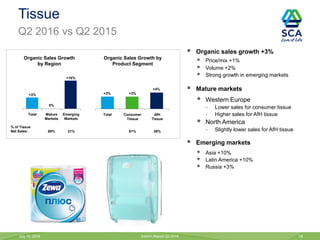

SCA reported strong results for Q2 2016. Organic operating profit growth was strong due to good organic sales growth in hygiene products and emerging markets. Cash flow was also strong. Efficiency gains contributed positively despite provisions for anti-trust and tax cases. The divestment of businesses in Asia closed on April 1 for integration with Vinda. Seven new product innovations were introduced, including for TENA, Okay, Lotus, Zewa, and Tork.