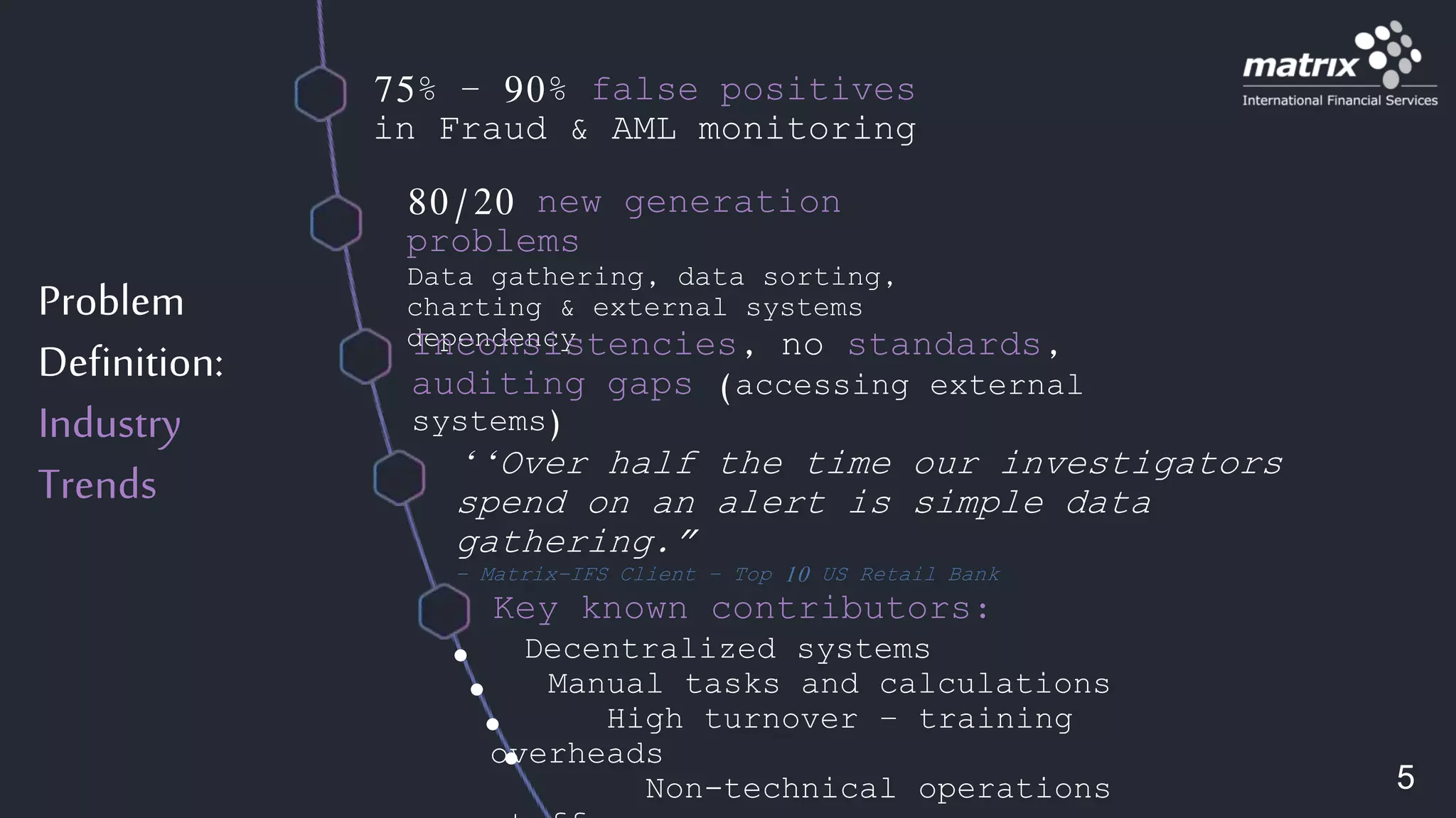

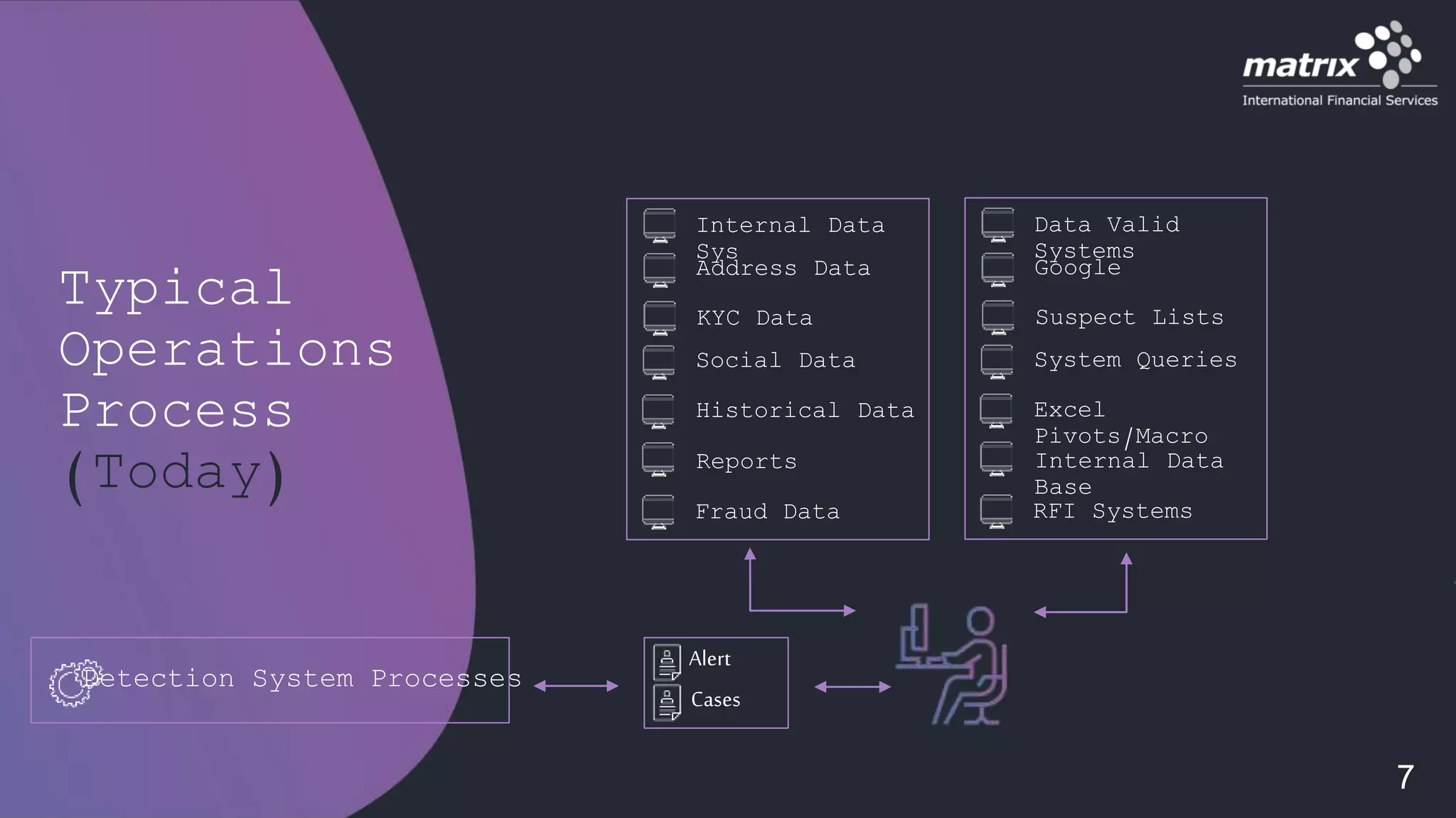

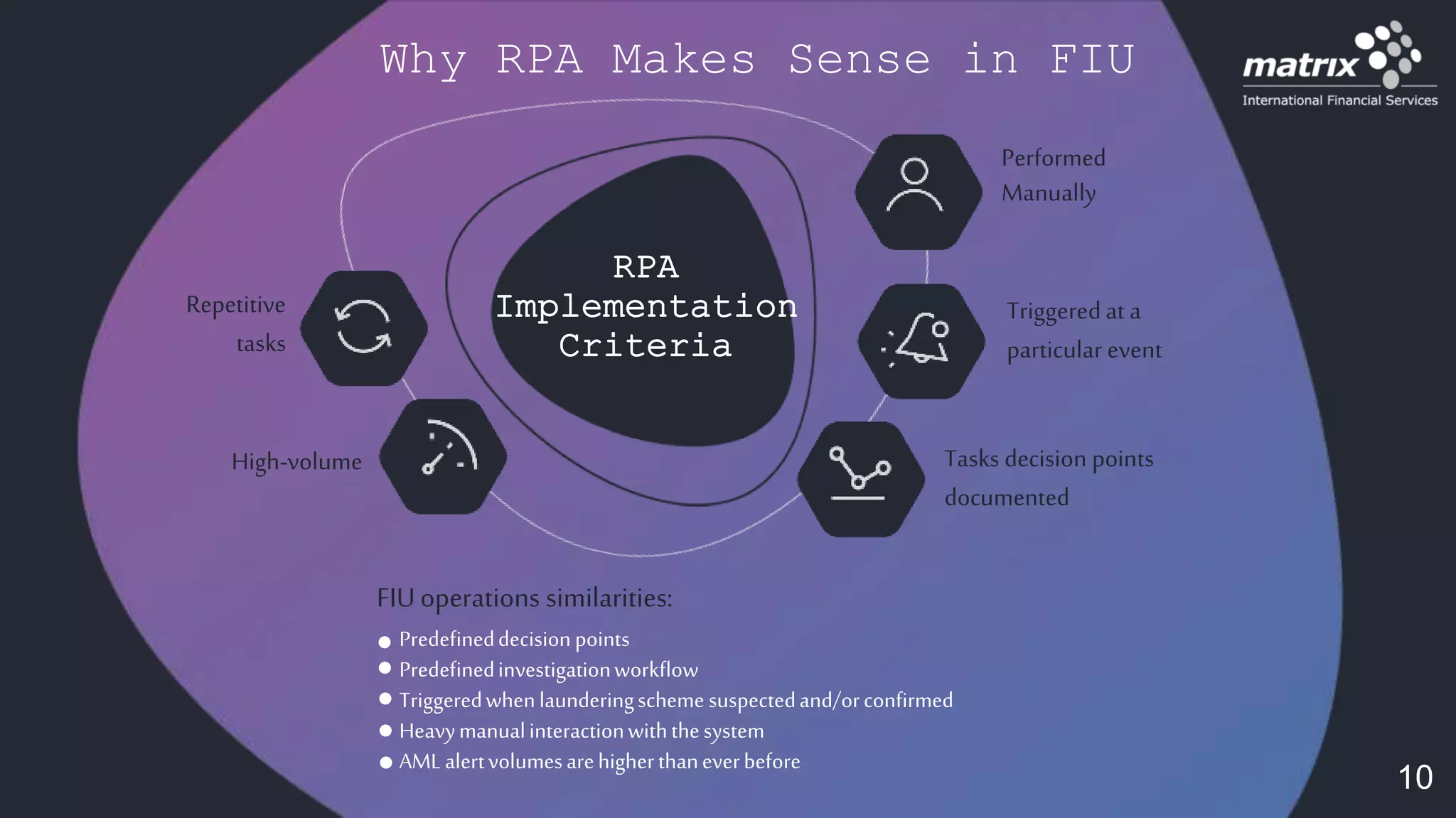

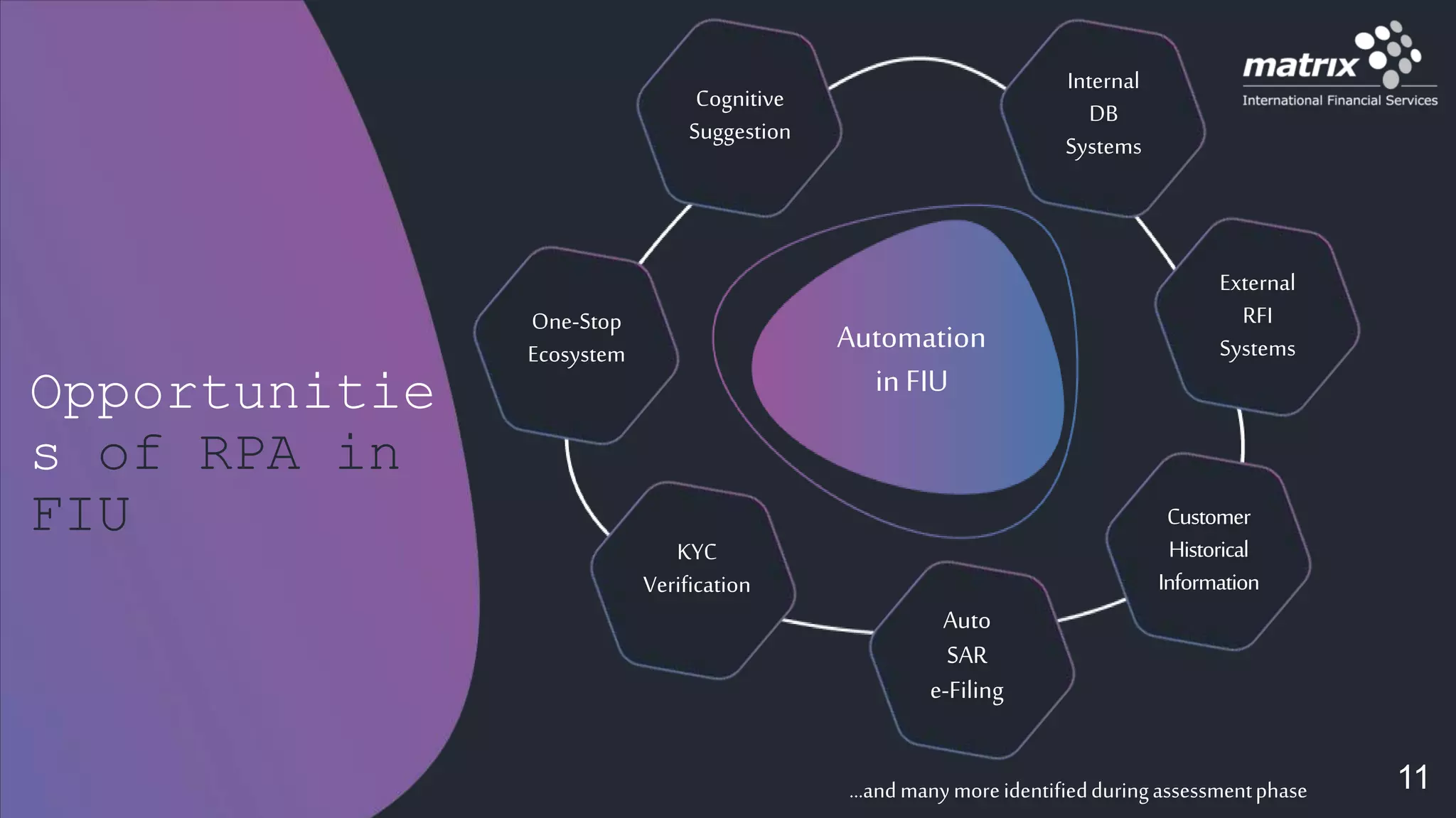

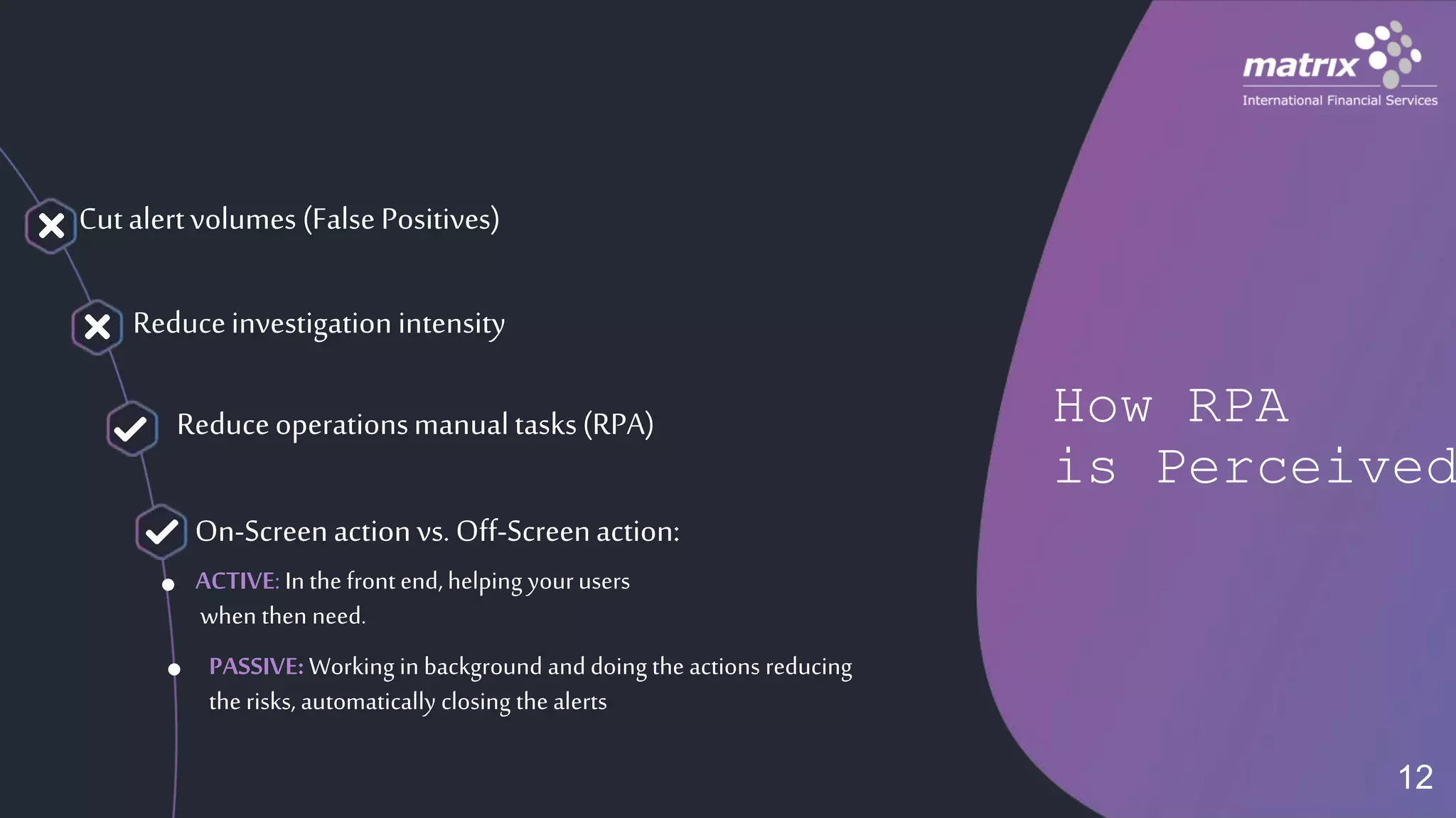

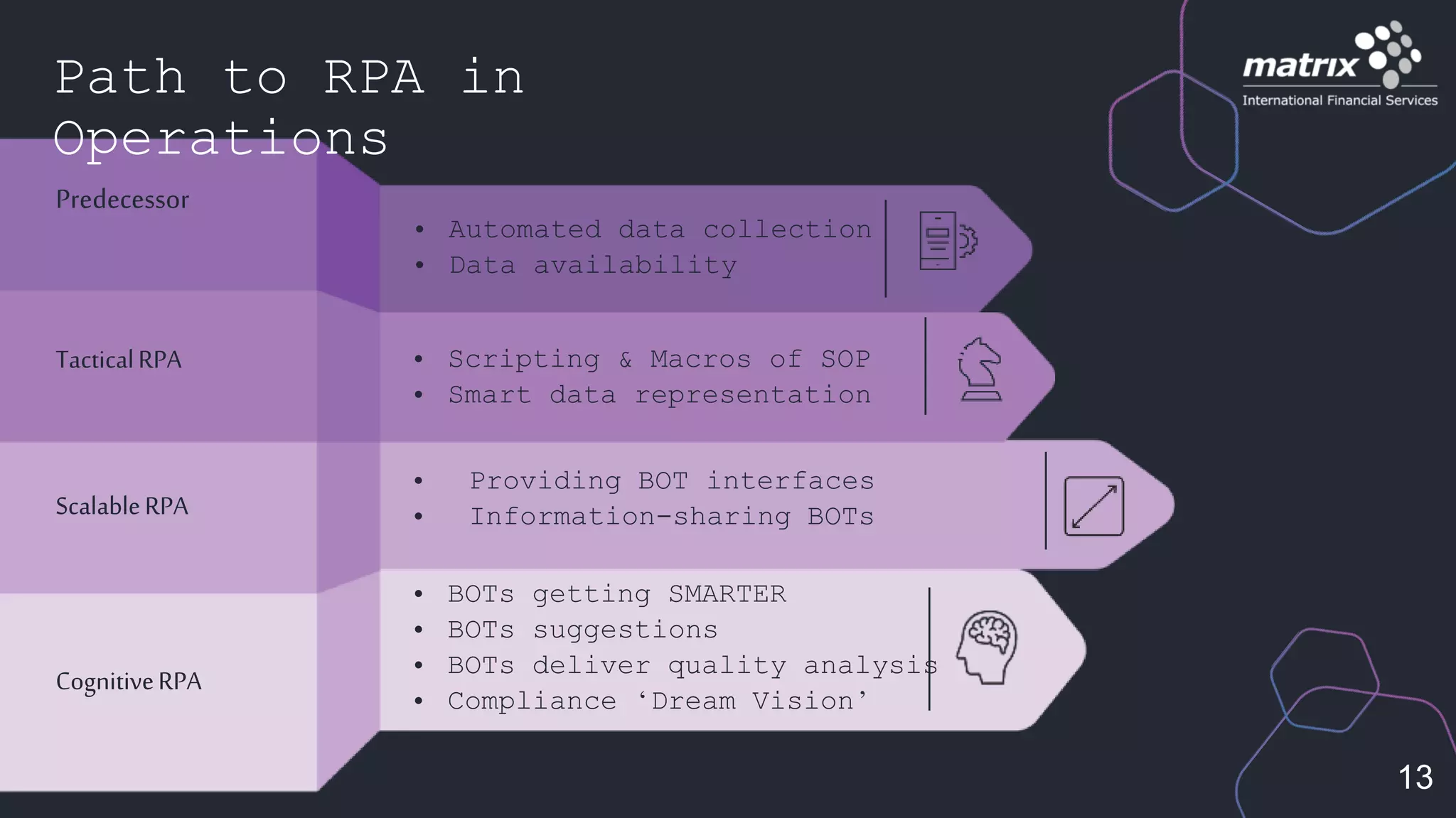

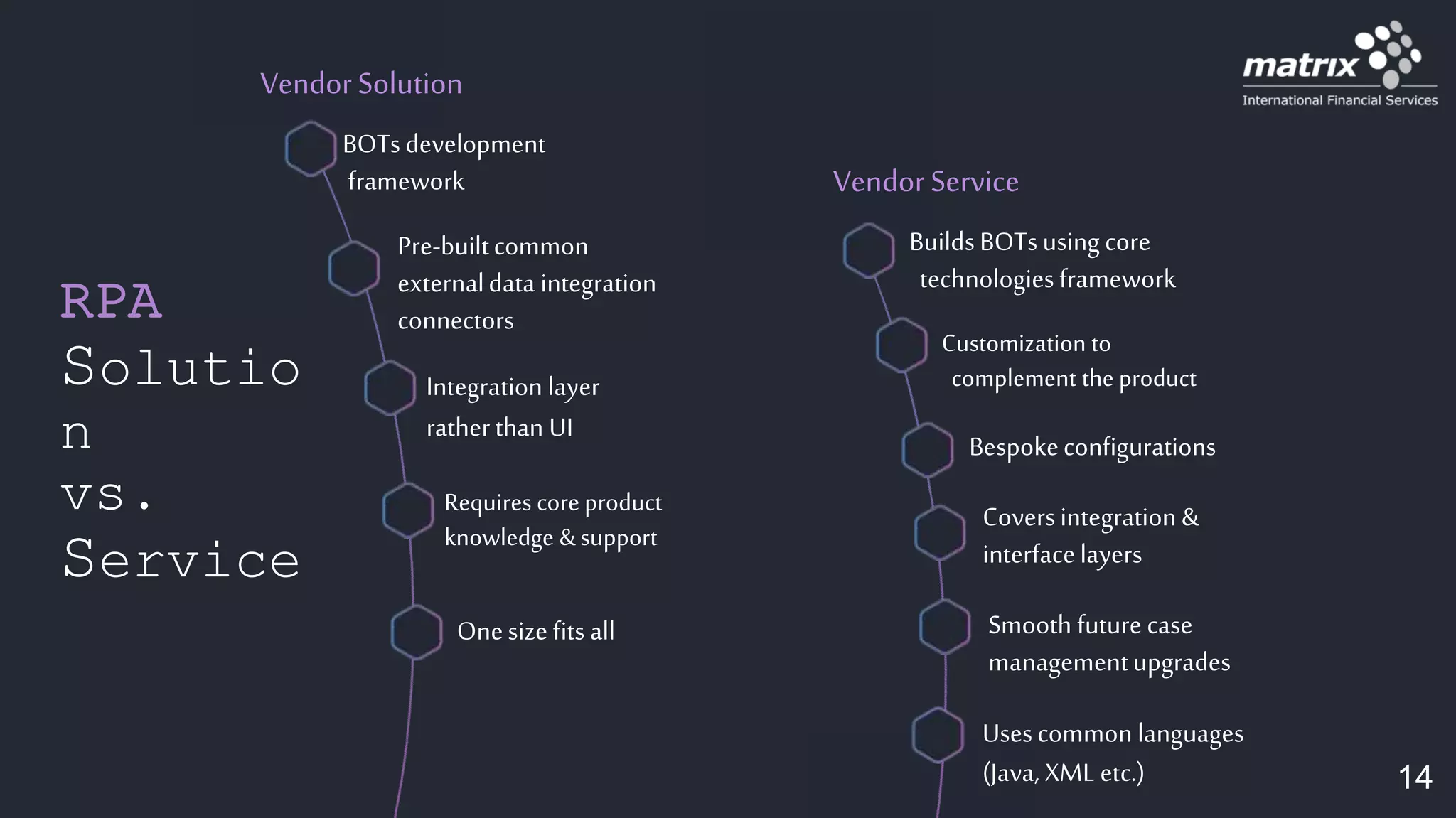

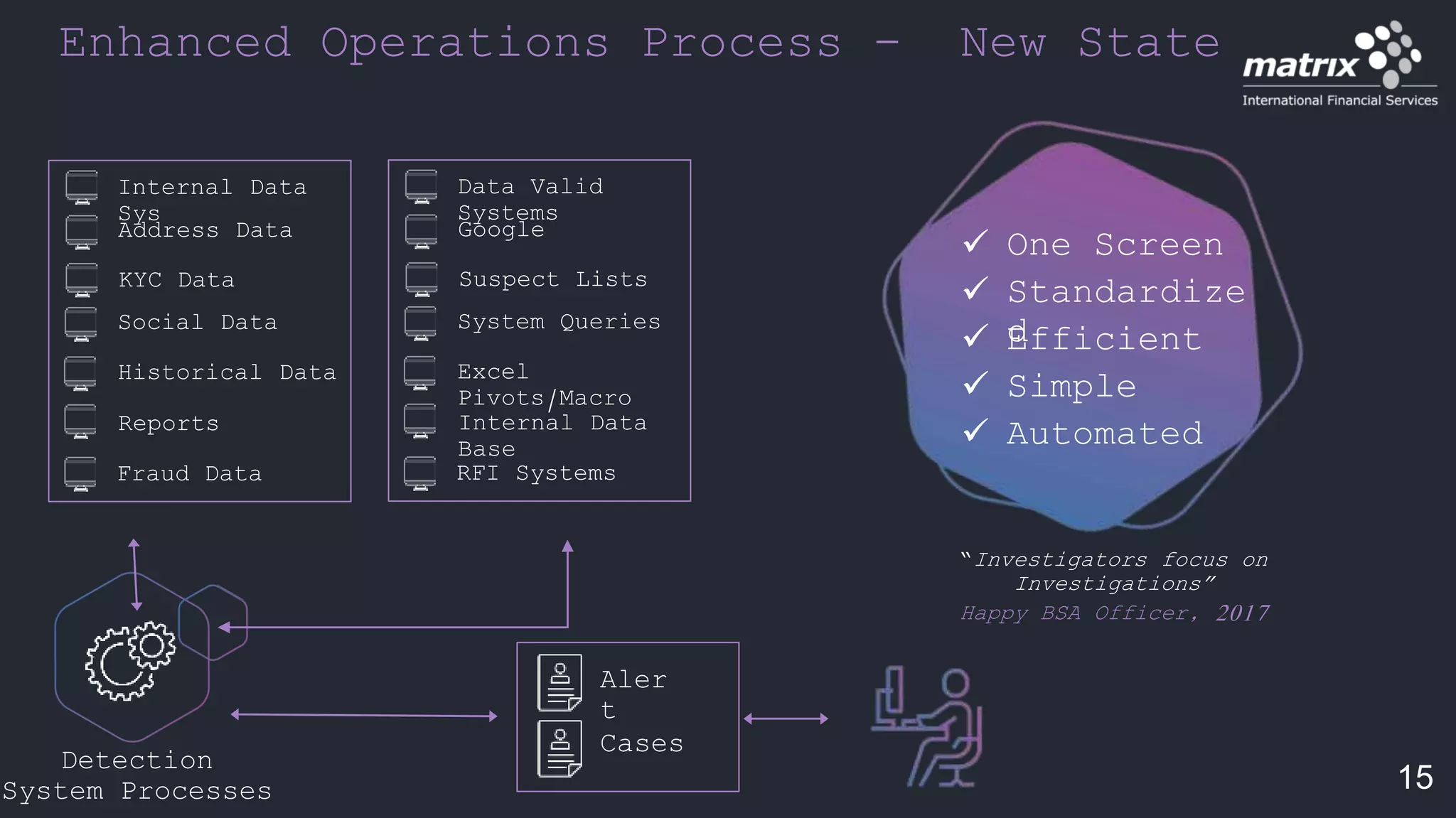

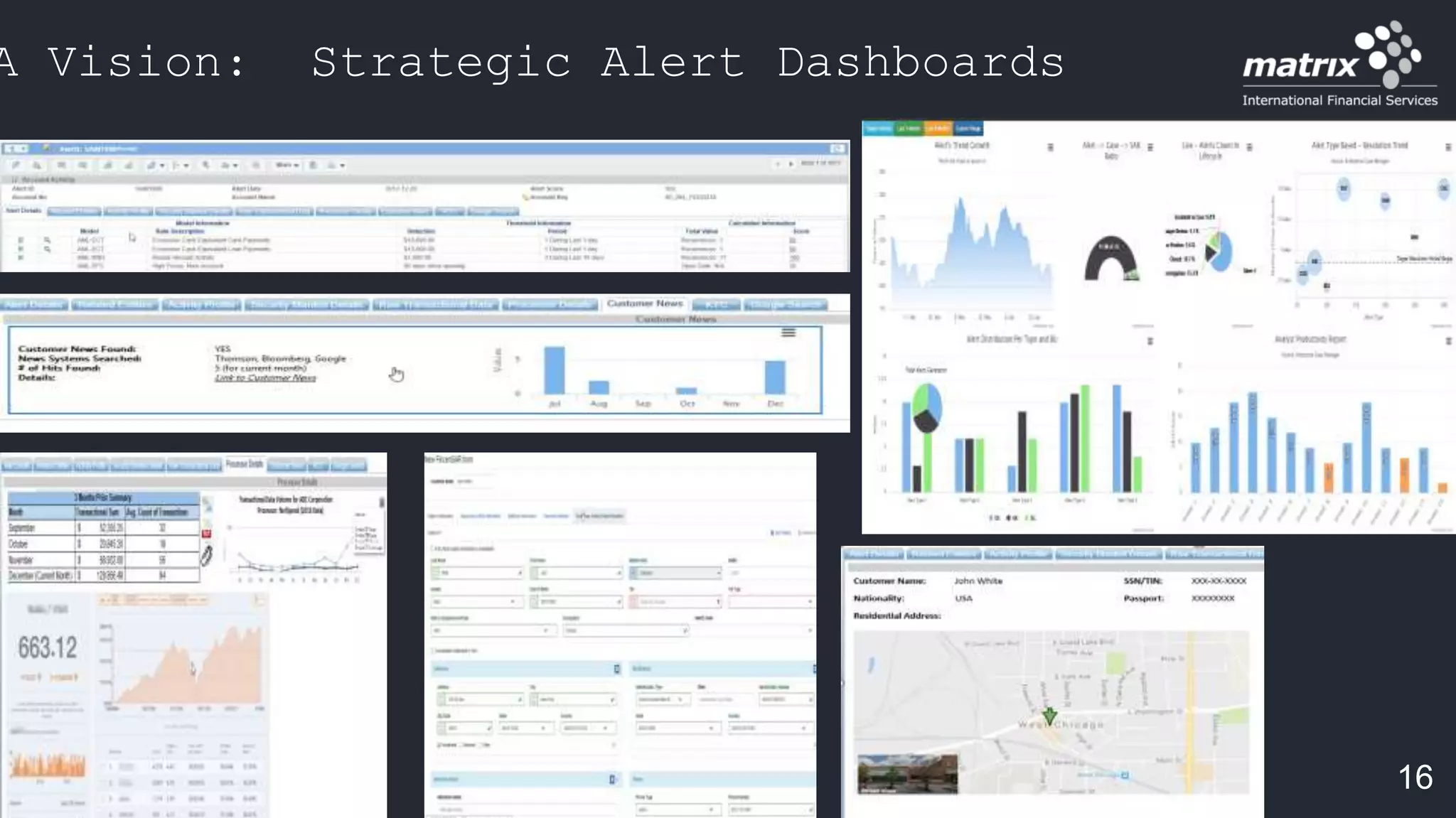

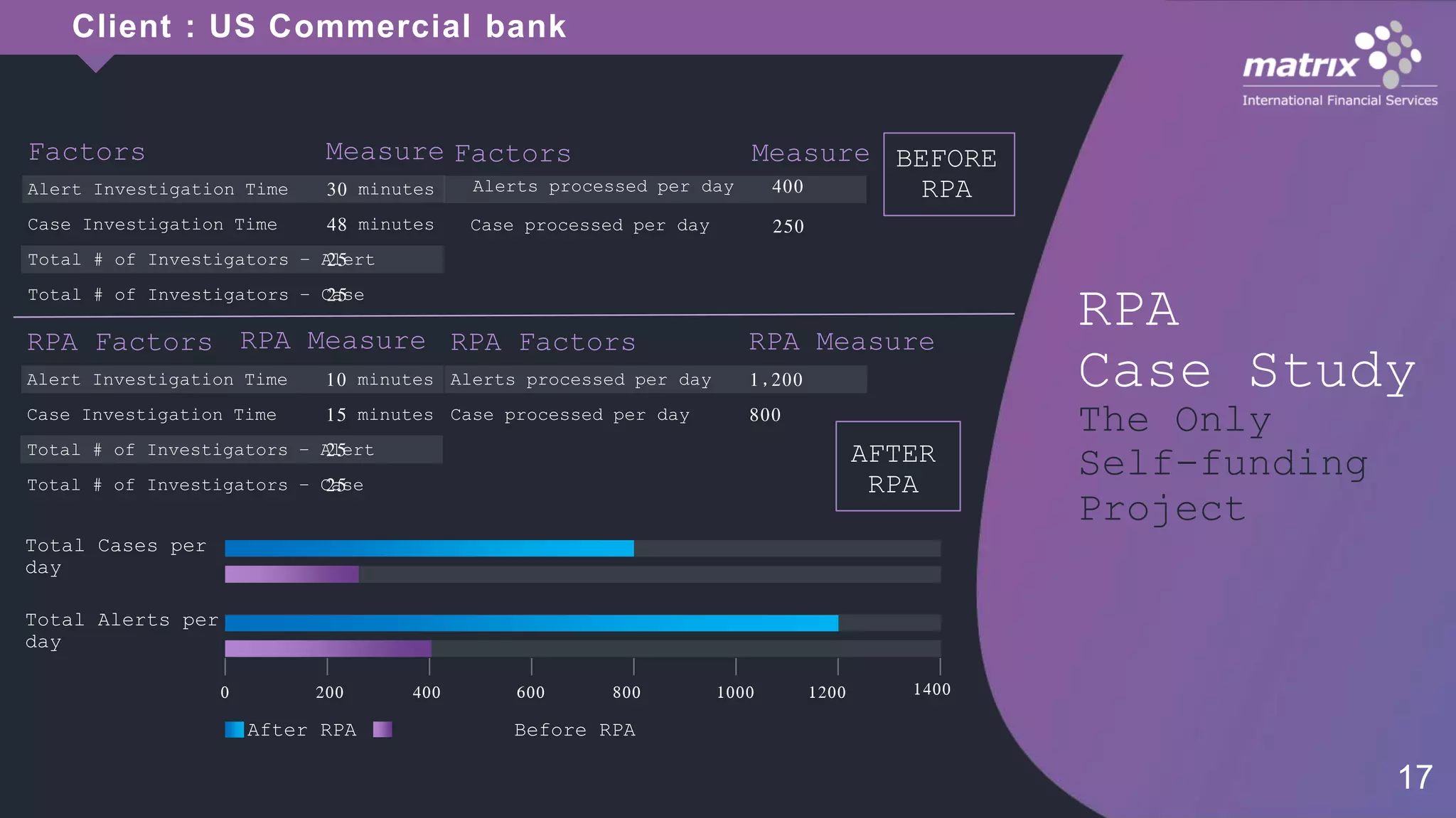

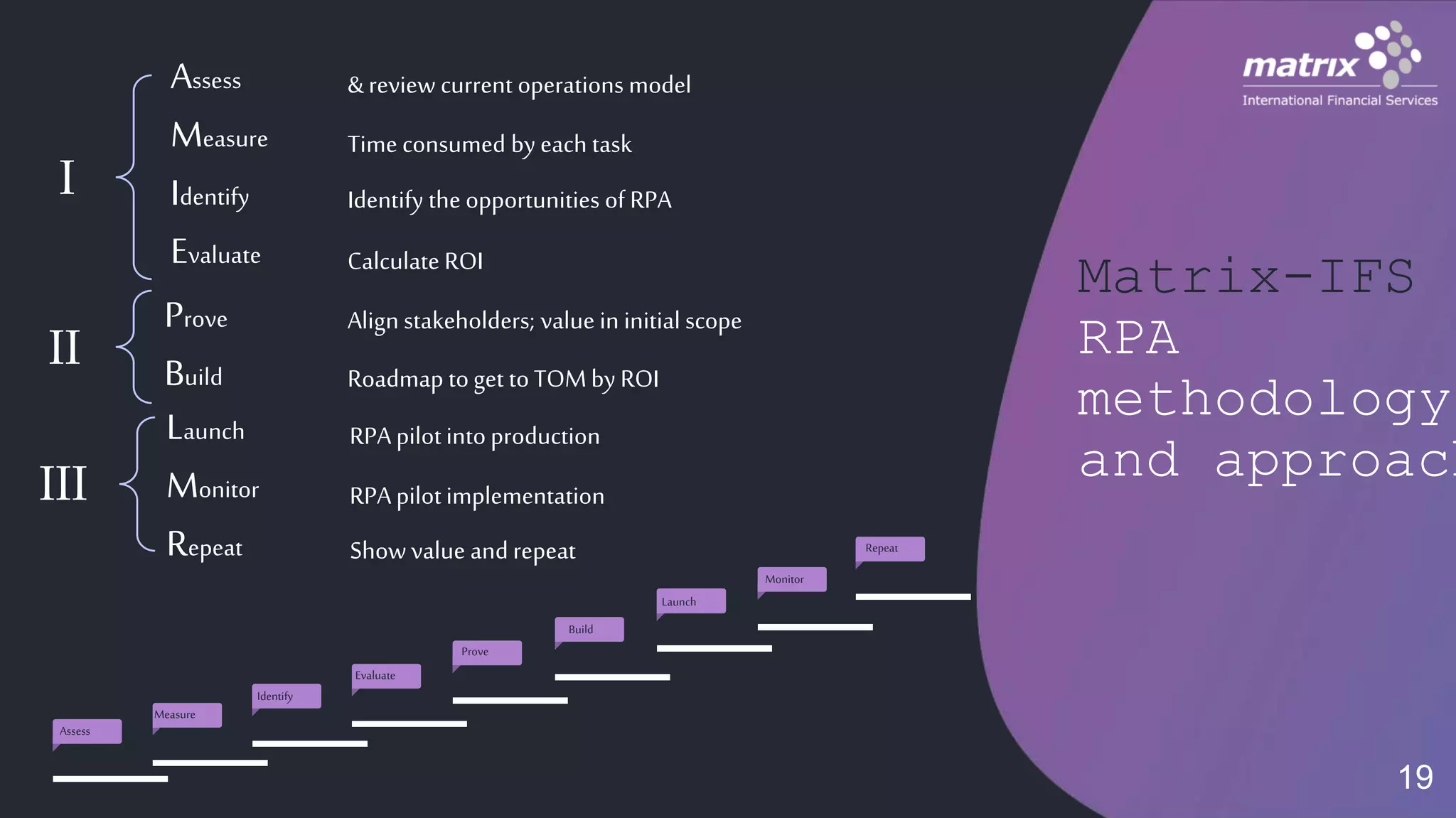

The document outlines the benefits and applications of Robotic Process Automation (RPA) in financial crime operations, particularly in Anti-Money Laundering (AML) and fraud monitoring. It discusses the operational challenges faced in the industry, such as high false positive rates and the need for standardization, while presenting RPA as a self-funding solution that enhances efficiency and reduces manual tasks. The RPA methodology is highlighted, emphasizing improvements in processes, accuracy, and overall team effectiveness.