÿcation

of any equilibrium model for ÿnancial assets.

A further objective is to tie our analysis in with a minimum axiomatic and conceptual framework related with utility theory in the presence of risk.

Against this background, Section 2 contains a ÿnancial

analysis of the functioning of Sharpe’s ratio and proposes

certain small changes, while respecting the essence of the

original. Section 3 provides an empirical study of a set of

Spanish investment funds. The paper concludes with a review of our ÿndings from the study.

2. Sharpe’s ratio in connection with utility theory in the

presence of risk

2.1. Re ections on Sharpe’s ratio

Sharpe’s ratio can be used to measure portfolio performance without the need to validate or verify any prior model,

in contrast to Treynor’s and Jensen’s indices, which assume

the validity of the CAPM and, therefore, presuppose optimum diversiÿcation of the portfolios analysed.

Sharpe’s ratio is expressed as follows:

Sp =

E p − Rf

p

;

(1)

where Ep is the average return on a portfolio, p, Rf is the

average return on a risk-free asset and p is the standard

deviation in the return on the portfolio, p.

Consequently, this performance measure considers a

given combination for the expected return on a portfolio

and the total associated risk.

If Sharpe’s ratio, or any other performance measure for

that matter, is to be considered as an approximation to a

utility index, it is necessary ÿrst to propose a minimum, objective conceptual framework for its application. It seems

reasonable to extend Sharpe’s performance measure to an

investor utility index in order to derive a complementary

application which allows the generalisation of a minimum

objective conceptual framework, on the one hand, and the

inclusion of a degree of discretion with regard to the subjective perception of risk on the other.

Starting from the framework created by Markowitz [5],

we propose six logical/ÿnancial postulates that take into account basic aspects of Portfolio Theory and Utility Theory

in the presence of risk. These postulates are as follows:

1. Utility or satisfaction depend on risk and returns:

U = f(Ep ;

p );

(2)

where U is utility, Ep is the expected return on p and

p is the portfolio risk measured in terms of standard

deviation.

2. Utility increases in line with returns if risk remains constant:

U

¿ 0:

(3)

Ep

3. Utility decreases as risk increases if returns remains constant:

U

¡ 0:

(4)

p

4. There is a positive premium on returns at higher levels of

risk. As risk increases it must be traded o against rising

returns:

dEp

¿ 0:

(5)

d p

This postulate is a consequence of or inference from

the preceding two.

5. Marginal returns rise strictly in line with risk. Where risk

increases, the related increment in returns is more than

proportional:

d 2 Ep

¿ 0:

d( p )2

(6)

The combination of this and the fourth postulate implies

a ÿnancial risk-return ÿeld formed by increasing, convex indi erence curves. The degree of risk aversion is represented

by the convexity of the indi erence curve, which is equivalent to the demand for higher premiums to trade the acceptance of higher risk o against an increase in returns.

6. Positive marginal utility decreases strictly in line with

returns.](https://image.slidesharecdn.com/sesin4-131023112348-phpapp02/85/Sesion-4-articulo-omega-2-320.jpg)

![284

L. Ferruz Agudo, J.L. Sarto Marzal / Omega 32 (2004) 273 – 284

References

[1] Sharpe W. Mutual fund performance. Journal of Business

1966;39:119–38.

[2] Sharpe W. Asset allocation: management style and

performance measurement. Journal of Portfolio Management

1992;18:7–19.

[3] Sharpe W. The Sharpe ratio. Journal of Portfolio Management

1994;21:49–58.

[4] Sharpe W. Morningstar’s risk-adjusted ratings. Financial

Analysts Journal 1998;54:21–33.

[5] Markowitz H. Portfolio selection. Journal of Finance

1952;7:77–91.

[6] Markowitz H. Mean-variance analysis in portfolio choice and

capital markets. Oxford, New York: Basil Blackwell Inc.;

1987.

[7] Markowitz H. Portfolio selection. Oxford, New York: Basil

Blackwell Inc.; 1991.

[8] Tobin J. Liquidity preferences as behaviour towards risk.

Review of Economic Studies 1958;26:65–86.

[9] Sharpe W. A simpliÿed model for portfolio analysis.

Management Science 1963;9:277–93.

[10] Fama EF. E cient capital markets: II. Journal of Finance

1991;46:1575–617.

[11] Treynor JL. How to rate management of investment funds?

Harvard Business Review 1965;43:63–75.

[12] Jensen MC. The performance of mutual funds in

the period 1945 –1964. Journal of Finance 1968;23:

389–416.

[13] Roll R, Ross S. On the cross-sectional relation between

expected returns and betas. Journal of Finance 1994;49:

101–21.

[14] Leland

HE.

Beyond

mean-variance:

performance

measurement in a nonsymmetrical world. Financial Analysts

Journal 1999;55:27–35.

[15] Carhart MM. On persistence in mutual fund performance.

Journal of Finance 1997;52:57–82.

[16] Fama E, French KR. Common risk factors in the returns on

stocks and bonds. Journal of Financial Economics 1993;33:

3–56.

[17] Jegadeesh N, Titman S. Returns to buying winners and selling

losers: implications for stock market e ciency. Journal of

Finance 1993;48:65–91.

[18] Khorama A. Performance changes following top management

turnover: evidence from open-end mutual funds. Journal

of Financial and Quantitative Analysis 2001;36(3):

371–93.

[19] Modigliani F, Modigliani L. Risk-adjusted performance.

Journal of Portfolio Management 1997;23:45–54.

[20] Grinblatt M, Titman S. Mutual fund performance: an

analysis of quarterly portfolio holdings. Journal of Business

1989;62:394–415.

[21] Grinblatt M, Titman S. The persistence of mutual fund

performance. Journal of Finance 1992;47:1977–84.

[22] Grinblatt M, Titman S. Performance measurement without

benchmarks: an examination of mutual fund returns. Journal

of Business 1993;66:47–68.

[23] Rubio G. Further evidence on performance evaluation:

portfolio holdings, recommendations and turnover costs.

Review of Quantitative Finance and Accounting 1995;5:

127–53.

[24] Ferson W, Schadt R. Measuring fund strategy and performance

in changing economic conditions. Journal of Finance

1996;51:425–61.

[25] Daniel K, Grinblatt M, Titman S, Wermers R.

Measuring mutual fund performance with characteristic-based

benchmarks. Journal of Finance 1997;52:1035–58.

[26] Christopherson J, Ferson W, Glassman D. Conditioning

manager alphas on economic information: another look at

the persistence of performance. Review of Financial Studies

1998;11:111–42.

[27] Becker C, Ferson W, Myers D, Schill M. Conditional

market timing with benchmarks investors. Journal of Financial

Economics 1999;52:119–48.

[28] Barrasate B, Rubio G. Nonsimultaneous prices and the

evaluation of managed portfolios in Spain. Applied Financial

Economics 1999;9:273–81.

[29] Kothari SP, Warner JB. Evaluating mutual fund performance.

Journal of Finance 2001;56(5):1985–2010.

[30] Malkiel B. Returns from investing in equity mutual funds

1971 to 1991. Journal of Finance 1995;50:549–72.

[31] Elton EJ, Gruber MJ, Blake CR. The persistence of

risk-adjusted mutual fund performance. Journal of Business

1996;69:133–57.

[32] Ribeiro M, Paxson D, Rocha MJ. Persistence in Portuguese

mutual fund performance. The European Journal of Finance

1999;5:342–65.

[33] Jain PC, Wu JS. Truth in mutual fund advertising: evidence

on future performance and fund ows. Journal of Finance

2000;55(2):937–58.

[34] Agarwal V, Yaik N. Multi-period performance persistence

analysis and hedge funds. Journal of Financial and

Quantitative Analysis 2000;35(3):327–42.

[35] Casarin R, Pelizzon L, Piva A. Italian equity funds:

e ciency and performance persistence. Working Paper in

www.efmaefm.org, 2000.

[36] Hallaham TA, Fa RW. Induced persistence of reversals

in fund performance?: the e ect of survivor bias. Applied

Financial Economics 2001;11:119–26.

[37] Droms WG, Walker DA. Persistence of mutual fund operating

characteristics: return, turnover rates and expense ratios.

Applied Financial Economics 2001;11:457–66.

[38] Davis JL. Mutual fund performance and management style.

Financial Analysts Journal 2001;57(1):19 –27.

[39] Stutzer M. A portfolio performance index. Financial Analysts

Journal 2000;56:52–61.

[40] Muralidhar A. Risk-adjusted performance: the correlation

correct. Financial Analysts Journal 2000;56:63–71.](https://image.slidesharecdn.com/sesin4-131023112348-phpapp02/85/Sesion-4-articulo-omega-12-320.jpg)