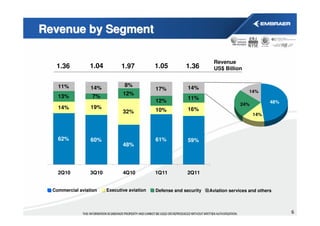

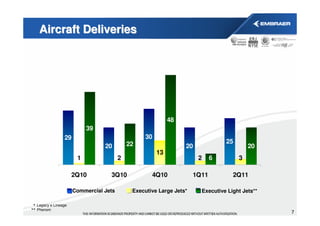

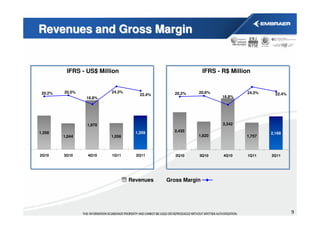

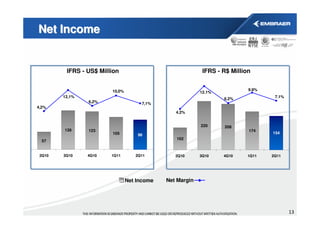

- The company reported financial results for the second quarter of 2011, with revenues of $1.97 billion, a 45 aircraft delivery total, and 62 firm E-Jet orders.

- Recent highlights included new orders from airlines and leasing companies, customer base expansion, and cooperation agreements.

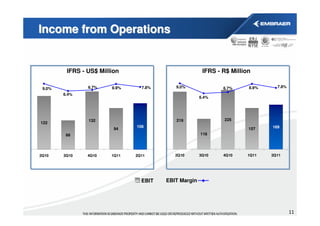

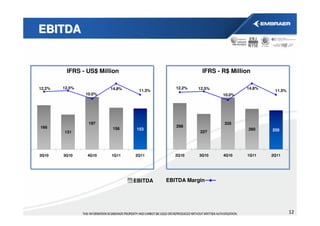

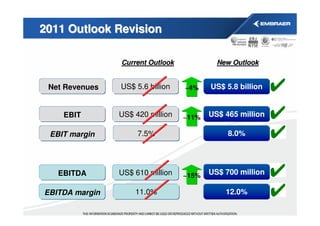

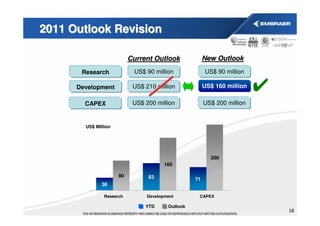

- The presentation revised full-year 2011 outlook with increased expected revenues to $5.8 billion, EBIT to $465 million, and EBITDA to $700 million. Research spending is projected to remain $90 million while development spending will decrease to $160 million.