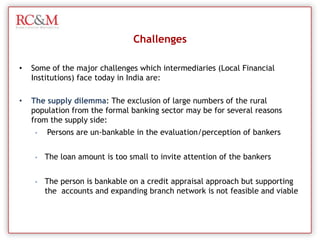

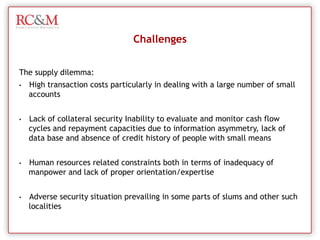

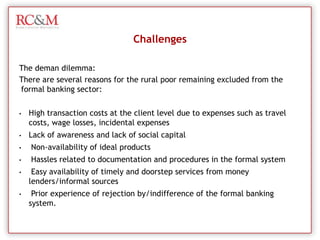

The document provides an extensive overview of rural finance in India, highlighting the significant lack of banking access for the rural population, where around 70% do not have bank accounts. It details the various financial institutions, such as nationalized banks, private banks, and microfinance organizations, that are working to enhance financial inclusion through innovative lending strategies and technology. It also discusses the challenges faced by these institutions in reaching rural areas and the strategies being implemented to overcome these obstacles.

![Corporation BankCasestudy III- Technology adoptedState Bank of India initiated a project called the SBI Tiny Card Accounts [SBITCAs] recently in Aizwal. The SBITCAs are based through new generation mobile phones based on near-field communication [NFC] technology, enhanced with fingerprint recognition software and attached to receipt printer. The Card tremendously increased the customer base for the bank. This card allows:Activation of transfer of funds for the purpose of micro-savings Cash deposits and withdrawal,](https://image.slidesharecdn.com/ruralfinance-110716062840-phpapp01/85/Rural-Finance-Study-Finance-Presence-in-Rural-India-By-RC-M-India-52-320.jpg)

![Casestudy III- Technology adoptedThe card allows:Micro-credit, money transfer [account-to-account within the system], Micro-insurance Cashless payments to merchants SHG Savings-cum-credit accounts and attendance systems Disbursements of Government benefits like the national rural employment guarantee scheme, for equated monthly installments Utility payments, coupons, vouchers, tickets, automatic fare collection systems, etc.](https://image.slidesharecdn.com/ruralfinance-110716062840-phpapp01/85/Rural-Finance-Study-Finance-Presence-in-Rural-India-By-RC-M-India-53-320.jpg)

![Casestudy IV- Technology adoptedThe corporation bank:The Corporation Bank adopted a branchless banking model in August 2007. The bank opted for a branchless banking model based on Business Correspondents [BCs] and use of a small hand held device. This technology enabled bank to reach out the villagers by offering them savings and loan products at their door steps there by saving of customers time and cost of travel to branch. The bank is able to reach out to the hitherto unreached segments and mop up rural savings at lower transaction costs.](https://image.slidesharecdn.com/ruralfinance-110716062840-phpapp01/85/Rural-Finance-Study-Finance-Presence-in-Rural-India-By-RC-M-India-54-320.jpg)