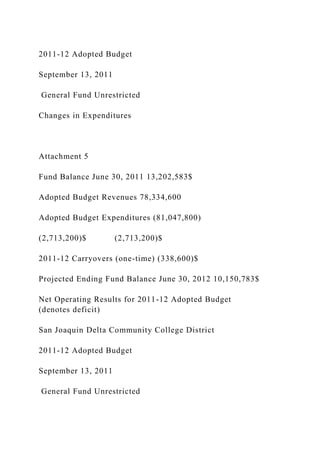

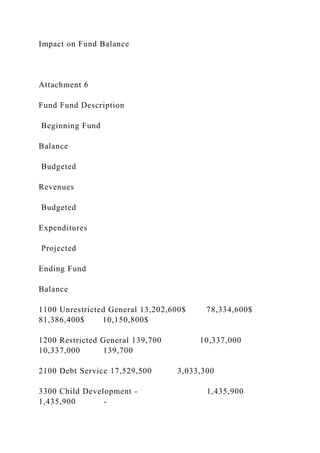

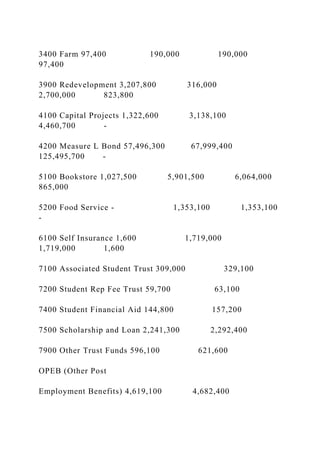

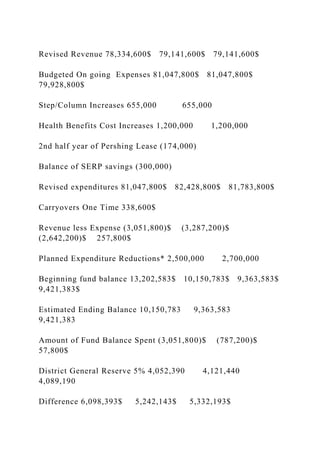

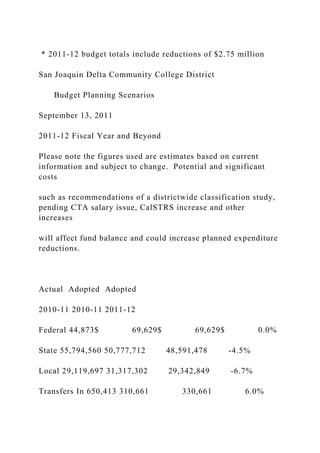

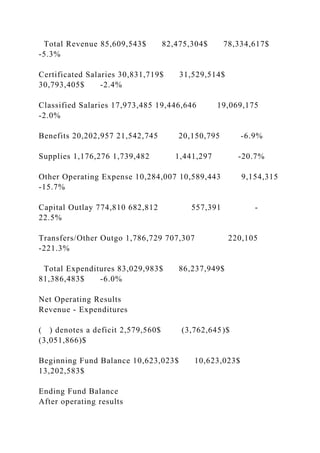

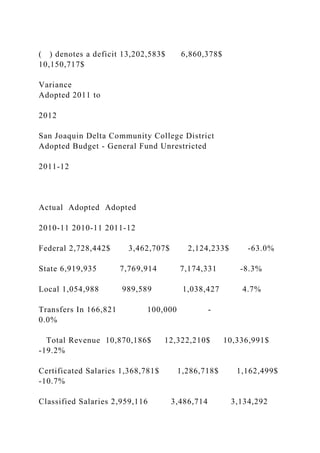

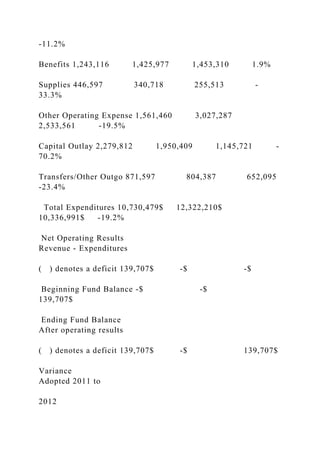

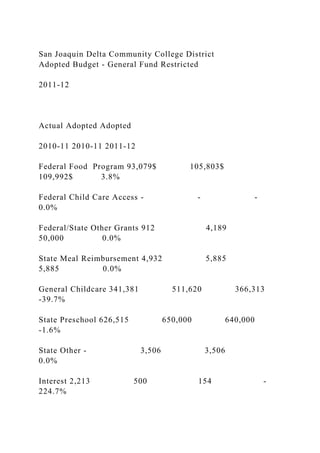

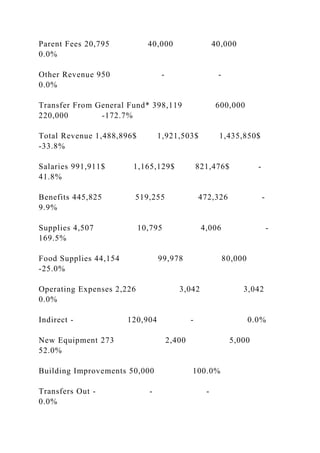

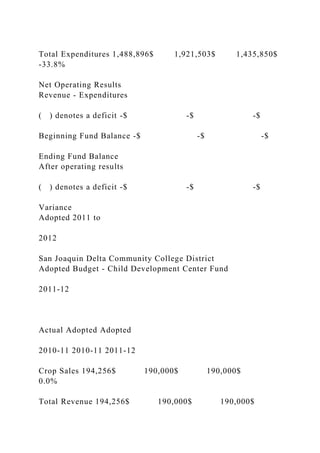

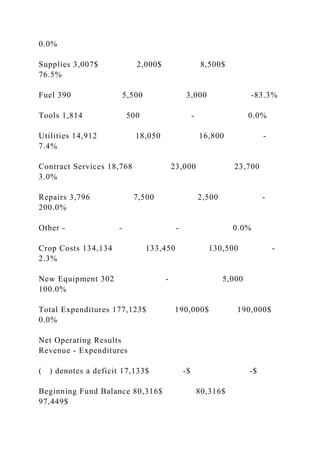

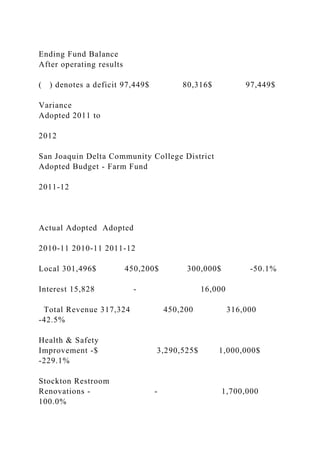

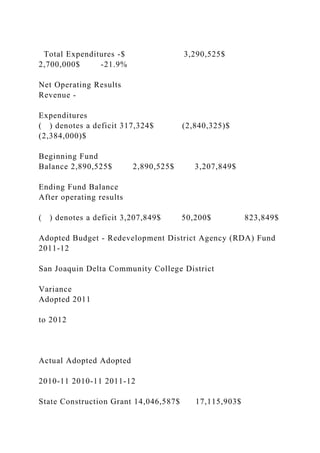

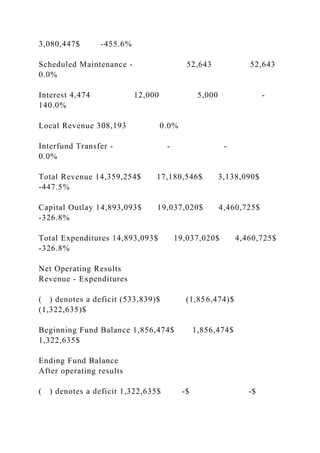

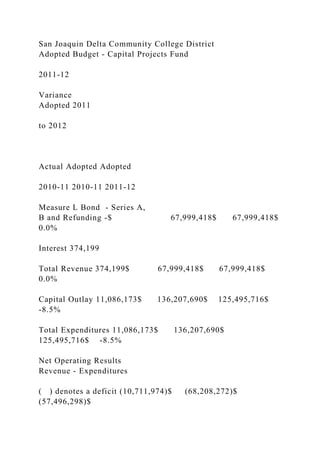

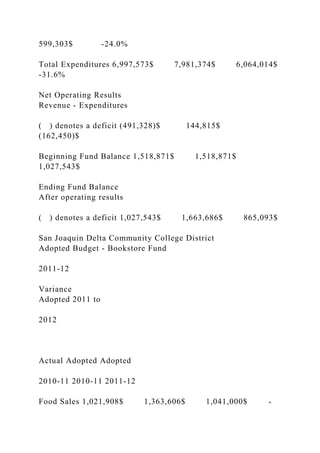

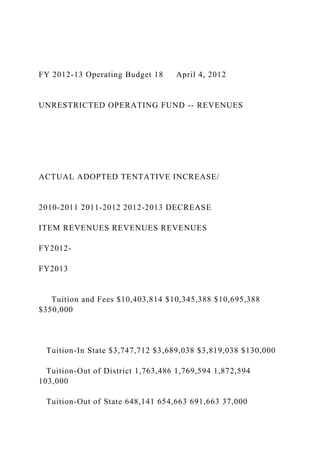

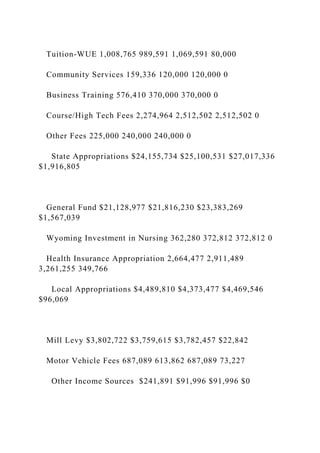

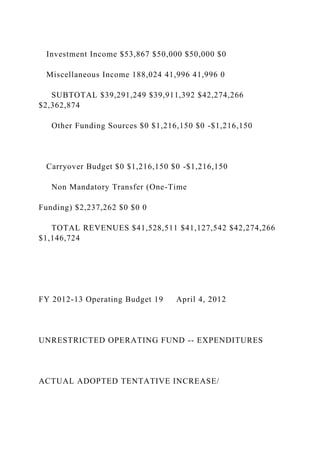

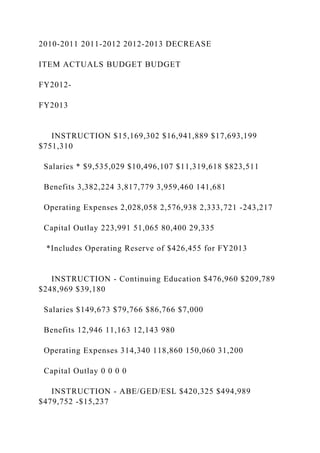

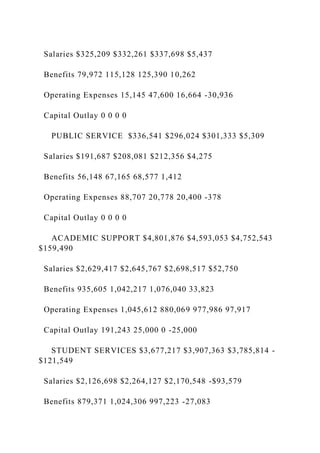

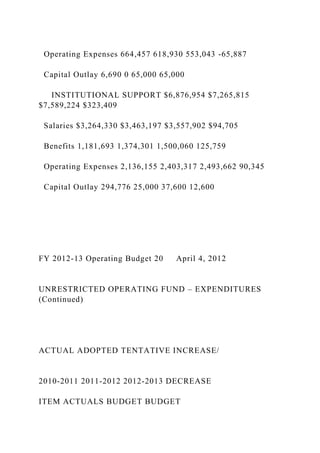

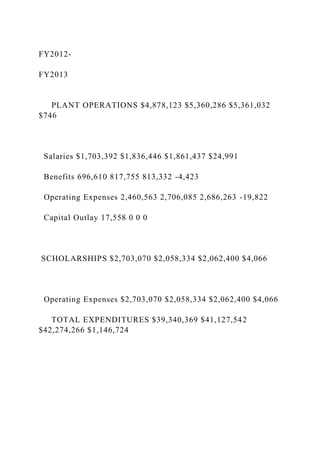

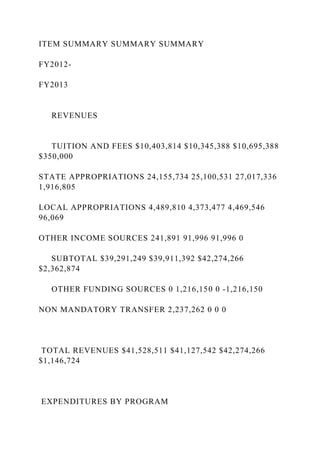

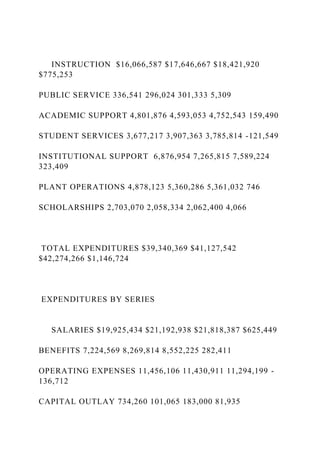

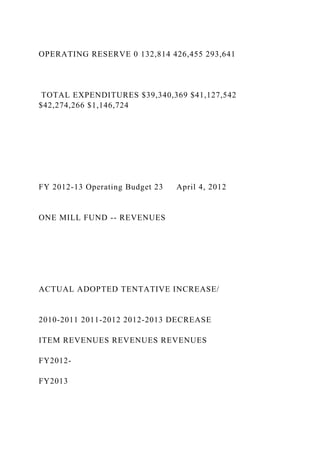

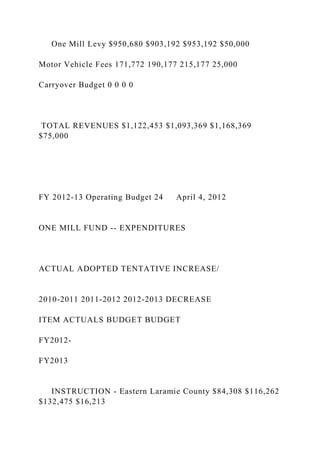

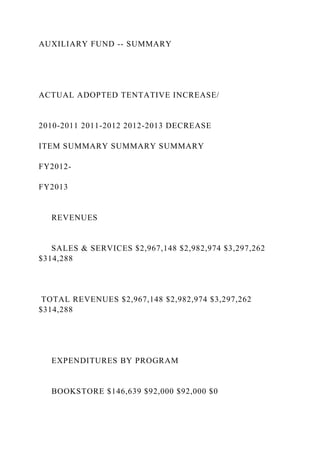

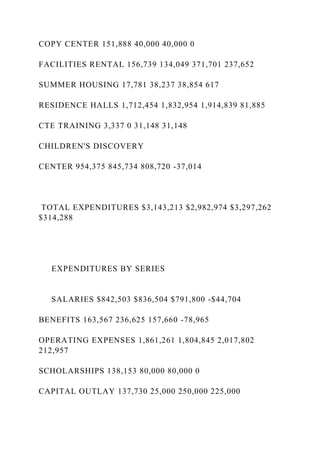

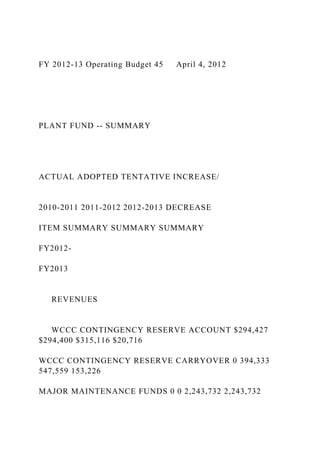

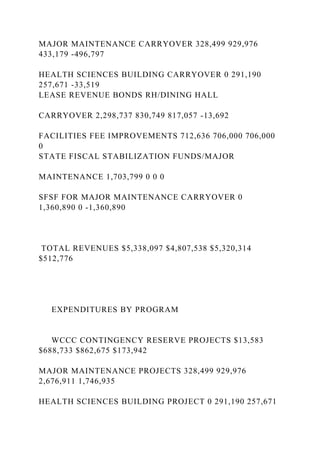

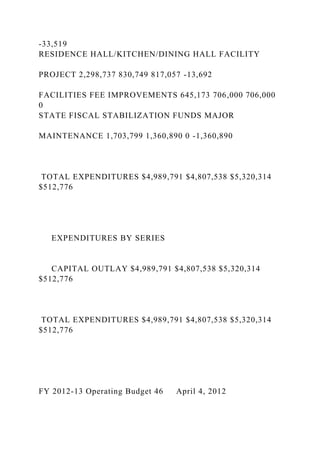

The San Joaquin Delta Community College District's 2011-12 adopted budget process was smoother than the previous year, with minor changes from the tentative to adoption stages. Despite state funding challenges and a projected revenue loss, the district aims to maintain educational opportunities and budget prudently while planning for future fiscal years. The budget reflects a strong financial position, albeit with necessary considerations for upcoming budget reductions due to ongoing financial pressures.