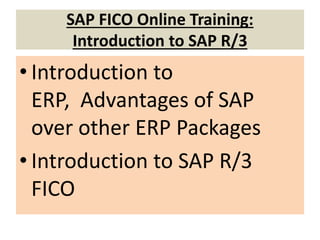

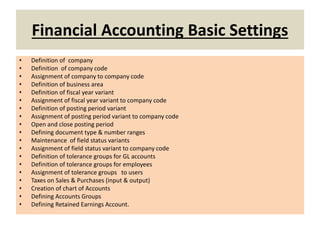

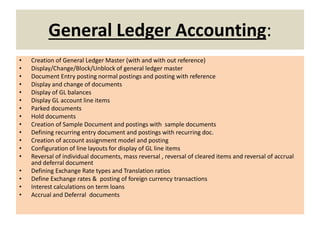

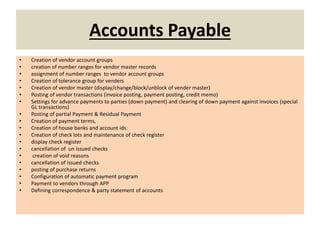

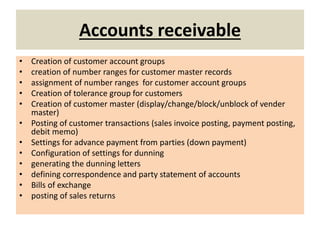

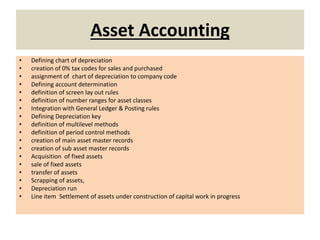

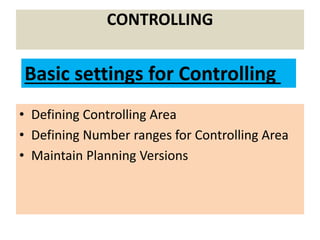

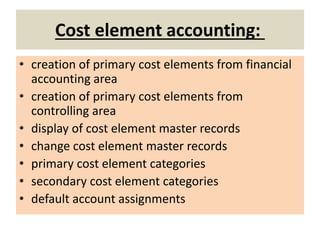

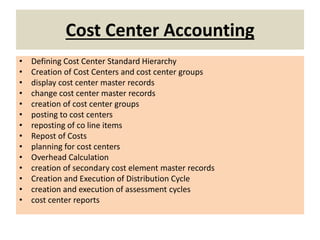

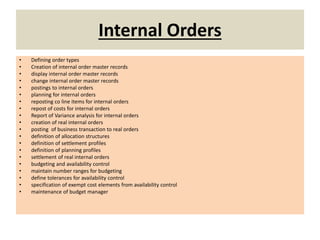

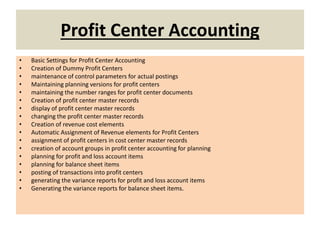

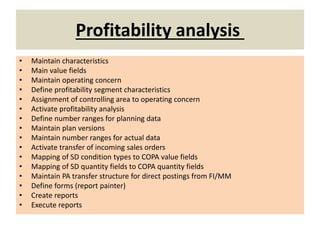

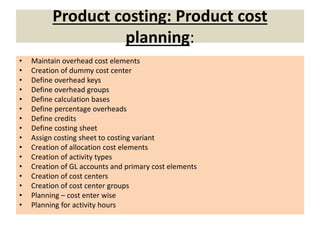

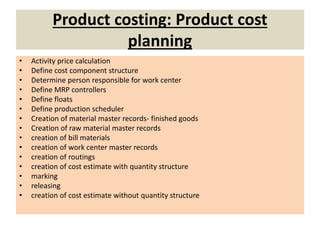

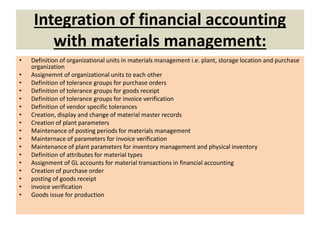

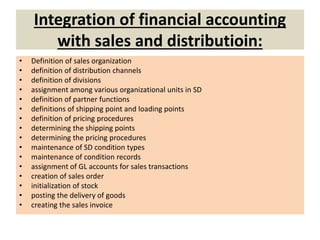

The document outlines a comprehensive SAP FICO online training program, covering topics like financial accounting, general ledger accounting, accounts payable and receivable, asset accounting, controlling, and product costing. It includes foundational concepts such as the definition of company codes, fiscal years, and tax regulations, as well as detailed processes for vendor and customer transactions, budgeting, and profit center accounting. The training aims to equip learners with the essential skills and knowledge required for effective financial management within the SAP ERP system.