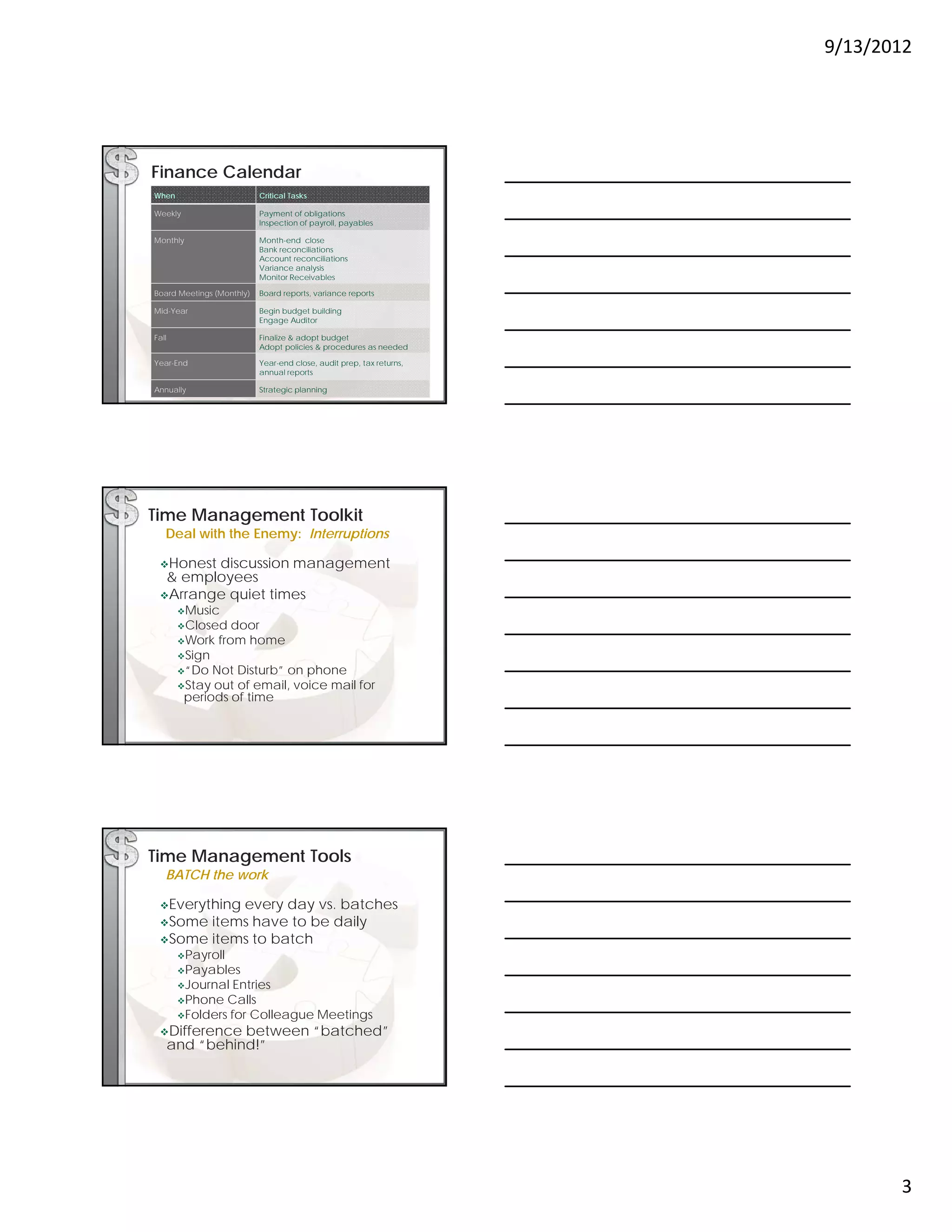

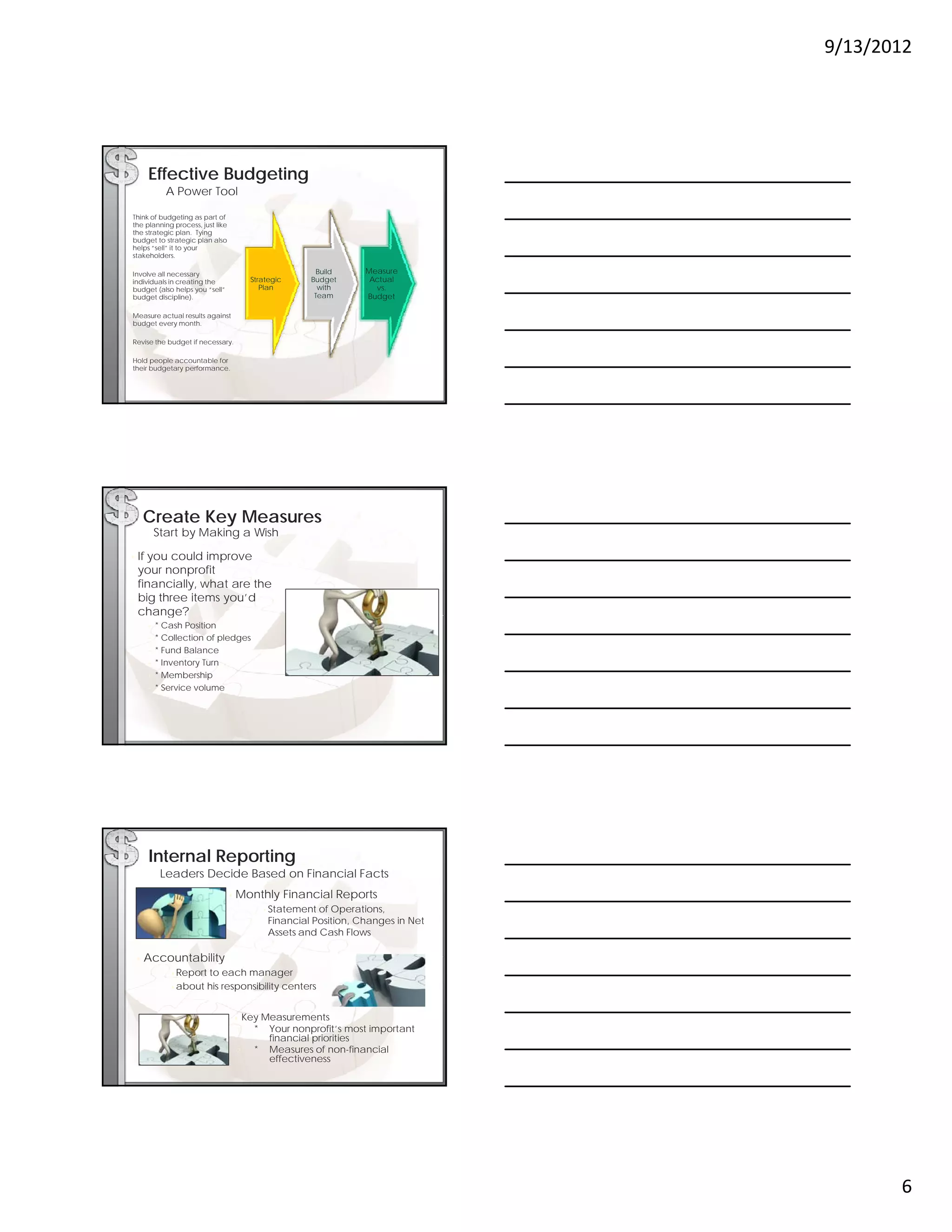

1) The document provides tips and tools for effective financial management, including assessing critical areas for improvement, establishing policies and procedures, creating routines like a finance calendar, and effective budgeting and reporting.

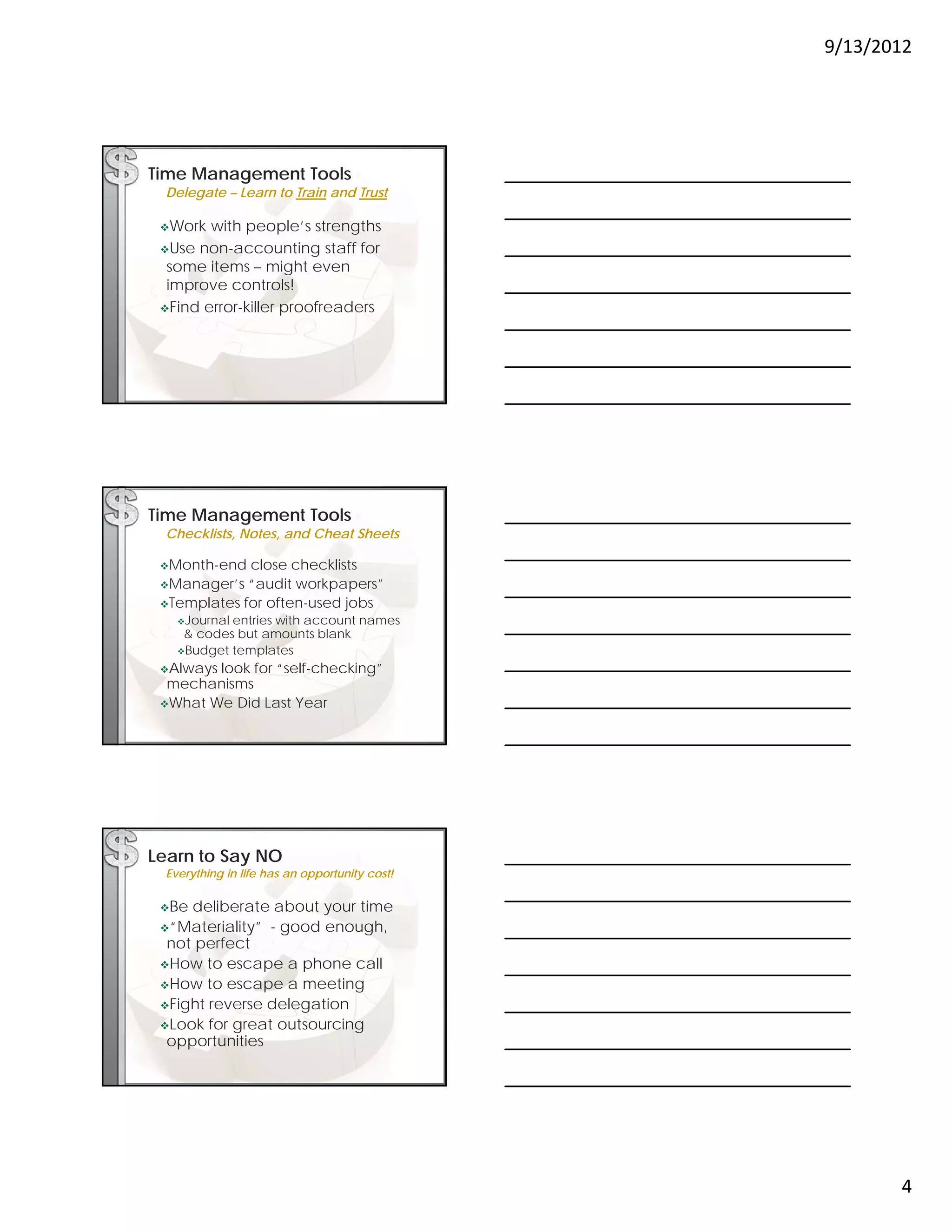

2) It emphasizes the importance of people and critical resources like accounting staff, leadership, and outside relationships.

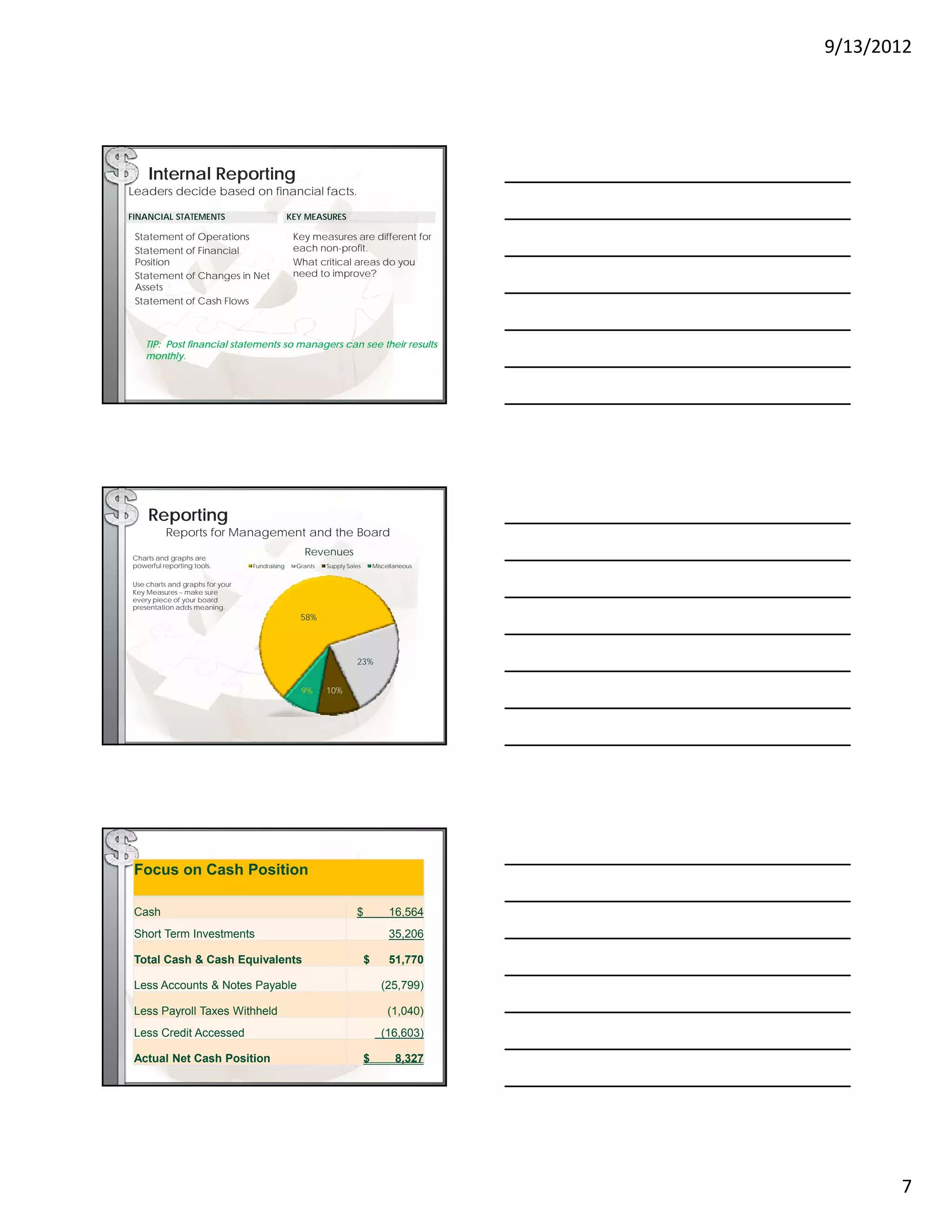

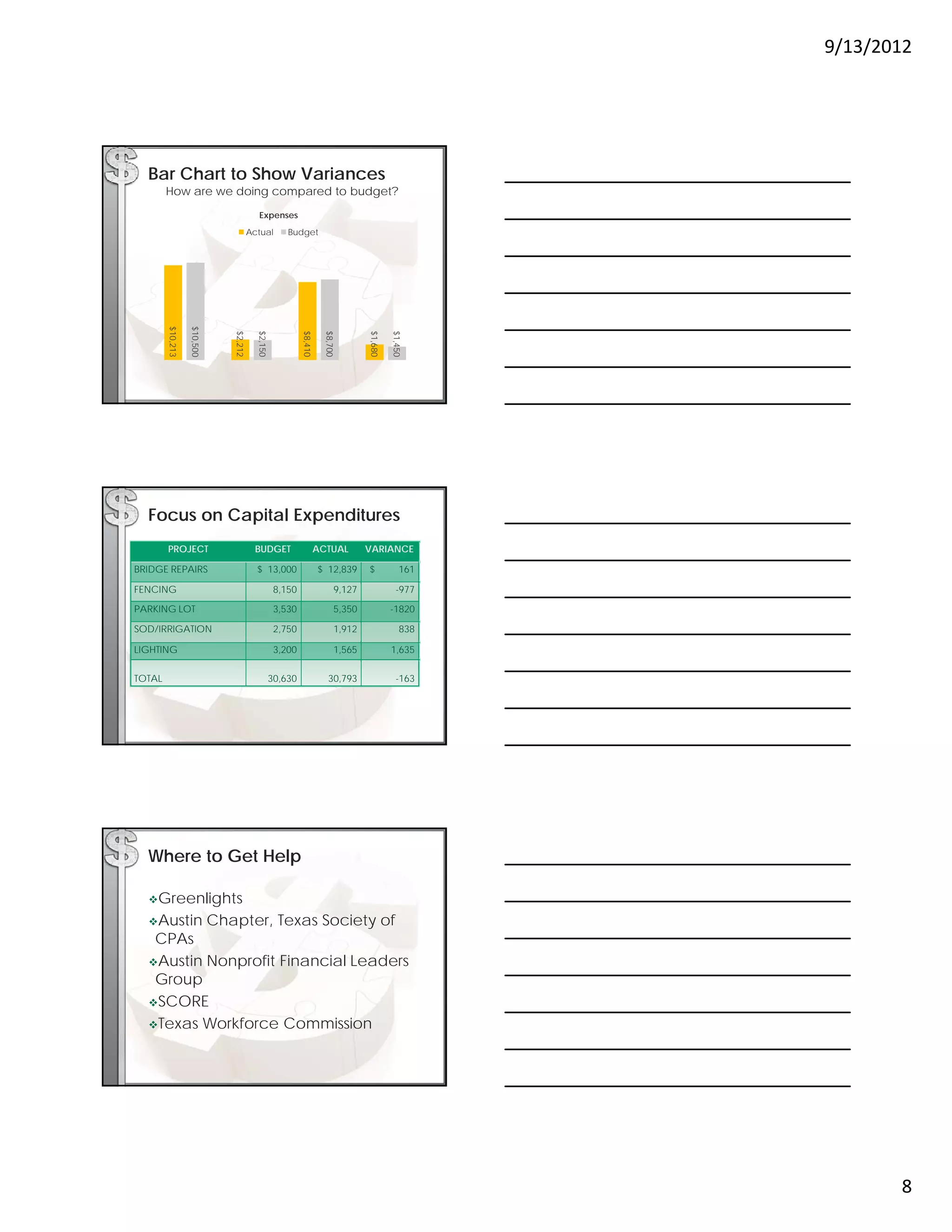

3) Powerful reporting tools are discussed, including key performance measures, internal reporting to managers, and board reporting using charts, graphs, and a focus on cash position, revenues, expenses, and variances from budget.