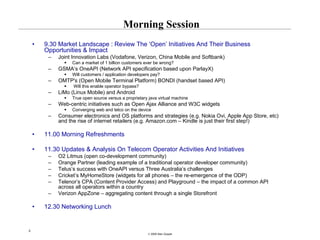

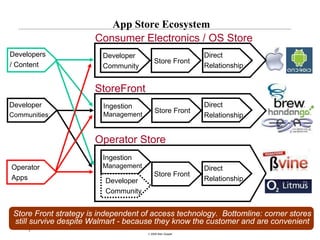

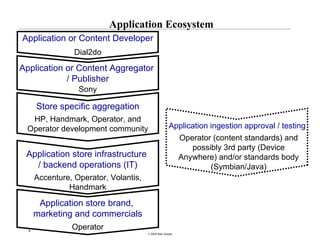

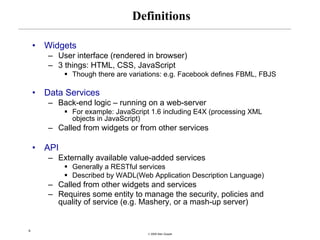

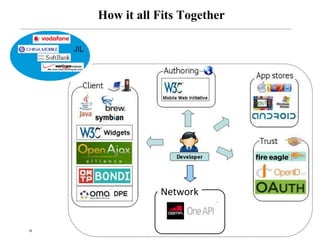

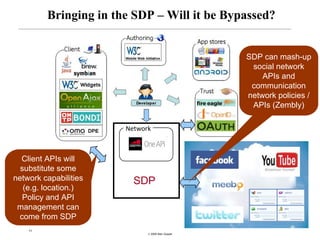

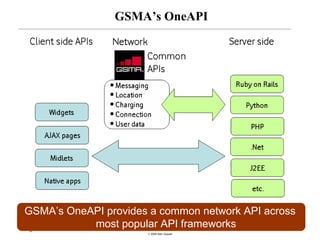

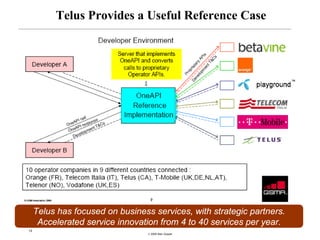

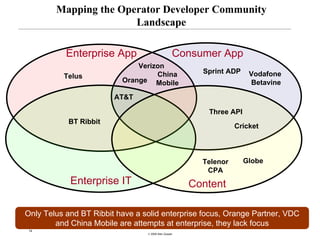

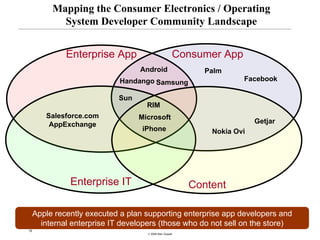

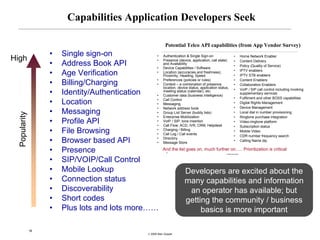

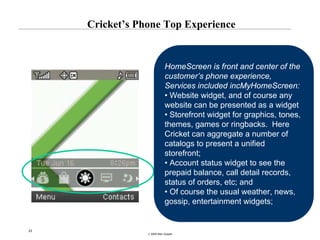

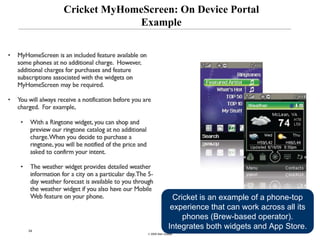

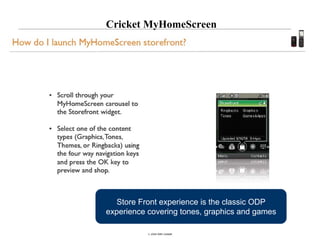

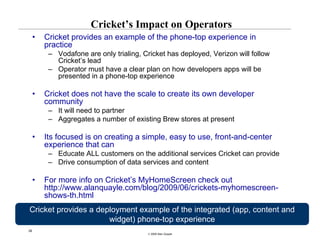

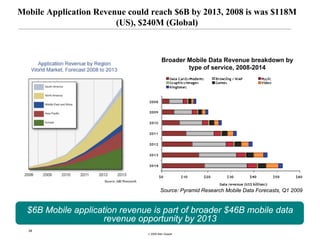

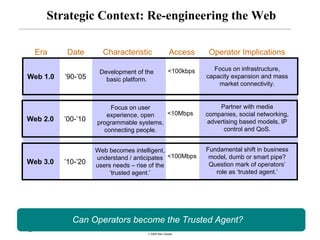

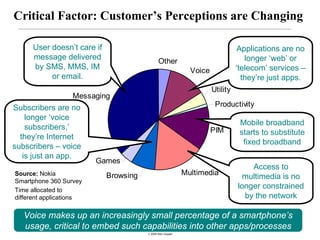

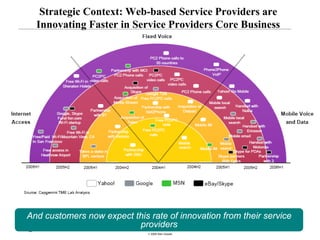

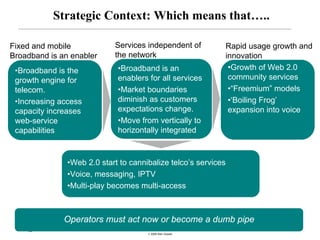

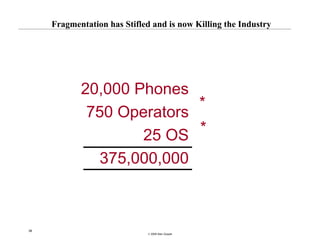

The document provides a strategic market review and analysis of opportunities and threats in the telecom industry, focusing on application stores, developer communities, and content delivery. It discusses the impact of open initiatives and APIs on operator revenue streams and highlights key case studies from various telecom operators. The document concludes with insights on the evolving landscape of mobile applications and strategies operators need to adopt to remain competitive.