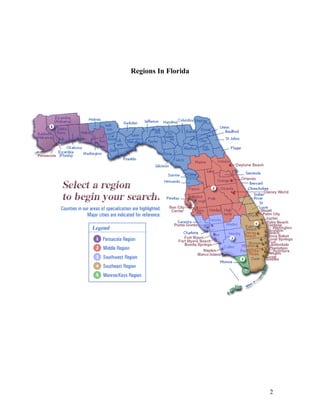

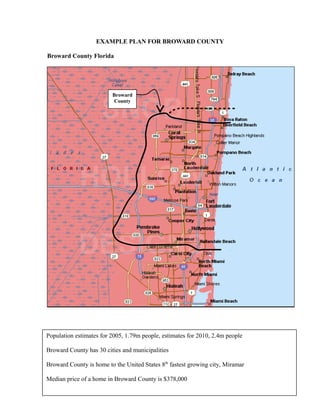

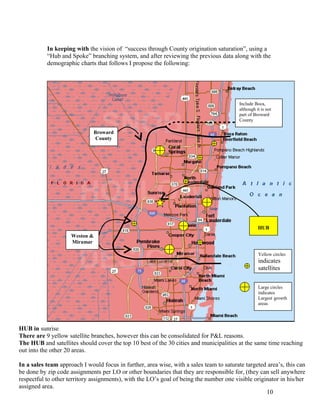

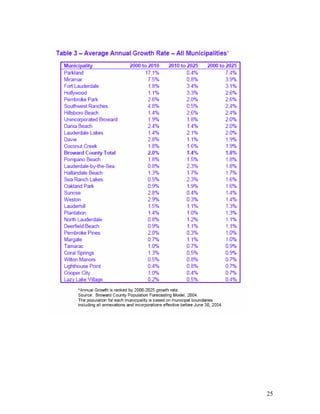

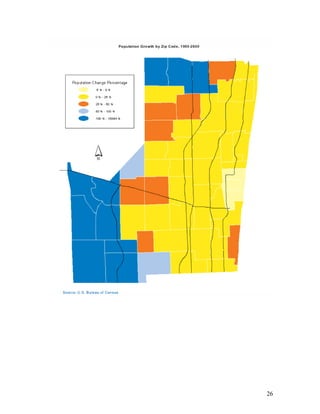

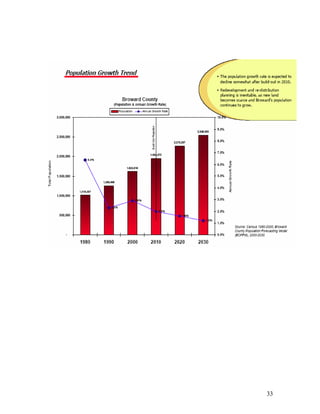

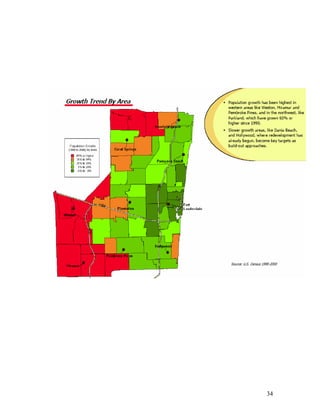

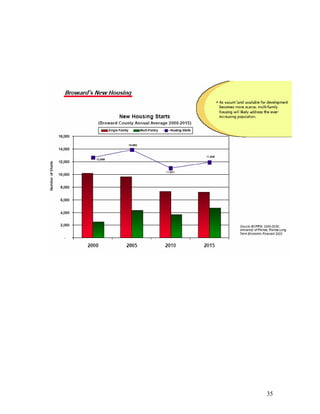

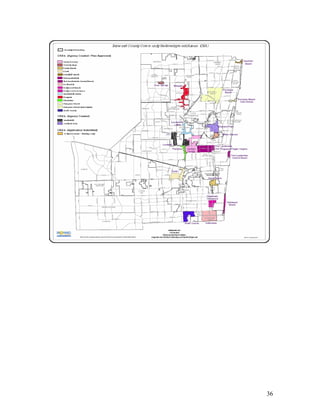

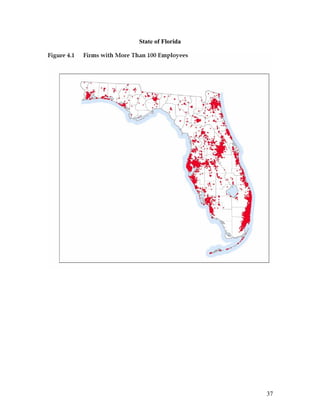

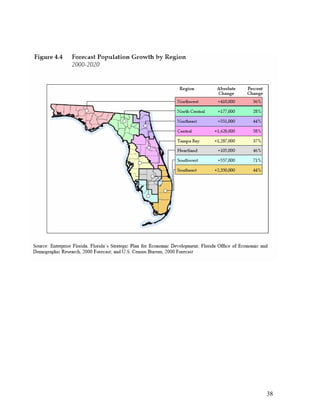

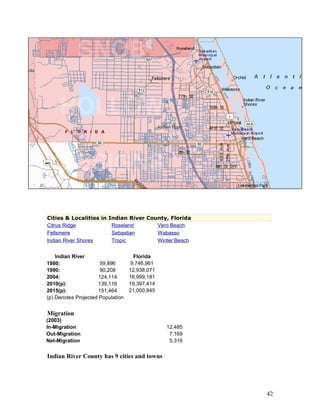

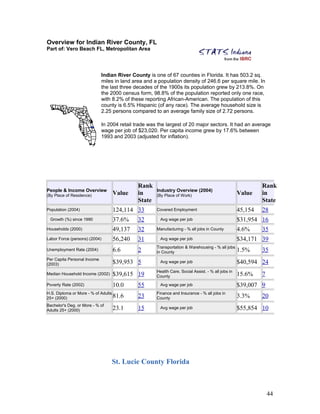

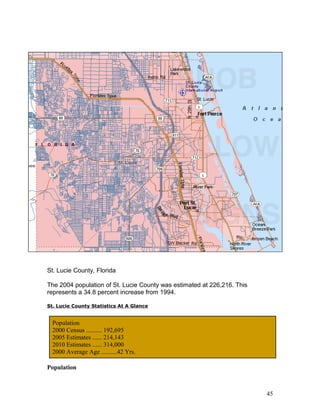

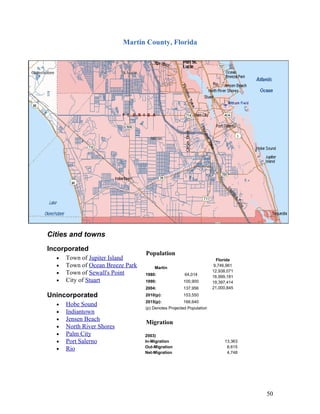

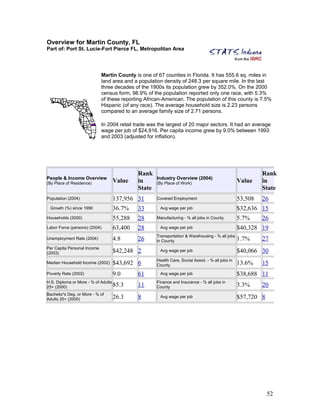

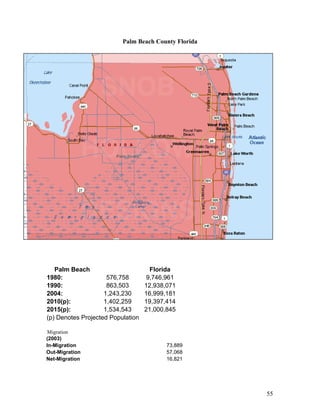

The document outlines a comprehensive business plan proposal for WCI Mortgage focusing on Broward County, Florida, projecting a significant increase in mortgage origination volume through strategic marketing and relationship building with realtors and builders. It presents demographic and market trends, including a robust housing market with rising home prices and an expected population growth in the area. The proposal emphasizes the need for a mindset shift among mortgage originators to focus on relationship-based selling and targeted area marketing to capture a larger market share.