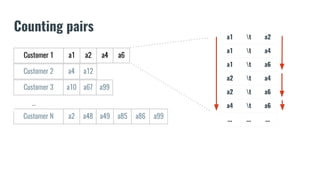

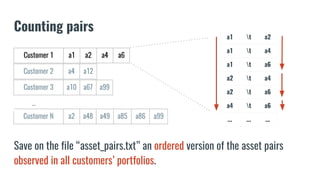

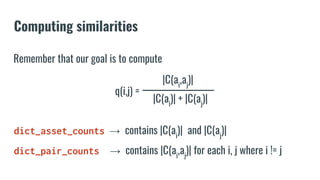

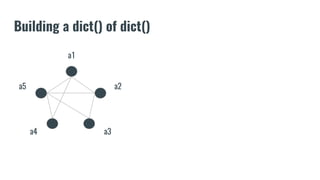

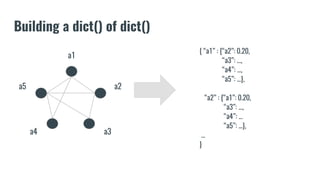

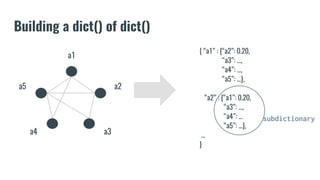

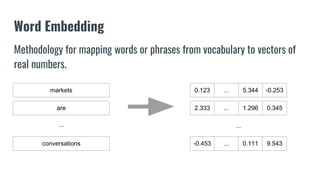

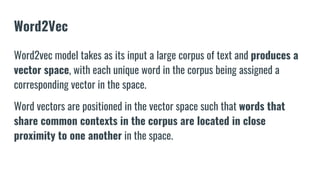

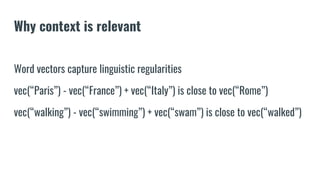

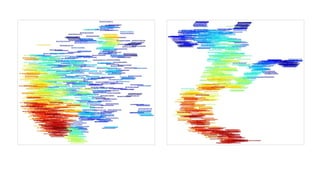

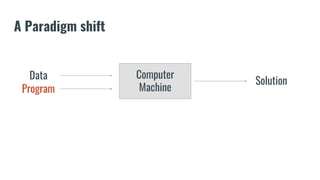

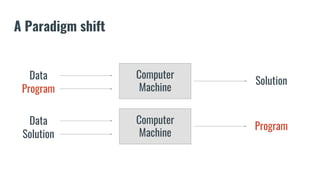

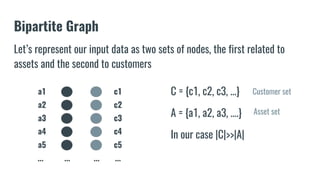

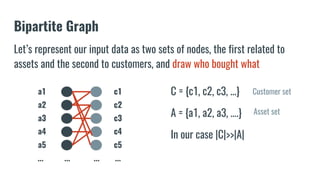

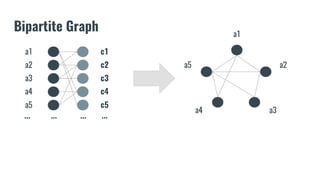

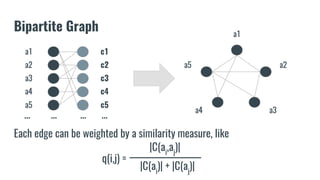

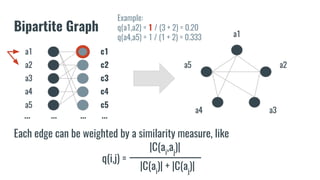

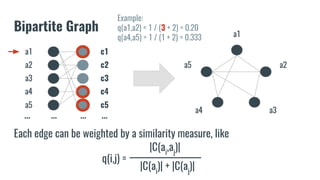

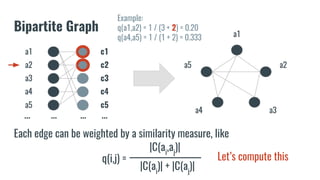

The document discusses recommendation systems in banking and financial services. It describes different types of recommendation systems including content-based filtering, collaborative filtering, and hybrid filtering. It then discusses how recommendation systems could be useful in banking by using a bipartite graph and word embedding approaches to represent customer and asset data and identify relationships between them. Code examples are provided for implementing some of these recommendation system techniques.

![Counting assets

a1 t 200

a2 t 1850

a3 t 800

a4 t 1100

a5 t 120

... ... ...

asset_counts = {}

with open("asset_counts.txt", 'r') as f:

for line in f:

items = line.split(‘t’)

asset, count = items[0], items[1]

dict_asset_counts[asset] = count

Let’s assume we saved on the file “asset_counts.txt” the counts for each

available asset on our dataset and we want to save them in a dict()](https://image.slidesharecdn.com/letthemusicplay-nocode-170411131257/85/Recommendation-Systems-in-banking-and-Financial-Services-27-320.jpg)