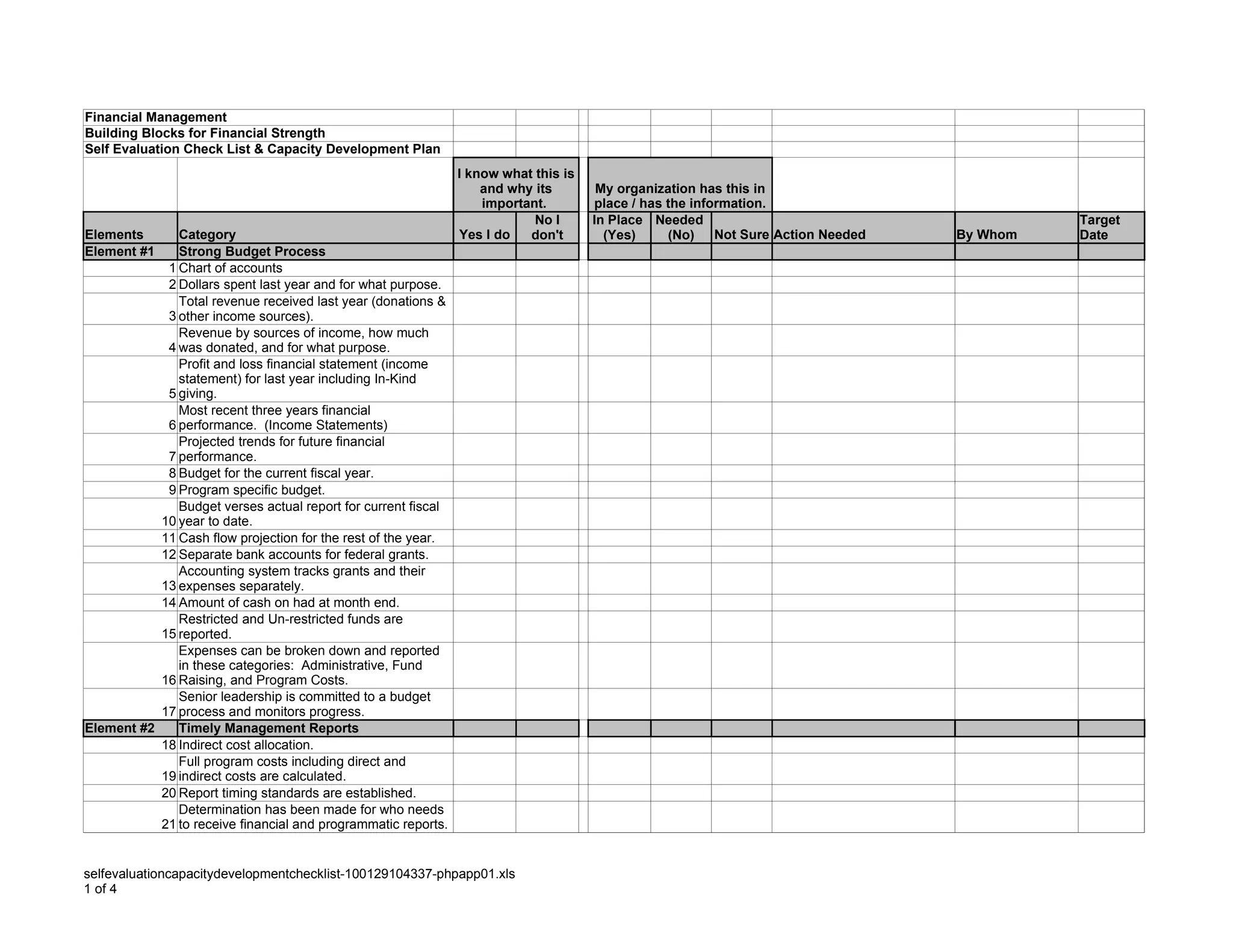

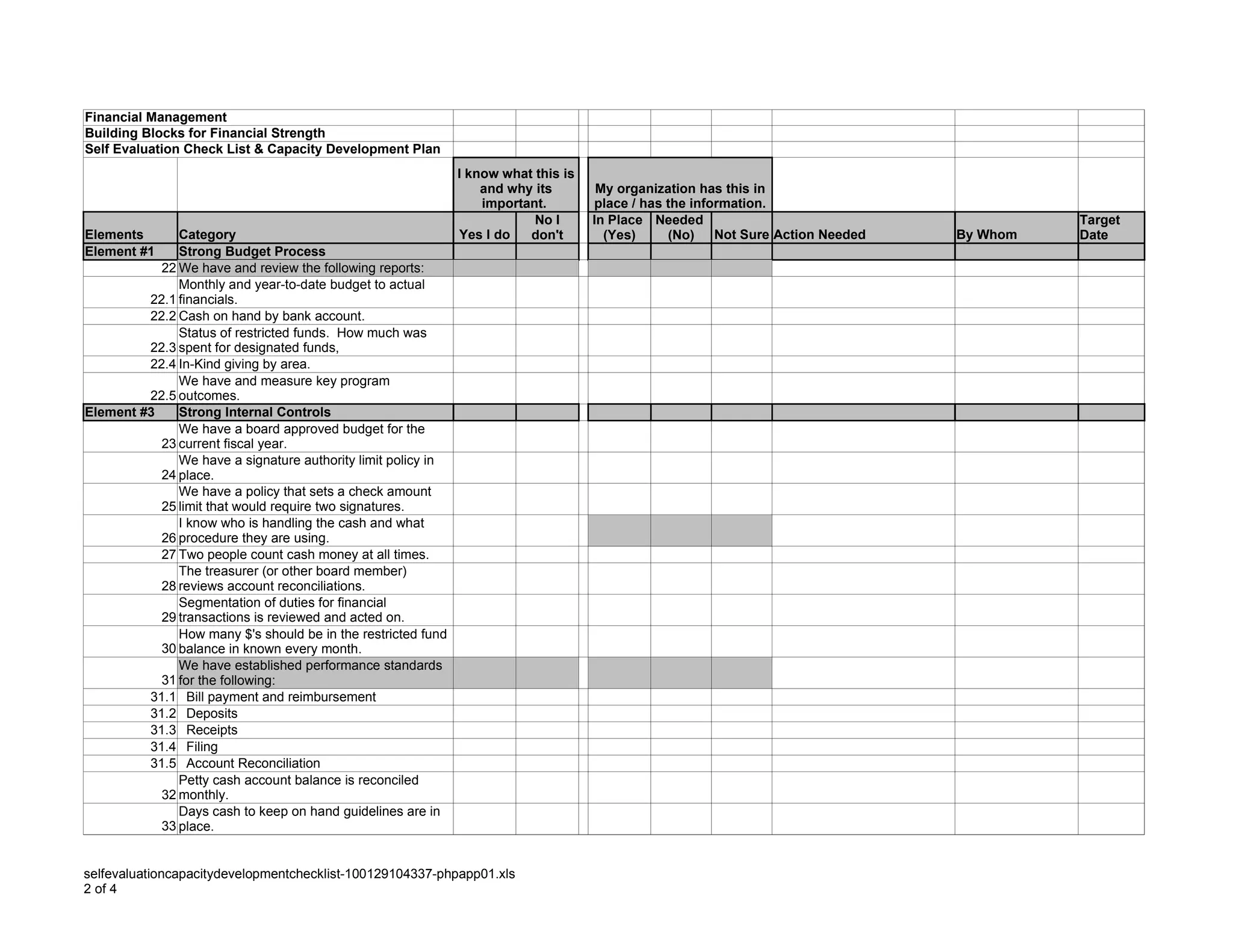

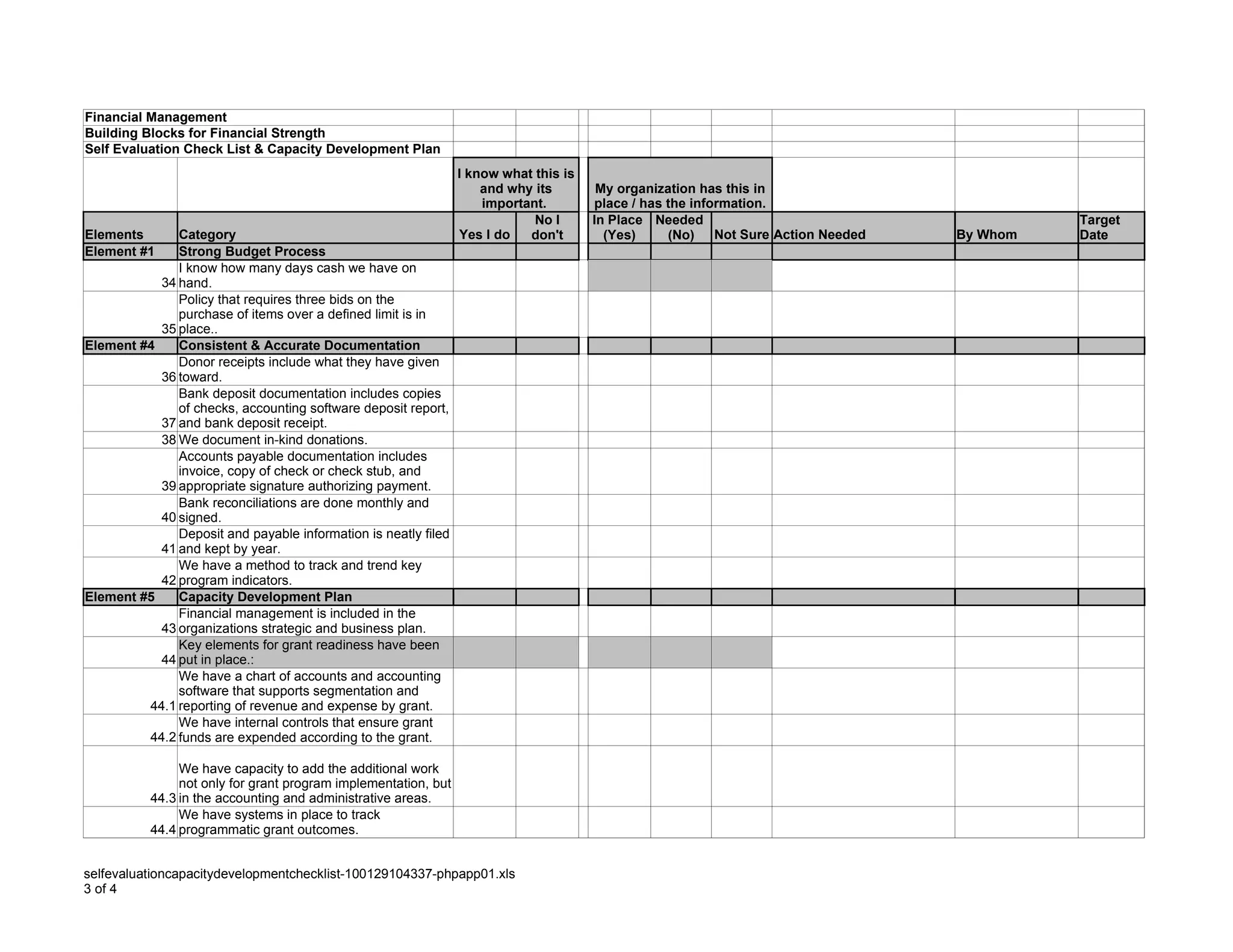

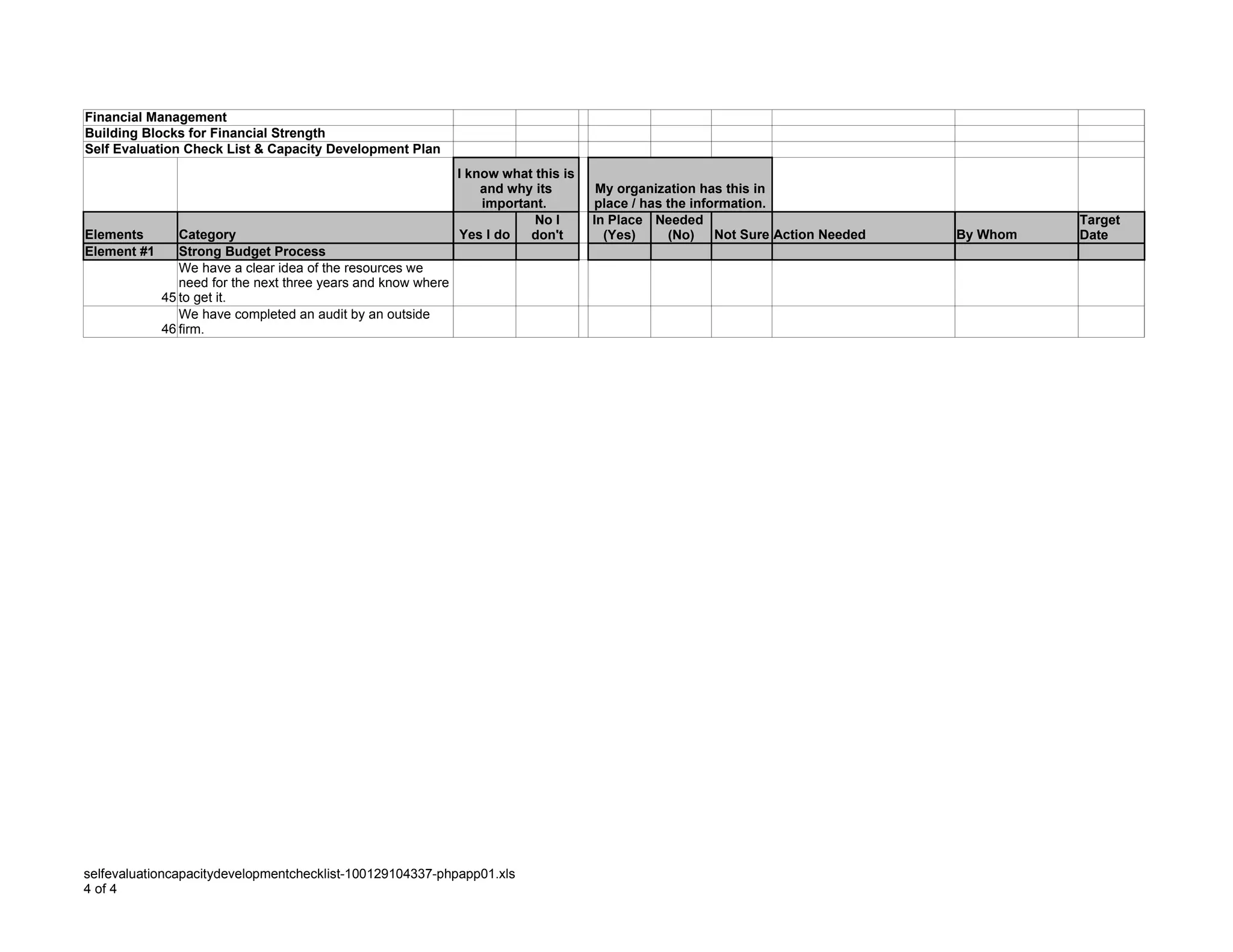

This document contains a self-evaluation checklist for a non-profit organization to assess its financial management capacity. It includes elements such as having a strong budget process, timely management reports, strong internal controls, consistent documentation, and a capacity development plan. The checklist contains over 45 questions organized into 5 categories to help the organization identify areas of financial management that are in place as well as gaps that need to be addressed to strengthen financial operations.