This document provides information about buying a first home, including:

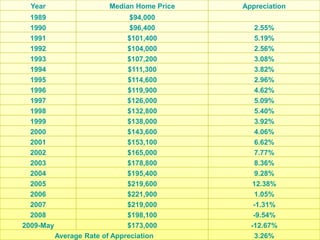

- Historical home price appreciation rates and how home values can rise, fall, or stay the same.

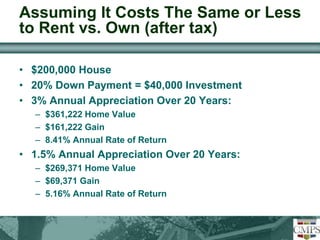

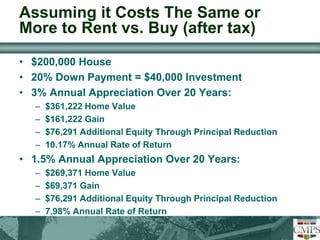

- Calculations showing the potential returns from home appreciation over 20 years at 3% and 1.5% rates.

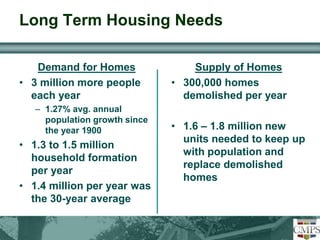

- Factors that influence long-term housing demand and supply such as population growth and new home construction.

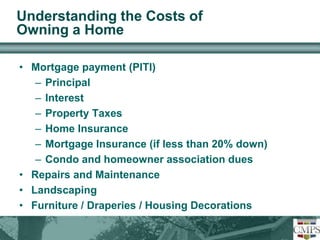

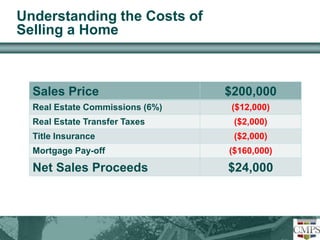

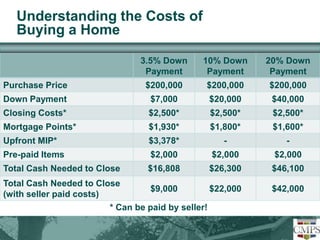

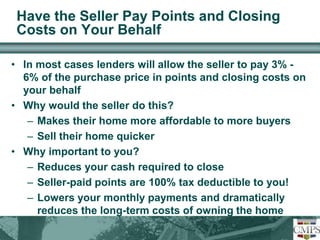

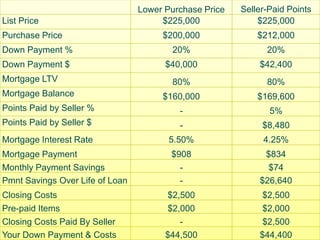

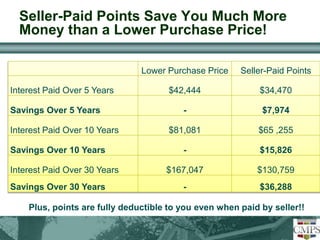

- Costs of owning, selling, and buying a home.

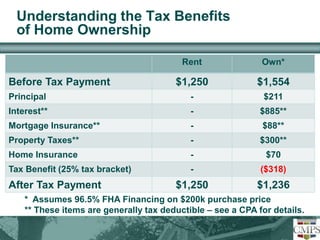

- Tax benefits of home ownership like mortgage interest and property tax deductions.

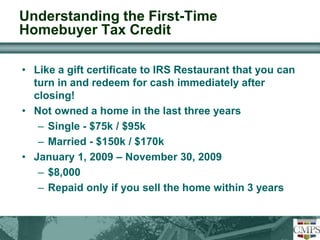

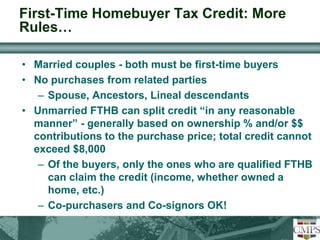

- First-time homebuyer tax credits available until November 2009.

![Is this a good time to buy?

• Warren Buffet:

– “I buy on the assumption that they could close the market

the next day and not reopen it for five years.”

– “The dumbest reason in the world to buy a stock is because

it’s going up.” [buy value]

• Imagine going shopping a department store, and getting all

emotional and buying all you can when prices are rising. Then,

when prices are falling because of a blow-out sale, you stay

away from the store, or worse, you go back to the store and sell

everything at rummage sale prices that you bought before at a

high price. That is what people do every day in the real estate

market.](https://image.slidesharecdn.com/2009firsttimehomebuyerpresentation-141120215157-conversion-gate02/85/First-Time-Home-Buyer-Presentation-2009-9-320.jpg)