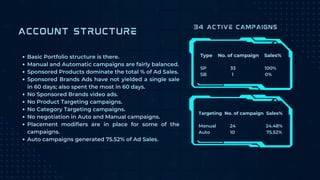

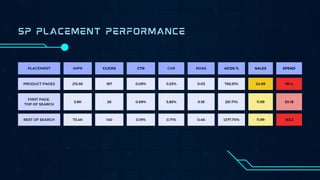

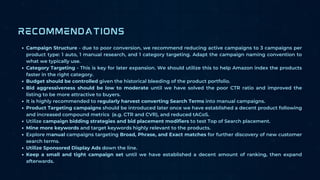

The document summarizes a PPC audit case study. It found that the account had poor performance metrics over 60 days including a high ACoS of 1,111.01%, low CTR of 0.15%, and low CVR of 0.41%. It provided recommendations to restructure campaigns, expand category targeting, harvest keywords from auto to manual campaigns, and test moving sales to top of search placements.