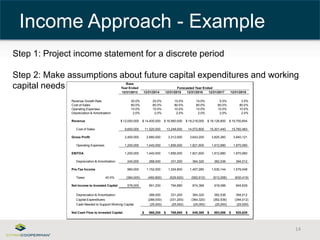

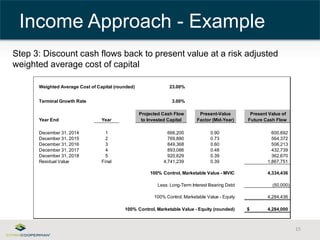

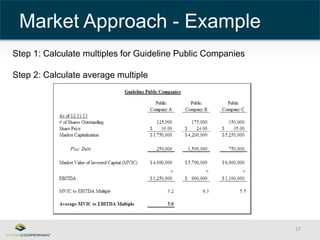

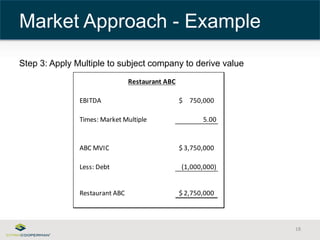

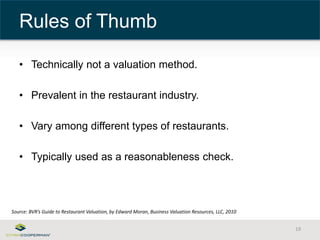

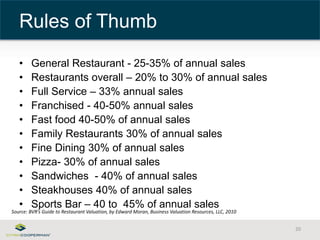

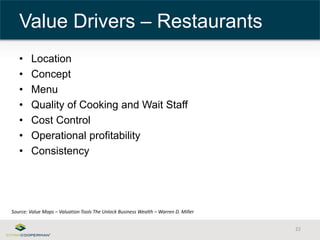

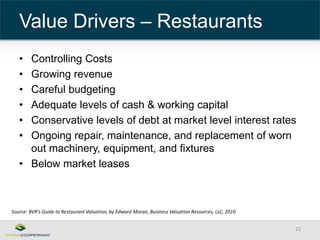

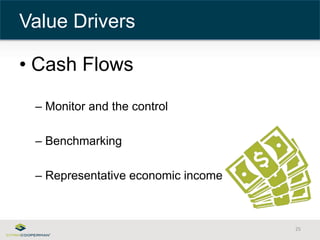

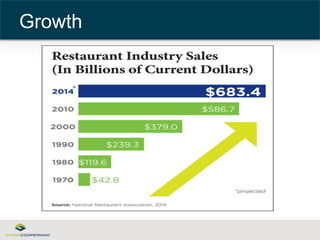

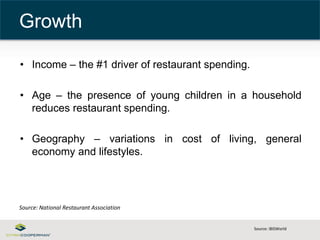

The document discusses the complexities of restaurant valuation, emphasizing the various standards of value necessary for different purposes such as mergers, estate taxes, and financial reporting. It outlines common valuation approaches including income, cost, and market approaches, along with examples and typical rules of thumb for assessing worth. Additionally, the document highlights key value drivers in the restaurant industry, common errors in valuation, and best practices for effective valuation reporting.