The document outlines the OECD framework for facilitating the net-zero transition of the steel sector in Indonesia, addressing key challenges such as financing, technology transfer, and policymaking. It emphasizes the need for tailored solutions, stakeholder engagement, and the development of bankable projects to support Indonesia's emission reduction targets. The framework aims to align with national development plans and establish market conditions conducive to low-carbon transitions over an implementation period of 12-18 months.

![9

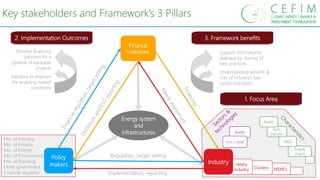

Overview of Pillar 2: Implementation Outcomes

Step 3: Business Cases and Pipeline of Projects

Evaluate business cases and identify

a pipeline of projects and financing needs

Assess investment needs

Choose a net zero pathway for the Focus Area

Choose a Current Policies scenario as a reference

3.1

3.2

3.3 3.4

Technology solutions

to close the transition gap:

• Energy efficiency

• Direct use of renewables

• Switching to low-carbon fuels

and feedstocks

• Circular economy

• CCUS

Investment needs for the technology

solutions

Based on quantification of technology

solutions (how many tons of low-carbon

fuels, % of recycling, ...)

2020 2050

2030 2040

Emissions of

Focus Area

[Mt CO2/yr]

Current policies

scenario

Net-zero

transition pathway

Choice of scenario/pathway

based on existing analyses for the

Focus area

Business Cases and pipeline of

projects

Based on a subset of technology

solutions consistent with the net-

zero transition pathway

Selection of relevant technologies

and projects:

• Technical parameters

• Economic parameters (CAPEX,

market prices, …)

• Selection of indicators and

metrics (Internal Rate of Return,

public money spend…)](https://image.slidesharecdn.com/20231025kick-offmeetingsteelcefimindustryindonesia-231205163559-36fa4fd0/85/Framework-for-Industry-s-net-zero-transition-9-320.jpg)

![10

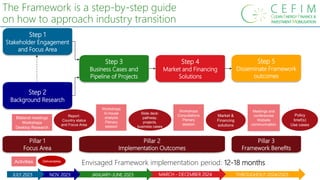

Overview of Pillar 2: Implementation Outcomes

Step 4: Market and financing solutions

4.1

4.3

4.4

4.5

Agree on a monitoring and evaluation

mechanism

Identify financing gaps in the available financing

instruments

Match low-carbon projects and financing

solutions

Establish the financing and market barriers

Develop market enabling solutions

4.2 Develop financing solutions

Analysis of gaps and barriers

Based on extended desktop research and

work with stakeholders, supported by

output of business cases in Step 3

Internal Rate of Return

[ % ]

Low-carbon Conventional

Development of solutions

Based on policy toolboxes and

workshops with stakeholder groups;

covering the capital and the operation

and maintenance costs

Internal Rate of Return

[ % ]

Low-carbon Conventional

Matching of solutions with projects

Based on quantitative KPIs (required

financing, CO2 improvement, ...)

Definition of country-level mechanisms

for monitoring and evaluation

Policy maker Industry

Finance institutions](https://image.slidesharecdn.com/20231025kick-offmeetingsteelcefimindustryindonesia-231205163559-36fa4fd0/85/Framework-for-Industry-s-net-zero-transition-10-320.jpg)

![Breakdown by industry sub-sectors [%] (2016)

20

Contribution to Gross Domestic Product

Manufacturing industry: 20% of Indonesia’s GDP in 2020

Food and beverages,

32.8%

Tobacco products , 5.2%

Textile and apparel,

6.4%

Paper and paper

products, 4.0%

Chemical and pharmacy,

9.9%

Rubber and plastics, 3.5%

Non-metallic

mineral, 3.9%

Basic metal, 4.0%

Fabricated

metal, 10.7%

Transport equipment,

10.5%

Furniture, 1.4%

Wood products, 3.6%

Machinery and

equipment, 1.8%

Source: UNDP, 2018](https://image.slidesharecdn.com/20231025kick-offmeetingsteelcefimindustryindonesia-231205163559-36fa4fd0/85/Framework-for-Industry-s-net-zero-transition-20-320.jpg)