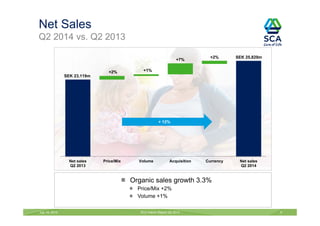

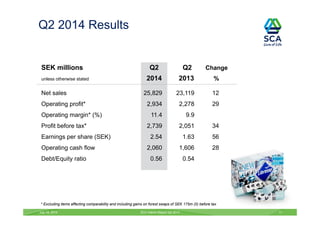

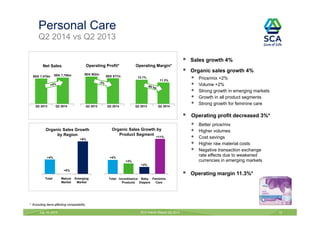

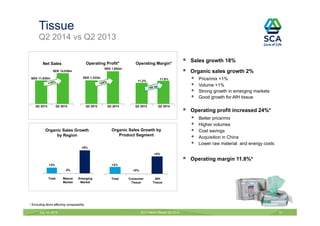

The SCA interim report for Q2 2014 highlights stable tissue demand in Europe and growth in emerging markets, particularly for personal care products. The report details a strong organic sales growth, a significant increase in EBIT and operating margin, as well as several new product launches and strategic business integrations, including a joint venture in Australia and a transfer of hygiene business to Vinda in China. Overall, the document presents a positive outlook with improved sales, profits, and operational efficiency compared to Q2 2013.