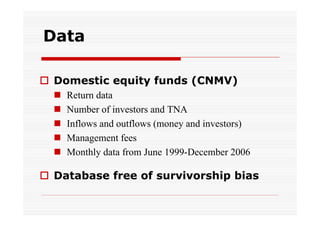

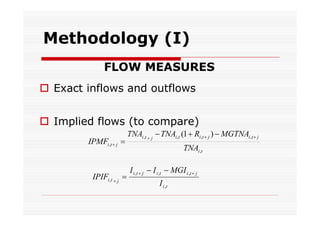

1) The document analyzes what determines investors' purchases and redemptions of funds by examining the relationship between past fund performance, risk, fees, and fund flows.

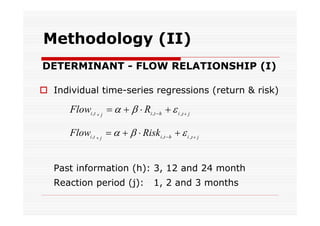

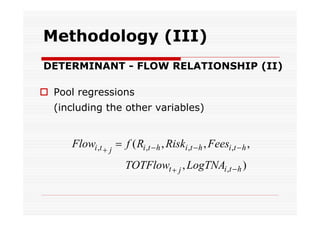

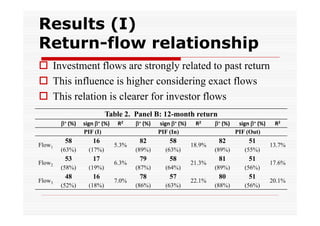

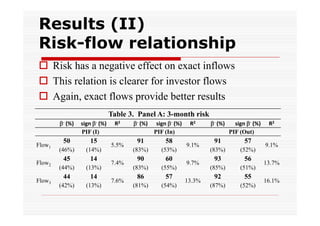

2) Regression analyses show that fund flows are strongly related to past returns, with this influence being clearer for investor flows than money flows. Risk also negatively impacts inflows.

3) Management and custodial fees negatively affect investment flows, while larger fund size is inversely related to flows. The findings suggest investors are sensitive to short-term past performance in their decisions.