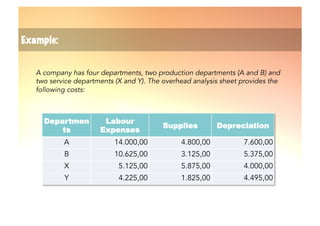

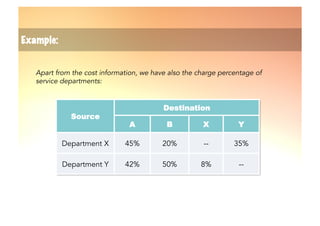

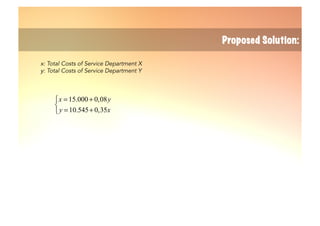

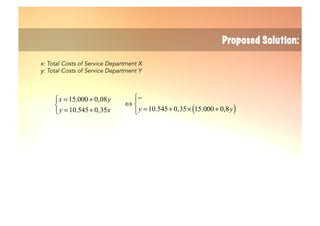

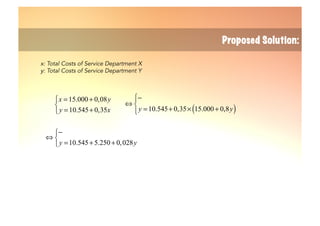

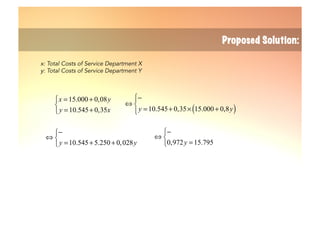

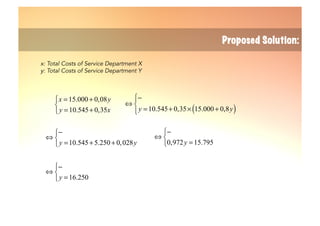

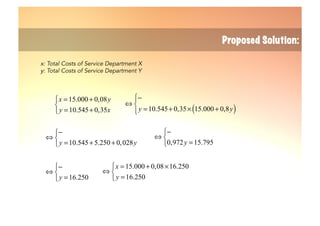

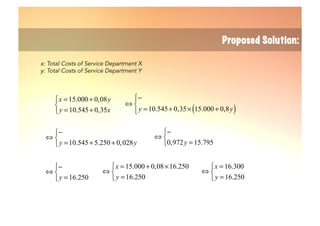

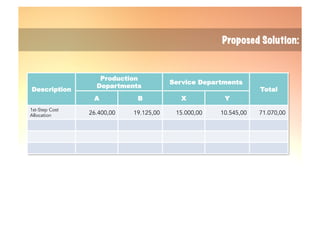

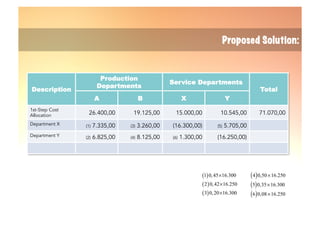

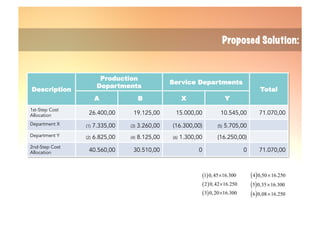

The document explains the reciprocal allocation method used in management accounting for distributing indirect costs among departments, specifically addressing the challenges posed by reciprocal charges between service departments. Through a detailed example involving four departments, it outlines a two-step cost allocation process, including the elimination of reciprocal charges and the final allocation of costs. The document provides formulas and calculations for determining the total costs for each department involved.