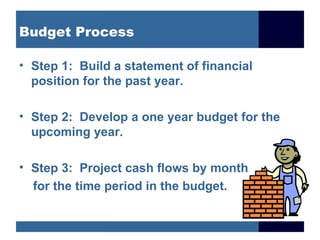

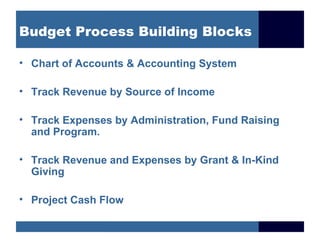

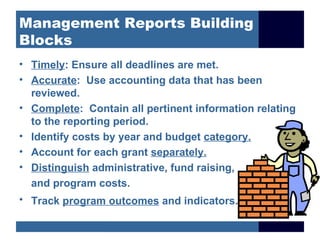

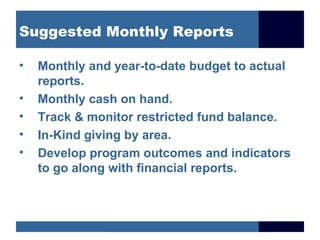

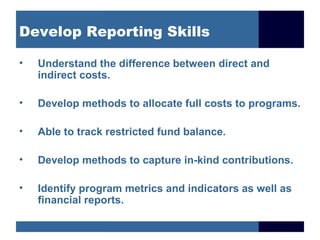

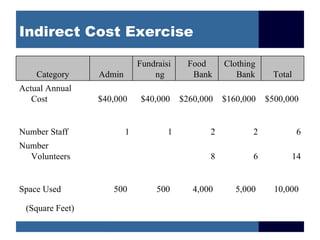

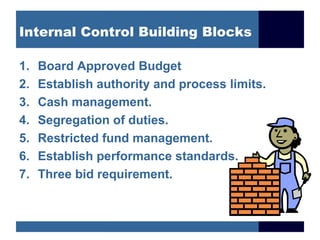

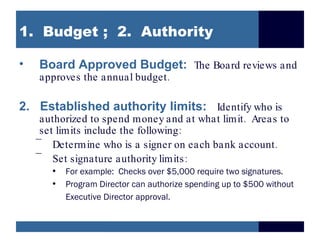

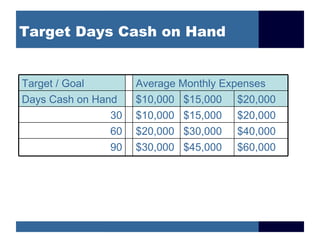

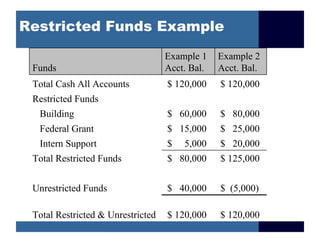

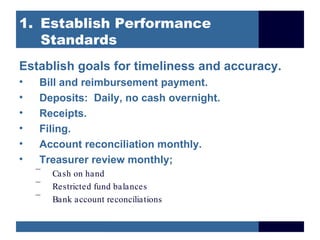

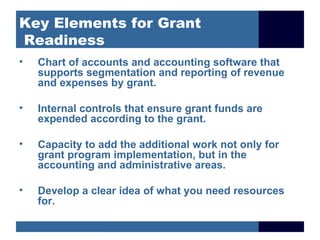

This document provides an overview of key elements for sound financial management of non-profits. It discusses the importance of having a strong budget process, timely management reports, strong internal controls, consistent documentation, and conducting self-assessments. Specific tools and processes are presented for each element, such as how to build budgets, examples of monthly reports, internal control policies around segregation of duties and restricted funds, sample documentation forms, and steps for self-evaluation. The overall message is that being faithful in implementing these financial fundamentals daily will help non-profits achieve their missions and access more resources.