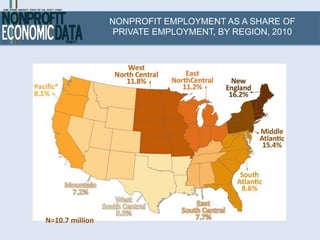

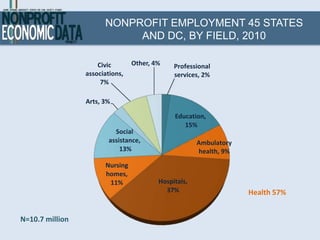

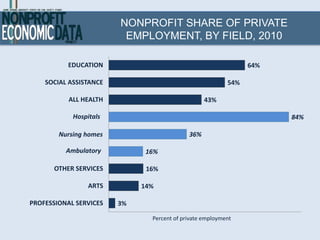

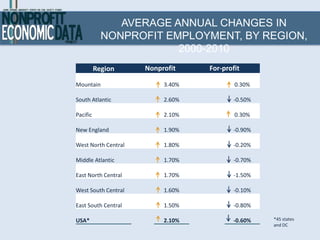

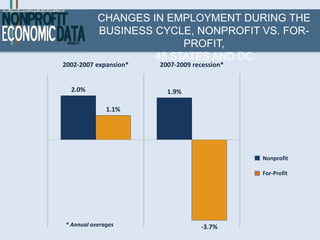

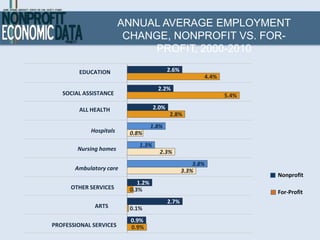

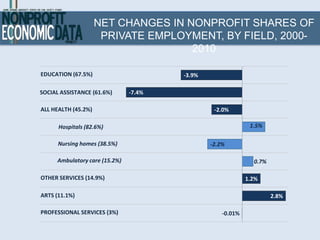

This document analyzes major data sources on the U.S. nonprofit sector from 2000-2010. It finds that: 1) nonprofits are a major employer, employing over 10 million people or 10% of private sector employment; 2) they are significant service providers, especially in education and health; 3) nonprofit employment grew dynamically at 2.1% annually compared to a 0.6% decline for for-profits; 4) nonprofits proved resilient during the recession; and 5) they face increasing competition from for-profit firms in some industries like education and healthcare.