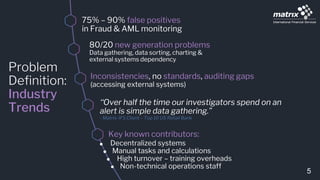

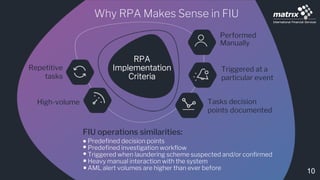

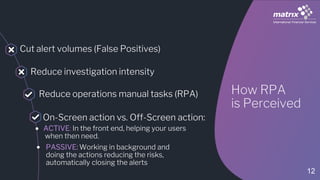

(1) RPA can automate repetitive tasks in financial crime compliance like AML/KYC to reduce manual work and costs. It allows focusing investigator time on more complex cases.

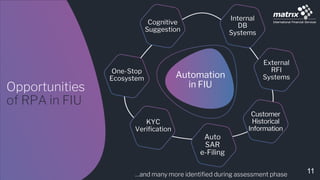

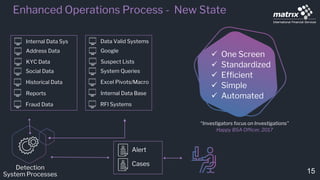

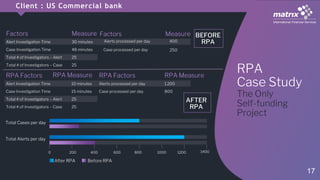

(2) The document discusses how RPA can enhance operations throughput by automating tasks like external data retrieval and form filling. A case study shows an organization improved alerts processed per day from 200 to 1200 using RPA.

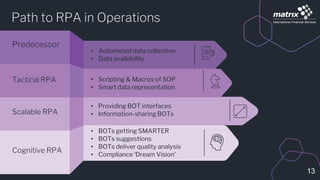

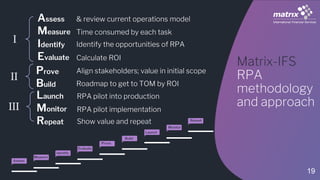

(3) The presentation recommends organizations first assess their operations to identify automation opportunities, then start with a pilot RPA project and scale up based on proven value and ROI. RPA benefits include faster processes, accuracy, and scalability with business needs.