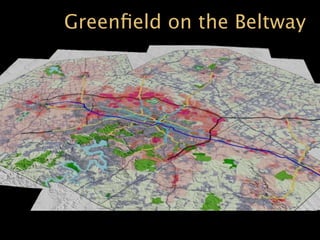

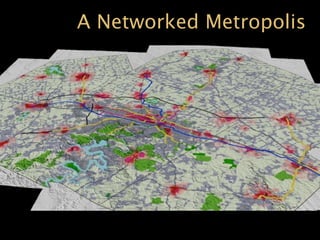

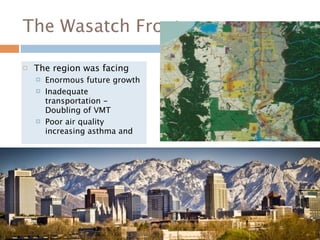

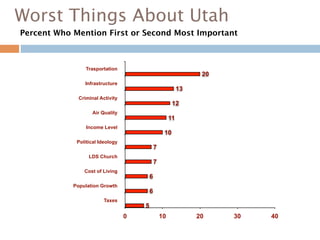

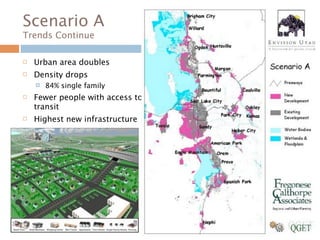

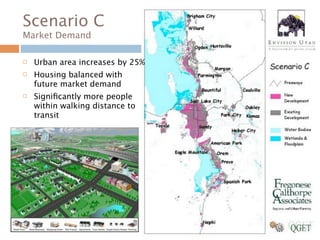

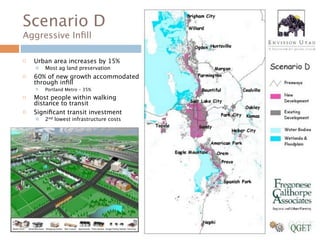

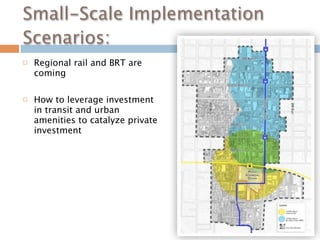

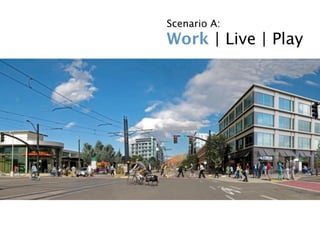

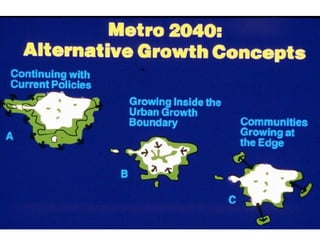

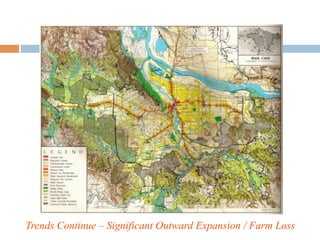

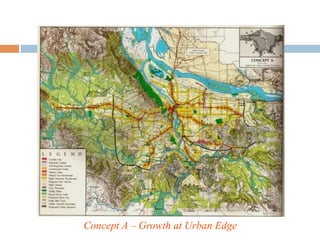

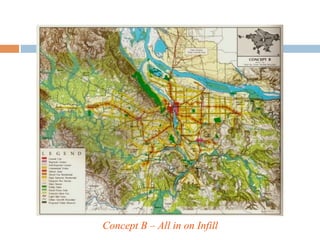

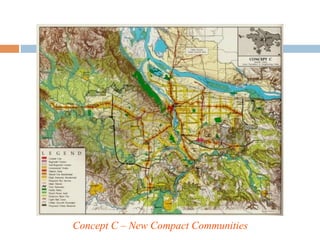

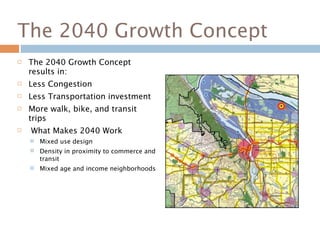

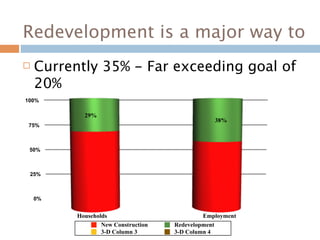

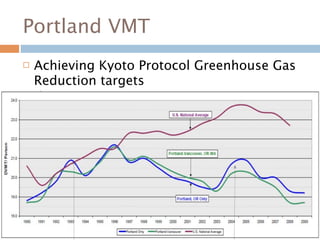

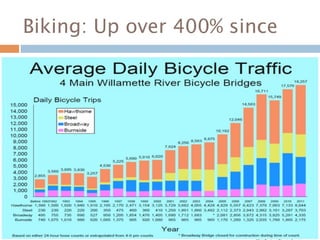

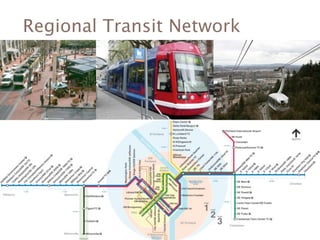

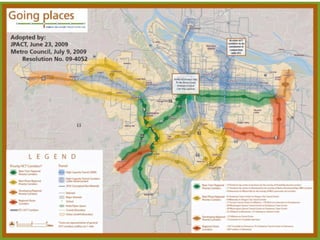

This document discusses the results and benefits of regional scenario planning. It provides examples of scenario planning processes in the Wasatch Front region of Utah and the Portland, Oregon metro area. Scenario planning can influence spending on transportation and development policies, lead to economic development opportunities, and influence regional leaders. The examples show how scenario planning led to increased transit ridership, preserved farmland, reduced vehicle travel, and supported biking and compact development. Factors like mixed uses, density, and amenities were important to making growth concepts successful.