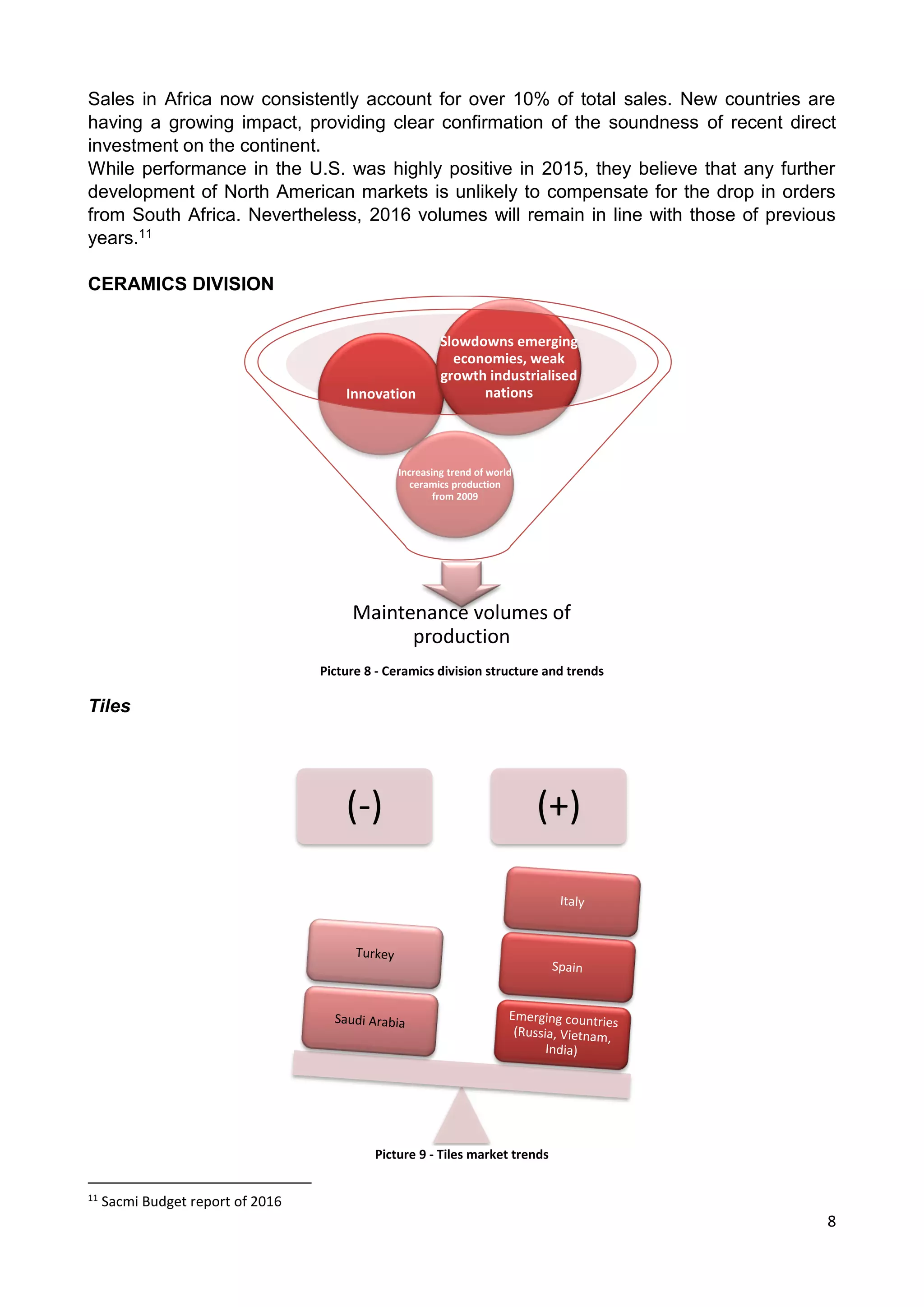

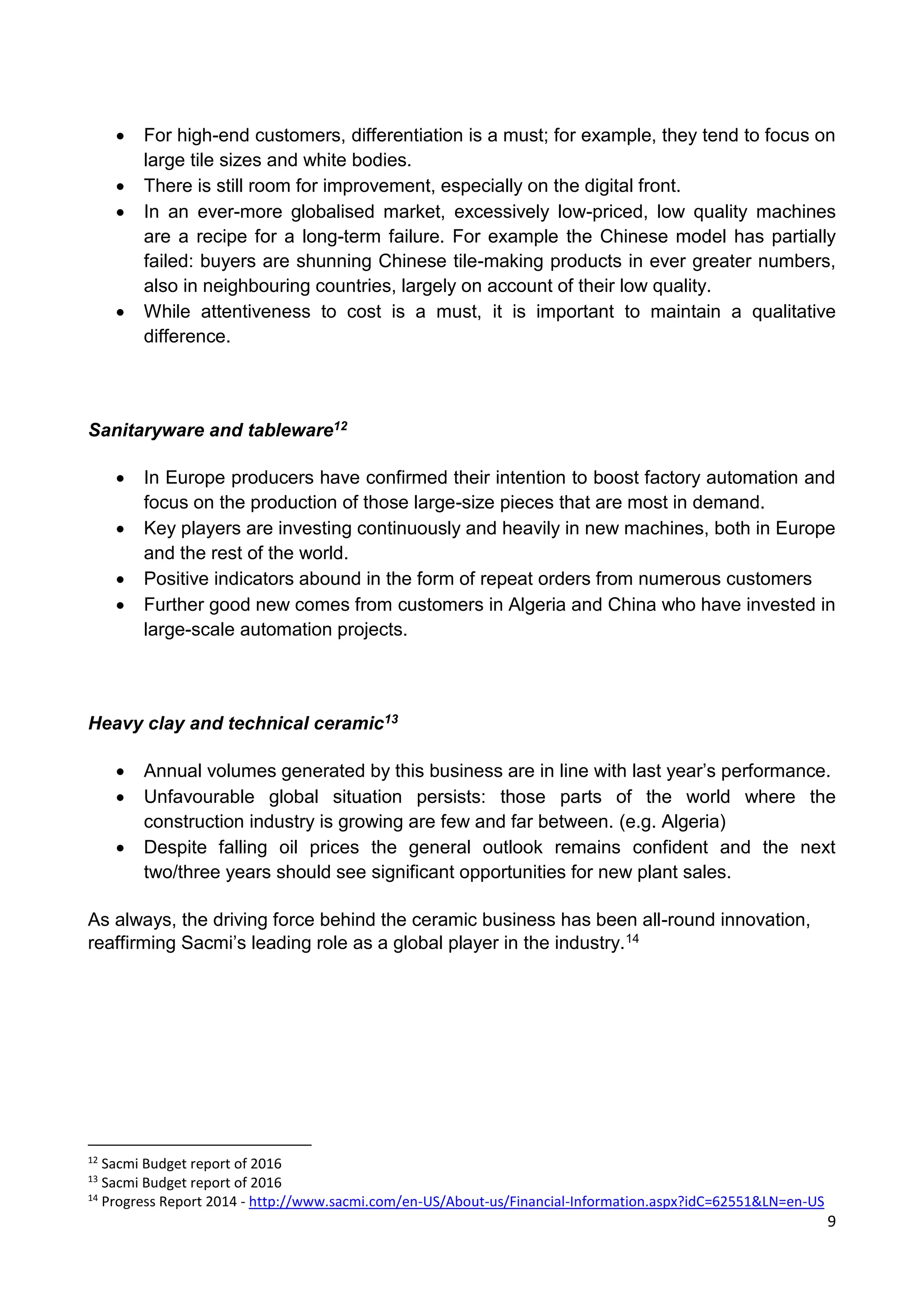

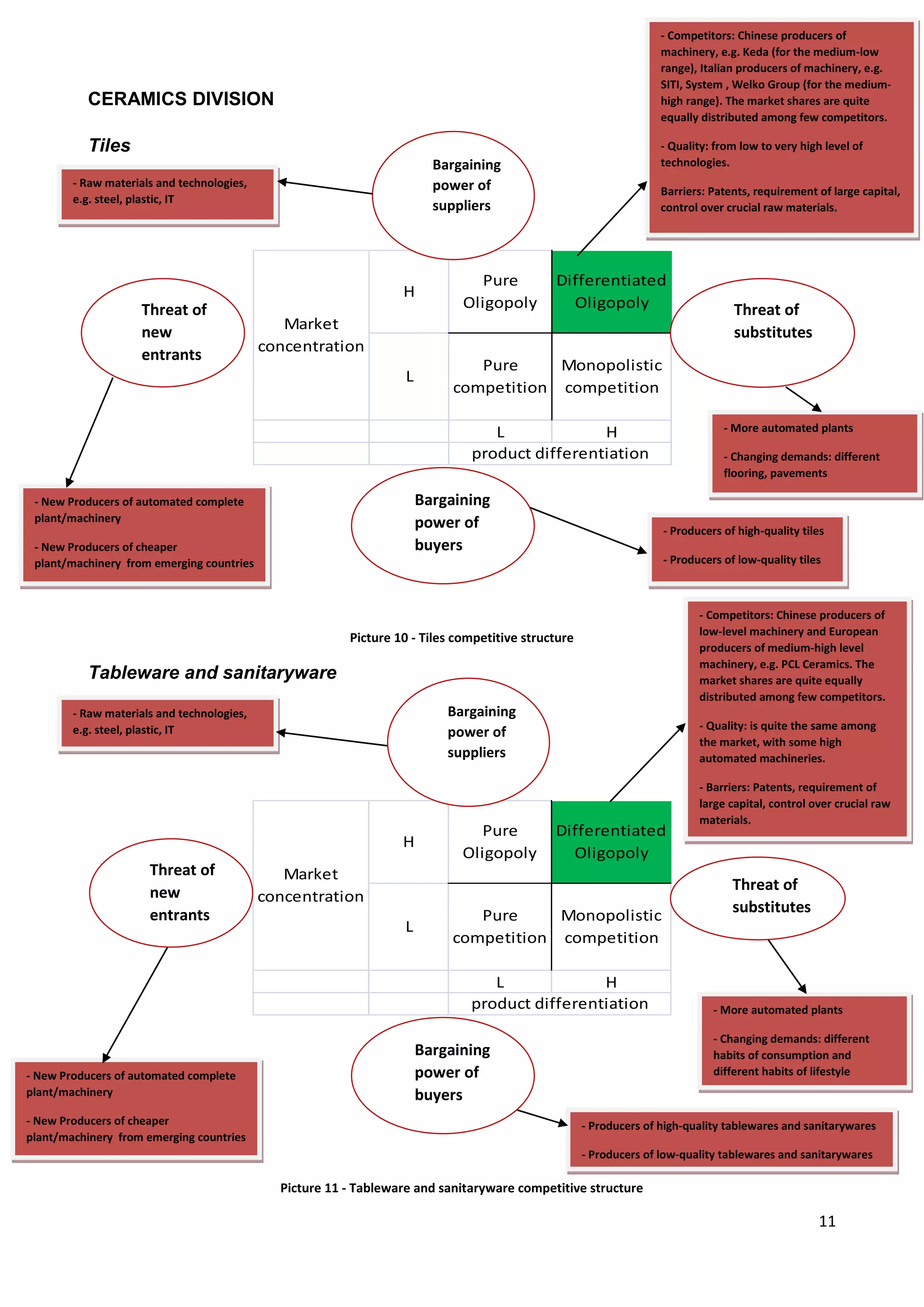

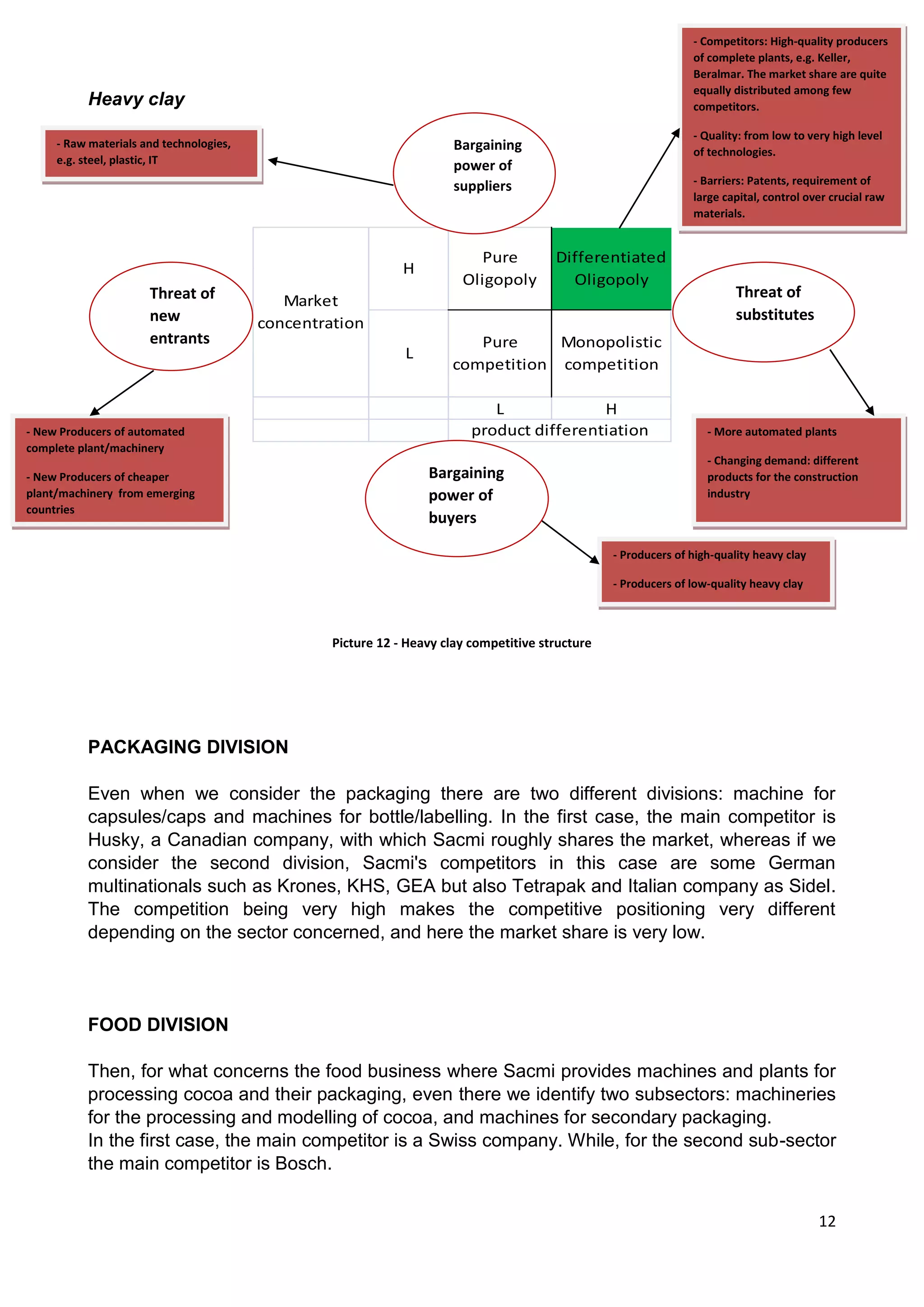

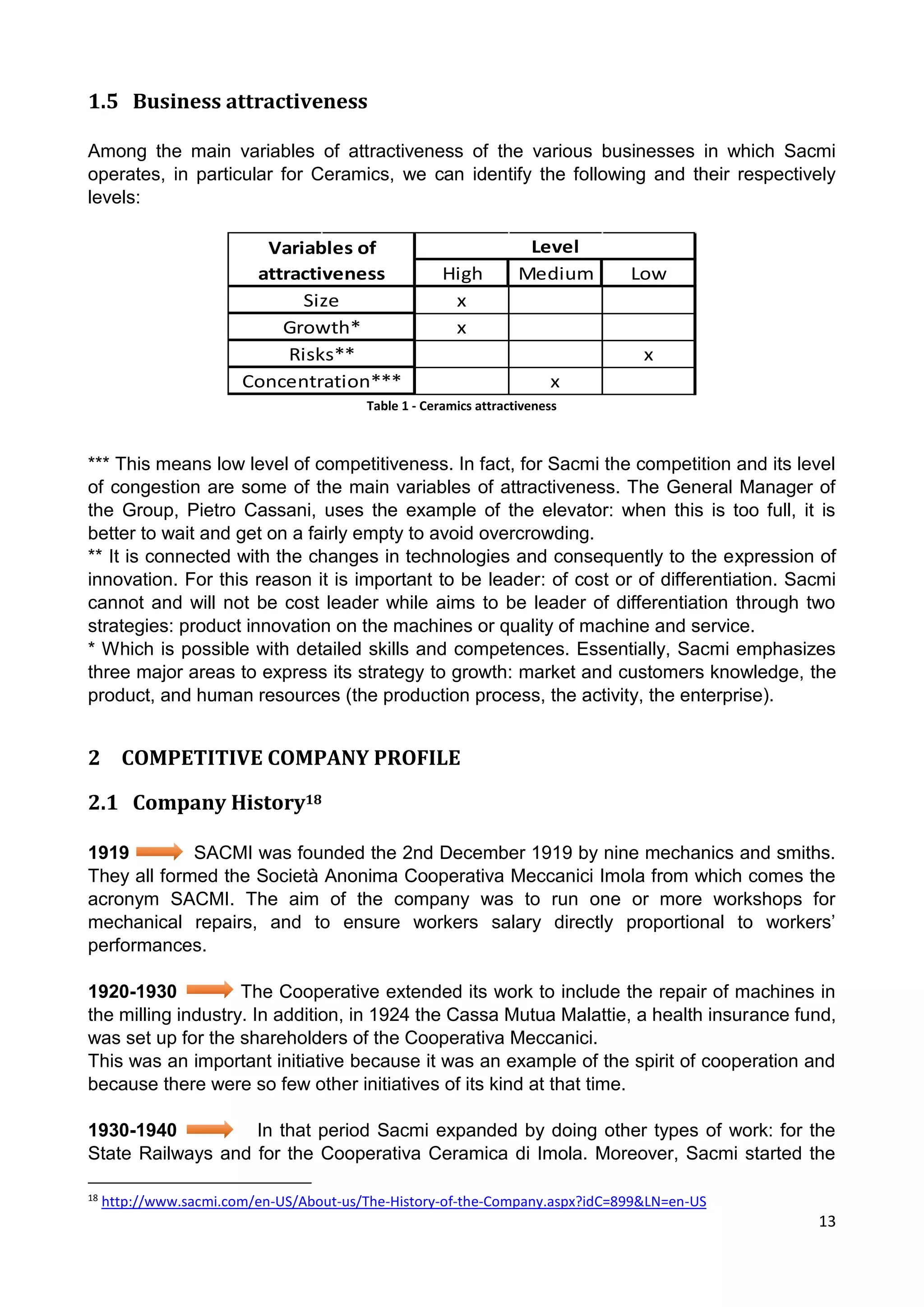

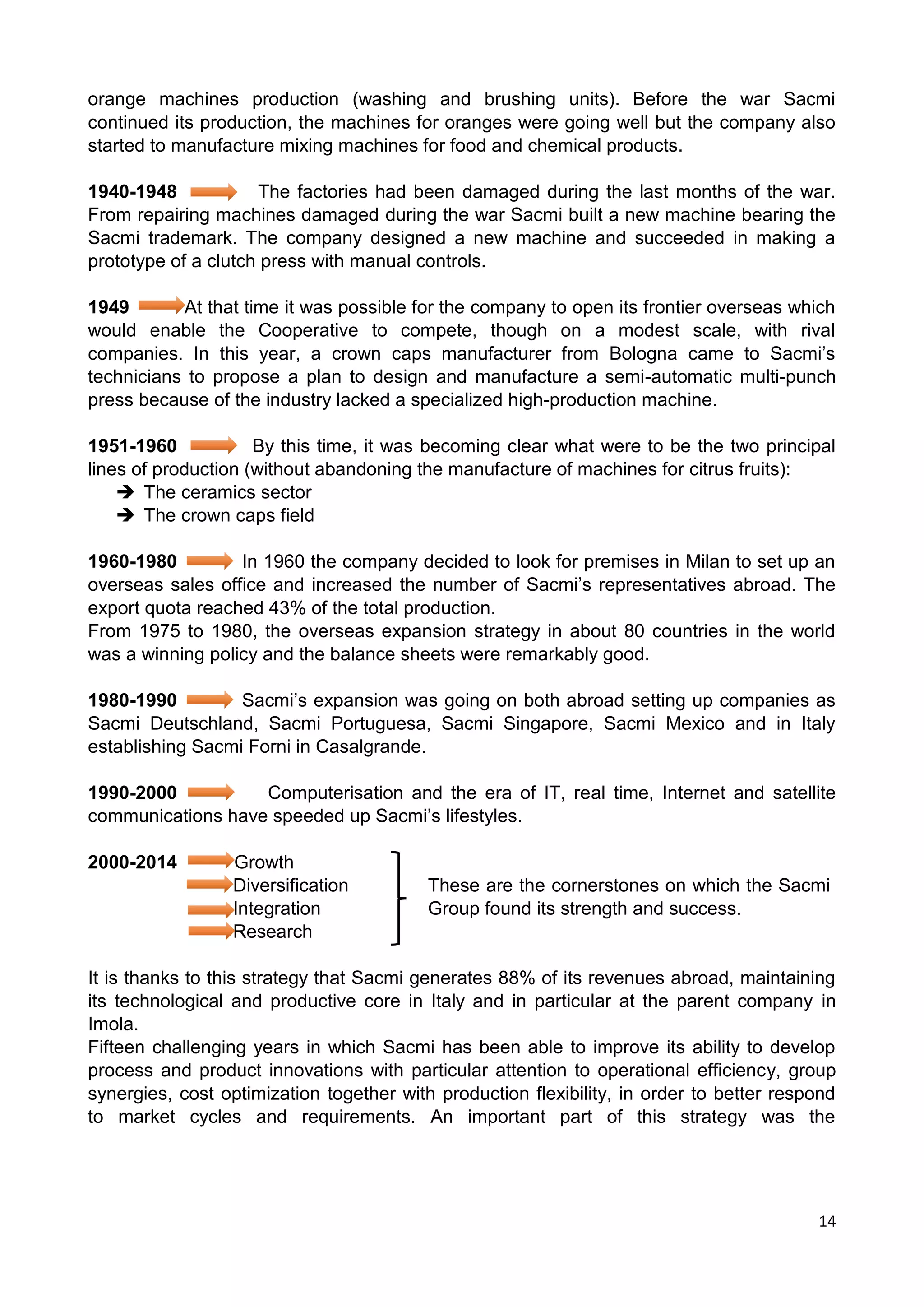

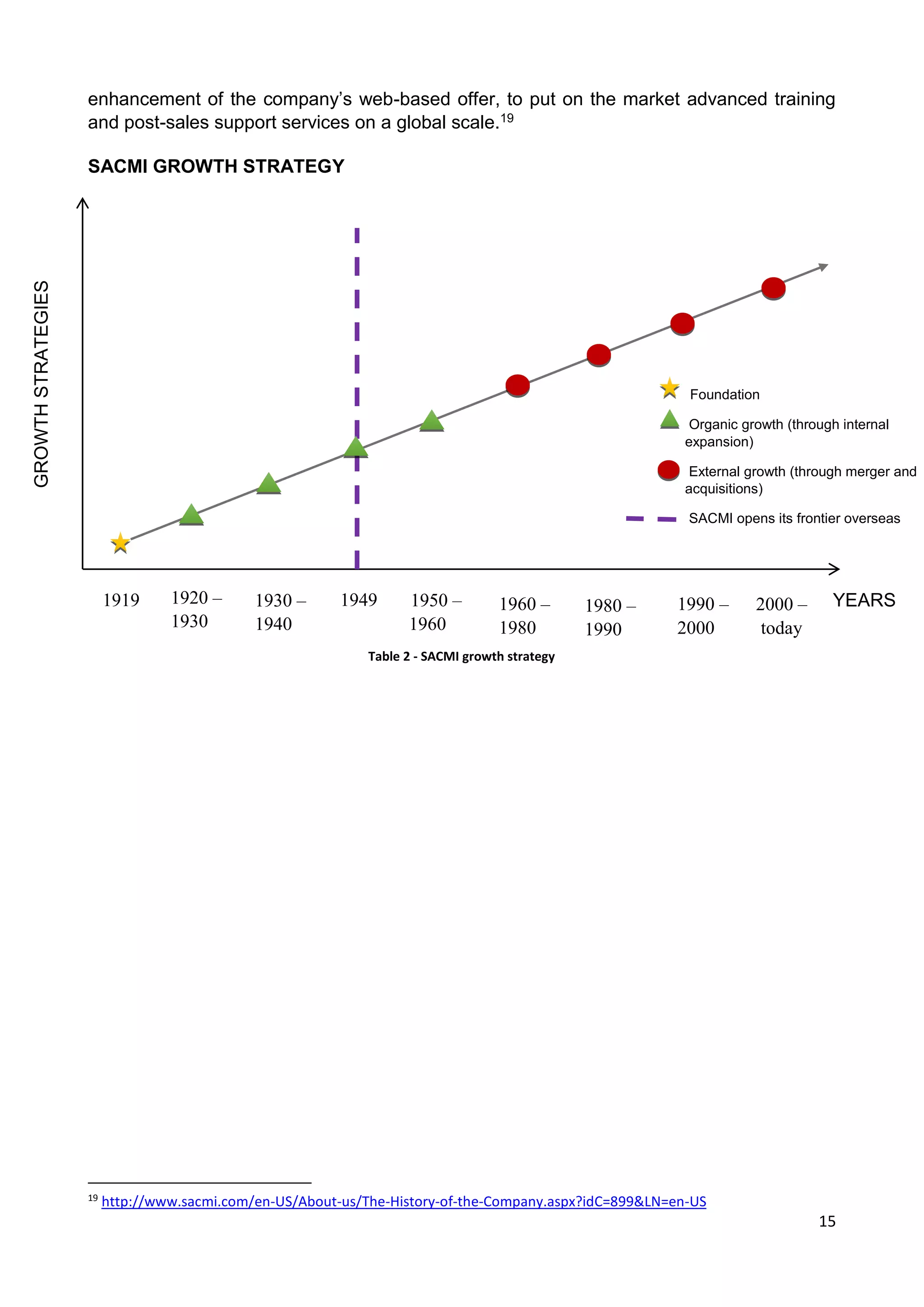

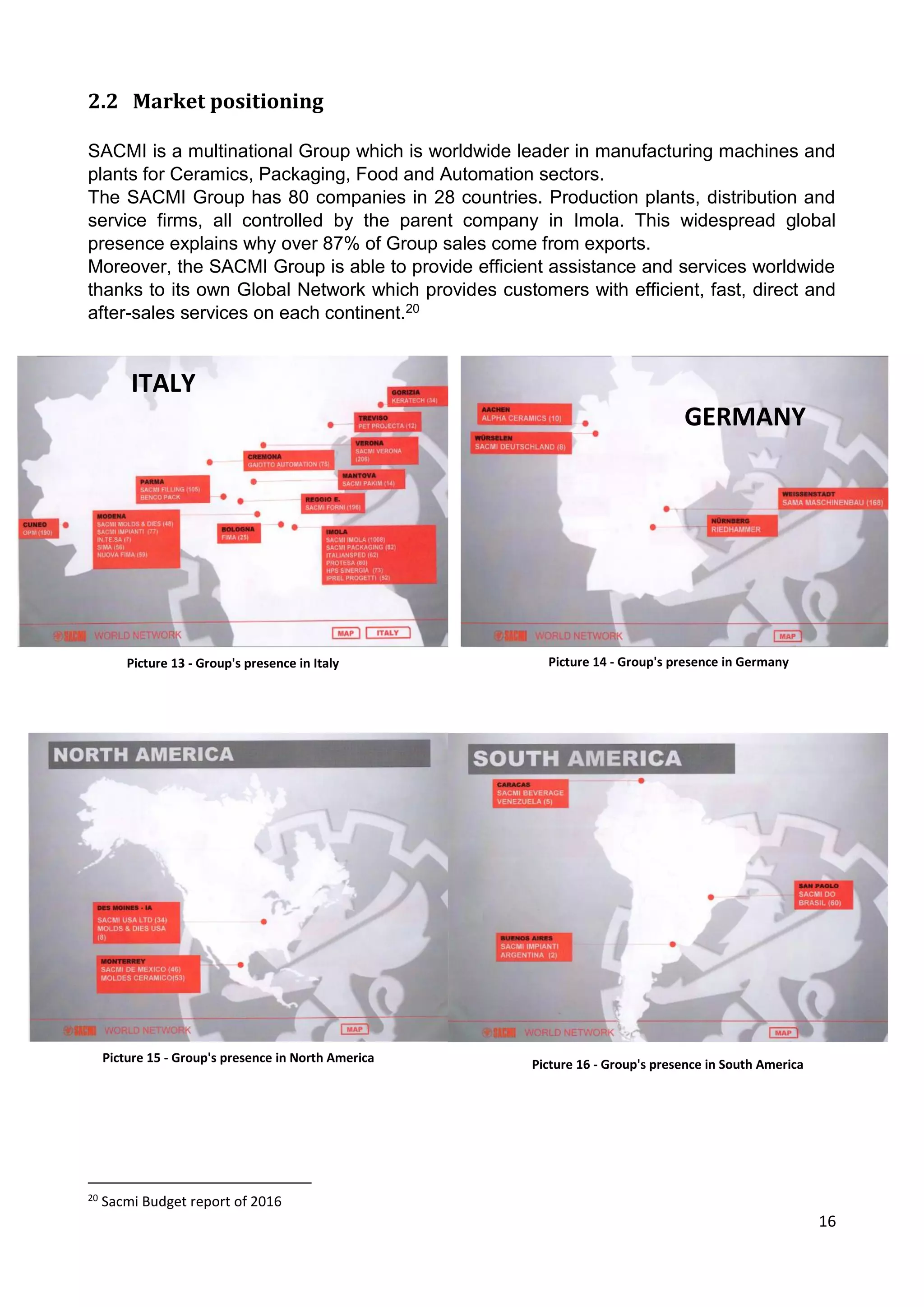

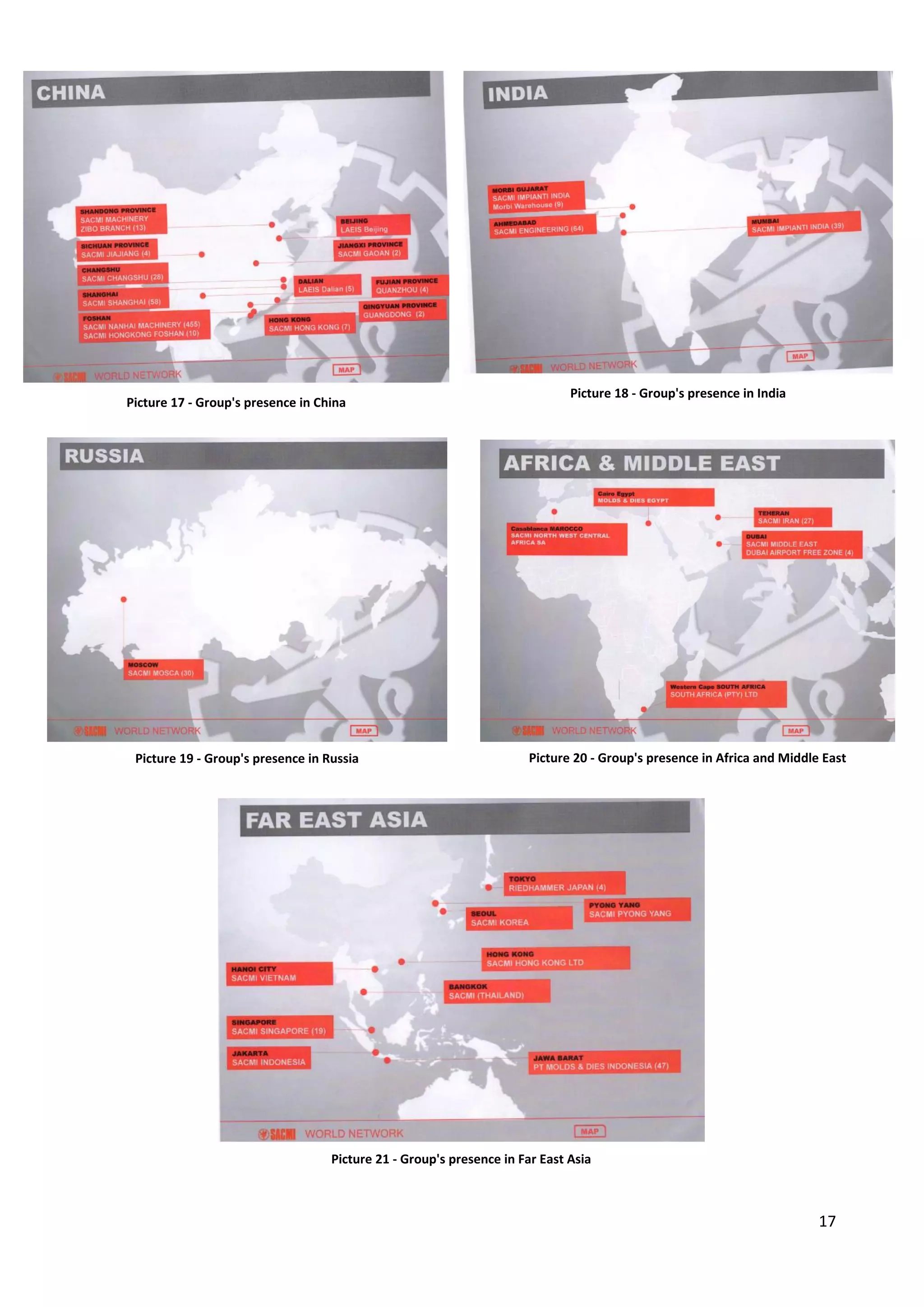

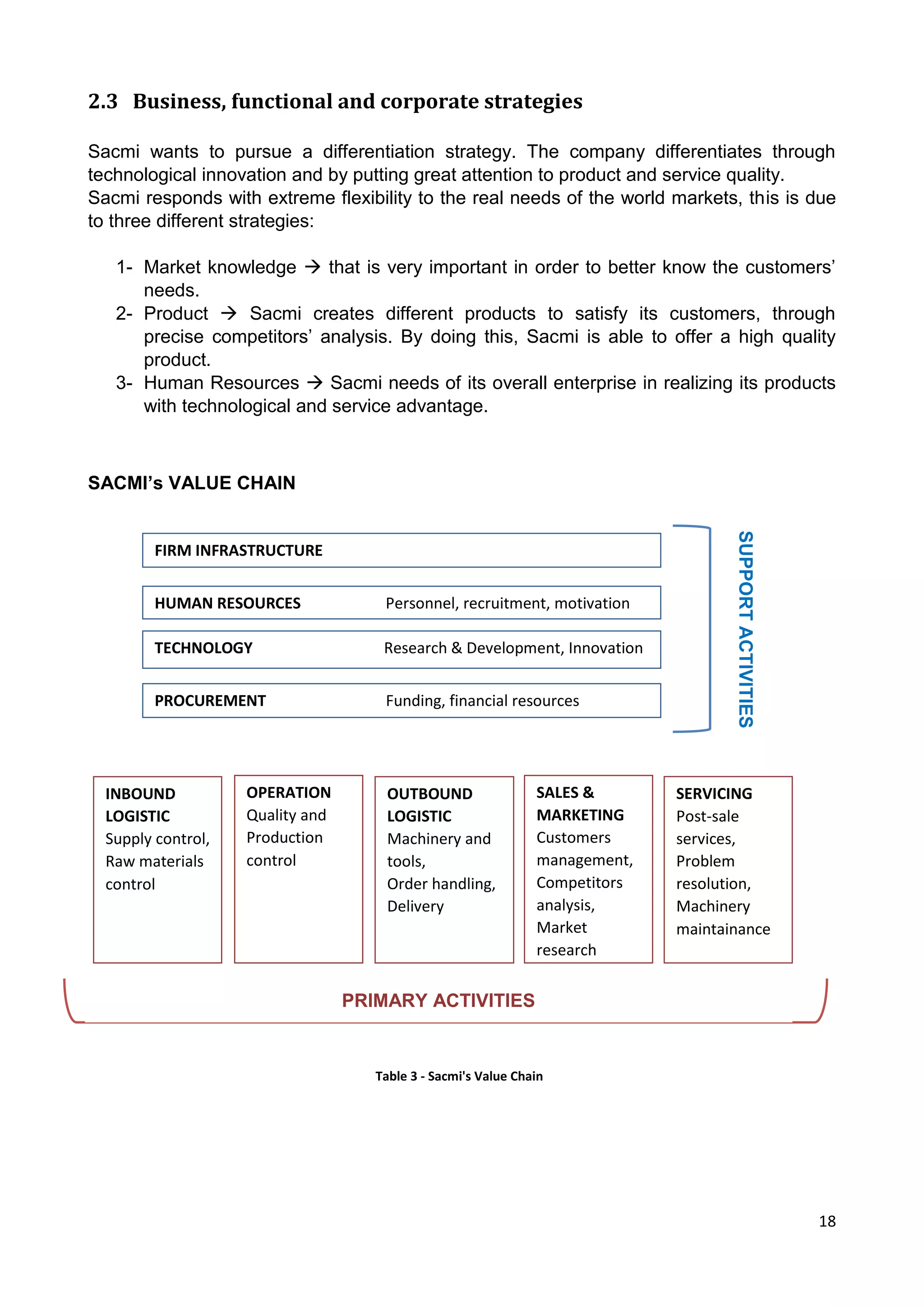

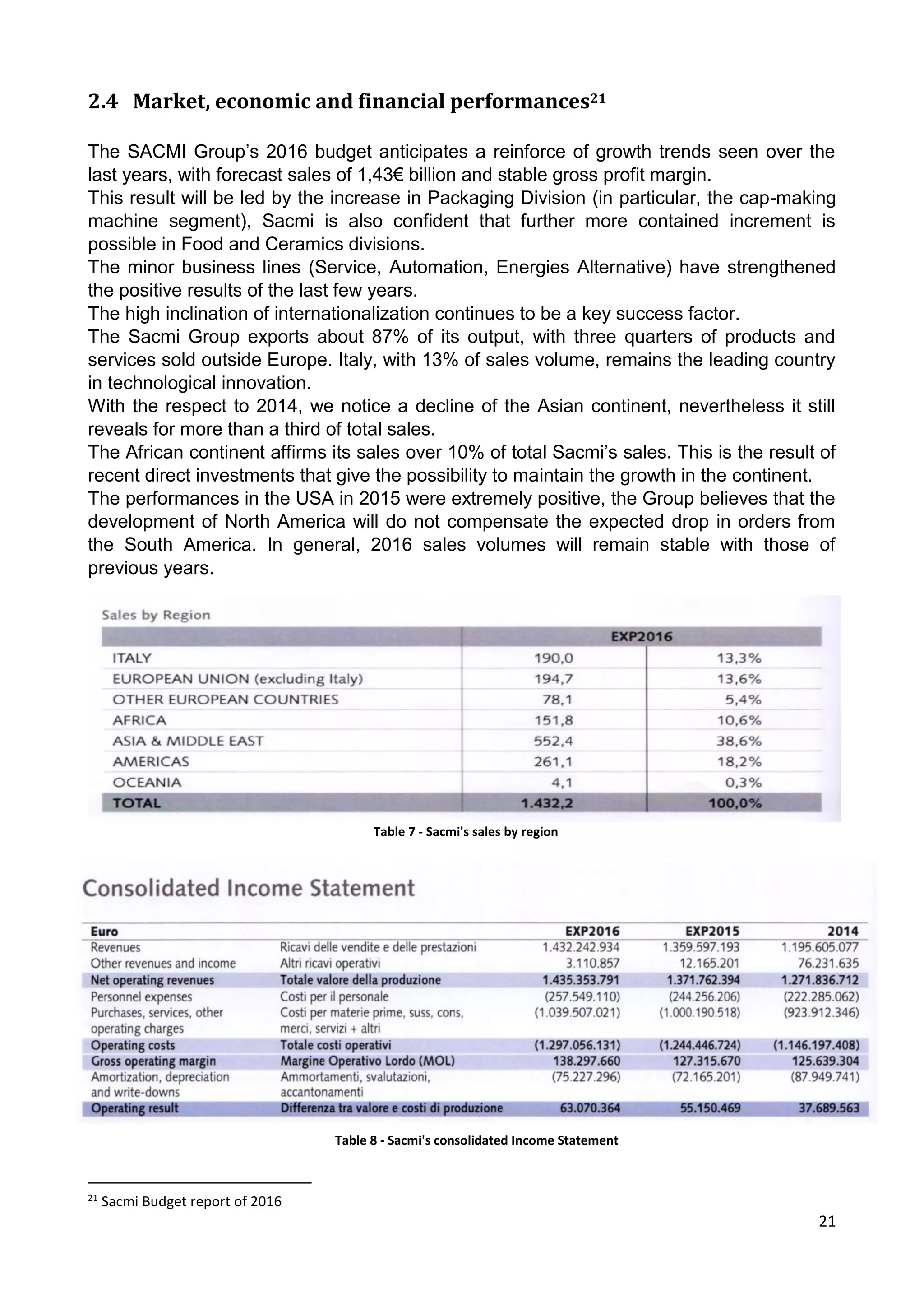

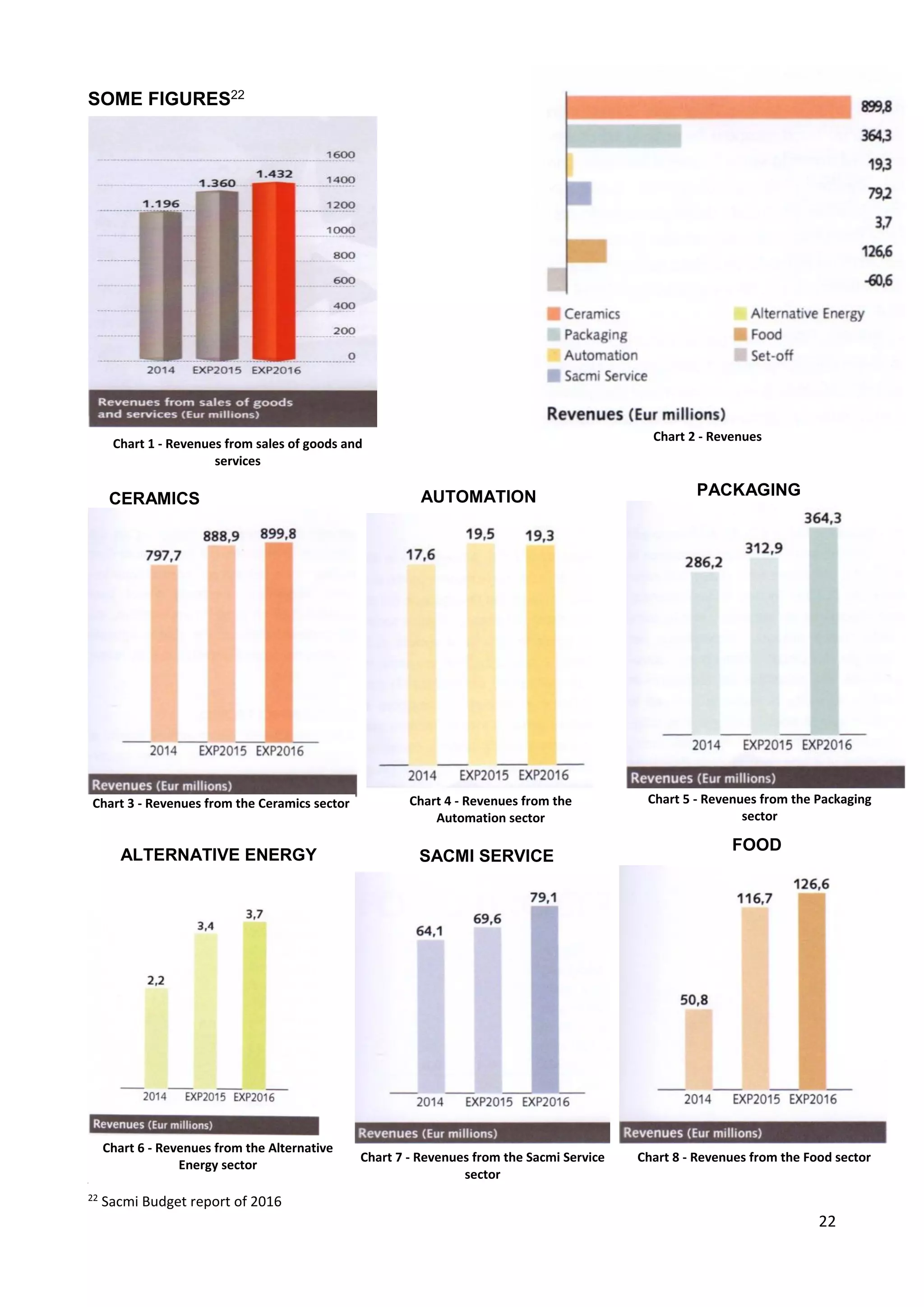

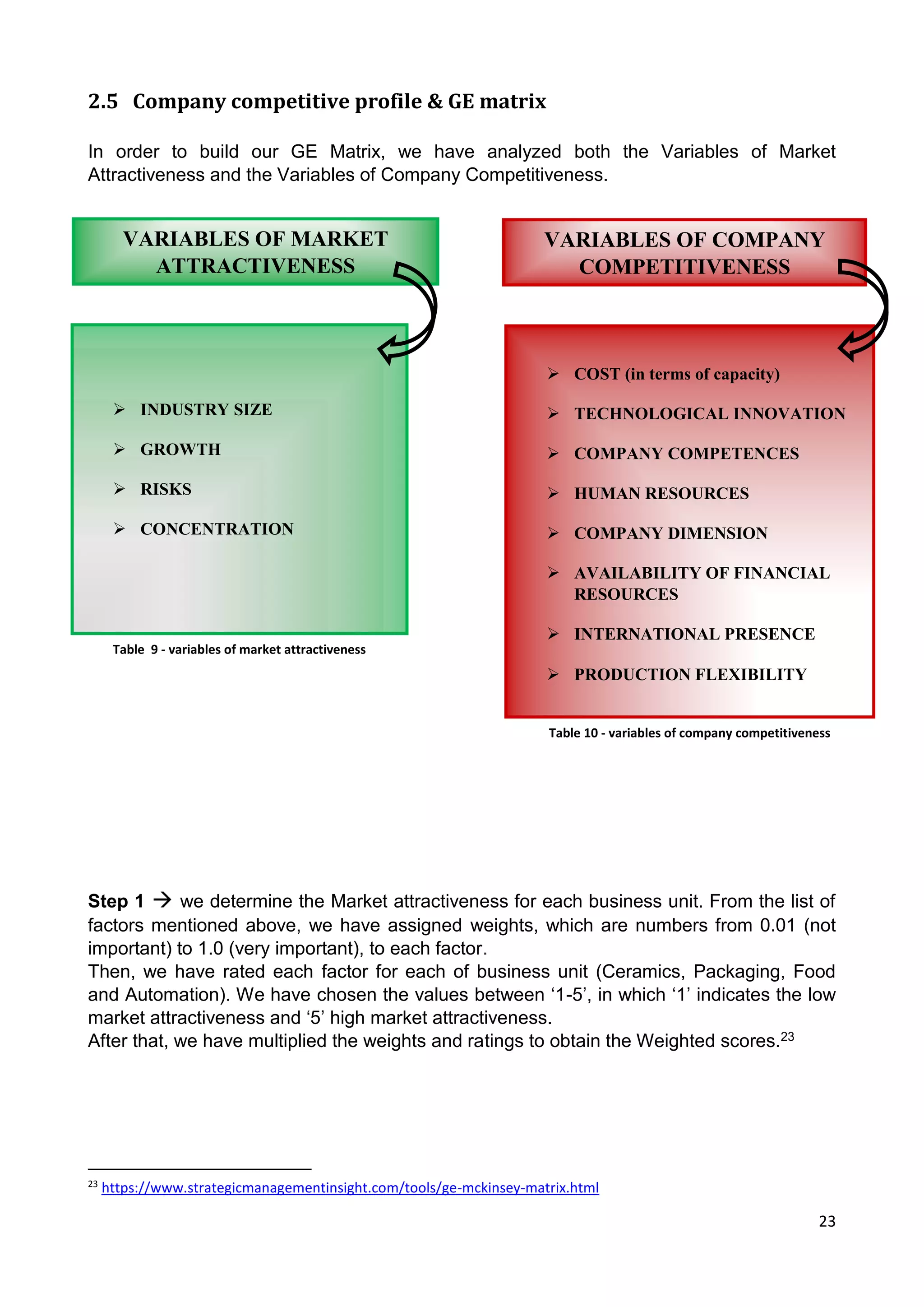

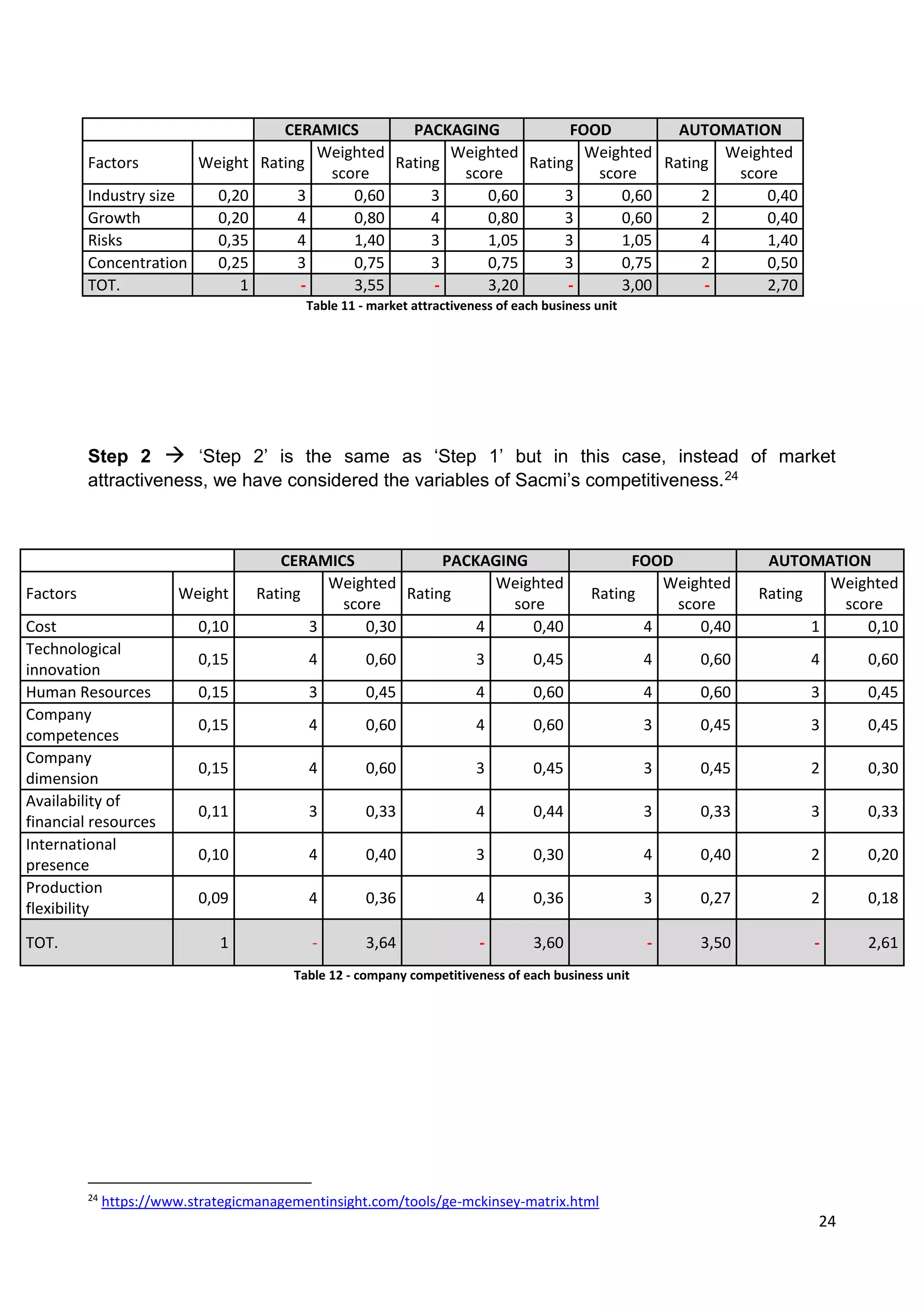

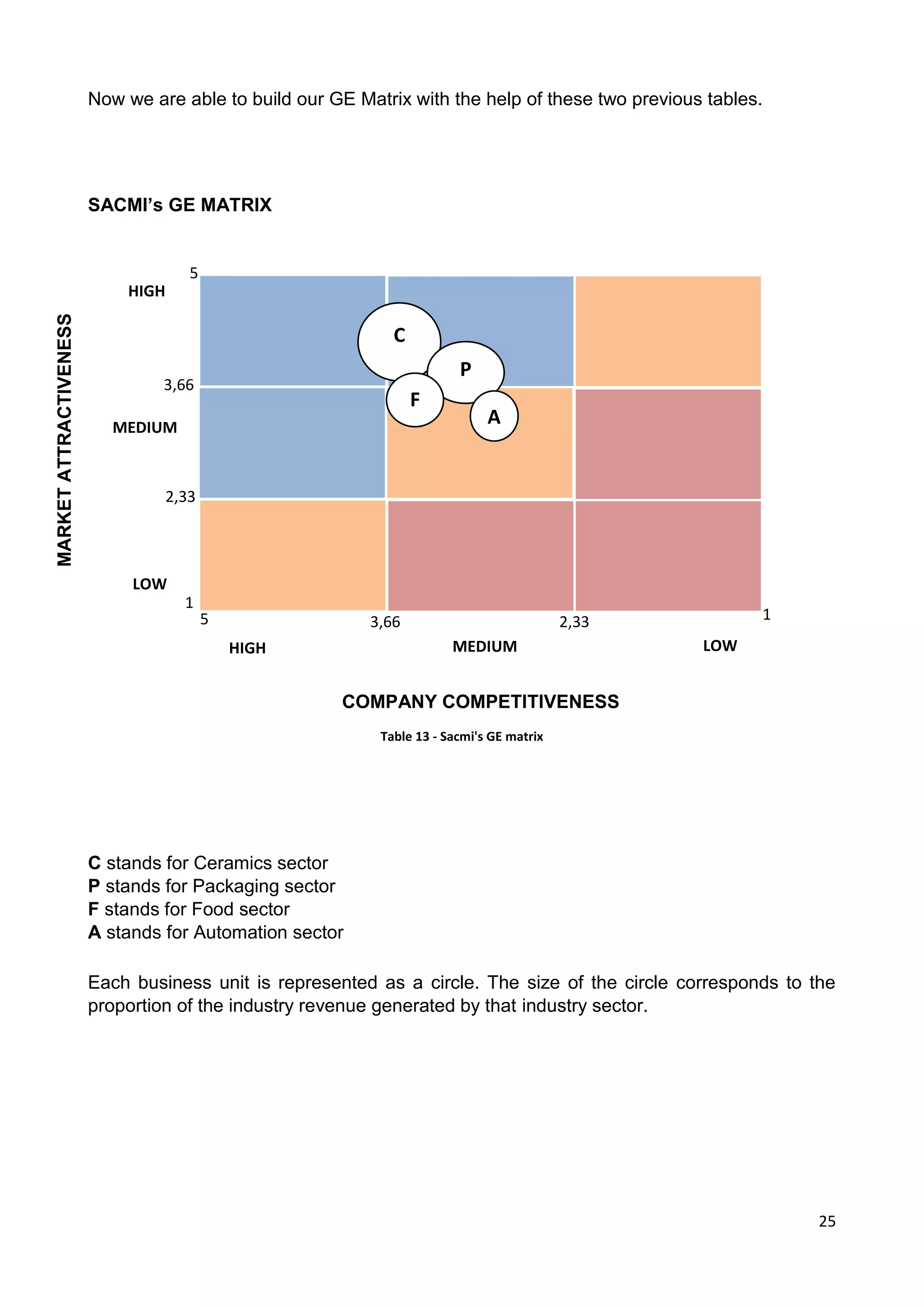

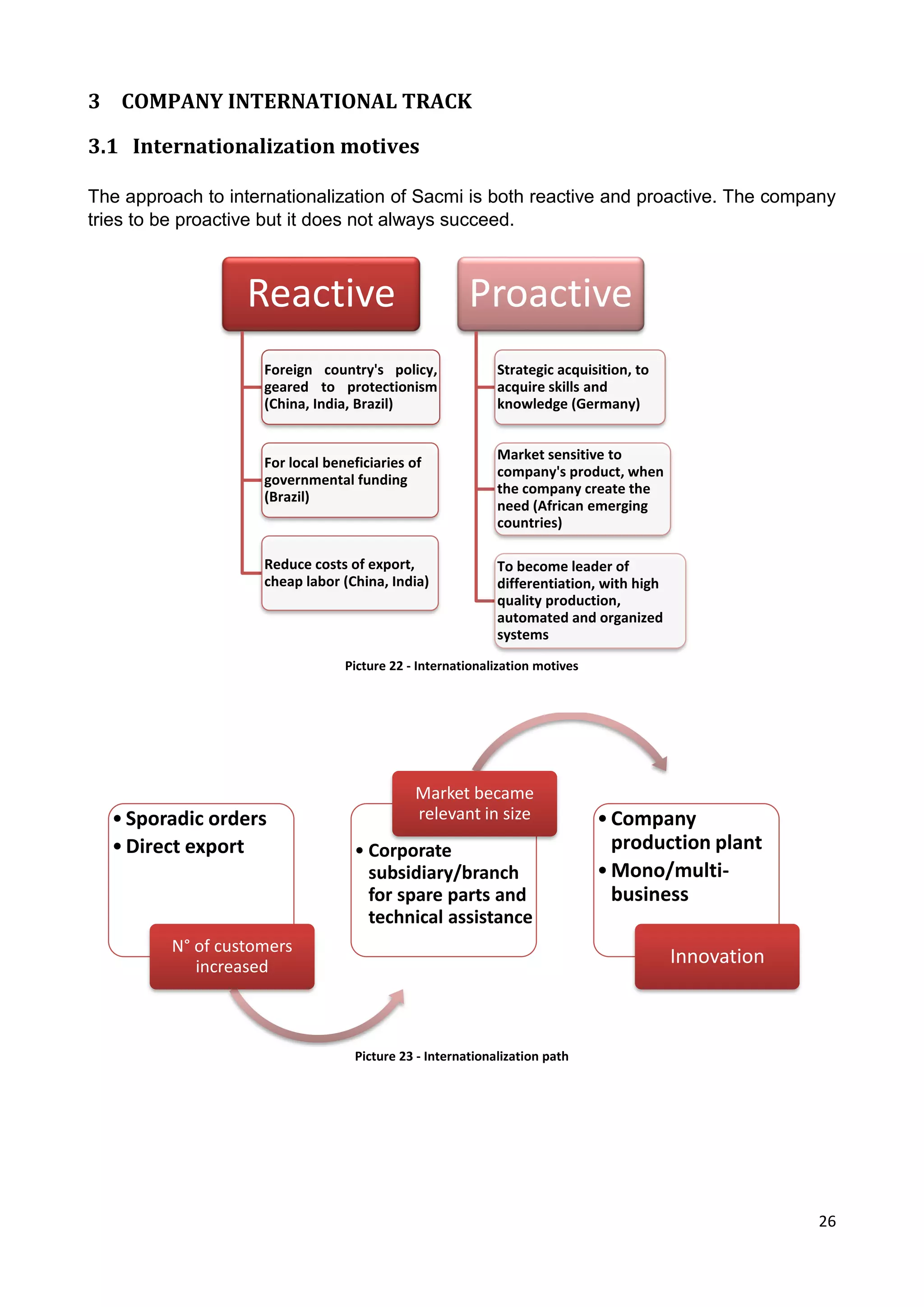

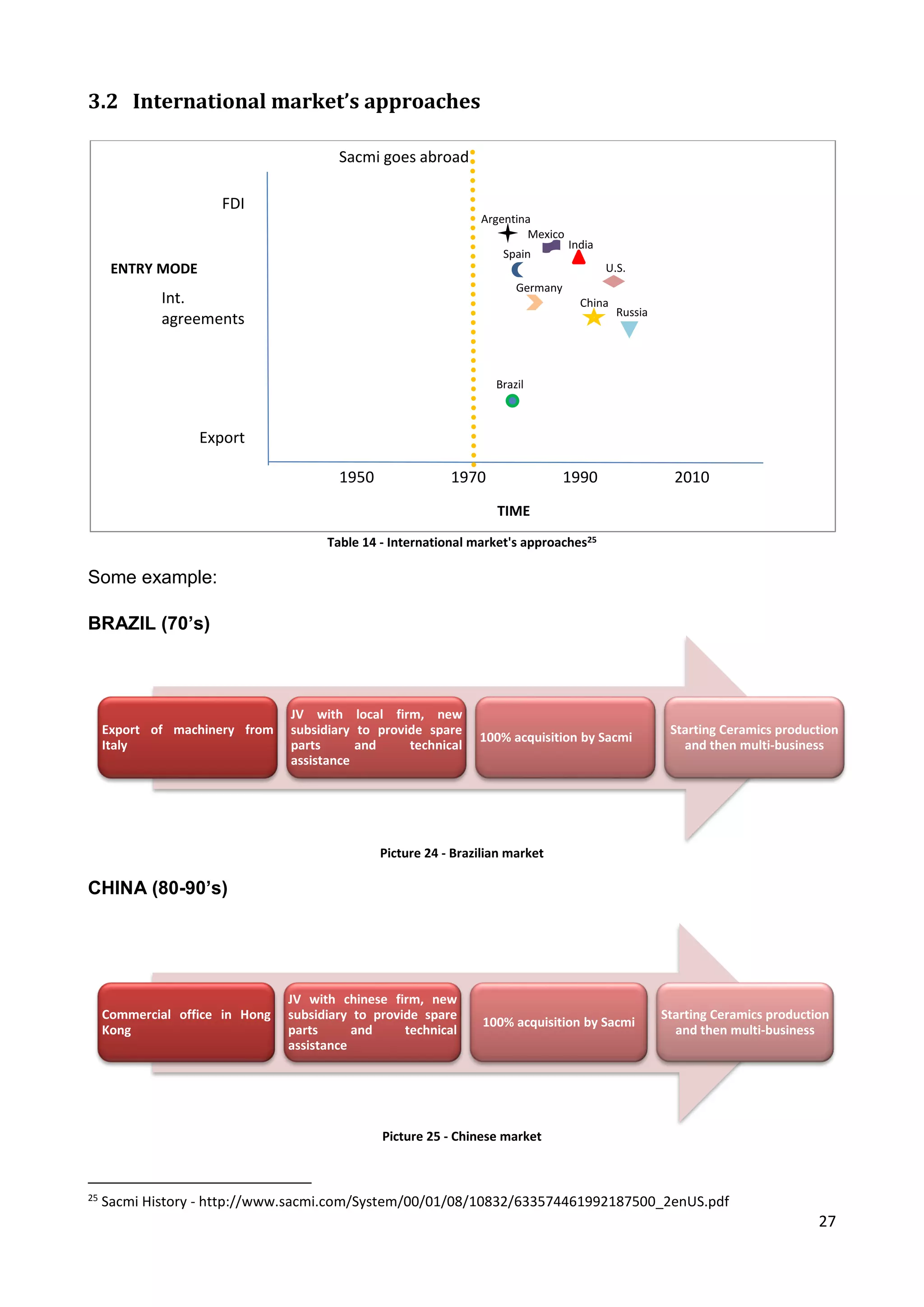

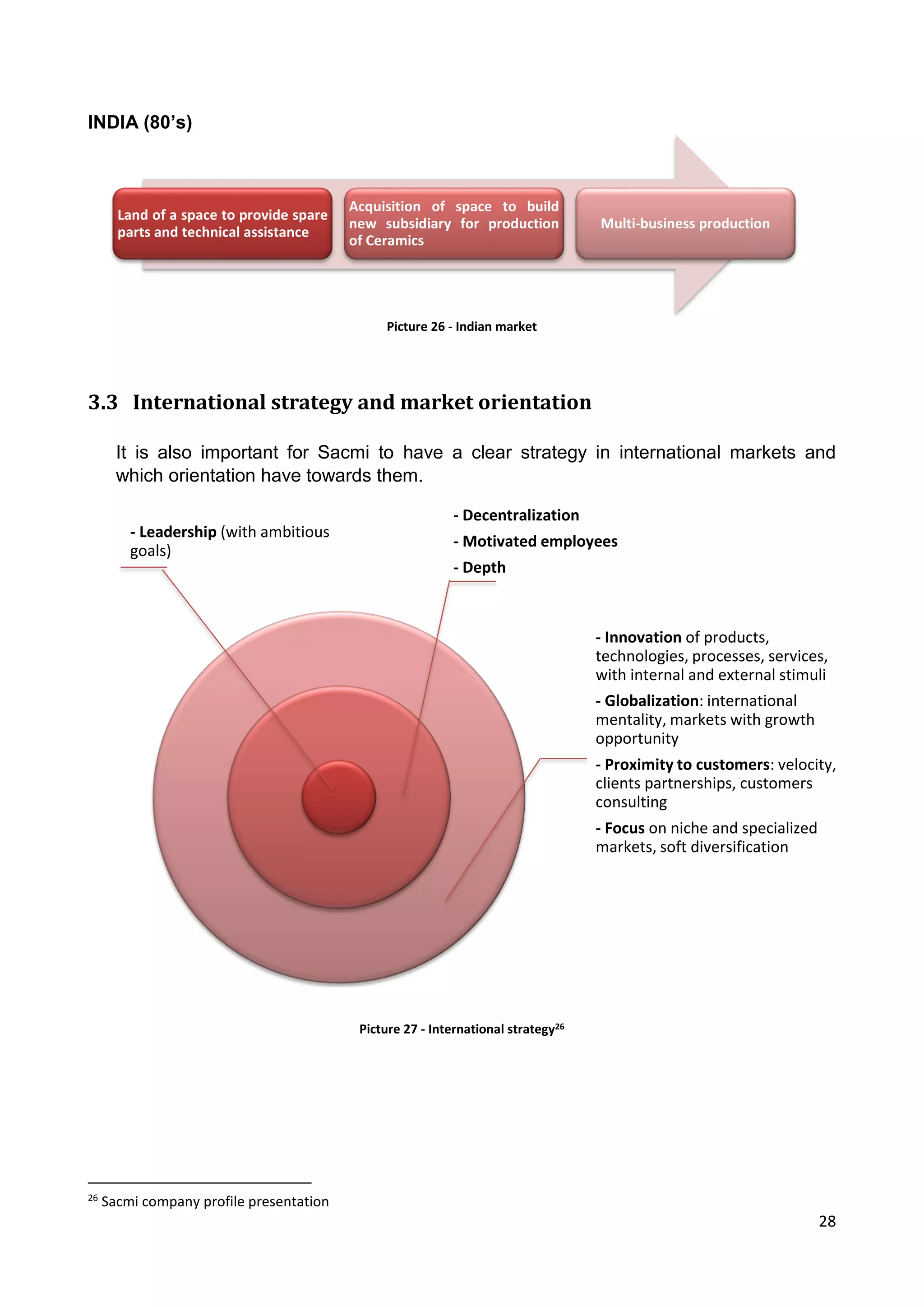

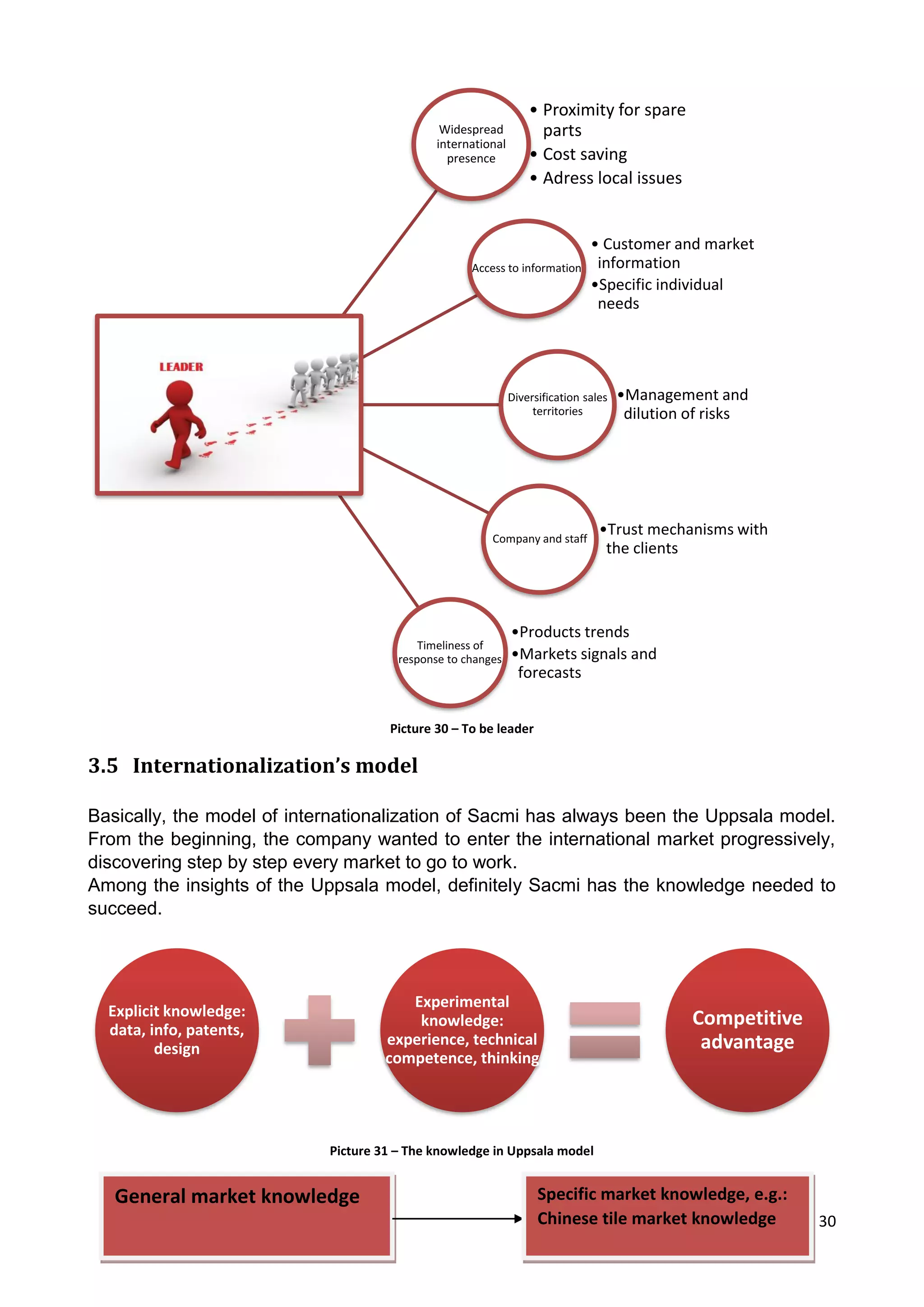

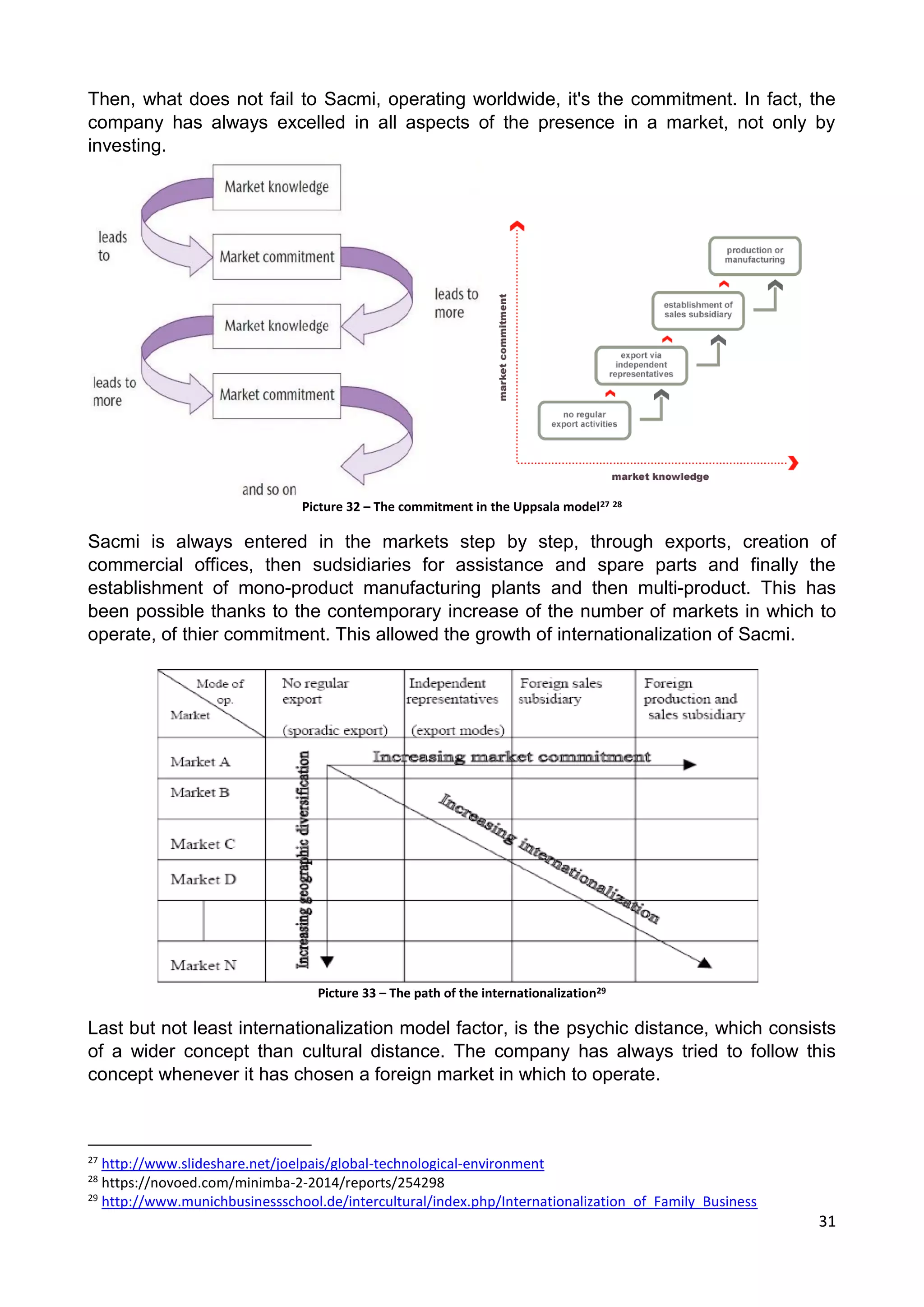

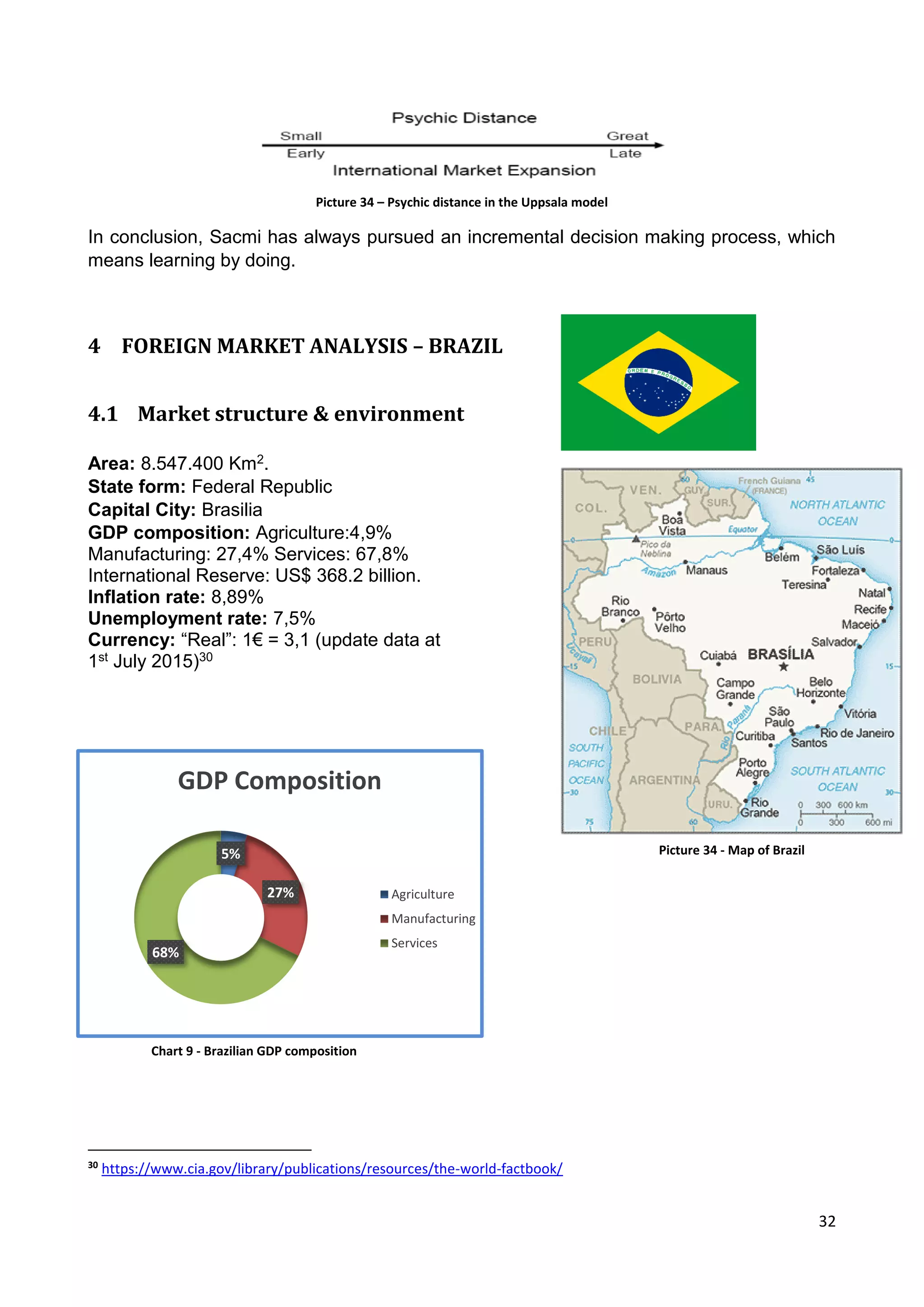

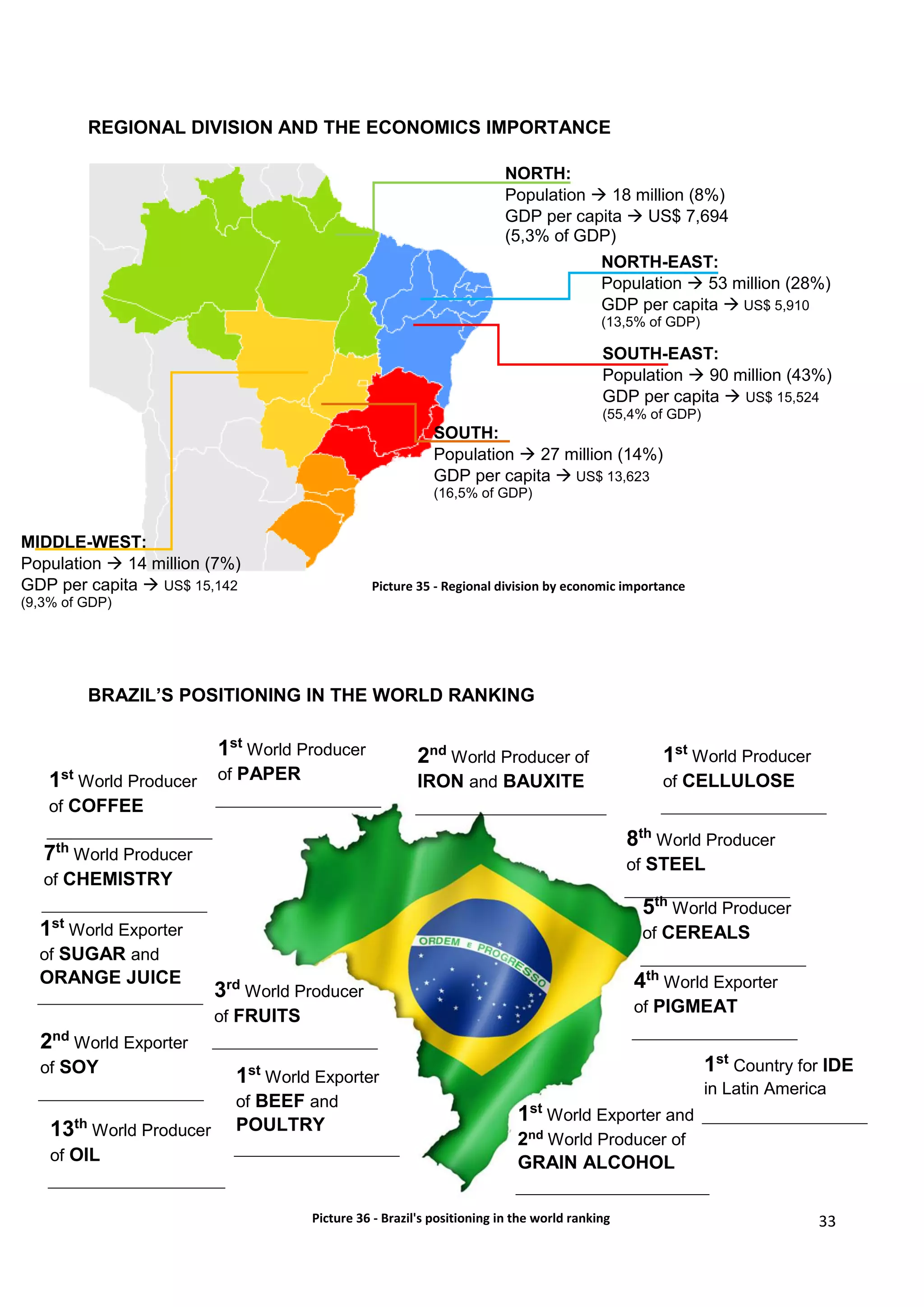

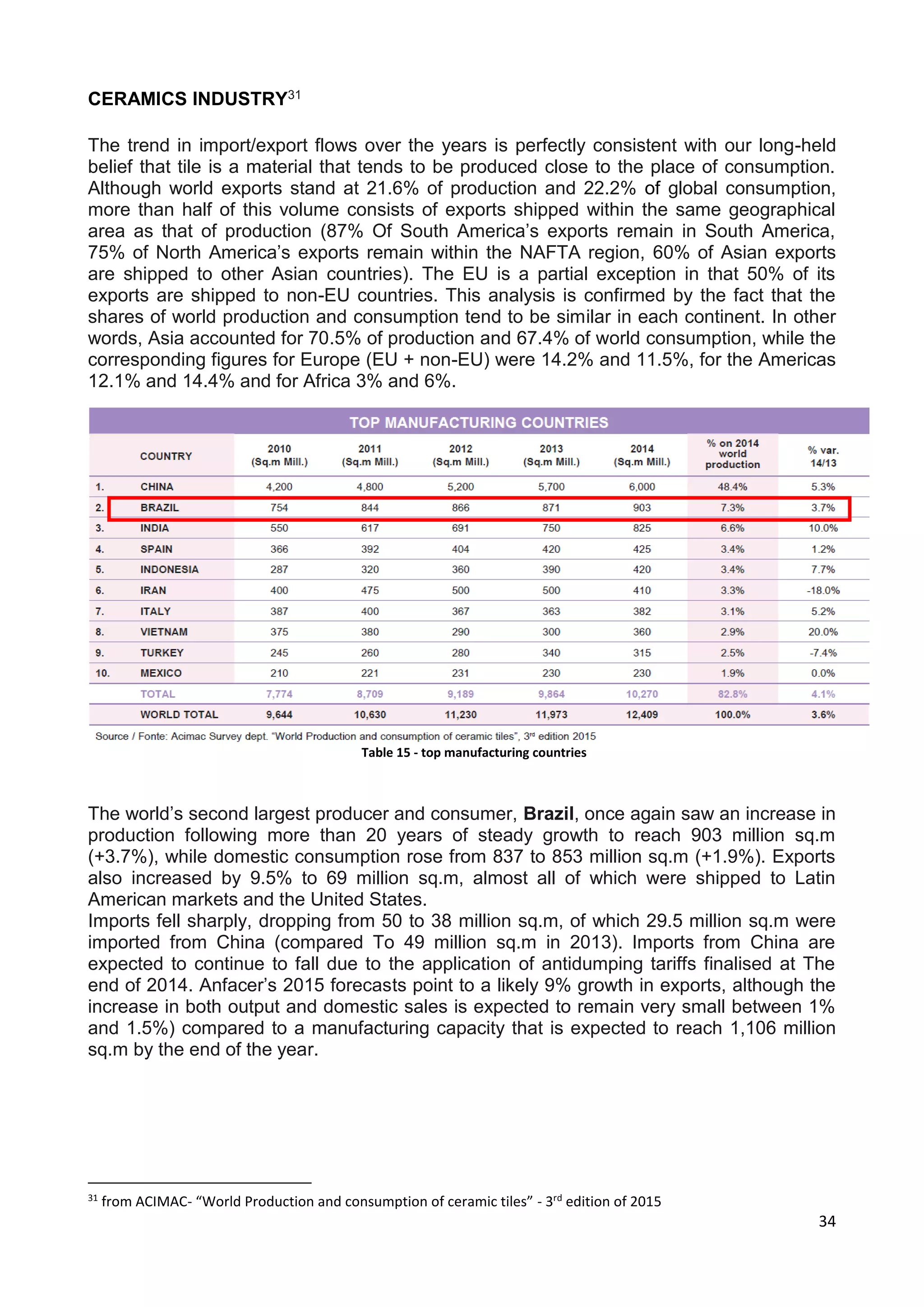

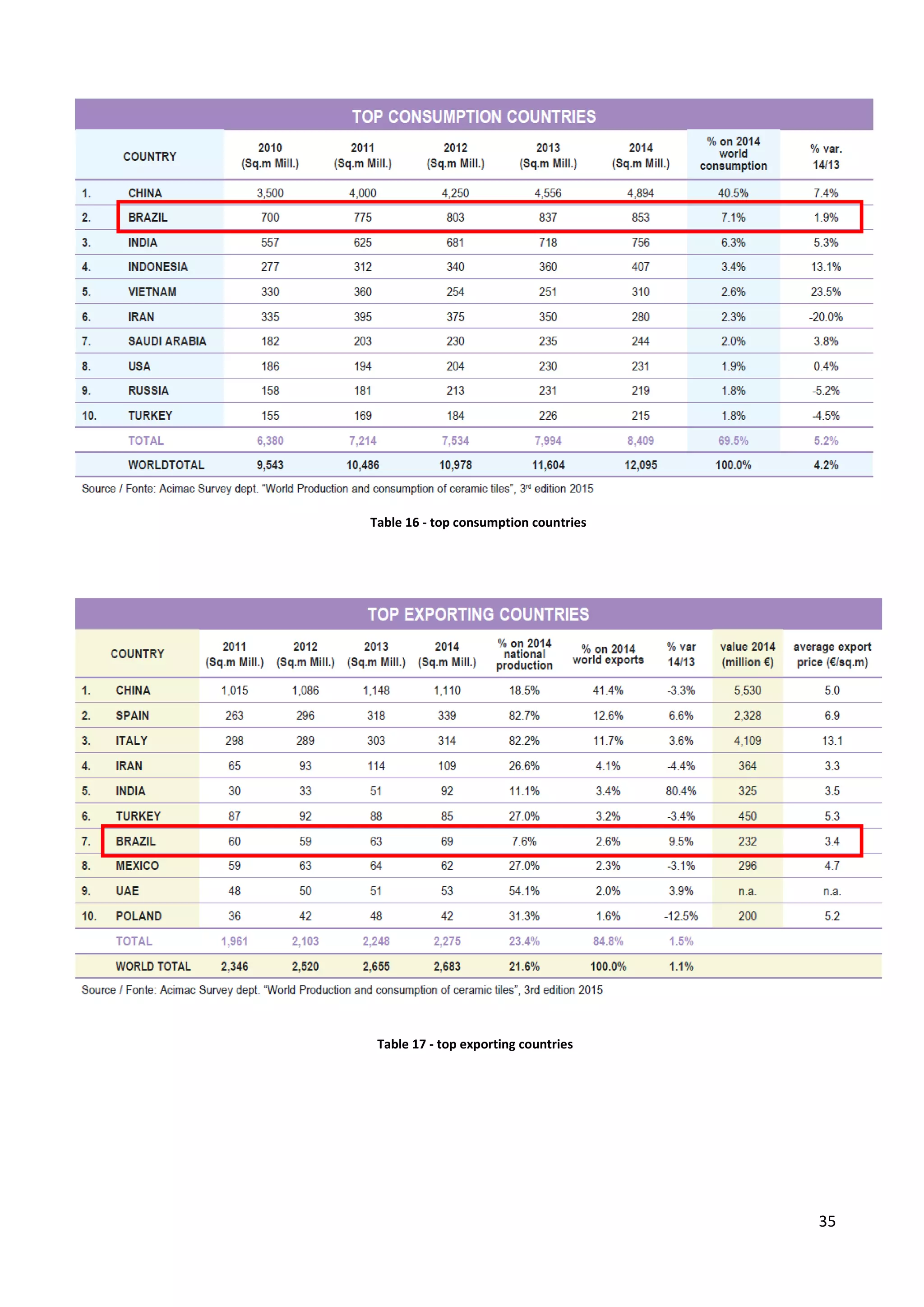

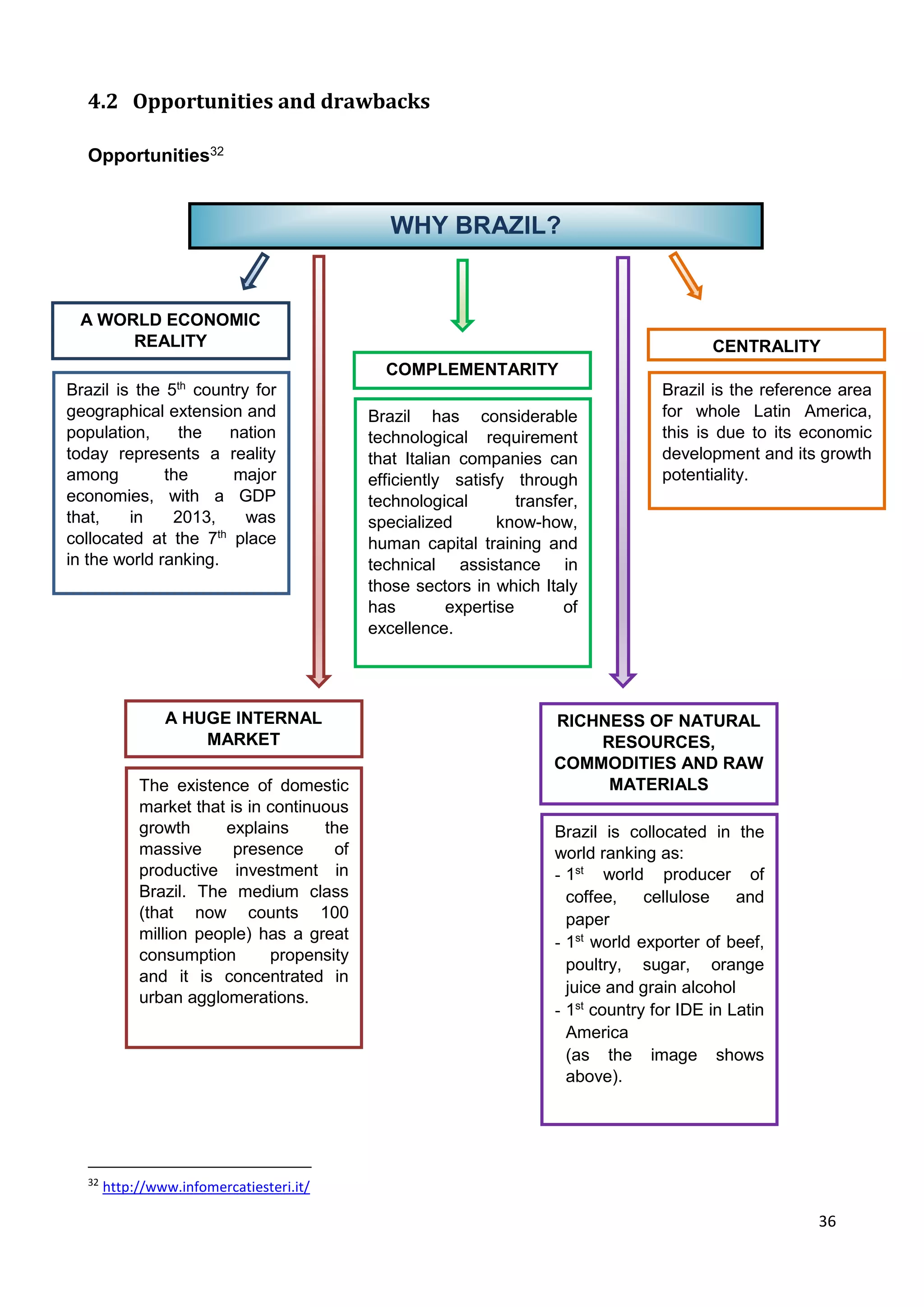

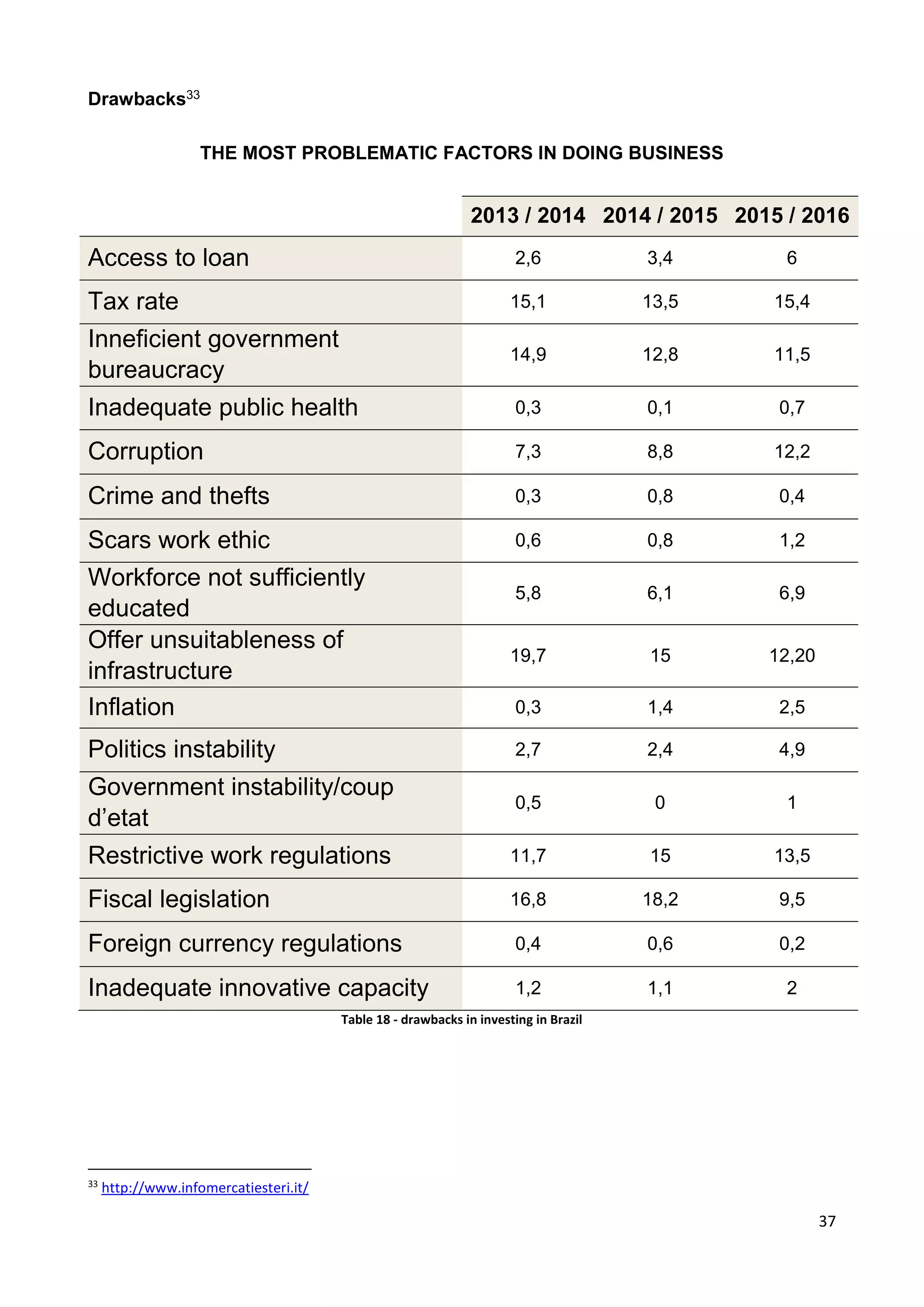

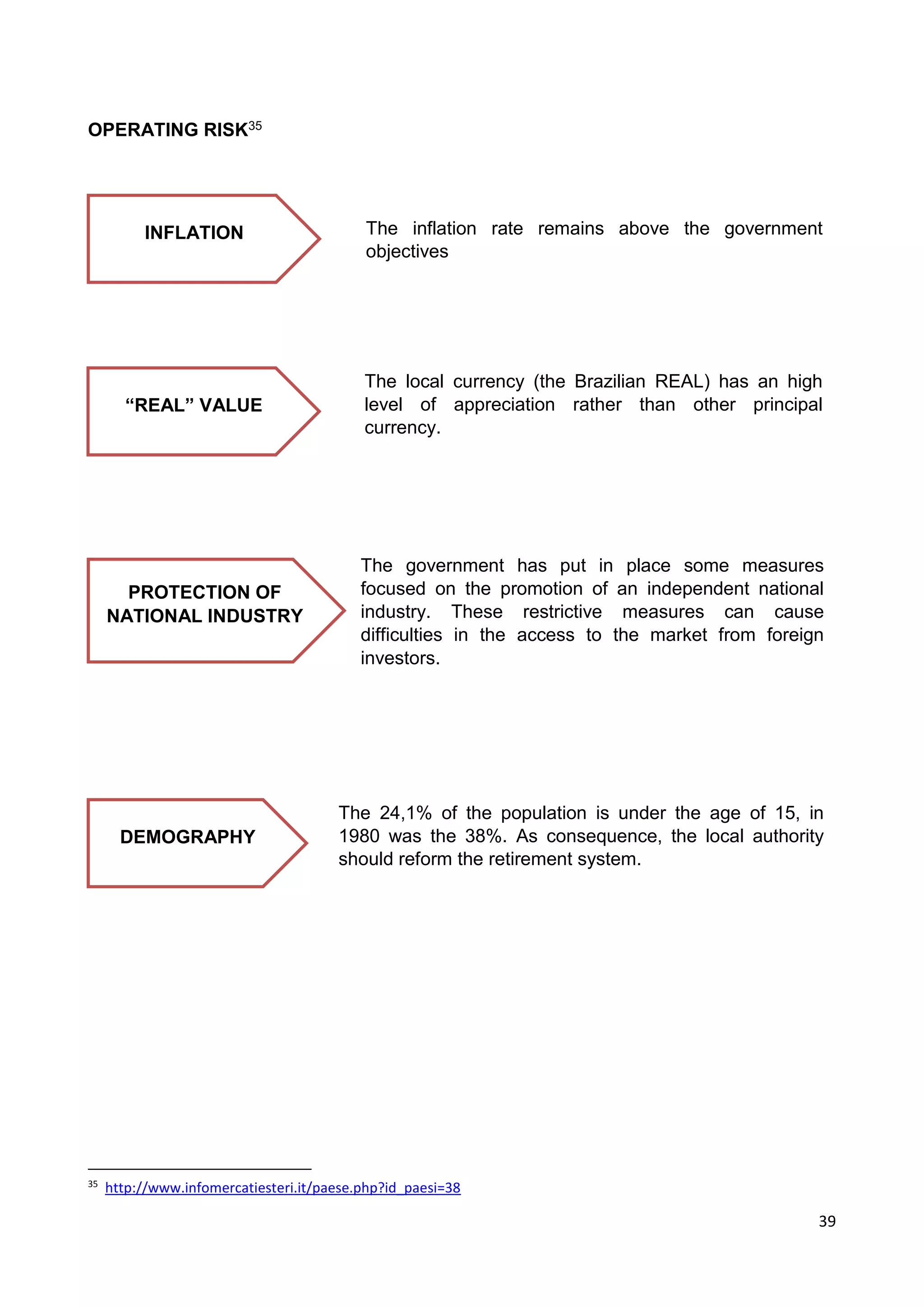

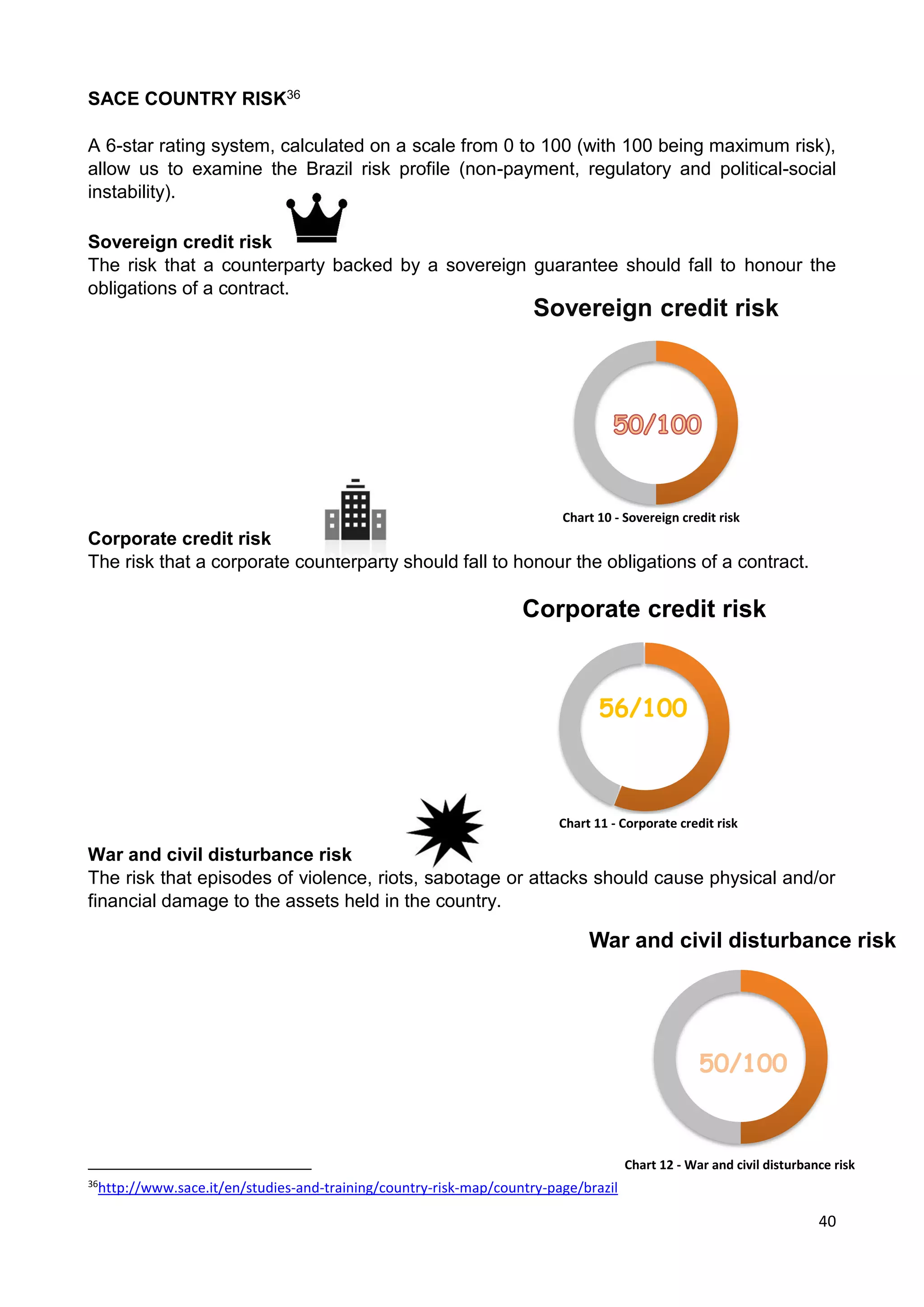

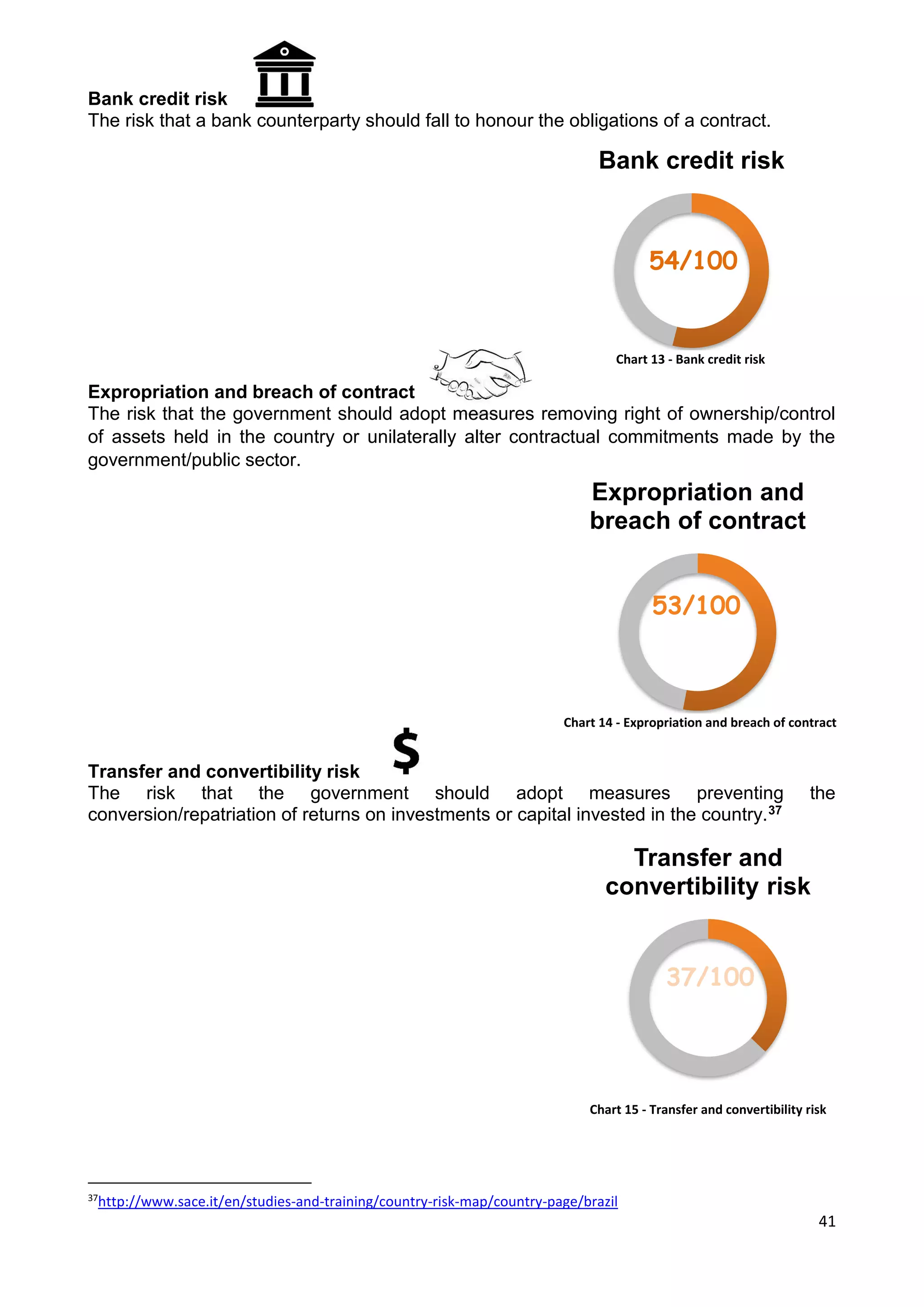

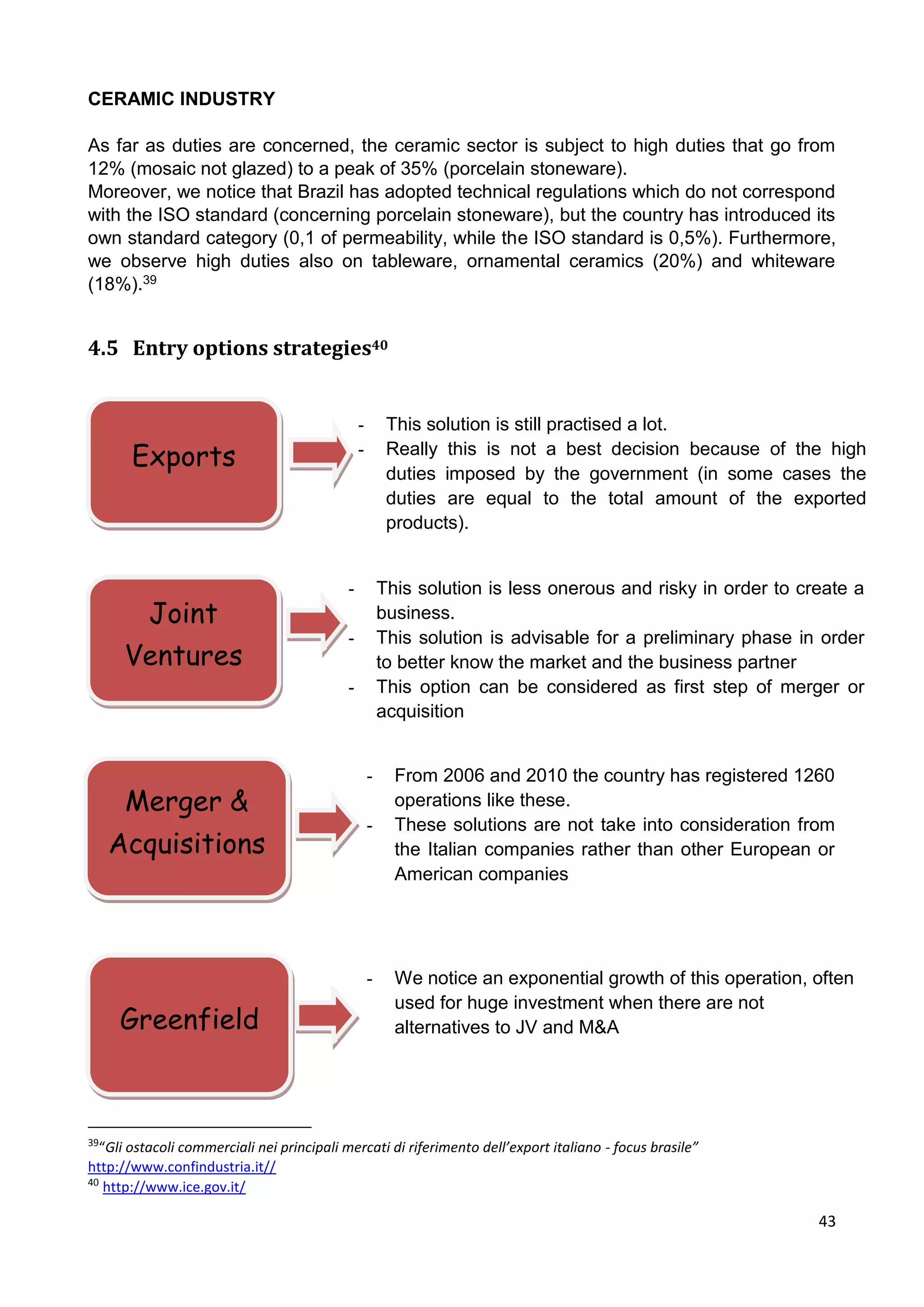

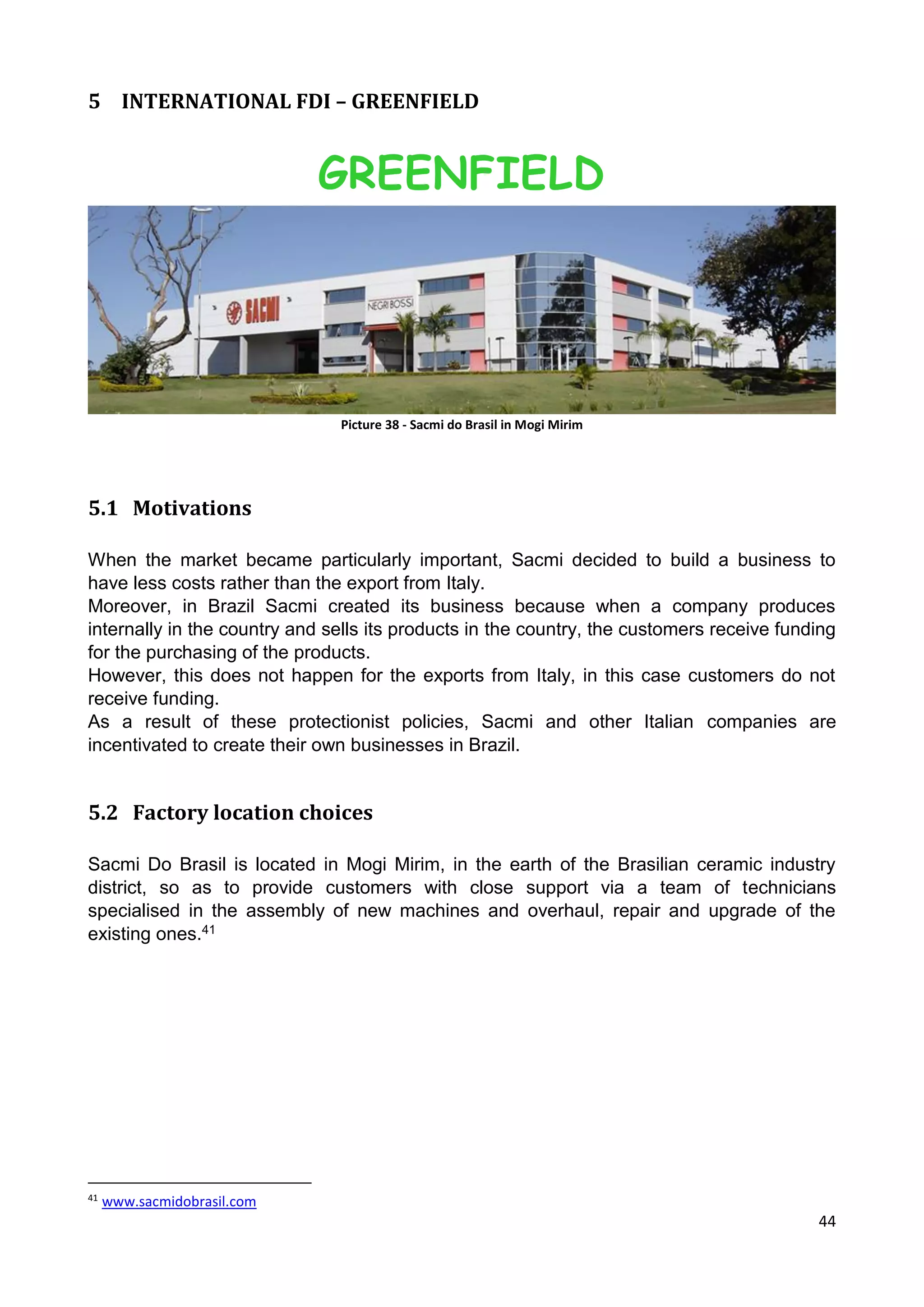

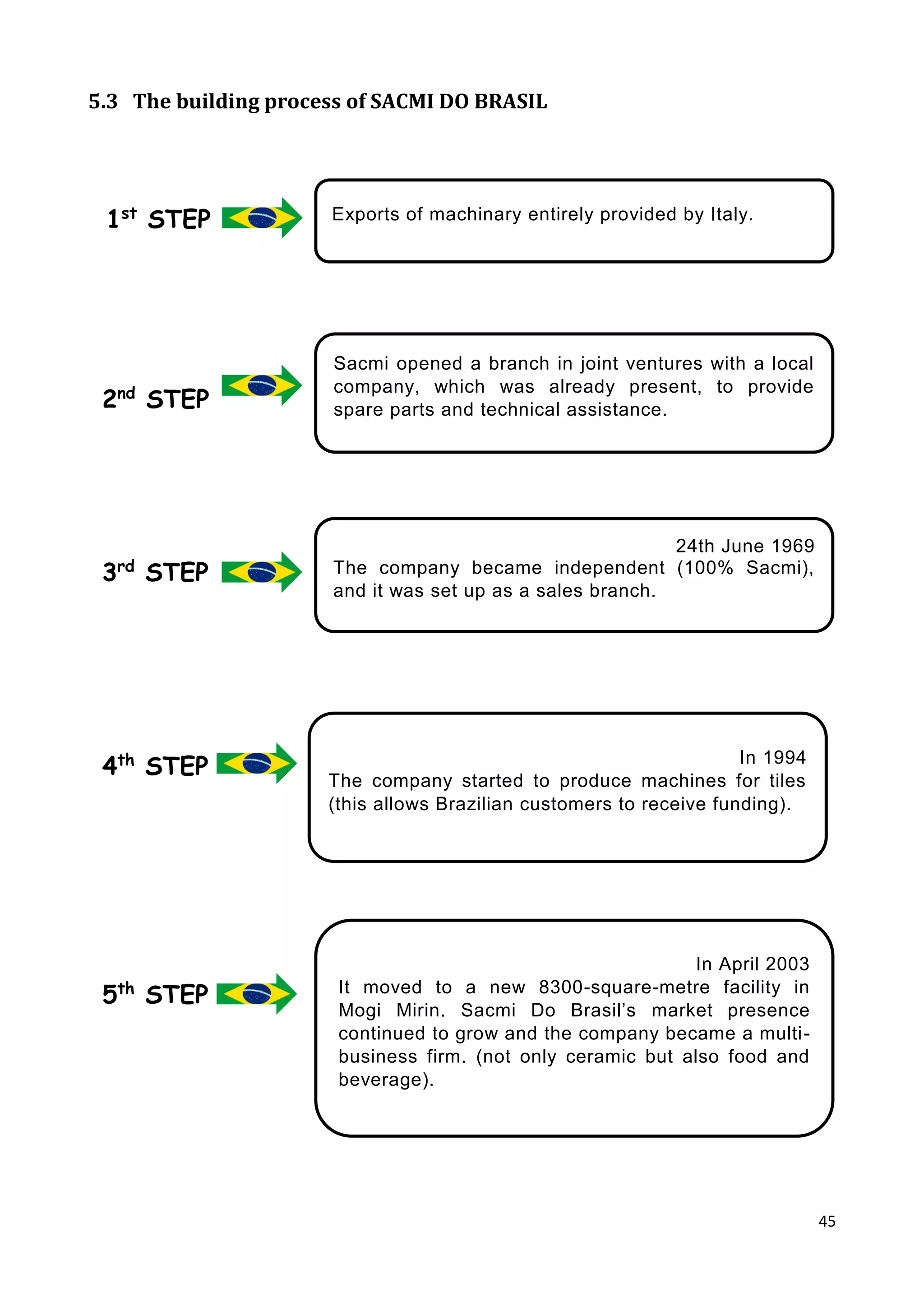

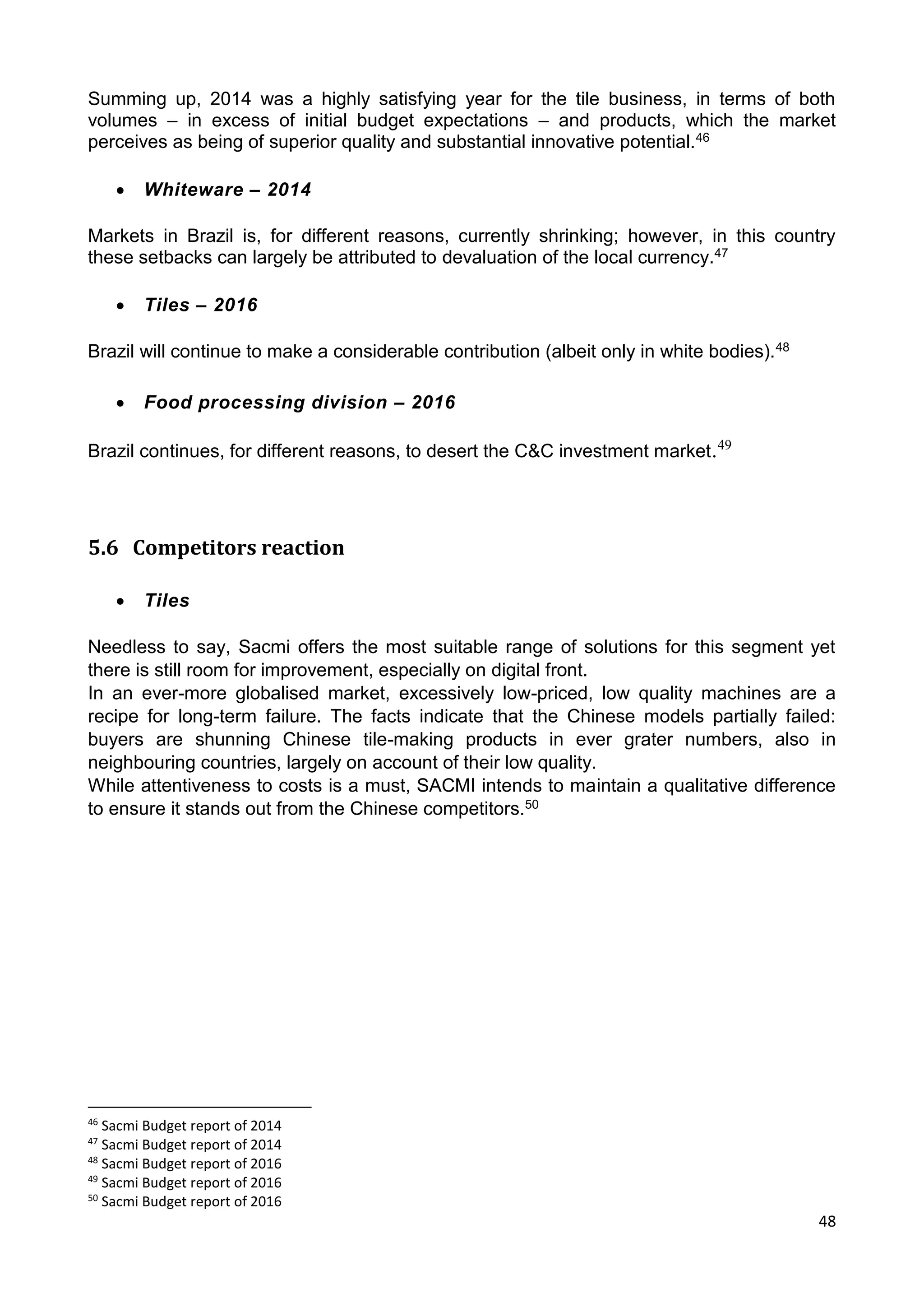

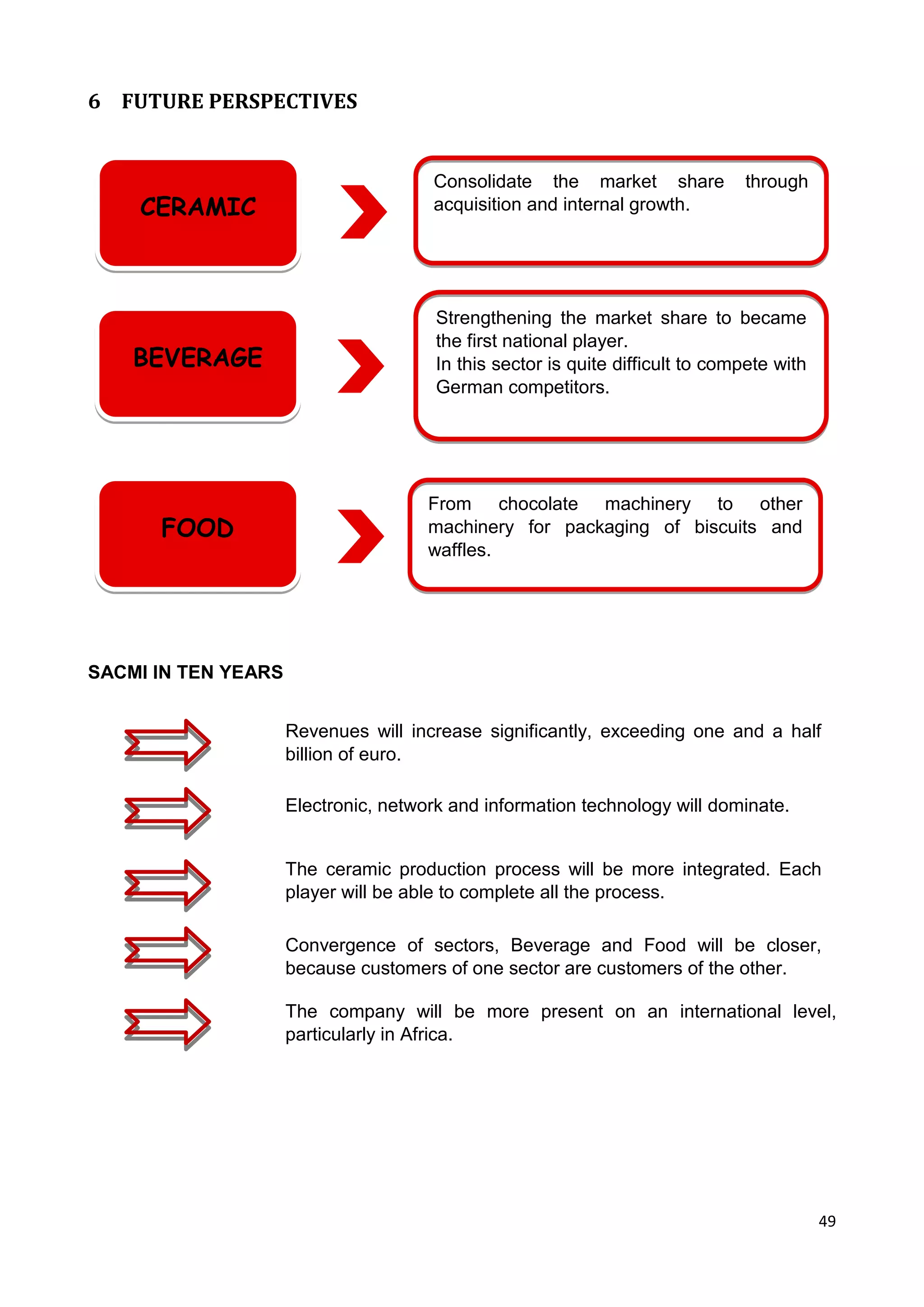

The document discusses the internationalization and market analysis of Sacmi, a multinational group specializing in machinery and plants for the ceramics, packaging, food, and automation industries. It details the company's competitive positioning, strategies, and performance in various international markets, particularly focusing on the Brazilian market as a case study. The paper outlines Sacmi's operational structure, market dynamics, and future perspectives, emphasizing the importance of innovation and customer care in its business model.