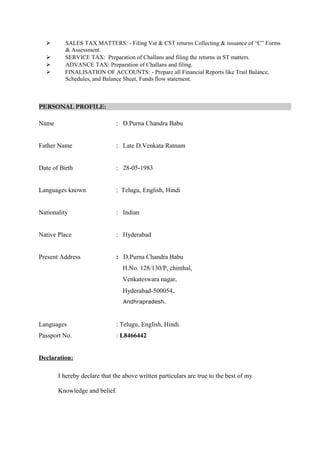

- The document is a resume for Doguparthi Purna Chandra Babu, who has over 7 years of experience in accounting, finance, and human resources roles.

- He holds an MBA degree and seeks to work in a professional organization with opportunities for growth.

- His work experience includes roles as an Accounts Supervisor/HR Manager and Senior Accountant for construction and medical device companies.

- Key responsibilities involved financial reporting, accounting, tax compliance, auditing, payroll, and HR functions like recruiting and training.