sai bijji (cv)

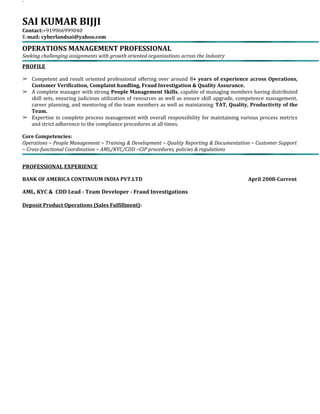

- 1. ` SAI KUMAR BIJJI Contact:+919966999040 E-mail: cyberlandsai@yahoo.com OPERATIONS MANAGEMENT PROFESSIONAL Seeking challenging assignments with growth oriented organizations across the Industry PROFILE ➢ Competent and result oriented professional offering over around 8+ years of experience across Operations, Customer Verification, Complaint handling, Fraud Investigation & Quality Assurance. ➢ A complete manager with strong People Management Skills, capable of managing members having distributed skill sets, ensuring judicious utilization of resources as well as ensure skill upgrade, competence management, career planning, and mentoring of the team members as well as maintaining TAT, Quality, Productivity of the Team. ➢ Expertise in complete process management with overall responsibility for maintaining various process metrics and strict adherence to the compliance procedures at all times. Core Competencies: Operations ~ People Management ~ Training & Development ~ Quality Reporting & Documentation ~ Customer Support ~ Cross-functional Coordination ~ AML/KYC/CDD ~CIP procedures, policies & regulations PROFESSIONAL EXPERIENCE BANK OF AMERICA CONTINUUM INDIA PVT.LTD April 2008-Current AML, KYC & CDD Lead - Team Developer - Fraud Investigations Deposit Product Operations (Sales Fulfillment):

- 2. ` ➢ Leading a cross-site team of specialist across HYD & GGN ➢ Involves providing services to the bank customers by following Customer Identification Program (CIP) Procedures Regulations ➢ Follow Anti Money Laundering (AML) and Know Your Customer (KYC) guidelines to investigate fraud ➢ Provide services such as (Fund Transfer(Internal & External)/Online Banking/Keep The Change/ODP ➢ Verification of customers source of funds ➢ Report any transaction of customers that were determined to be suspicious or fraudulent activity ➢ Involved in effective day planning according to the capacity & Volume ➢ Strictly maintaining Service Level Adherence and ensure exceptions are closed prior to the set deadline ➢ Preparing & presenting various weekly/monthly MIS & Quality ➢ Ensure team meet their CTQ’s and targets on a daily basis and feedback is provided as and when required. ➢ Conducting weekly quality huddles with associates to share the error trend and discuss ways to improve the accuracy percentage. ➢ Provide guidance, motivation to team members while managing leave and retention of critical resources ➢ Conduct monthly one- on-one with team members to discuss about their performance and necessary action plan to be in place for bottom performers. ➢ Daily call management with LOB ➢ Identify , escalate and debate risk on day to day job to achieve the bank’s business plans. Fraud Investigation, Customer Verification and Due Diligence: ➢ End to End Verification of consumer applications applied through Internet channel ➢ Providing course of action to the agents after thorough investigation and risk authentication ➢ Updating the Fraud wing list and Potential risk email addresses in the SOP repository on regular basis ➢ Monitor closely on money laundering prevention guidelines and review all relevant reports. ➢ Ensure adherence to the AML, KYC management framework in identifying, controlling, monitoring and reporting ➢ Improve and implement internal KYC management and procedure comply with all key regulations ➢ Lead the team in ensuring money-laundering prevention requirements incorporated into procedures ➢ Schedule and assign quarterly trainings on anti money laundering measures ➢ Lead in the investigation of suspicious transactions, detecting fraud applications and financial crime risks ➢ Represent BACI operations team on process ideation and procedural calls with Onshore Business Partners ➢ Understands vulnerabilities of products and services and refer suspected fraud applications to RED Flags and OSSS business support team

- 3. ` ➢ Reporting funding transactions greater than $10,000 and completing authorizations after validations ➢ Raising SAR and TRM as and when required for reporting Potential and Unusual activities ➢ Verification of High risk fields such as Name, Social security number, Address and DOB ➢ Ensuring compliance on verification procedures by conducting daily huddles and process knowledge assessments ➢ Engaging onshore team for KIQ questions to perform additional verification ➢ Managing KYC refresh and on-boarding of all consumer related applications ➢ Ensuring complete audits on Certificate of deposits and Party ID related applications for avoiding Privacy Breach and Data compromise issues ➢ Preparing the complete checklist of all the unusual activities, system of record messages and CIP procedures Funding and Account Opening: ➢ Auditing all the transactions which include funding irrespective of the limit ➢ Checking CTR for all the transactions greater than $10,000 and escalating applications to onshore team if the CTR is not raised ➢ Opening external funded applications, which is a new initiative by Bank of America ➢ Checking customer names for all debit/credit card funding transactions ➢ Masking the funding information after completing the application ➢ Generating GL ticket numbers for $10000 above threshold ➢ Performing FDES funding and instant payment system for certificate of deposits Key Achievements: Executed Basic Six Sigma Project on Process Application in the 4th Quarter of 2011 - Eliminated two steps from the process cycle with Value stream Mapping and achieved. Saved 54% of non value added time Saved 47.64 man-hours every month. Being Subject Matter Expert of the process Mentored & Trained the new Associates. Awarded with most prestigious awards like ZEAL, WOW, KUDOS & K- PERFORMER for maintaining the core values of “BANK OF AMERICA”. Received appreciations from Vice President - Quality and Change Delivery and other managers for contributions towards the improvement of processes. Recently Visionary award given by LOB(Line of Business). Awarded with the Quality Award for maintaining the Quality and customer delight for more than 11 months. In-House Training's: Basics of Six Sigma

- 4. ` Creativity and Analytical Thinking Approach to Problem Solving Even Eagles need A Push Fish Planning and Prioritizing Retail Banking. Risk & Compliance Prior Work Experience: Worked for “KNOAH Solutions Pvt Ltd” as a BOPO from March 26th 2007- Jan 27th 2008. Worked for “Sreesa chit fund Pvt Ltd” as an Accountant from June 8th 2006 – Feb 20 2007. EDUCATIONAL & PROFESSIONAL CREDENTIALS MBA (Finance) Osmania University, Hyderabad 2006. Bachelor of Commerce Osmania University, Hyderabad 2004. Intermediate Board of Intermediate Education 2001. S.S.C State Board of School Education 1999. Personal Details: Name : B. Sai Kumar Father’s Name : B. Bikshapathi Date of Birth : 11th October, 1984 Marital Status : Married Nationality : Indian Hobbies : Listening to Music and Gardening. Strengths : Ability to work in a team or as an individual Good verbal and written communication skills. Languages Known : English, Hindi & Telugu Declaration (I firmly declare that the above details provided by me are true to the best of my knowledge and belief). (B. Sai Kumar)