The document discusses a case involving Active Gear Inc. (AGI) and its challenges in the competitive footwear industry from 2004 to 2006, including low growth rates and supplier pressures. It proposes that AGI can resolve these issues by merging with Mercury Athletic, highlighting four key benefits of the acquisition, such as increased bargaining power and expanded sales channels. The document also outlines the performance of different product segments within Mercury, noting the decline of women's casual footwear and the potential for increased revenue through the merger.

![5

division has sources of potential including an increase in Active Gear’s revenue, an increase in

leverage with contract manufacturers, boosting capacity utilization and expanding its presence

with retailers and distributors.

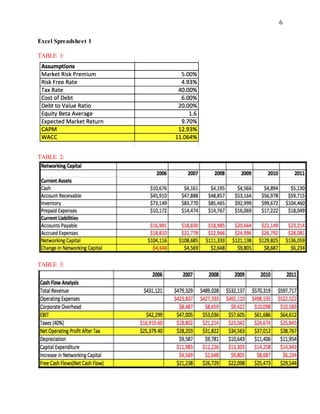

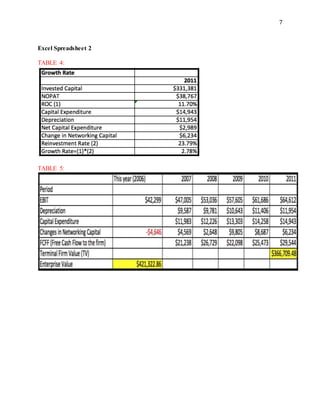

Formulas:

CAPM=Risk Free Rate + Beta (MRP)

WACC=[Debt*Cost of Debt (1-Tax rate)]+(Equity*CAPM)

Networking Capital=CURRENT ASSETS-CURRENT LIABILITIES

CHANGES IN Networking Capital=YEAR 2 NWC-YEAR 1 NWC

Net reinvestment=(Capital Expenditure +Change in net NWC)/NOPAT

FCF=EBIT*(1-tax)+DEPR-change in NWC-Capital expenditure

Terminal Value=Last value of stock*(1+Growth Rate)/(WACC-Growth Rate)

Enterprise Value=](https://image.slidesharecdn.com/mercurycase-160802220120/85/Mercury-case-5-320.jpg)