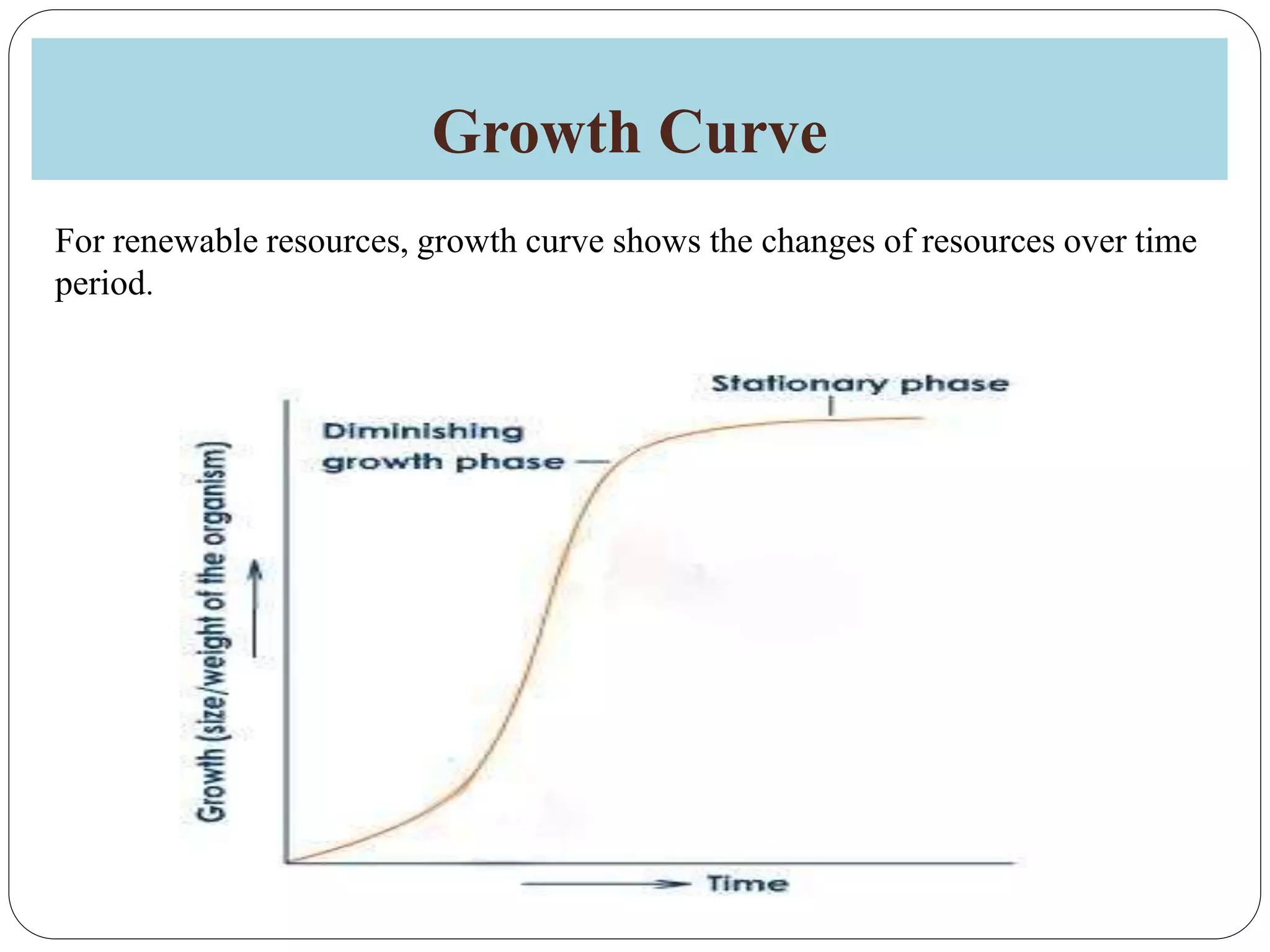

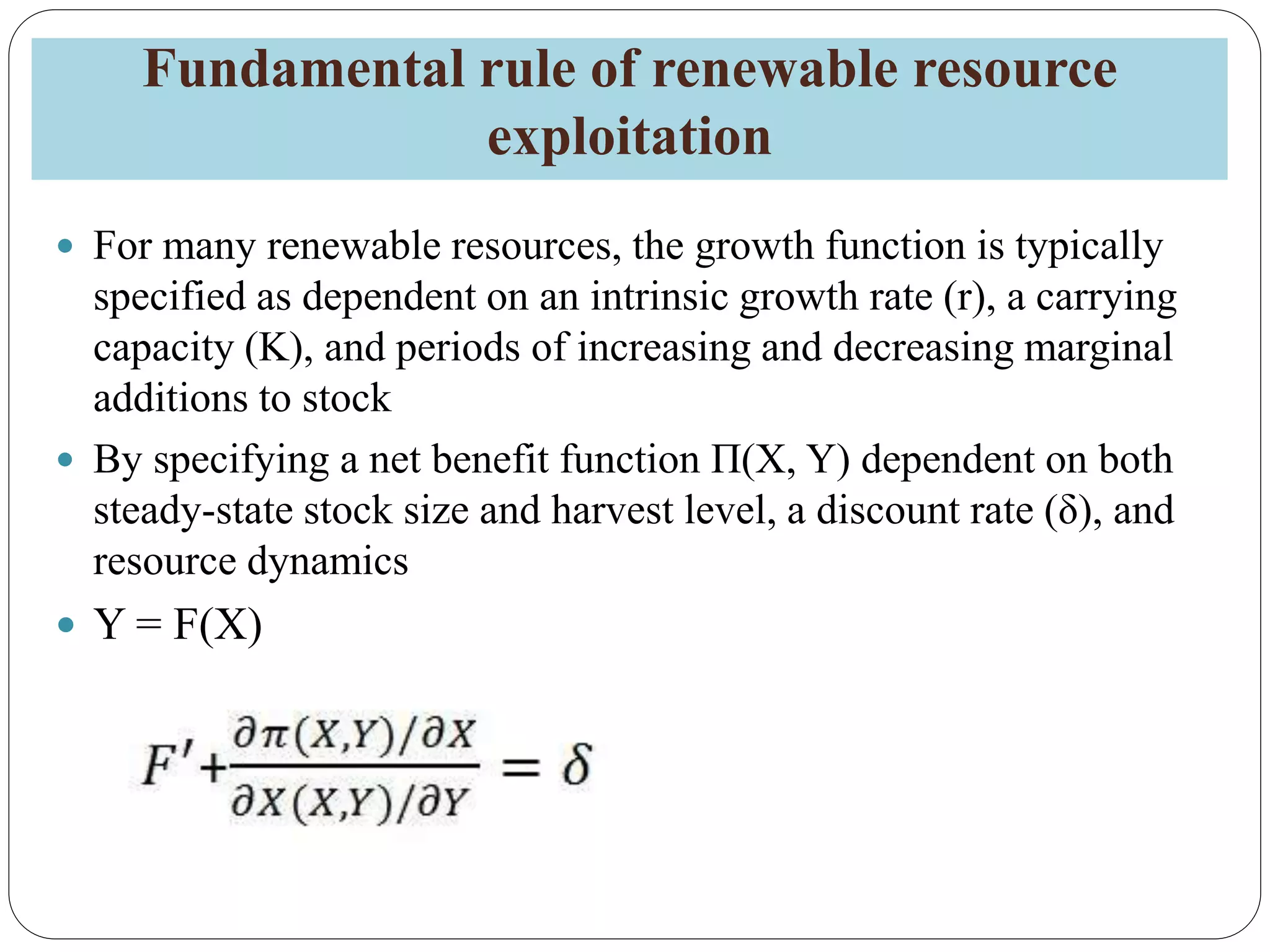

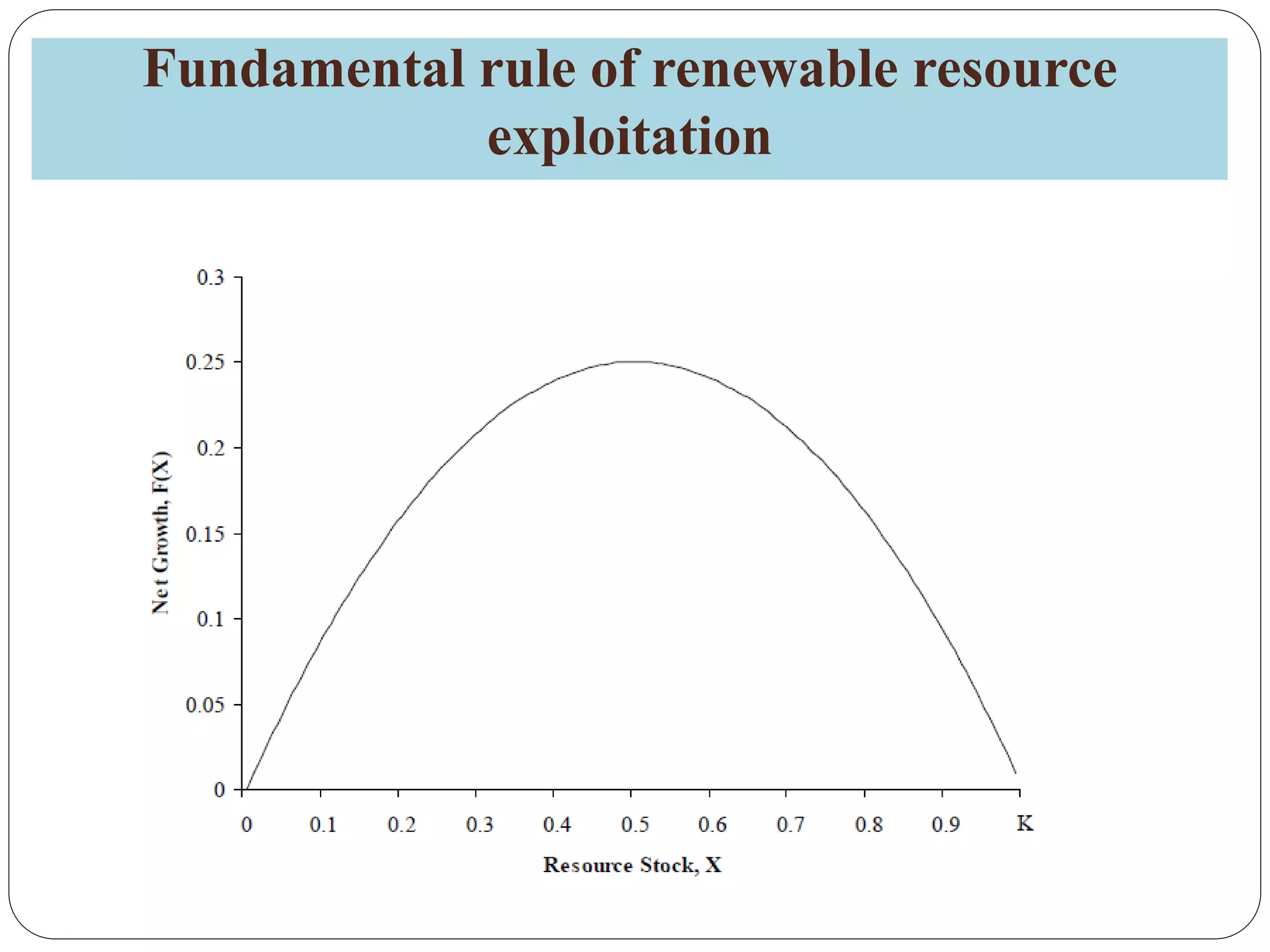

Renewable resources are defined as natural assets that can be replenished over short periods, such as solar and wind energy, while non-renewable resources are depleted at a much slower rate and include fossil fuels. Efficient management and allocation of these resources are crucial for sustainable development, addressing issues such as environmental degradation and economic growth challenges. The document discusses the complexities of resource exploitation, including the relationship between current use and future availability, the risk of extinction due to overharvesting, and the importance of strategic investment in renewable energy infrastructure.