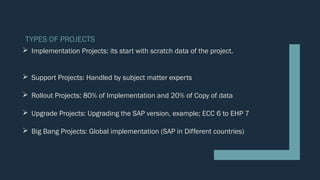

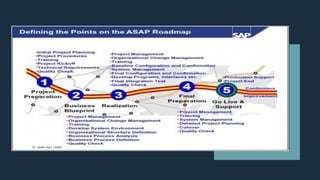

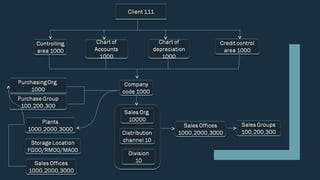

SAP is a German software company known for its enterprise resource planning (ERP) software. It started in 1972 and developed one of the first ERP systems, which allowed organizations to manage business operations data in real-time rather than through overnight batches. Key SAP modules include Finance & Controlling, Sales & Distribution, Materials Management, and Human Resources. SAP uses standardized methodologies like ASAP for ERP implementations and offers various types of projects like new implementations, upgrades, and support projects.

![GENERAL LEDGER STRUCTURE

• Creation of Chart of Accounts: [C.O.A = Company Code]

• Assign Chart of Accounts to Company Code

• Define Accounts Groups

• Define Retained earnings Account (Reserves & Surplus)

• Define Tolerance Group for General Ledger Account.

• Define Tolerance Group for Employees.

Note: C.O.A/A.G/: (Four character code: Alpha/Alpha Numeric/Numeric)](https://image.slidesharecdn.com/sapfico-170905115610/85/SAP-FICO-13-320.jpg)