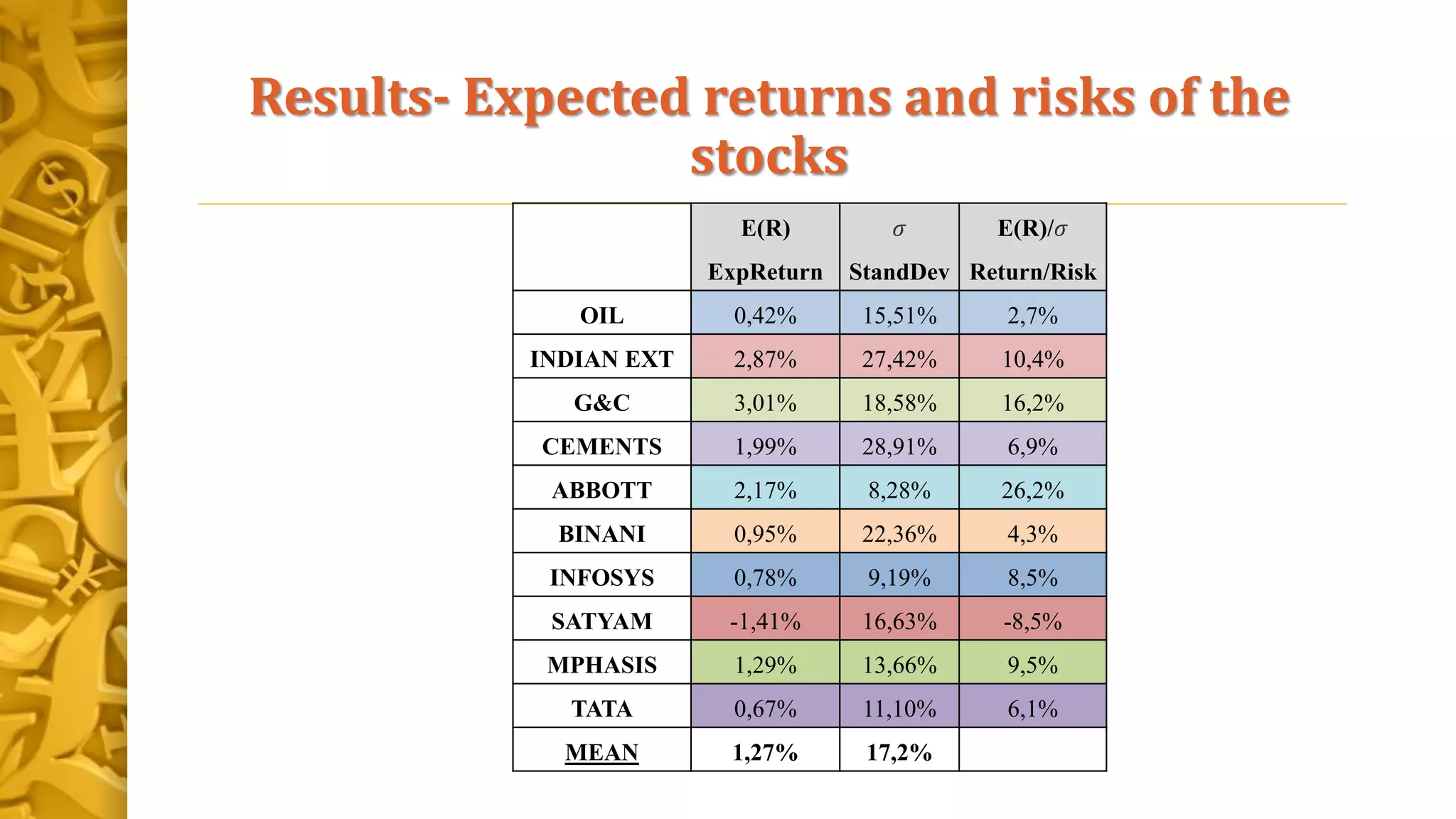

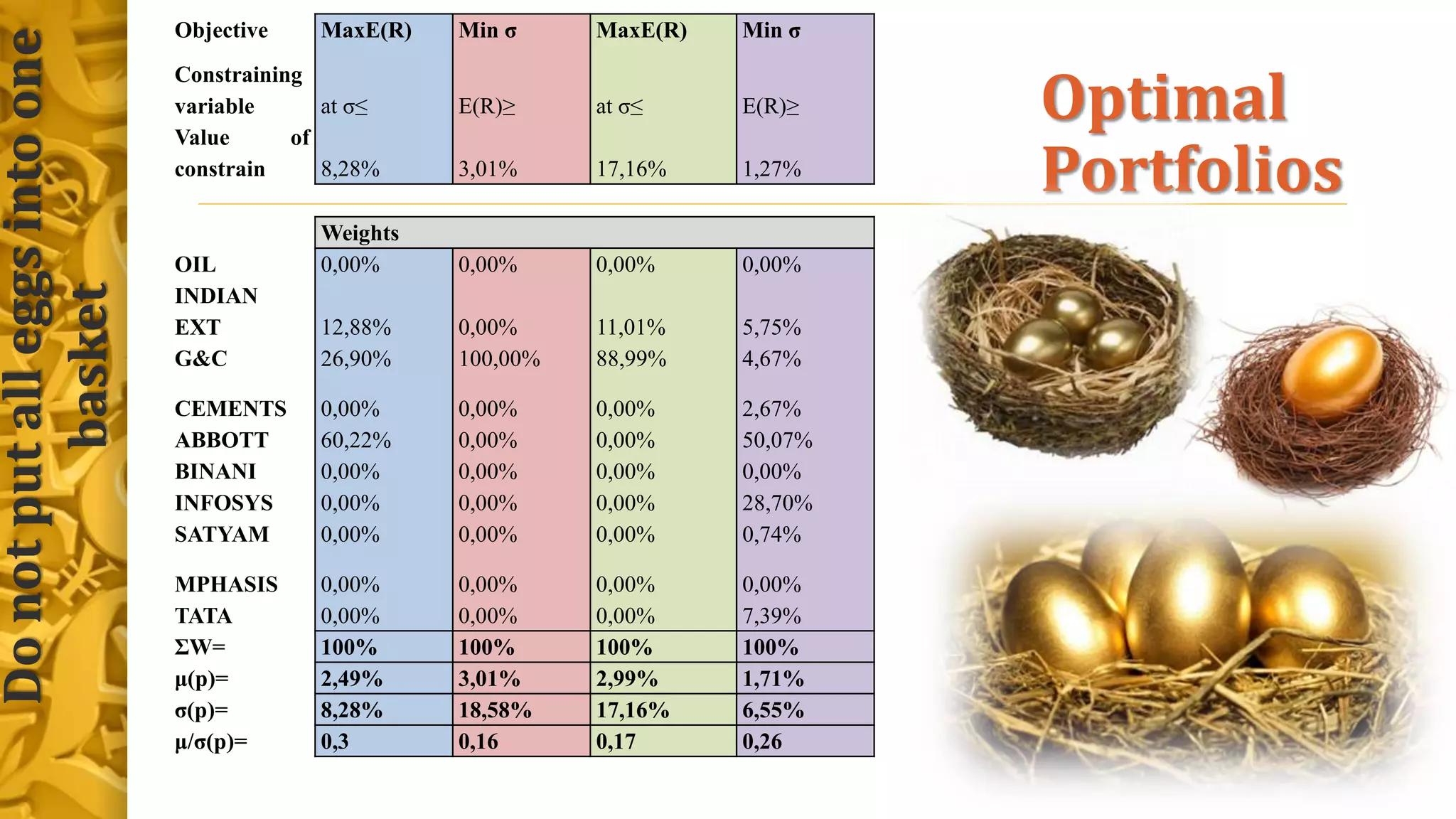

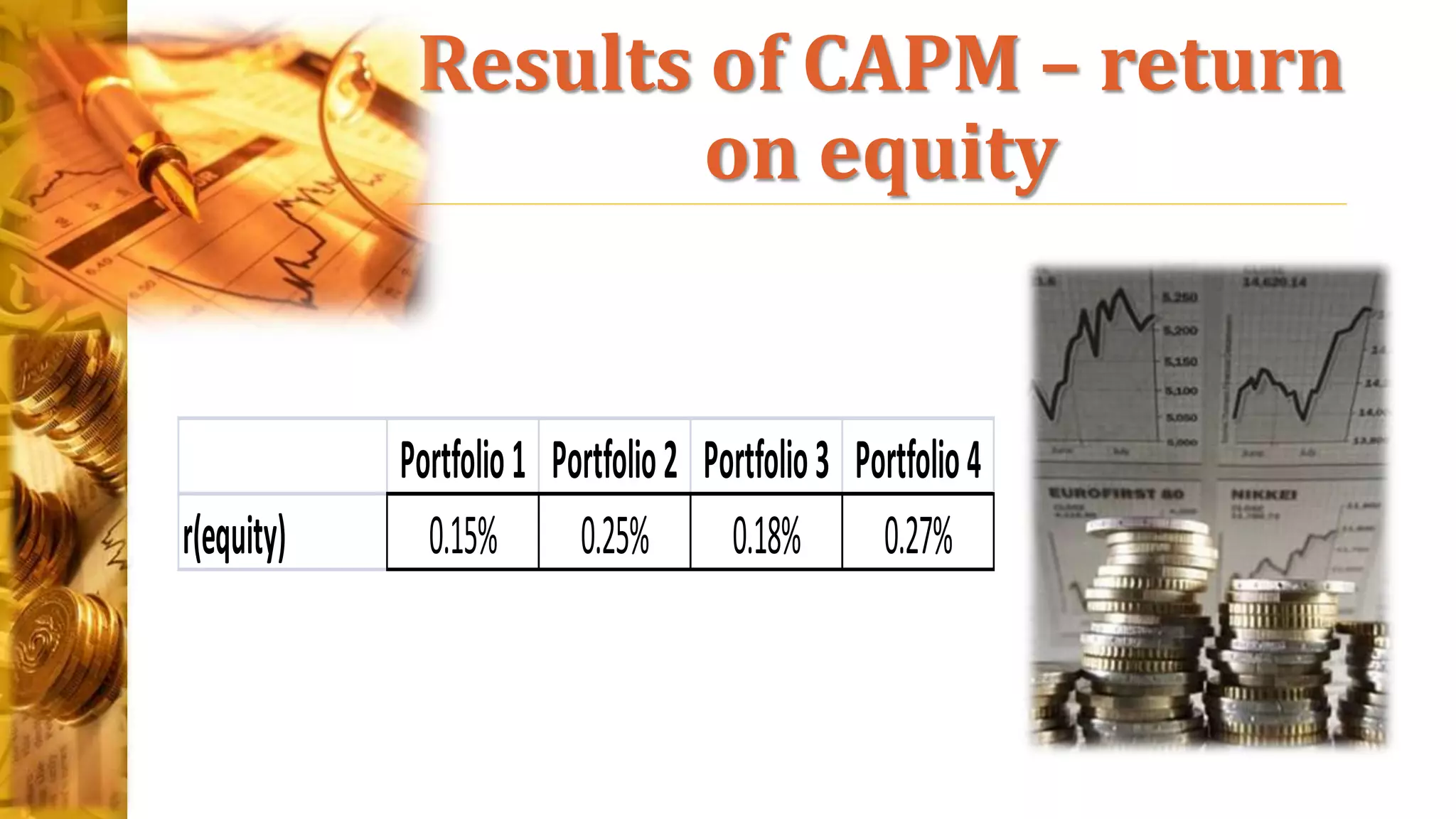

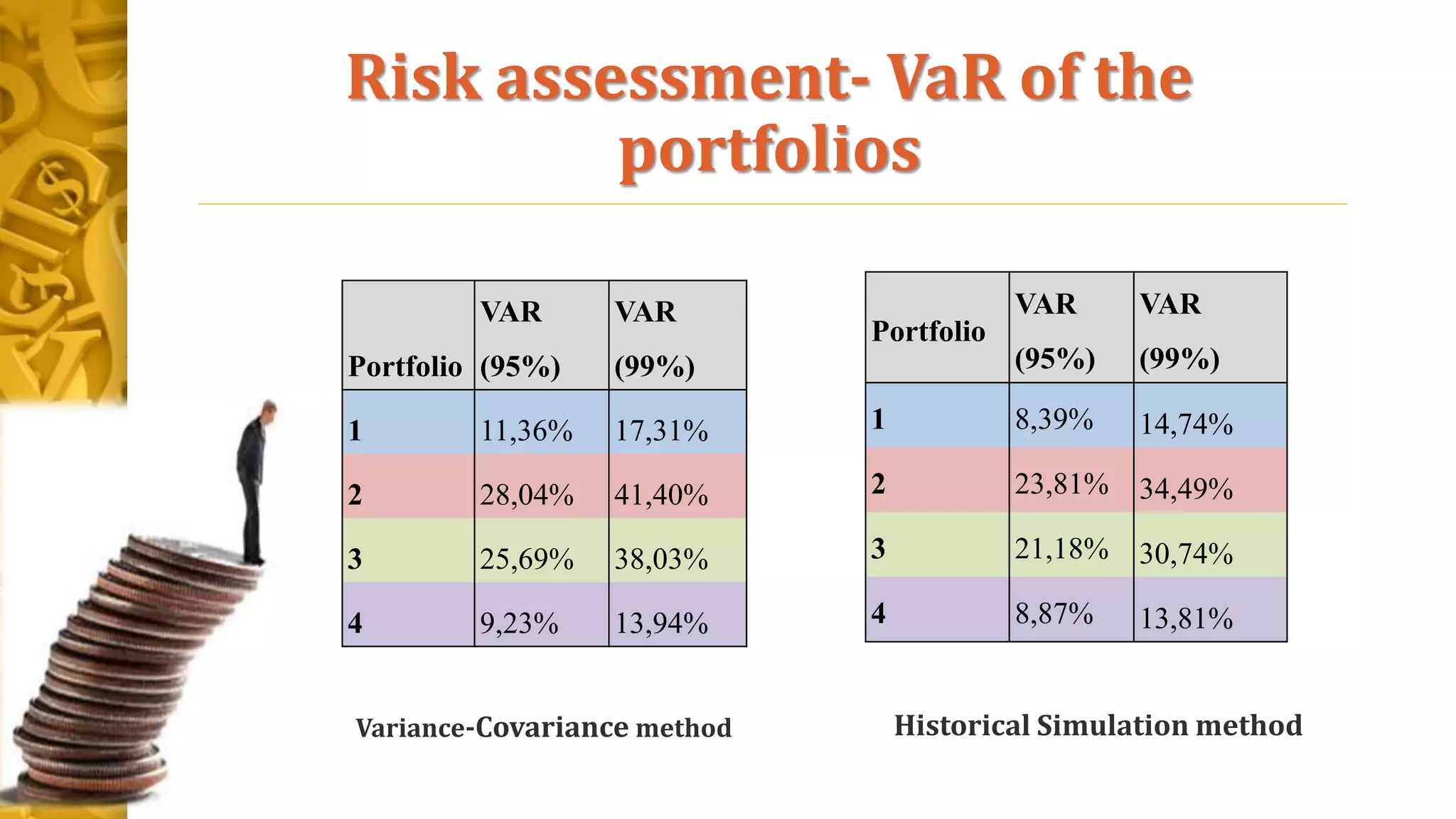

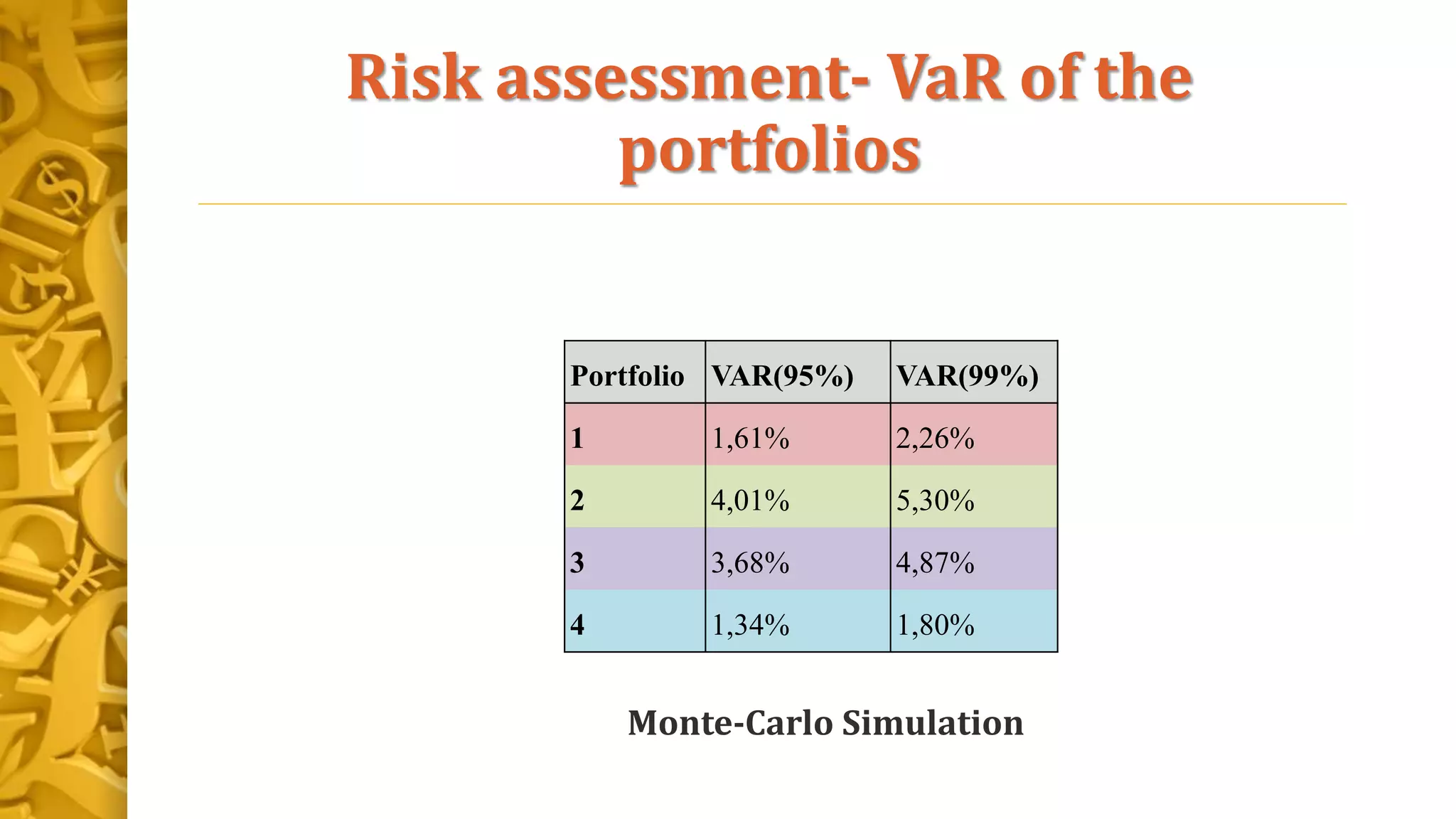

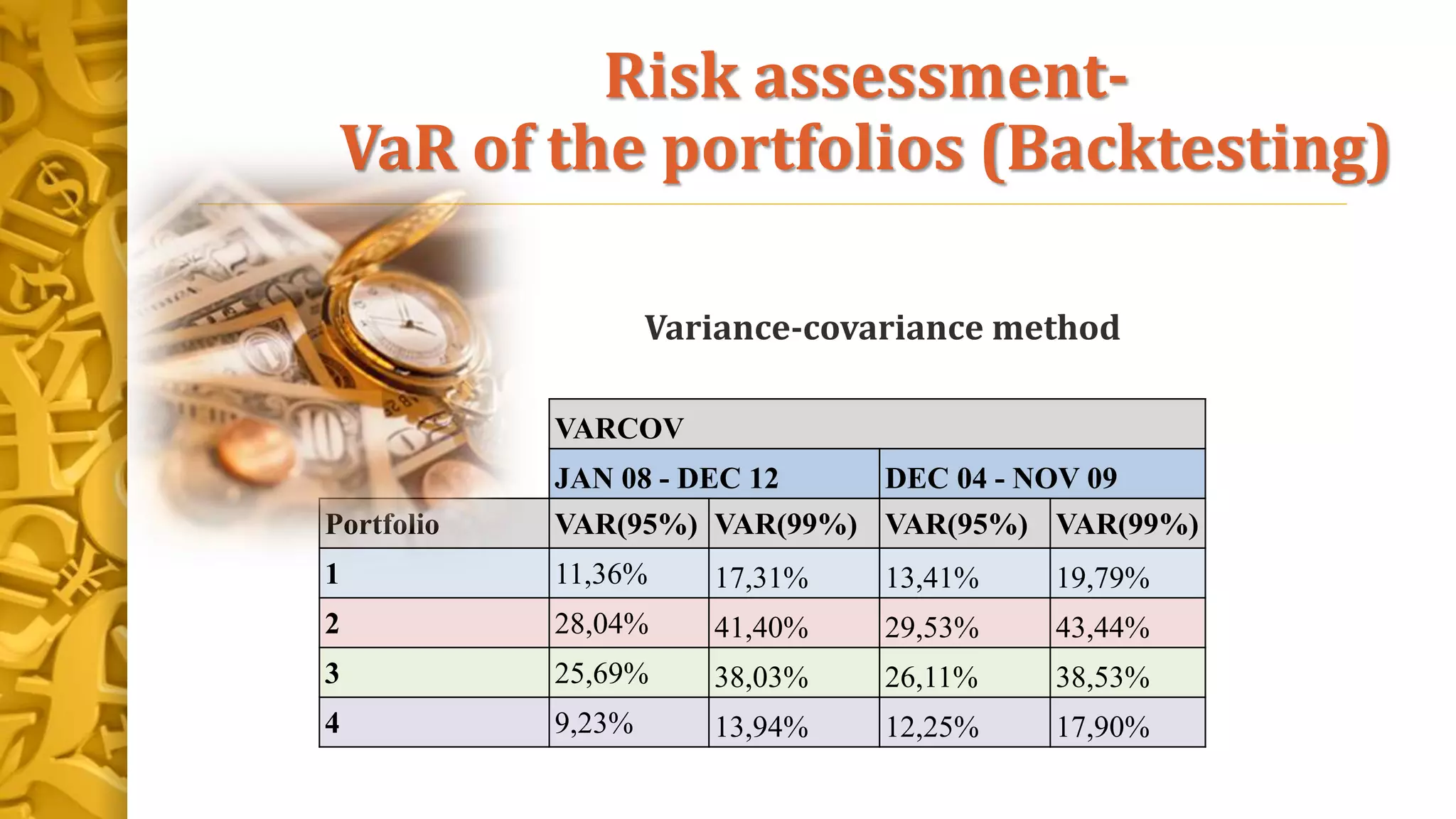

This thesis aims to create optimal investment portfolios tailored to investors' different risk tolerances and return requirements. It will investigate portfolio construction theory, explore portfolio crafting techniques, define an investment policy, and assess risk and return using techniques like modern portfolio theory, CAPM, value at risk, backtesting and stress testing. Optimal portfolios will be created with the highest possible returns under a given level of risk, or the lowest risk given a return threshold. The results will suggest which portfolios are most suitable for different investor risk profiles.