Embed presentation

Downloaded 33 times

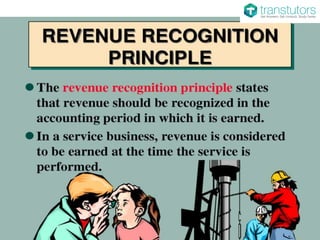

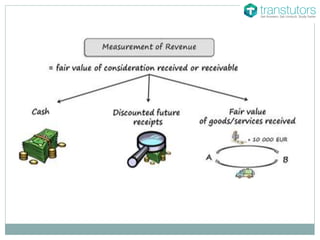

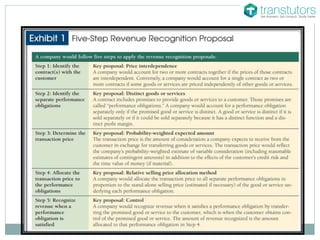

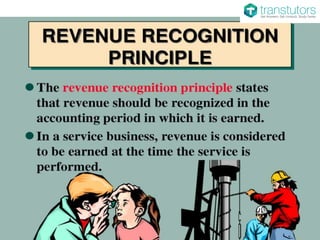

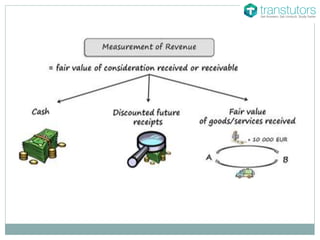

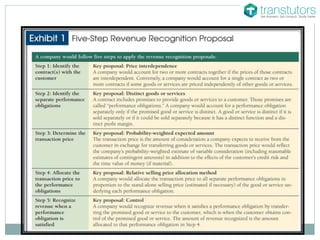

The document outlines accounting principles, divided into accounting concepts, which include various foundational postulates, and accounting conventions that govern consistency and disclosure. Key concepts mentioned are the business entity, money measurement, cost, and going concern concepts, among others. It also briefly touches upon the revenue recognition principle and provides a link for more detailed information.