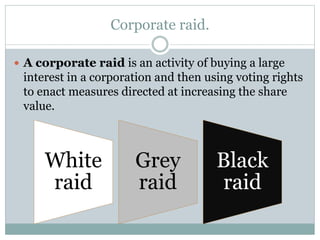

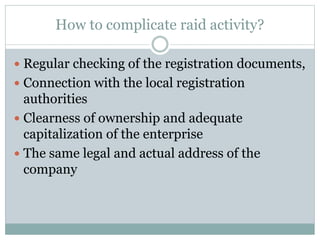

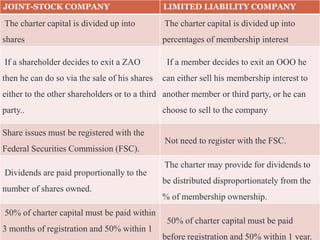

This document discusses ways for businesses to protect themselves from internal and external threats. Internal threats include dishonest employees, shareholders, and managers. External threats include competitors, consumers acting in extreme ways, mergers and acquisitions, corporate raids, and regulatory authorities. The document defines different types of corporate raids and provides tips to complicate raid activity such as regularly checking registration documents and maintaining clear ownership. It also discusses patents, non-disclosure agreements, technological problems businesses may face and ways to address them, and differences between joint-stock companies and limited liability companies.