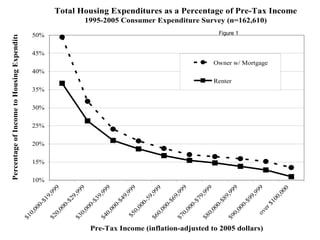

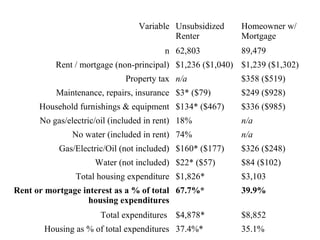

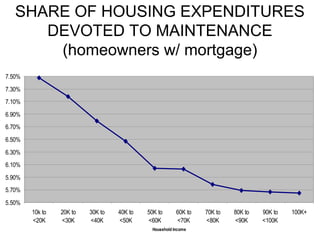

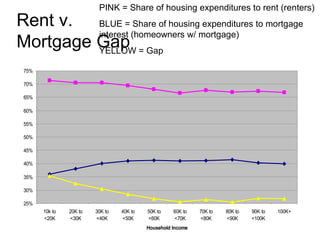

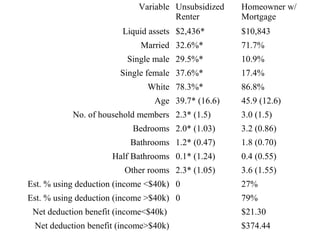

The study compares housing-related expenditures between renters and homeowners with a mortgage, revealing significant differences in costs and miscalculations that can increase foreclosure risk. It highlights both obvious and hidden expenses of homeownership, emphasizing the importance of consumer education, especially for low-income renters. The analysis is based on data from the Consumer Expenditure Survey from 1995 to 2005, covering over 162,000 households.