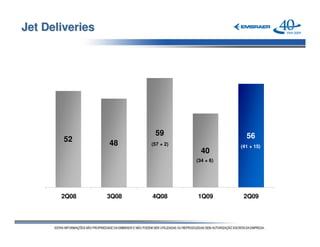

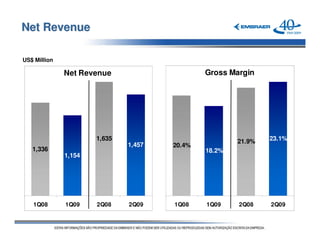

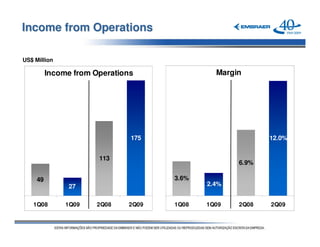

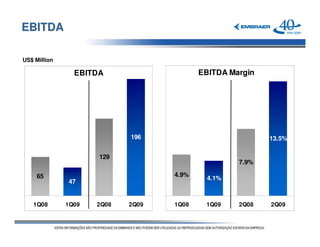

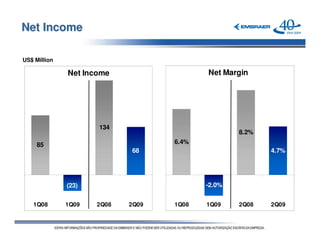

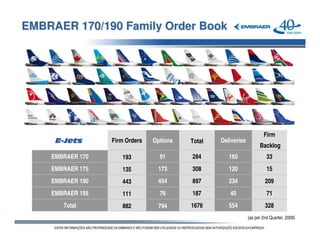

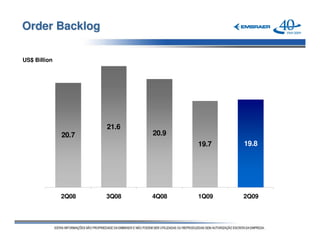

Embraer reported its second quarter 2009 results. Net income was $68 million, down from $134 million in the second quarter of 2008. Embraer also reported lower jet deliveries, net revenue, and gross margin compared to the previous year. However, the backlog remained strong at $19.8 billion, though down slightly from prior quarters. Embraer continues development of new programs like the KC-390 military transport while modernizing aircraft for existing customers.