This document discusses social networking trends from Nielsen reports. Some key points:

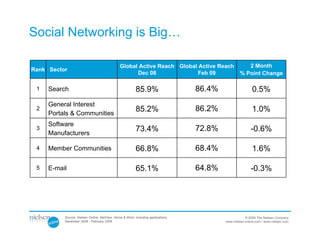

- Social networking is very popular globally, with the top sector being member communities reaching 68.4% of internet users.

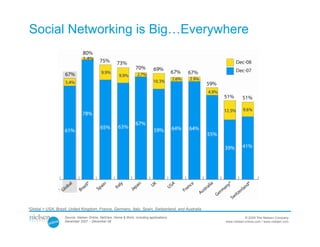

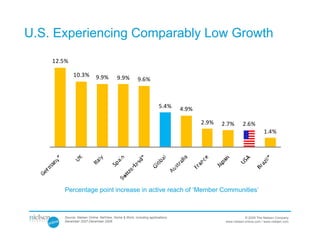

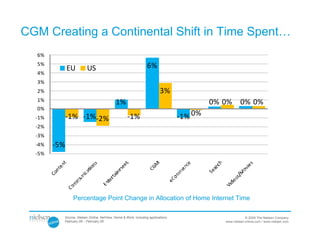

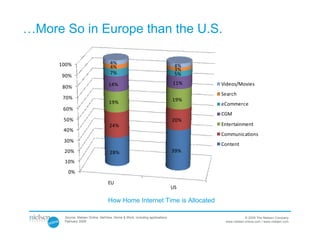

- Social networking growth is higher in Europe than the US, with Europeans spending more time on social media than Americans.

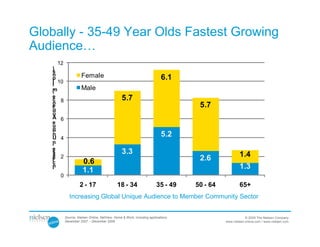

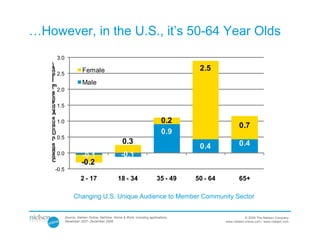

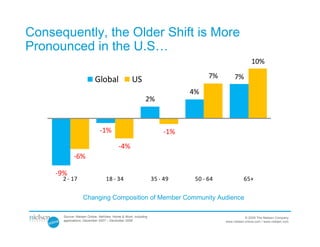

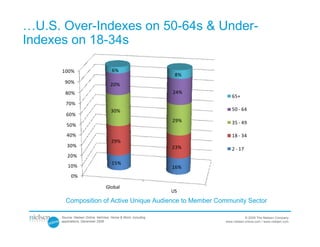

- The fastest growing demographic for social media globally is 35-49 year olds, but in the US it is 50-64 year olds, showing social media is becoming more widely adopted among older age groups in the US compared to globally.

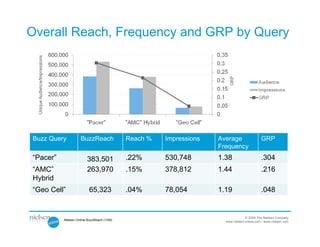

![BuzzReach RF vs. NetView Web RF

Impressions Total R/F/GRP Target R/F/GRP

Audience Audience

Total Target % in % of 2+ % of

Reached Freq GRPs Reached Freq TRPs

[000] [000] Target Univ. Target

[000] [000]

Comcast.net 132 52 39 129 0.07 1.03 0.07 51 0.06 1.02 0.06

MSN/Windows Live 35 19 54 35 0.02 1 0.02 19 0.02 1 0.02

AutoTrader.com 135 53 39 125 0.07 1.08 0.08 50 0.06 1.05 0.07

AutoMart.com 415 242 58 209 0.12 1.98 0.23 118 0.15 2.04 0.3

Photobucket 189 93 49 177 0.1 1.07 0.11 86 0.11 1.08 0.12

Sum/Average 906 459 51 666 0.37 1.36 0.5 320 0.4 1.43 0.57

“Pacer” BuzzReach 531 271 51 384 .22 1.38 .304 191 .24 1.42 .35

© 2009 The Nielsen Company

Nielsen Online BuzzReach/WebRF (1/09) www.nielsen-online.com / www.nielsen.com](https://image.slidesharecdn.com/ridingwavesocialnetworking-24mar2009-090806215950-phpapp02/85/Riding-Wave-Social-Networking-24-Mar-2009-25-320.jpg)